Tax Breaks Business Expenses Verkko 4 jouluk 2023 nbsp 0183 32 20 Popular Tax Deductions and Tax Breaks for 2023 2024 NerdWallet Low Interest and No Fee Credit Cards Vacations amp

Verkko 22 jouluk 2022 nbsp 0183 32 Suzanne Kvilhaug For the small business owner tax season can be stressful and the prospect of shelling out a load of Verkko 21 hein 228 k 2022 nbsp 0183 32 These expenses must be ordinary necessary and reasonable for the business to operate Some examples of tax deductible business expenses include Salaries and wages paid to

Tax Breaks Business Expenses

Tax Breaks Business Expenses

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/81/images/DR4kYkH5SVGGKw3JHFkY_Taxes.jpg

Tax Breaks For The Middle Class Milliken Perkins Brunelle

https://millikenperkins.com/wp-content/uploads/2014/05/658198_44079665.jpg

Business Expenses And Tax Deductions For Birth Professionals

https://www.inspiredbirthpro.com/wp-content/uploads/2010/03/Business-Expenses-and-Tax-Deductions1-682x1024.png

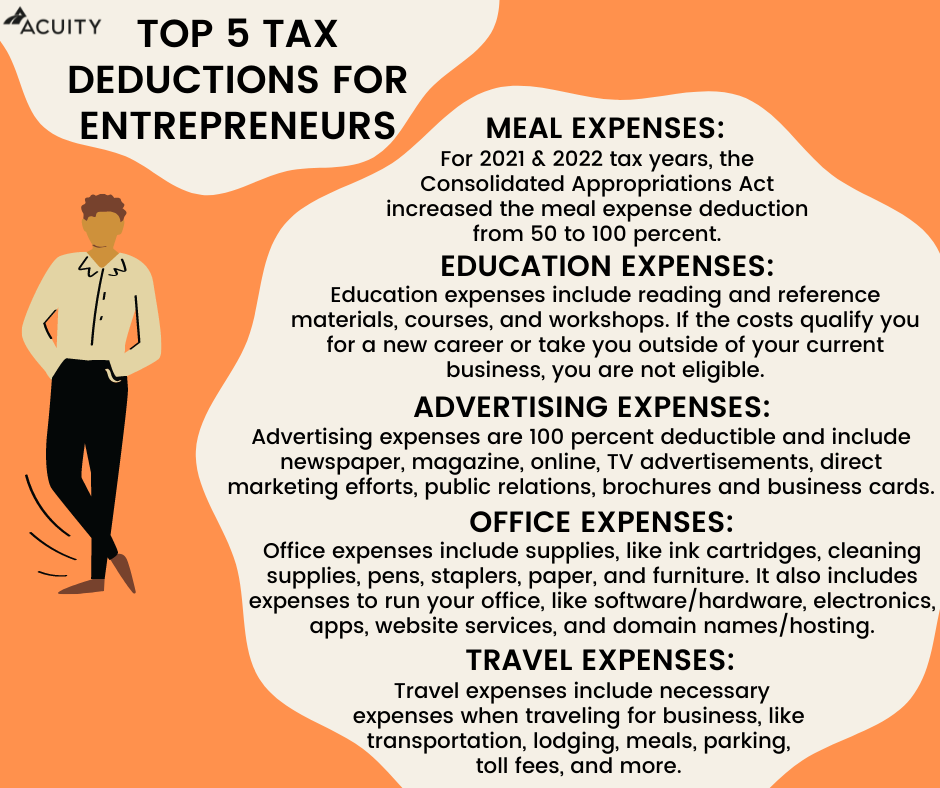

Verkko 14 elok 2023 nbsp 0183 32 Business expenses need to be considered ordinary and necessary for them to be tax deductible Business expenses are recorded on an income profit and loss statement Business Verkko 22 maalisk 2023 nbsp 0183 32 1 Startup costs Amount Up to 5 000 Small business owners may take a startup cost deduction of up to 5 000 in startup costs in their first year of business This can include legal

Verkko 15 kes 228 k 2022 nbsp 0183 32 Corporate Tax A corporate tax is a levy placed on the profit of a firm to raise taxes After operating earnings is calculated by deducting expenses including the cost of goods sold COGS and Verkko 1 helmik 2021 nbsp 0183 32 Business expenses incurred during the startup phase are capped at a 5 000 deduction in the first year This limit applies if your costs are 50 000 or less So if your startup expenses exceed

Download Tax Breaks Business Expenses

More picture related to Tax Breaks Business Expenses

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

How Do You Write Off Fuel On Your Taxes Leia Aqui Is It Better To

https://acuity.co/wp-content/uploads/2021/01/top-5-tax-deductions.png

Verkko 18 jouluk 2023 nbsp 0183 32 Here are three ways to save the most on your taxes before the calendar flips 1 Ensure Your Books Are Clean Know this If your books are not clean and Verkko 30 toukok 2023 nbsp 0183 32 A small business tax deduction is an IRS qualifying expense that you can subtract from your taxable income These deductions can reduce the amount of income subject to federal and

Verkko 16 marrask 2021 nbsp 0183 32 Related 15 Capital Gains Tax Facts to Know A business expense deduction is a deduction allowed for ordinary and necessary expenses paid or Verkko 6 hein 228 k 2023 nbsp 0183 32 Master business expense categories to reduce your tax bill Our guide explains tax deductible expenses tracking with accounting software and IRS rules

RZR News The New Way To News

https://rzrnews.com/wp-content/uploads/2022/08/shutterstock_545369881-scaled.jpg

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

https://www.nerdwallet.com/article/taxes/tax-…

Verkko 4 jouluk 2023 nbsp 0183 32 20 Popular Tax Deductions and Tax Breaks for 2023 2024 NerdWallet Low Interest and No Fee Credit Cards Vacations amp

https://www.investopedia.com/articles/person…

Verkko 22 jouluk 2022 nbsp 0183 32 Suzanne Kvilhaug For the small business owner tax season can be stressful and the prospect of shelling out a load of

These Tax Breaks Were Restored For 2013 William Vaughan Company Blog

RZR News The New Way To News

State Income Tax Breaks To Provide Needed Relief For Many 11alive

Business Expenses Revolut IE

Overlooked Tax Breaks For Individuals Blog hubcfo

Pin On Spreadsheet Samples

Pin On Spreadsheet Samples

It remains To Be Seen If Unannounced Tax Breaks Will Be Implemented

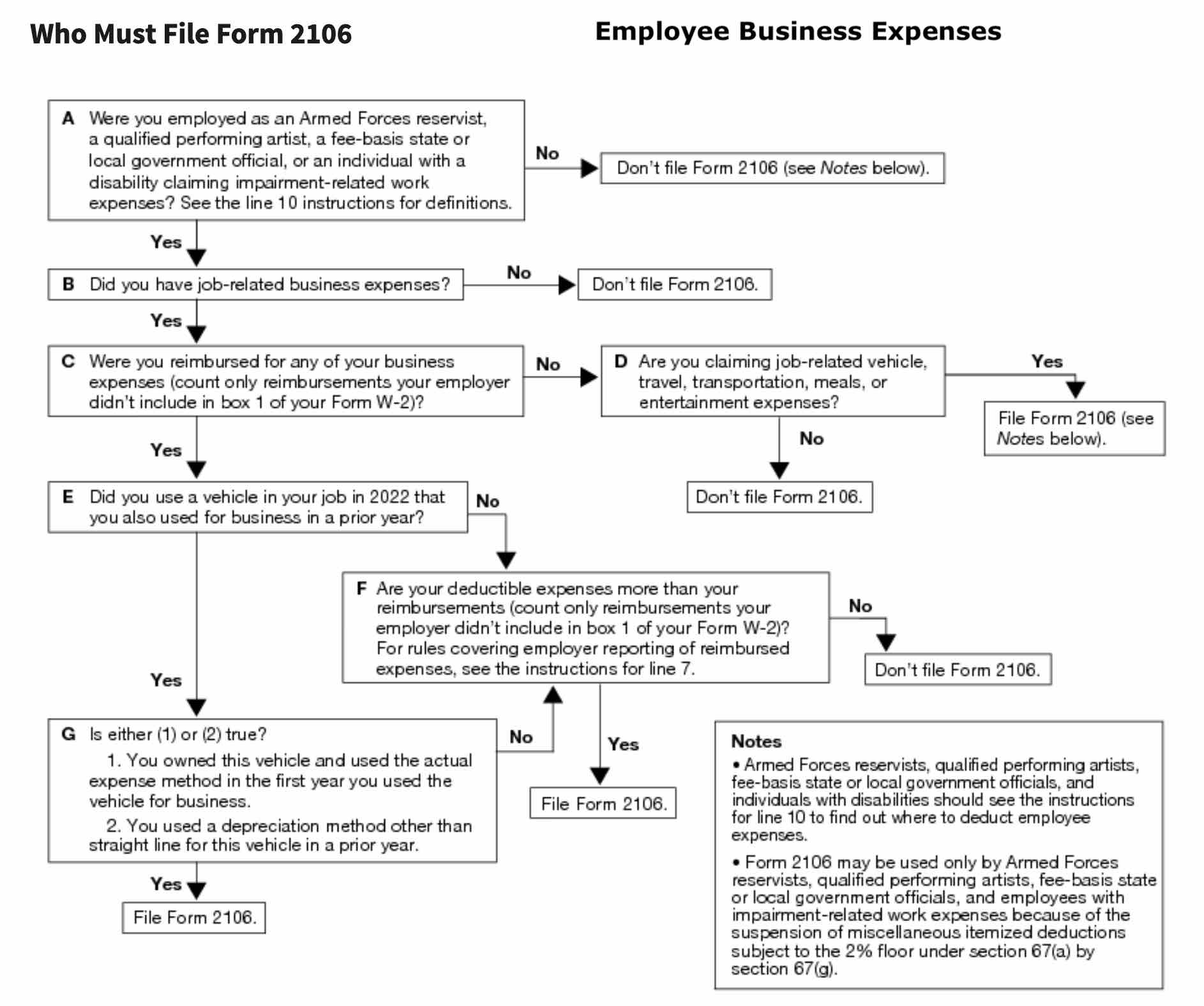

Can You Deduct Unreimbursed Employee Expenses In 2022

These Tax Breaks Are Back For 2020 And It Could Mean A Bigger Refund

Tax Breaks Business Expenses - Verkko 22 maalisk 2023 nbsp 0183 32 1 Startup costs Amount Up to 5 000 Small business owners may take a startup cost deduction of up to 5 000 in startup costs in their first year of business This can include legal