Tax Credit Daycare Expenses Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or Verkko 19 lokak 2023 nbsp 0183 32 You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023

Tax Credit Daycare Expenses

Tax Credit Daycare Expenses

https://i.pinimg.com/originals/67/62/b1/6762b1bcb53c6074dab4289dd09b60a5.jpg

Home Daycare Tax Worksheet

https://i.etsystatic.com/14457879/r/il/49f531/2691159813/il_fullxfull.2691159813_mk8h.jpg

Tax Credit Or FSA For Child Care Expenses Which Is Better

https://static.wixstatic.com/media/62b39d_9cd40e7758b749f88e3057d23a1a03f5~mv2.jpg/v1/fit/w_1000%2Ch_572%2Cal_c%2Cq_80/file.jpg

Verkko Topic No 602 Child and Dependent Care Credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to Verkko 27 marrask 2023 nbsp 0183 32 What is the child tax credit The child tax credit CTC is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your

Verkko 31 hein 228 k 2023 nbsp 0183 32 If you re filing for tax year 2021 the credit is worth up to 50 of qualifying expenses The maximum amount is 8 000 for one child and 16 000 for Verkko 11 tammik 2023 nbsp 0183 32 Form 2441 is used to by persons electing to take the child and dependent care expenses to determine the amount of the credit

Download Tax Credit Daycare Expenses

More picture related to Tax Credit Daycare Expenses

Understanding The Child Care Tax Credit What Kinds Of Expenses Qualify

https://www.topdaycarecenters.com/blog/wp-content/uploads/2016/02/Tax-credit.jpg

One stop Guide To Child Tax Credit Resources SaverLife

https://partner.saverlife.org/wp-content/uploads/2021/07/CTC-payment-schedule-2.gif

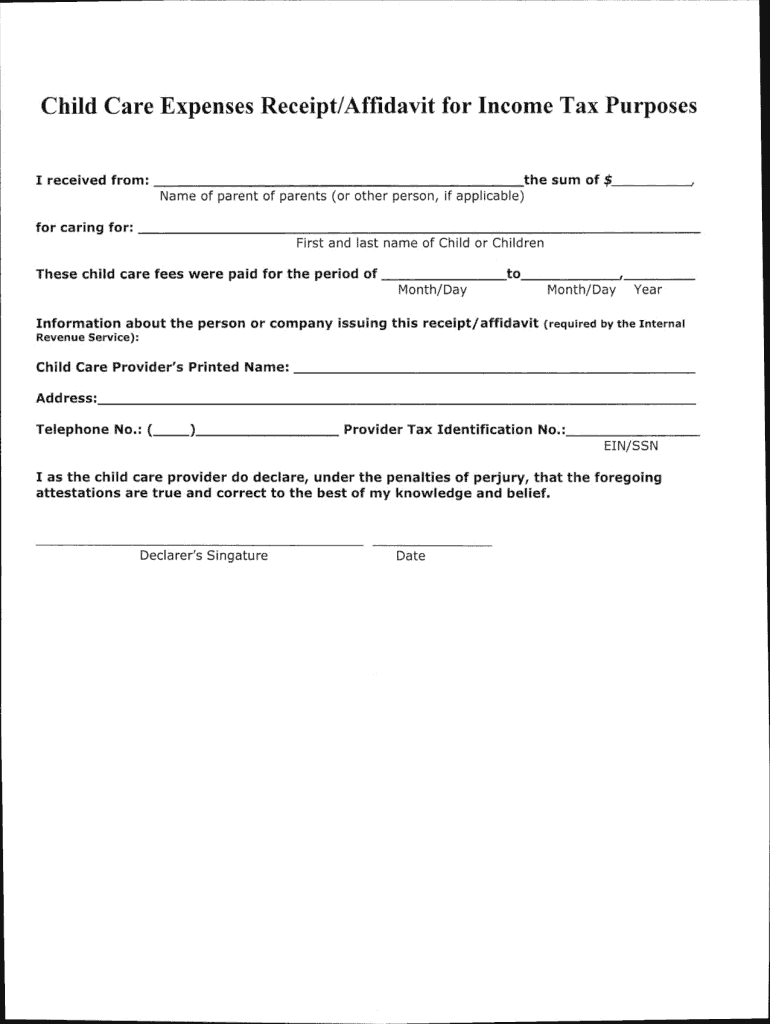

Child Care Receipt Template Canada Form Fill Out And Sign Printable

https://www.signnow.com/preview/100/291/100291606/large.png

Verkko 2 maalisk 2022 nbsp 0183 32 Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent Verkko 15 kes 228 k 2023 nbsp 0183 32 What expenses qualify for an education credit Why does my Form W 2 report a benefit of 5 000 in box 10 when my employer set aside 5 000 in wages for

Verkko 23 elok 2023 nbsp 0183 32 TRAVERSE CITY MI US August 22 2023 EINPresswire In a move set to ease the financial burden on families significantly the Internal Revenue Verkko 12 helmik 2022 nbsp 0183 32 Taxpayers can claim more child care expenses this tax season They can also get more of that money back Child care tax credit is bigger this year How to

Earned Income Tax Credit EITC Get My Payment IL

https://getmypaymentil.org/wp-content/uploads/2022/10/gmpil-website-poll-banner.jpg

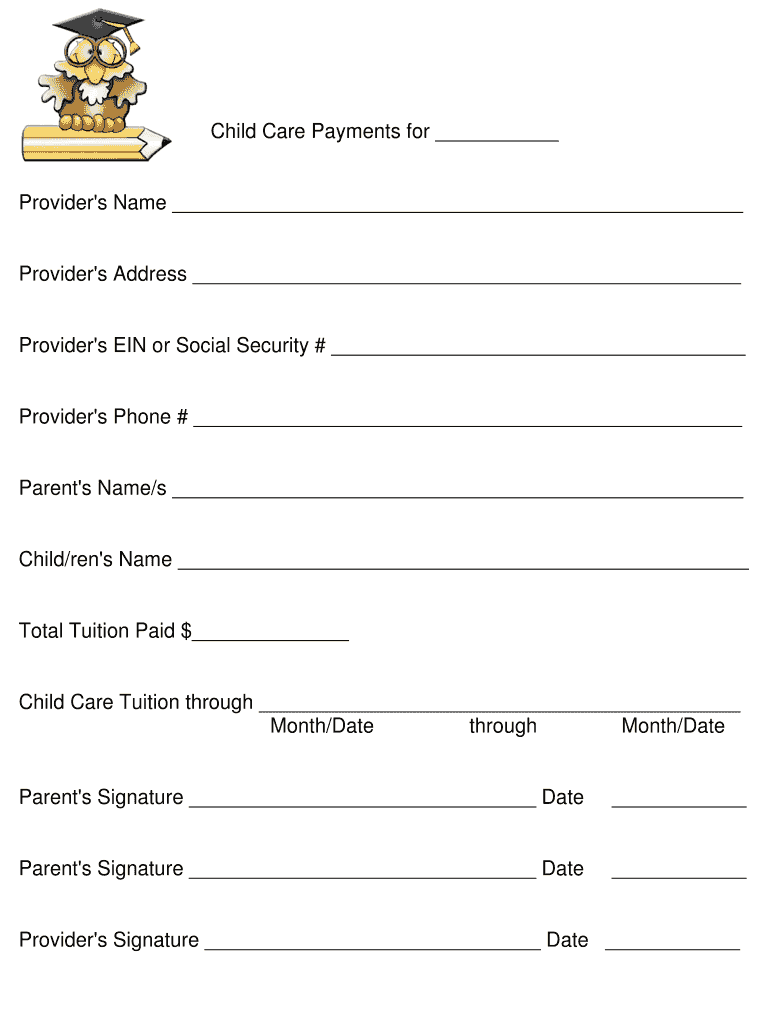

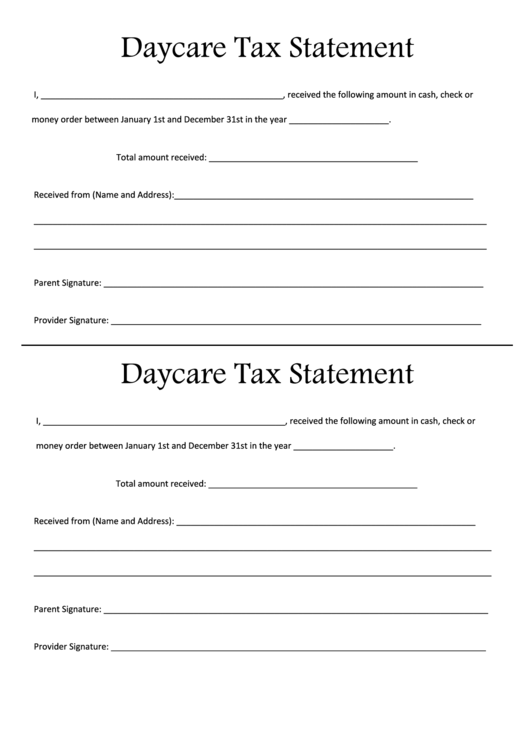

Fun Daycare Tax Statement Template Project Cost Tracking Excel

https://i.pinimg.com/originals/c2/d8/ec/c2d8ec251799057ba95dc5127a5c6651.jpg

https://www.nerdwallet.com/.../taxes/child-an…

Verkko 9 marrask 2023 nbsp 0183 32 The child and dependent care credit or CDCC is a tax credit for parents or caregivers to help cover the cost of qualified

https://www.irs.gov/publications/p503

Verkko For 2022 the credit for child and dependent care expenses is nonrefundable and you may claim the credit on qualifying employment related expenses of up to 3 000 if you had one qualifying person or

Earned Income Tax Credit EITC Get My Payment IL

Daycare Statement Template

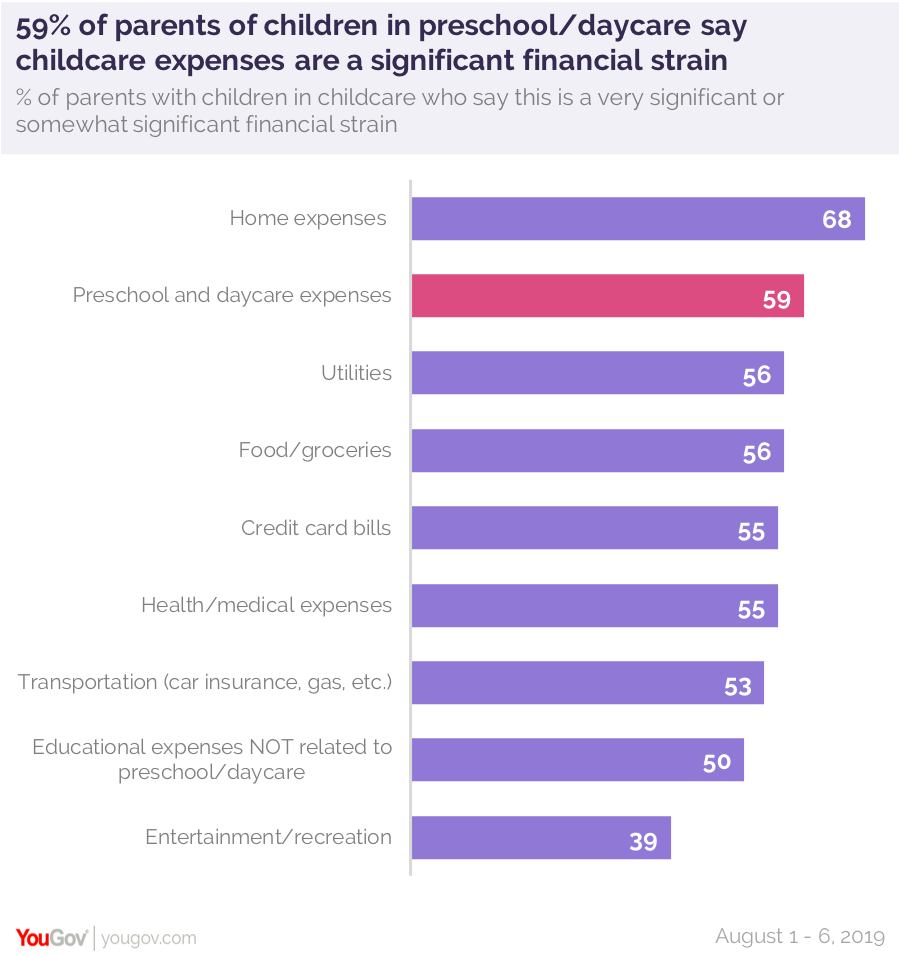

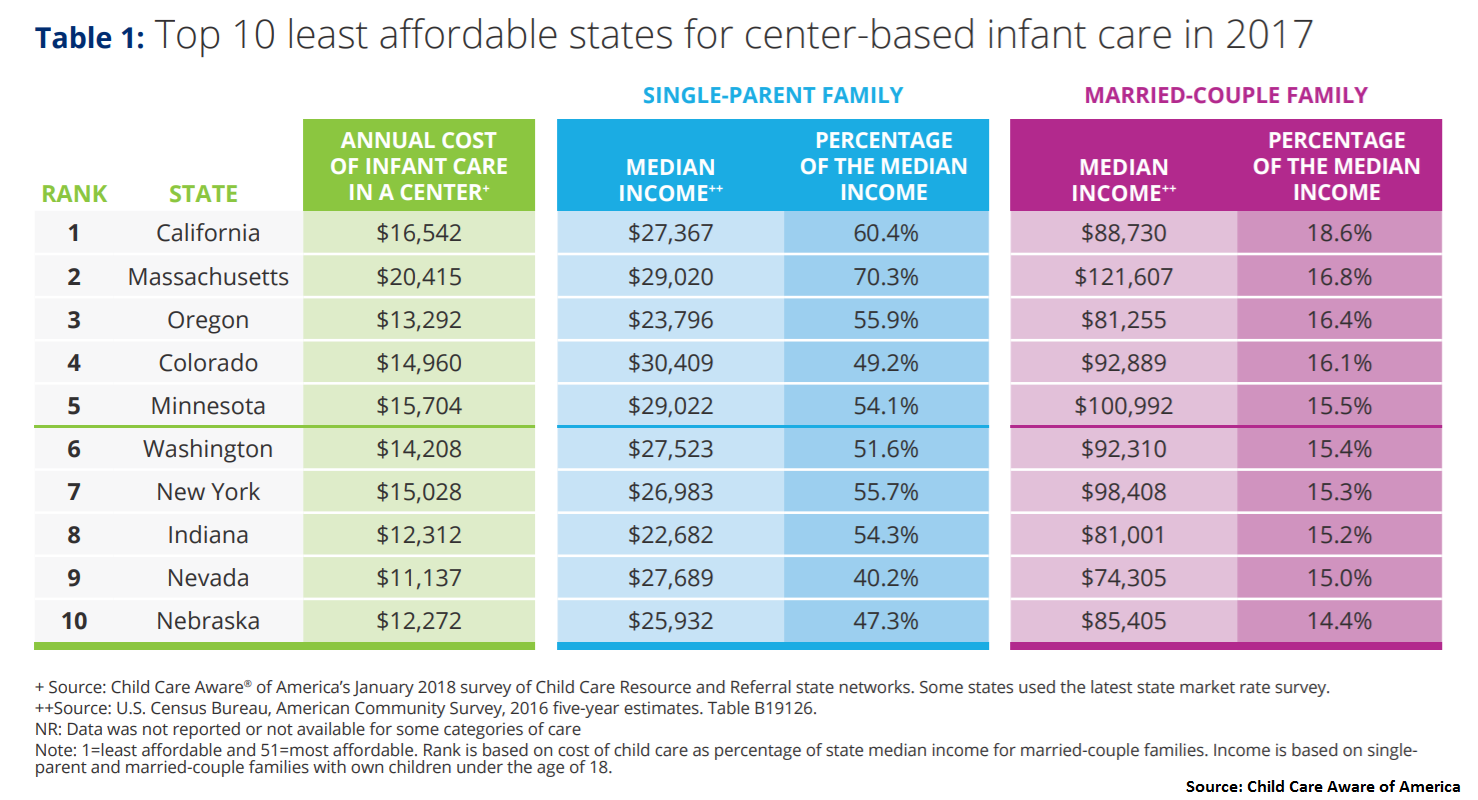

Childcare Expenses Are A Significant Financial Strain For Most Parents

Free 9 Daycare Receipt Examples Samples In Pdf Doc Child Care Expense

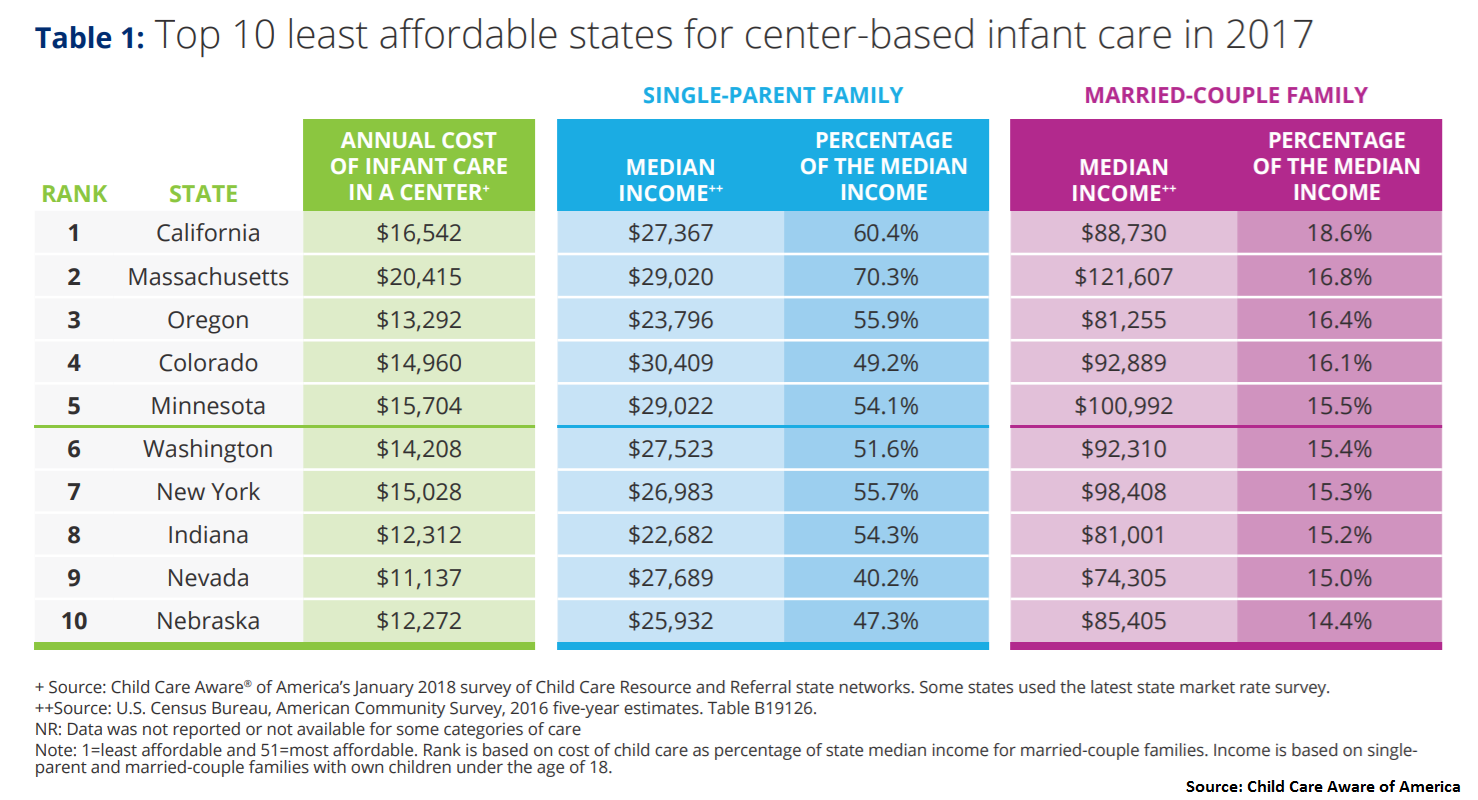

Childcare Costs Hit New Heights How You Can Save 5 000 A Year

Childcare Costs Hit New Heights How You Can Save 5 000 A Year

Childcare Expenses Abstract Concept Vector Illustration Child Care Tax

Top 7 Daycare Tax Form Templates Free To Download In PDF Format

Child Daycare Excel Tax Cheat Sheet Deductible Expenses Etsy

Tax Credit Daycare Expenses - Verkko 27 marrask 2023 nbsp 0183 32 What is the child tax credit The child tax credit CTC is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your