Tax Credit Electric Vehicle Used Verkko Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000

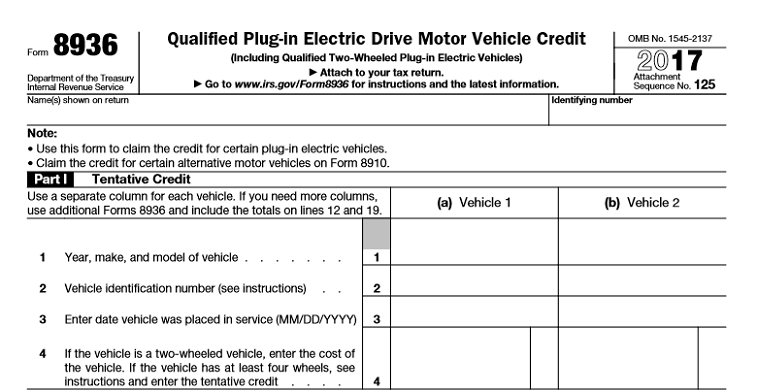

Verkko 8 lokak 2023 nbsp 0183 32 For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate Verkko 19 lokak 2023 nbsp 0183 32 The credit for electric vehicles also known as EVs is nothing new A version of it was introduced in 2009 In previous years you would have to wait until tax filing time to claim your EV

Tax Credit Electric Vehicle Used

Tax Credit Electric Vehicle Used

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png?x18731

Government Electric Vehicle Tax Credit Electric Tax Credits Car

https://electrek.co/wp-content/uploads/sites/3/2021/01/EV-Federal-Tax-Credits.jpg?quality=82&strip=all&w=1600

How Electric Vehicle Tax Credit Works Web2Carz

https://www.web2carz.com/images/articles/201610/electric_vehicle_tax_credit_1476984869_800x600.jpg

Verkko 3 marrask 2023 nbsp 0183 32 The tax credit for a used EV or PHEV is either 4 000 or 30 percent of the sale price of the vehicle whichever is lower That means if you re spending less than 13 333 you re not going Verkko 1 tammik 2023 nbsp 0183 32 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000

Verkko 10 marrask 2023 nbsp 0183 32 Under the IRA the EV tax credit is in place for 10 years until December 2032 for electric vehicles placed into service this year 2023 The tax credit is taken in the year you take delivery of Verkko 22 elok 2022 nbsp 0183 32 Starting Jan 1 2023 more caveats come into effect Sedans have to be under 55 000 to qualify and the cost of trucks vans and sports utility vehicles can t exceed 80 000 The price caps for

Download Tax Credit Electric Vehicle Used

More picture related to Tax Credit Electric Vehicle Used

What Is Electric Vehicle Tax Credit Todrivein

https://todrivein.com/wp-content/uploads/2023/05/what-is-electric-vehicle-tax-credit_featured_photo.jpeg

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

Understanding Electric Vehicle Tax Credit

https://blog.autobidmaster.com/wp-content/uploads/Understanding-Electric-Vehicle-Tax-Credit-1024x683.jpeg

Verkko 3 marrask 2023 nbsp 0183 32 For new cars you can claim up to 7 500 for a qualified plug in or fuel cell electric vehicle purchase You have to buy the car for your personal use that is not for resale and use Verkko 11 jouluk 2023 nbsp 0183 32 Clean vehicle credits are nonrefundable credits meant to lower the cost of qualifying plug in electric or other clean vehicles In Tax Years 2023 2032 the credit is up to 4 000 for previously owned clean vehicles and up to 7 500 for new clean vehicles There are certain requirements for qualified vehicles including the vehicle s

Verkko 7 elok 2023 nbsp 0183 32 For qualifying vehicles placed in service between Jan 1 and April 17 2023 the credit can be up to 2 500 base amount plus 417 for a vehicle with at least 7 kilowatt hours of battery capacity Verkko 21 marrask 2023 nbsp 0183 32 TheStreet Americans bought more than one million electric vehicles in 2023 Extends 7 500 tax credit The Inflation Reduction Act extends the current incentives of up to 7 500 in tax

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/electric-vehicle-tax-credit-you-can-still-save-greenbacks-for-going.png

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax

https://images.cars.com/cldstatic/wp-content/uploads/ev-full-tax-credit.jpg

https://www.irs.gov/credits-deductions/used-clean-vehicle-credit

Verkko Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a maximum credit of 4 000

https://cleantechnica.com/2023/10/08/heres-what-happens-to-the-federal...

Verkko 8 lokak 2023 nbsp 0183 32 For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

Update To List Of Eligible EVs Electric Vehicles For The Clean

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Electric Car Tax Credits And Rebates Charged Future

Audi MINI Toyota Prius Models Added To IRS Electric Vehicle Tax

Federal Tax Credits For EV Charging Stations Installation Extended

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

New EVs Eligible For The Clean Vehicle Tax Credit Electric Driver

Electric Vehicle Credit Phase Out Tax Accountant In Springfield Missouri

Audi MINI Toyota Prius Models Added To IRS Electric Vehicle Tax

Tax Credit Electric Vehicle Used - Verkko 17 elok 2022 nbsp 0183 32 The electric vehicle tax credit also known as the EV tax credit is a nonrefundable credit meant to lower the cost of qualifying plug in electric or other clean vehicles The credit is worth between 2 500 and 7 500 for the 2022 tax year and eligibility for claiming the credit depends on the number of electric vehicles sold by