Tax Credit For Dependent Care Expenses The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable

In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear except for 2021 In 2021 the credit is unavailable for any taxpayer with adjusted gross income over 438 000 Topic no 602 Child and dependent care credit You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a

Tax Credit For Dependent Care Expenses

Tax Credit For Dependent Care Expenses

https://mfiworks.com/wp-content/uploads/2021/05/the-child-tax-credit-and-the-dependent-care-credit.jpg

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/bGO8AFn9_9/1616431373979.png

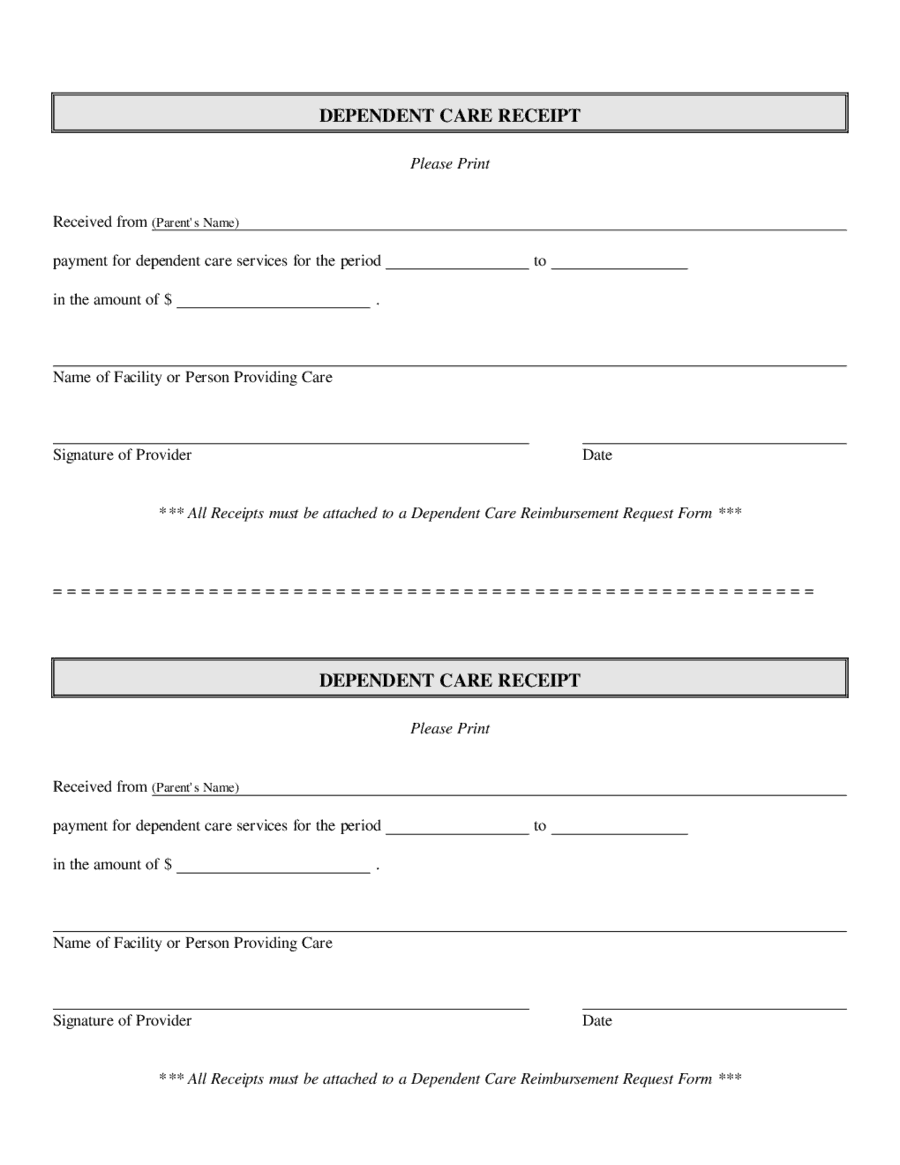

Daycare Or Dependent Care Receipt Templates Word Excel

https://toplettertemplates.com/wp-content/uploads/2020/06/Dependent-Care-Receipt-Template.png

Child and Dependent Care Credit Information If you paid someone to care for your child or other qualifying person so you and your spouse if filing jointly could work or look for work you may be able to take the credit for child and dependent care expenses Your federal income tax may be reduced by claiming the Credit for Child and Child And Dependent Care Credit A non refundable tax credit for unreimbursed childcare expenses paid by working taxpayers The Child and Dependent Care Credit is designed to encourage taxpayers

The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under age 13 and for a disabled spouse or dependent In order to claim the credit the taxpayer child or dependent and expenses must meet numerous requirements There is a limit to the amount of qualifying expenses The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under age 13 a disabled spouse or dependent To claim the credit there are requirements for the taxpayer child or dependent expenses There is a limit to the amount of qualifying expenses

Download Tax Credit For Dependent Care Expenses

More picture related to Tax Credit For Dependent Care Expenses

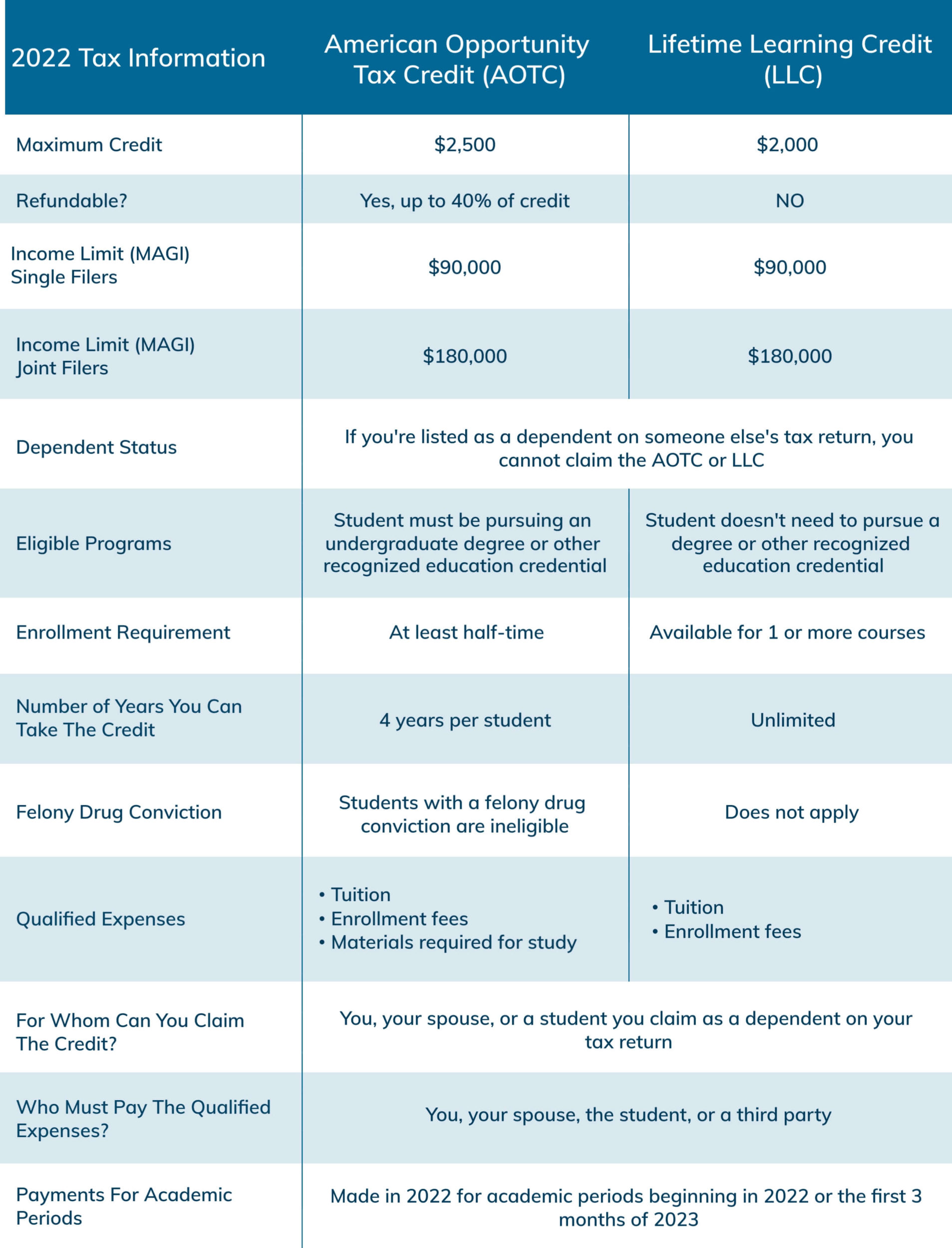

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

Geothermal Tax Credits Incentives

https://storage.googleapis.com/go-boost-partners-public/media_items/5178-tax-credit-percentage-30.png

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

https://cdn.newswire.com/files/x/32/c9/0bc29c33e2af4d42f581fad9e660.png

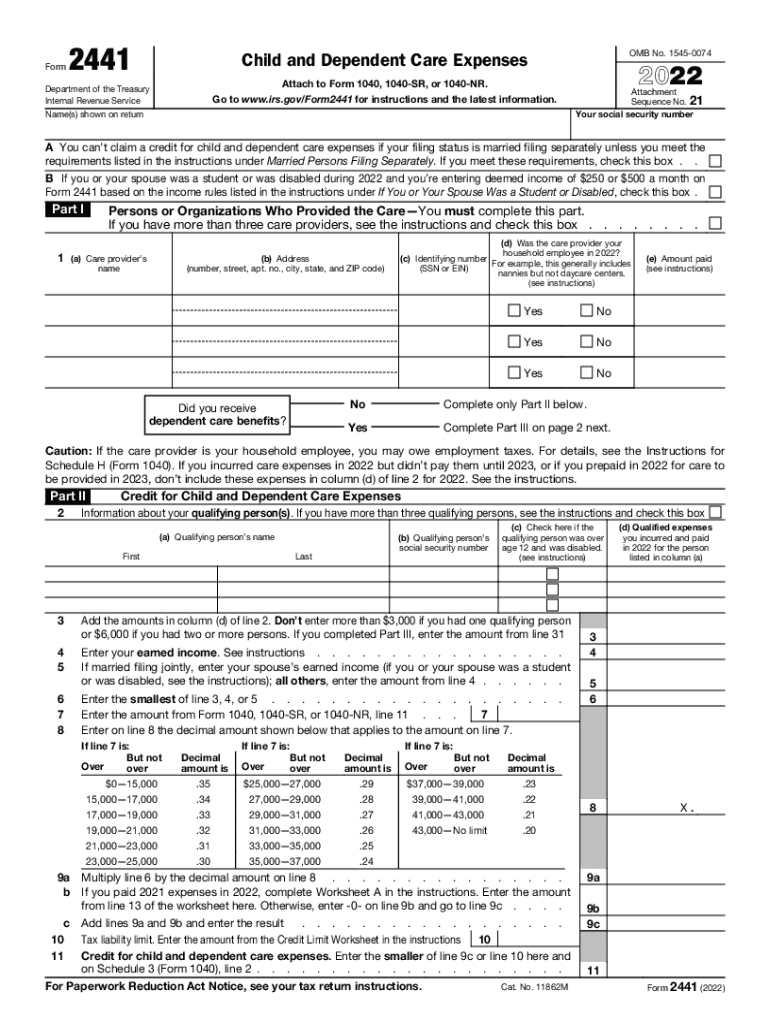

Module 9 Tax Credit for Child and Dependent Care Expenses Page 3 of 13 The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under age 13 a disabled spouse or dependent Be patient as you learn about the qualifications needed in order to claim the credit IRS Form 2441 is used to report child and dependent care expenses as part of your Federal income tax return By reporting these expenses you may be entitled to a tax credit of up to 3 000 for

Currently the Dependent Care Credit is 20 to 35 of qualified expenses The percentage depends on your adjusted gross income AGI The maximum amount of qualified expenses for the credit is 3 000 for one qualifying person 6 000 for two or more qualifying persons How much you can claim phases out depending on your income For the 2022 2023 tax year you can claim 3 000 in expenses for one dependent or 6 000 for two or more dependents Qualifying expenses include those you paid for someone other than your spouse or the child s parent to care for your dependent while you worked or looked for work

Dependent And Child Care Credits Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/statistics/images/dependent_credit_6.png?itok=LHCG_yxd

Free 9 Daycare Receipt Examples Samples In Pdf Doc Dependent Care

https://i.pinimg.com/originals/6a/f3/dd/6af3dde5da8a198d3dafc694dd3223b9.jpg

https://www.nerdwallet.com/article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable

https://turbotax.intuit.com/tax-tips/family/the...

In most years you can claim the credit regardless of your income The Child and Dependent Care Credit does get smaller at higher incomes but it doesn t disappear except for 2021 In 2021 the credit is unavailable for any taxpayer with adjusted gross income over 438 000

Quick Guide To The Child And Dependent Care Tax Credit

Dependent And Child Care Credits Tax Policy Center

Child And Dependent Care Credit 2022 2024 Form Fill Out And Sign

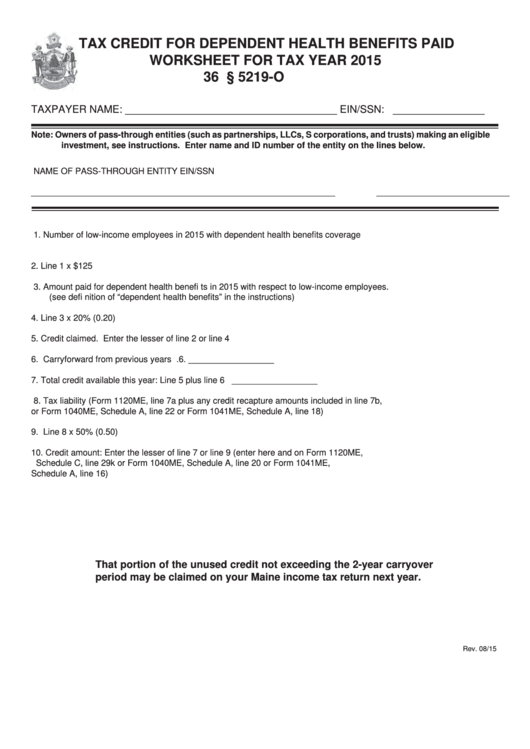

Tax Credit For Dependent Health Benefits Paid Worksheet 2015

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Tax Implications and Rewards Of Grandparents Taking Care Of

Tax Implications and Rewards Of Grandparents Taking Care Of

Tax Audit Reviews Dependent Child Care Expenses Sweet Captcha

Care Credit Printable Application Printable Word Searches

Child And Dependent Care Expenses Credit 2023 2024

Tax Credit For Dependent Care Expenses - The tax credit for child and dependent care expenses allows taxpayers to claim a credit for expenses paid for the care of children under age 13 and for a disabled spouse or dependent In order to claim the credit the taxpayer child or dependent and expenses must meet numerous requirements There is a limit to the amount of qualifying expenses