Tax Credit For Energy Efficiency Improvements The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

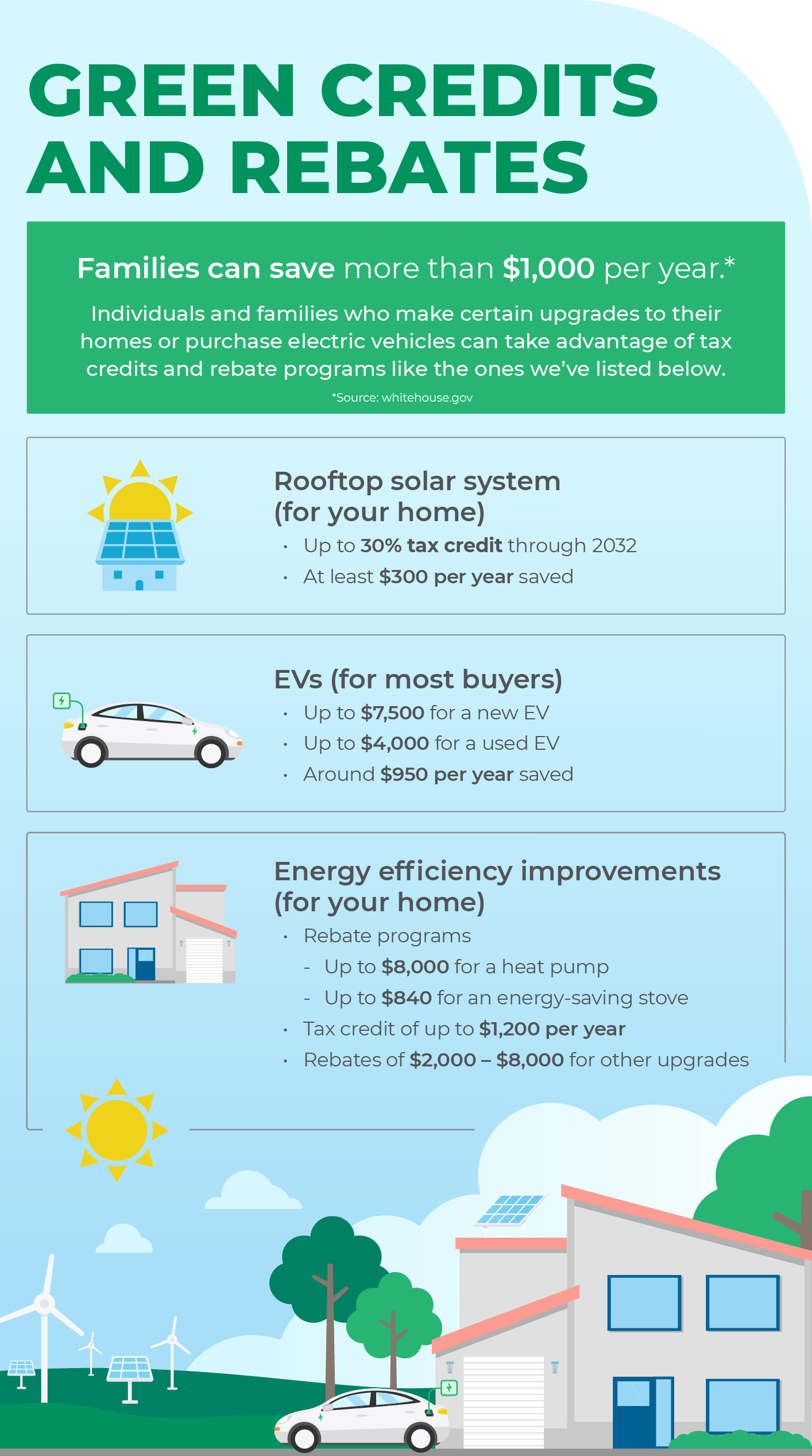

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits You can claim either the Energy Efficient Home Improvement Credit or the Residential Clean Energy Credit for the year when you make qualifying improvements Homeowners who

Tax Credit For Energy Efficiency Improvements

Tax Credit For Energy Efficiency Improvements

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

The Multiple Benefits Of Energy Efficiency Better Buildings Initiative

https://betterbuildingssolutioncenter.energy.gov/sites/default/files/BP-BenefitsOfEnergyEfficiency-TWITTER.jpg

2023 Energy Efficient Home Credits Tax Benefits Tips

https://accountants.sva.com/hubfs/sva-certified-public-accountants-biz-tip-energy-efficient-home-improvement-credit-more-opportuniities-in-2023-01.png

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Reduction Act Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do

The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year

Download Tax Credit For Energy Efficiency Improvements

More picture related to Tax Credit For Energy Efficiency Improvements

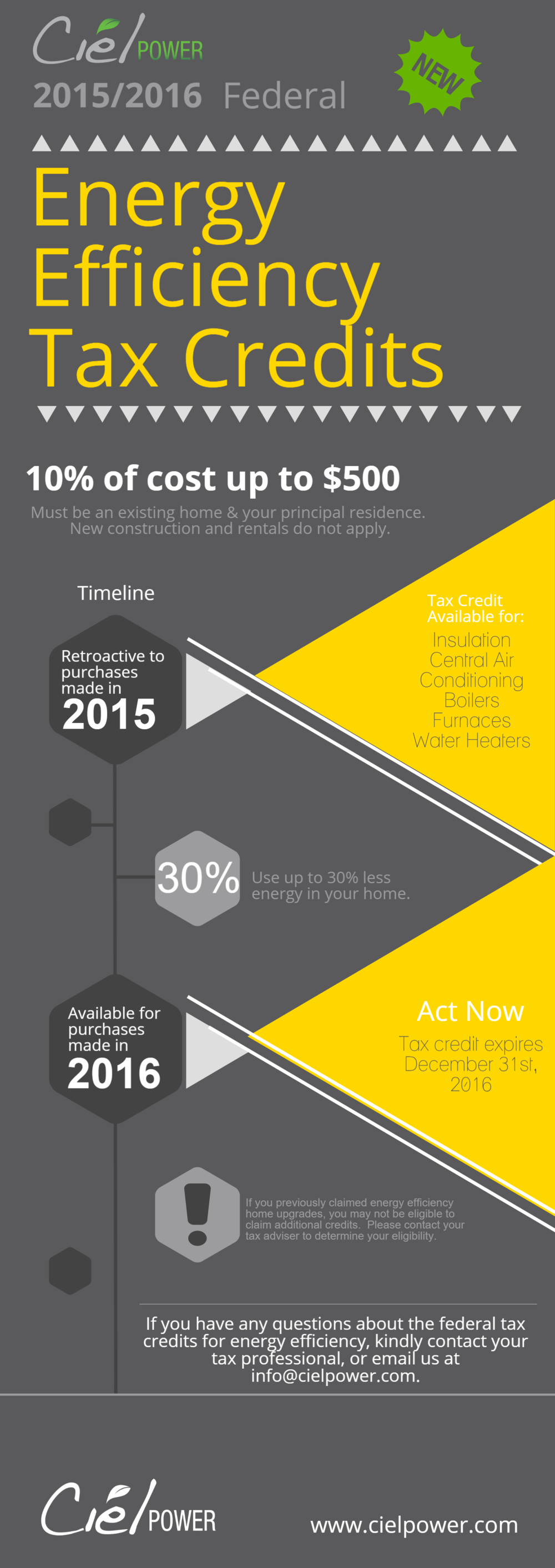

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

What Is An R D Tax Credit

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

You can claim the home improvement credit by attaching Form 5695 to your tax return What is the energy efficient home improvement credit The energy efficient home improvement credit can The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy Conservation Code IECC The 2021 IECC

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on

Federal Solar Energy Tax Credit Sapling

https://img.saplingcdn.com/640/photos.demandstudios.com/getty/article/176/34/158918050.jpg

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

https://www.energystar.gov › about › fe…

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner

https://turbotax.intuit.com › tax-tips › h…

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

Federal Solar Energy Tax Credit Sapling

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Who Pays For Energy Efficiency Improvements Deacon

Industry Prepares For Energy Efficiency Day 2017 Electrical

Georgia Tax Credits For Workers And Families

Georgia Tax Credits For Workers And Families

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

U S Restarts 10 Billion Tax Credit For Clean Energy Makers Data

Rising Cost Of Energy Efficiency Upgrades Put Pressure On Landlords

Tax Credit For Energy Efficiency Improvements - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do