Tax Credit For Health Care Workers Verkko 8 syysk 2023 nbsp 0183 32 What is a Tax Deduction A tax deduction is money that you subtract from your earned income which will lower the amount of money you are taxed and the amount of tax you may possibly owe 4 Common Tax Deductions for Nurses Mid wives and other Healthcare Professional 1 Clothing Uniforms

Verkko 26 lokak 2022 nbsp 0183 32 Everything You Need to Know About The Health Care Tax Credit Need to get health insurance through an Affordable Care Act exchange You may be eligible for help Image credit Getty Verkko 12 jouluk 2023 nbsp 0183 32 A premium tax credit also called a premium subsidy lowers the cost of your health insurance You can apply the discount to your insurance bill every month or you can get the credit as a refund on your federal income taxes Catastrophic coverage health plans aren t eligible for premium tax credits

Tax Credit For Health Care Workers

Tax Credit For Health Care Workers

https://www.letsbegamechangers.com/wp-content/uploads/2020/01/load-image-2020-01-24T030638.645-1536x1024.jpeg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

AGH Health Care Tax Credit Is Your Business Eligible

http://aghlc.com/images/health-care-tax-credit.jpg

Verkko More information is available in the IRS Statement about Letter 6534 The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace Verkko 3 maalisk 2022 nbsp 0183 32 Eligible Employers may claim tax credits for qualified leave wages paid to employees on leave due to paid sick leave or expanded family and medical leave for reasons related to COVID 19 taken for periods of leave beginning on April 1 2020 and ending on March 31 2021

Verkko 5 lokak 2022 nbsp 0183 32 The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it Find out if you meet the requirements and qualify and what steps you must take to claim the premium tax credit Verkko 31 maalisk 2023 nbsp 0183 32 How does Working Tax Credit WTC work for care workers What if I am on universal credit What is the National Minimum Wage The National Minimum Wage National Living Wage NMW NLW is the minimum pay per hour most workers are entitled to by law The rate will depend on your age and if you are an apprentice

Download Tax Credit For Health Care Workers

More picture related to Tax Credit For Health Care Workers

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

https://s1.cdn.autoevolution.com/images/news/approval-of-tax-credit-for-union-built-evs-will-face-internal-and-foreign-disputes-173073_1.jpg

.png?format=1500w)

United Health Care Workers Of Ontario

https://images.squarespace-cdn.com/content/v1/6169ff5703ef8a05149210f4/c251b3c3-d41f-4246-a872-b9d47e8903c2/uhcwo+color+(1).png?format=1500w

Don t Forget The Healthy Homes Tax Credit Safe Home

https://safeathomewindsor.ca/wp/wp-content/uploads/2015/04/HHTCgentleman1.jpg

Verkko A small employer is eligible for the credit if a it has fewer than 25 full time equivalent employees b the average annual wages of its employees are less than 50 000 adjusted for inflation beginning in 2014 and c it pays a uniform percentage for all employees that is equal to at least 50 of the premium cost of employee only Verkko You may qualify for the Small Business Health Care Tax Credit that could be worth up to 50 of the costs you pay for your employees premiums 35 for non profit employers See if you qualify for savings all You have fewer than 25 full time equivalent FTE employees

Verkko You must file tax return for 2022 if enrolled in Health Insurance Marketplace 174 plan Learn how to maximize health care tax credit amp get highest return Verkko A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace 174 Your tax credit is based on the income estimate and household information you put on your Marketplace application

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

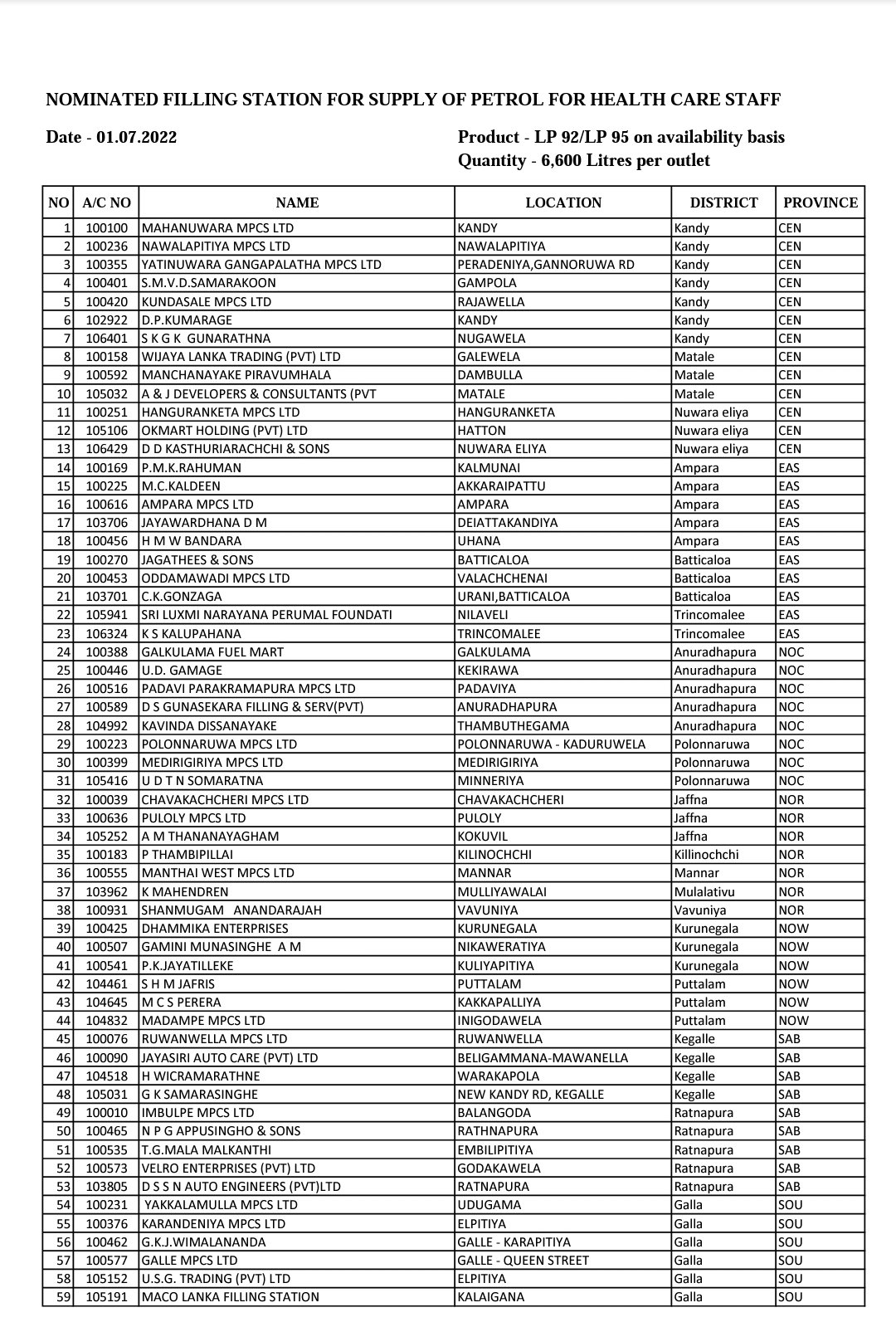

Fuel Will Be Issued In 92 Stations On Friday For Health Workers NewsWire

http://www.newswire.lk/wp-content/uploads/2022/06/20220630_225530.jpg

https://www.handytaxguy.com/overlooked-tax-deductions-for-nurses

Verkko 8 syysk 2023 nbsp 0183 32 What is a Tax Deduction A tax deduction is money that you subtract from your earned income which will lower the amount of money you are taxed and the amount of tax you may possibly owe 4 Common Tax Deductions for Nurses Mid wives and other Healthcare Professional 1 Clothing Uniforms

https://www.kiplinger.com/personal-finance/insurance/everything-you...

Verkko 26 lokak 2022 nbsp 0183 32 Everything You Need to Know About The Health Care Tax Credit Need to get health insurance through an Affordable Care Act exchange You may be eligible for help Image credit Getty

Tax Credit Bill For Rural Physicians Passes House Committee

Another Way To Save New Tax Credit For Plan Participants

.svg/1200px-Great_Seal_of_the_United_States_(obverse).svg.png)

Workplace Violence Prevention For Health Care And Social Service

Guide To Premium Tax Credits For Health Insurance How To Save Money

Modifications To The 45Q Tax Credit Great Plains Institute

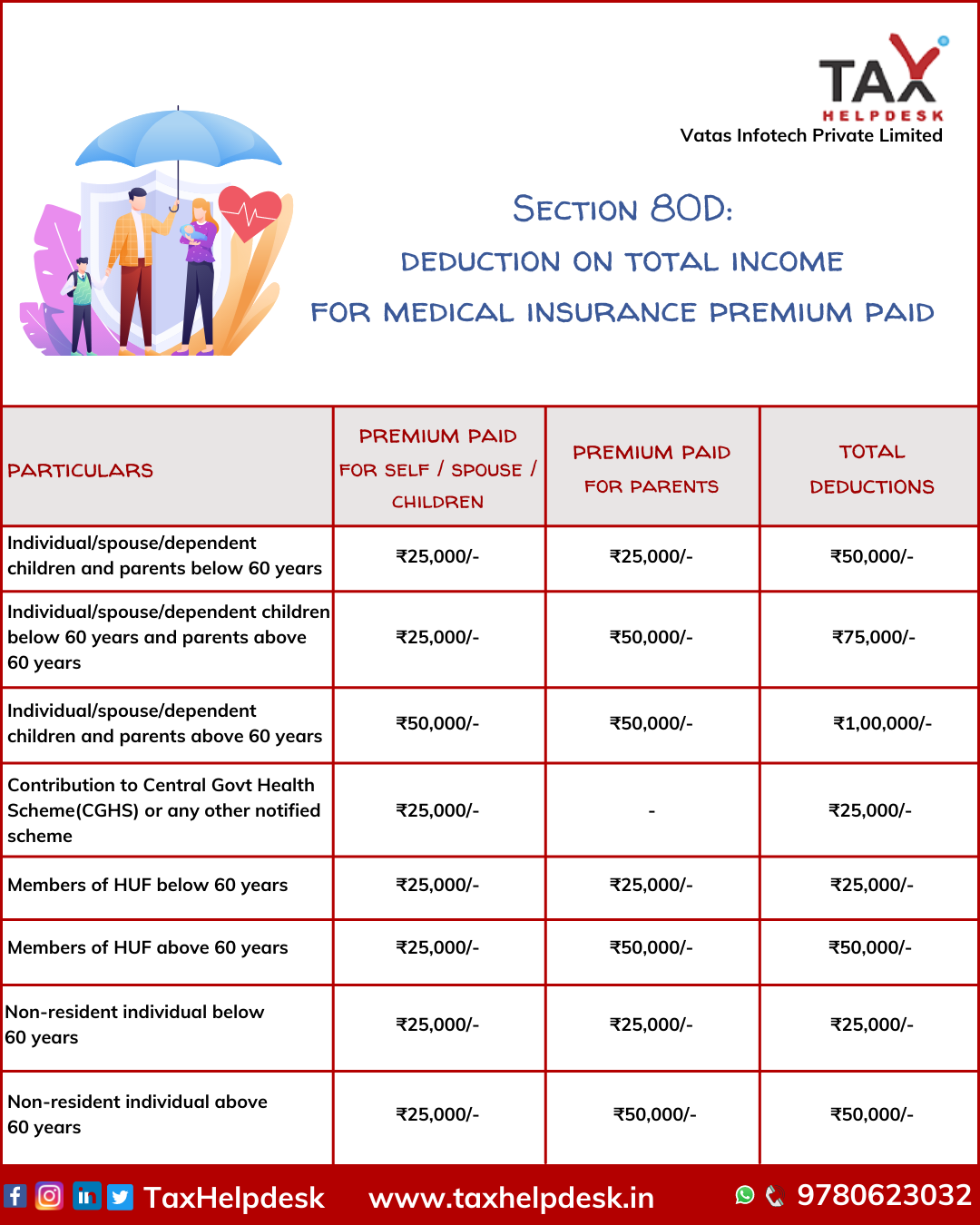

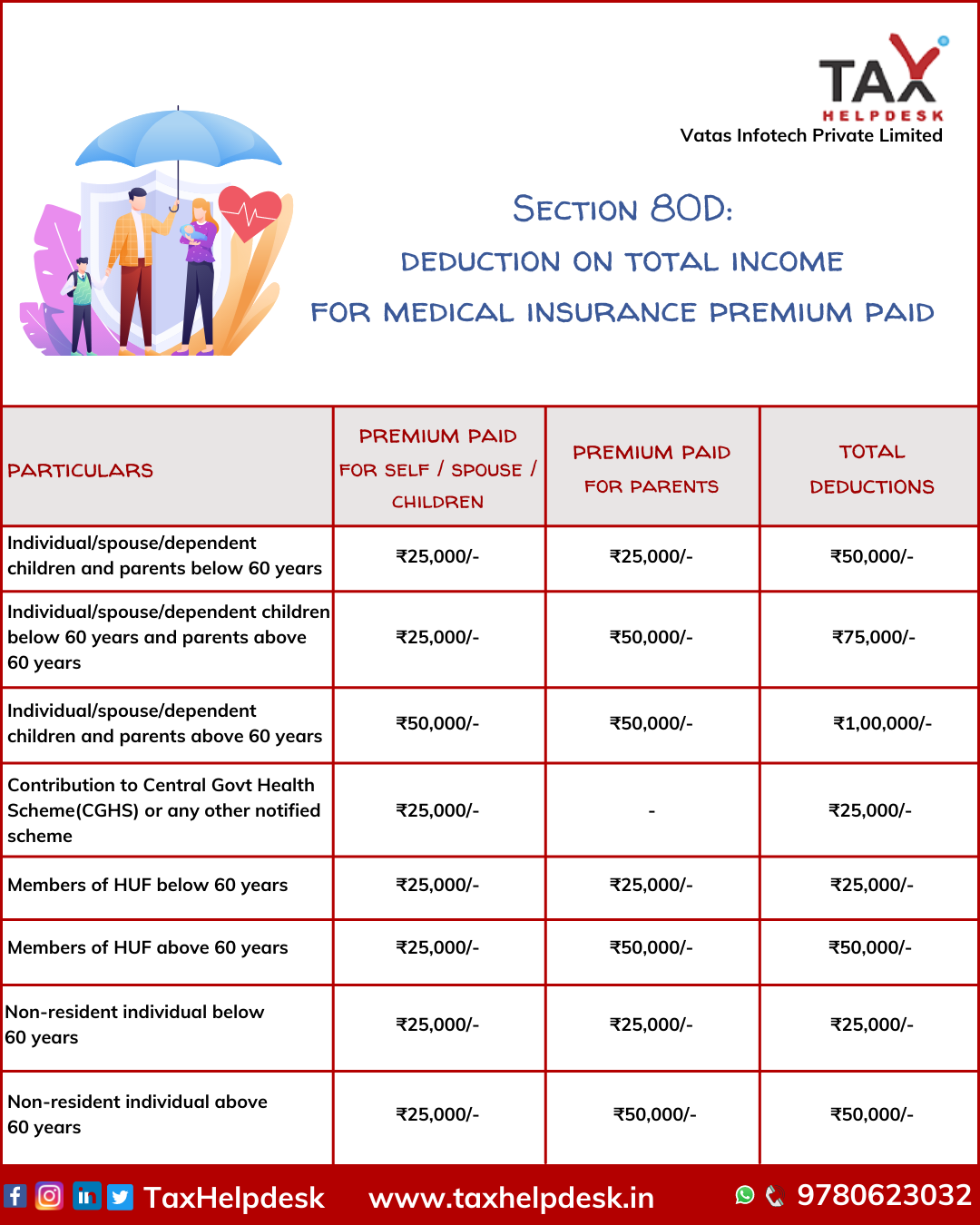

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

Learn About The NEW State Tax Credit For Working Families Key

Ontario Newsroom

New Business Tax Credit May Help Child Care Crisis In Kansas

Tax Credit For Health Care Workers - Verkko 1 helmik 2021 nbsp 0183 32 Under HB 8259 the medical frontliners qualified to avail of the 25 tax discount are those engaged in health related services and are employed in hospitals clinics or other medical