Tax Deductions For Home Health Care Workers As a home care aid you are eligible for a number of tax deductions including vehicle expenses home office deduction and professional association dues Here s the information you need for your next filing

The following FAQs illustrate some fact patterns involving family member caregivers who are not employees Q 1 Must a taxpayer pay self employment tax on the income they received from an insurance company to care for their spouse who was injured in an accident and permanently disabled The taxpayer is caring for their spouse in their home in If you pay for at home home care services the IRS may let you deduct the cost from your annual taxes The IRS does allow citizens to deduct certain medical deductions to cover the cost of doctors therapists surgeons psychiatrists and prescription medications

Tax Deductions For Home Health Care Workers

Tax Deductions For Home Health Care Workers

https://businessfirstfamily.com/wp-content/uploads/2015/10/home-care-franchise-employee.jpg

How Health Insurance Tax Deductions Can Save You Money Gusto

https://gusto.com/wp-content/uploads/2016/11/Screen-Shot-2017-03-08-at-12.56.00-PM.png

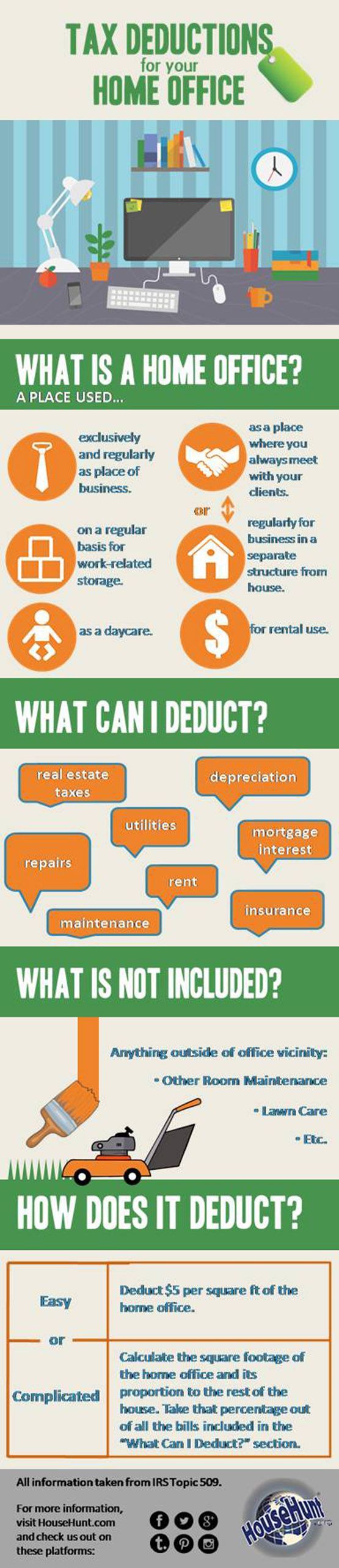

Tax Deductions For Your Home Office Visual ly

https://i.visual.ly/images/tax-deductions-for-your-home-office_5334b32711176.jpg

Is there a tax deduction or credit related to paying a caregiver Are there special rules if the caregiver is providing services for a family member Hiring an in home caregiver can be expensive and confusing If you hire a caregiver through a licensed home care company the caregiver s employer will handle many of the tax and payroll issues There are some tax deductions for home health care workers you may qualify for as long as the expenses are more than 2 percent of your adjusted gross income and your employer doesn t reimburse you for them

The medical expense deduction threshold had see sawed back and forth for several years between 10 and 7 5 of AGI but recent legislation made the lower threshold a permanent part of the Home care can be expensive nearly 5 000 per month on average but there are ways to help make it more affordable Certain home care services you ve paid for yourself your spouse or another dependent can qualify as a deductible expense on your taxes

Download Tax Deductions For Home Health Care Workers

More picture related to Tax Deductions For Home Health Care Workers

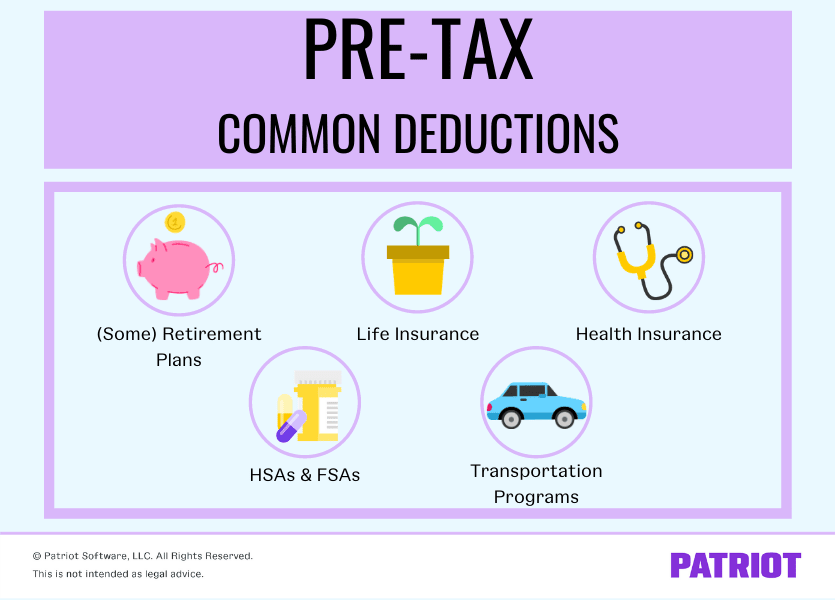

Top 8 What Are Pre Tax Deductions 2022

https://www.patriotsoftware.com/wp-content/uploads/2017/05/Pre-tax-deductions-1.png

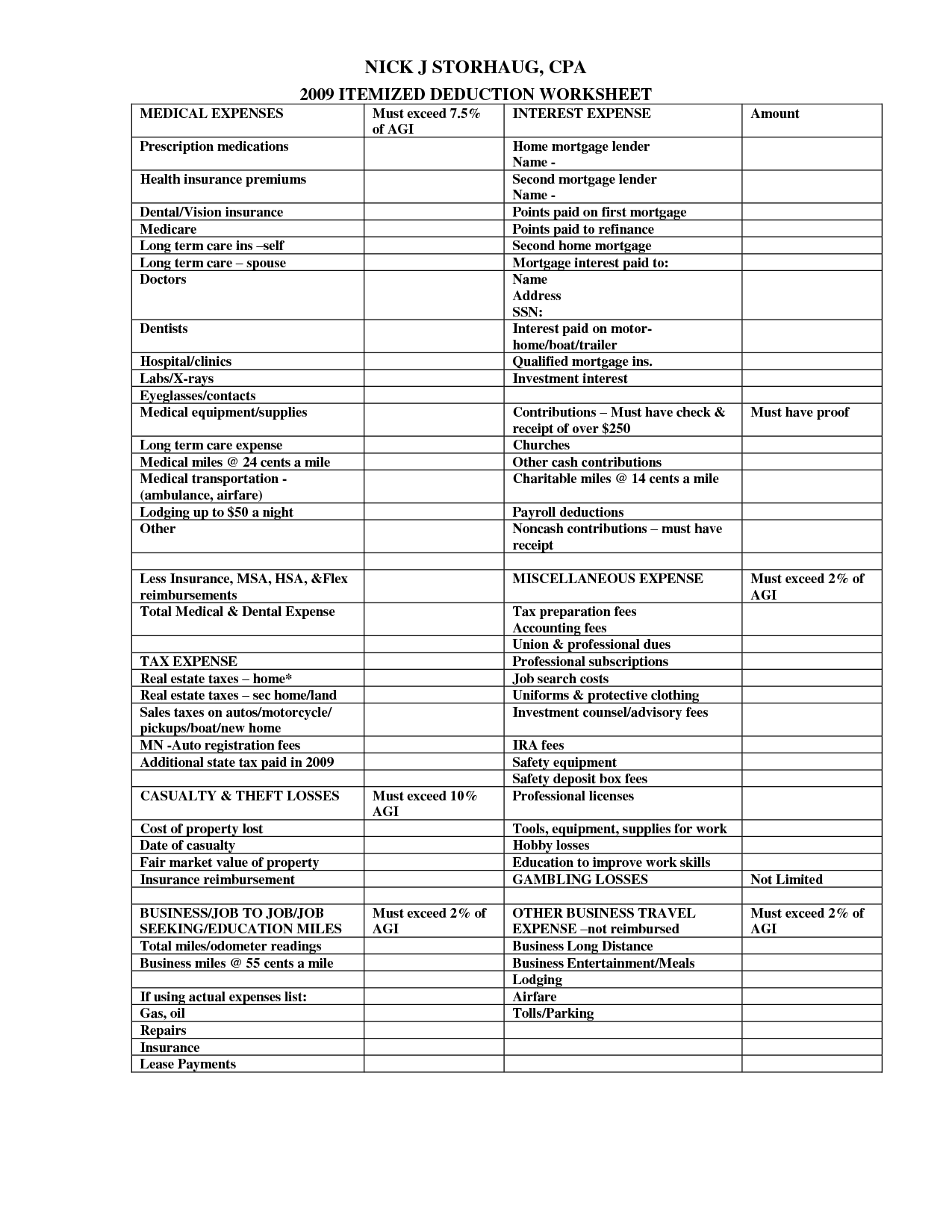

Itemized Tax Deduction Worksheet Oaklandeffect Deductions Db excel

https://db-excel.com/wp-content/uploads/2019/09/itemized-tax-deduction-worksheet-oaklandeffect-deductions.png

Business Itemized Deductions Worksheet Beautiful Business Itemized For

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet.jpg

Is home health care tax deductible Yes out of pocket costs for nursing services including home health care are tax deductible It s important to keep in mind that many home health care services may be covered by insurance such as Medicare and Medicaid This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents

[desc-10] [desc-11]

Long term Care Insurance Quotes Online Canada Pathinchman

https://i.pinimg.com/originals/aa/ff/66/aaff66b50aa5675134105d1a9a72039d.png

Online Essay Help Amazonia fiocruz br

http://blog.academyoflearning.com/wp-content/uploads/2017/04/bigstock-Home-health-care-worker-and-an-13926641.jpg

https://mileiq.com/blog/tax-deductions-for-home-health-care-workers

As a home care aid you are eligible for a number of tax deductions including vehicle expenses home office deduction and professional association dues Here s the information you need for your next filing

https://www.irs.gov/.../family-caregivers-and-self-employment-tax

The following FAQs illustrate some fact patterns involving family member caregivers who are not employees Q 1 Must a taxpayer pay self employment tax on the income they received from an insurance company to care for their spouse who was injured in an accident and permanently disabled The taxpayer is caring for their spouse in their home in

What Are The Different Types Of Home Health Care Services On Point

Long term Care Insurance Quotes Online Canada Pathinchman

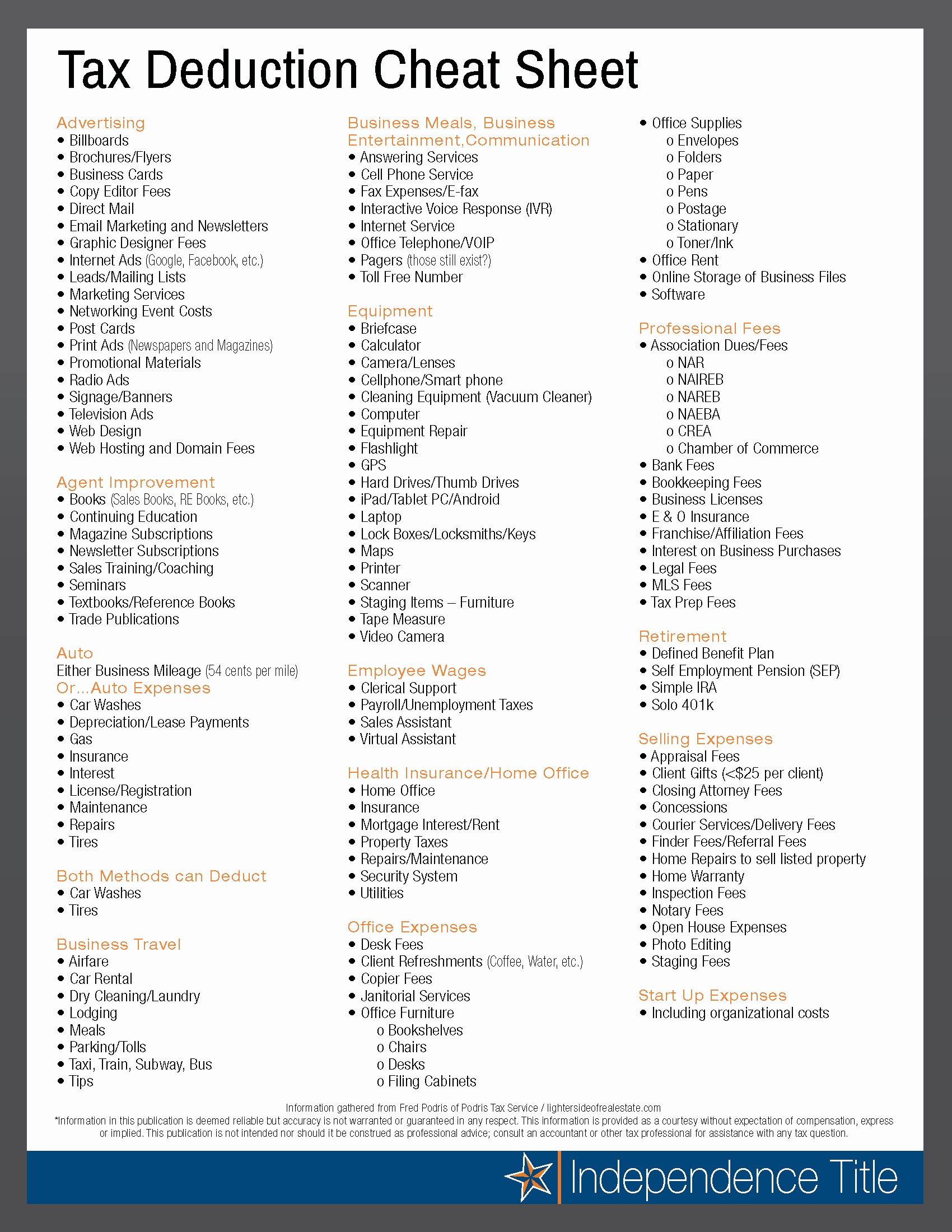

Tax Deductions For Home Daycare Businesses

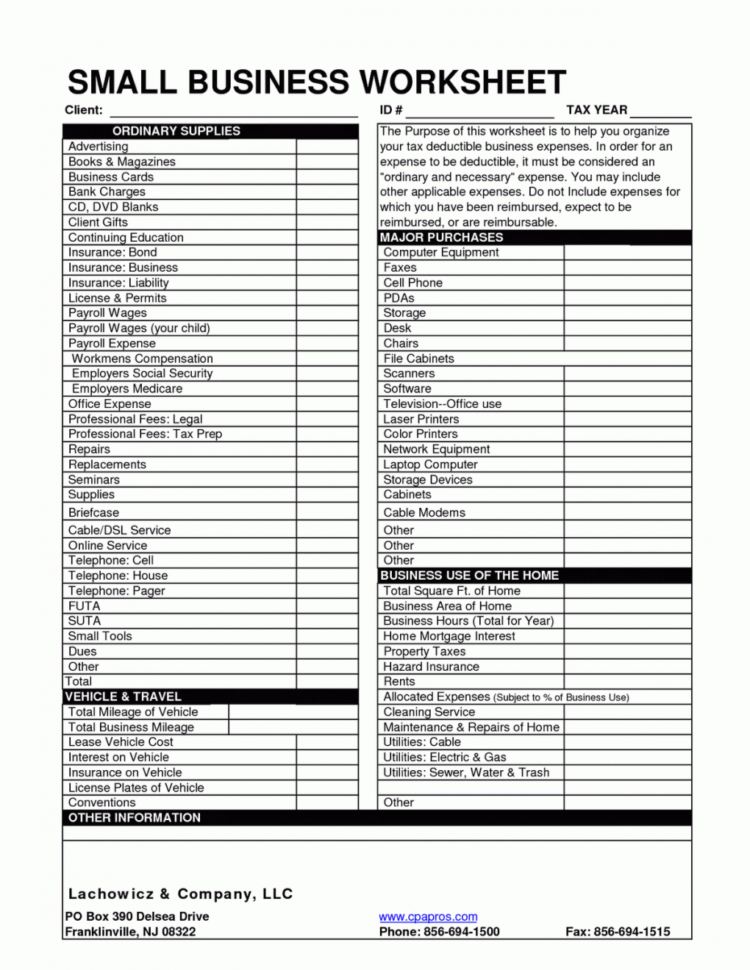

Small Business Tax Deductions Worksheet 2022

Printable Itemized Deductions Worksheet

Credits Vs Deductions Carpenter Tax And Accounting

Credits Vs Deductions Carpenter Tax And Accounting

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

16 Insurance Comparison Worksheet Worksheeto

Tax Deductions For Home Health Care Workers - Home care can be expensive nearly 5 000 per month on average but there are ways to help make it more affordable Certain home care services you ve paid for yourself your spouse or another dependent can qualify as a deductible expense on your taxes