Tax Credit For Medical Expenses 2022 Learn how to deduct qualified medical expenses that are more than 7 5 of your adjusted gross income for 2023 tax returns filed in 2024 Find out what counts as a medical expense how to

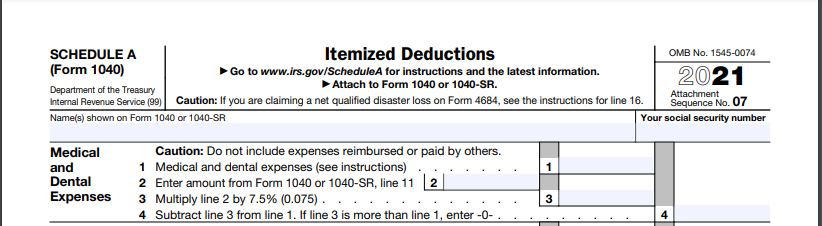

Learn how to deduct medical and dental expenses on Schedule A Form 1040 for 2022 Find out the standard mileage rate the health coverage tax credit and other rules and tips for claiming You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

Tax Credit For Medical Expenses 2022

Tax Credit For Medical Expenses 2022

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Child Tax Credit 2022 When Is The IRS Releasing Refunds With CTC Marca

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

Medical Expenses Tax Back Get 20 Tax Back Today My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

Learn how to claim medical expenses on your tax return including eligible expenses credits and deductions Find out the period amounts and conditions for claiming medical expenses You won t be eligible for the tax credit if you can get affordable health coverage through your employer or if you qualify for a government health insurance program You must file a tax return to claim and reconcile the

You must file tax return for 2022 if you are enrolled in a Health Insurance Marketplace plan Learn how to maximize health care tax credit get highest return Learn how to get the premium tax credit PTC to reduce your health insurance costs through an exchange Find out who qualifies how the PTC is calculated and how to report and reconcile the

Download Tax Credit For Medical Expenses 2022

More picture related to Tax Credit For Medical Expenses 2022

Medical Expenses Islamicmyte

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

How Does The Medical Expense Tax Credit Work In Canada

https://www.olympiabenefits.com/hubfs/How does the Medical Expense Tax Credit work in Canada.png

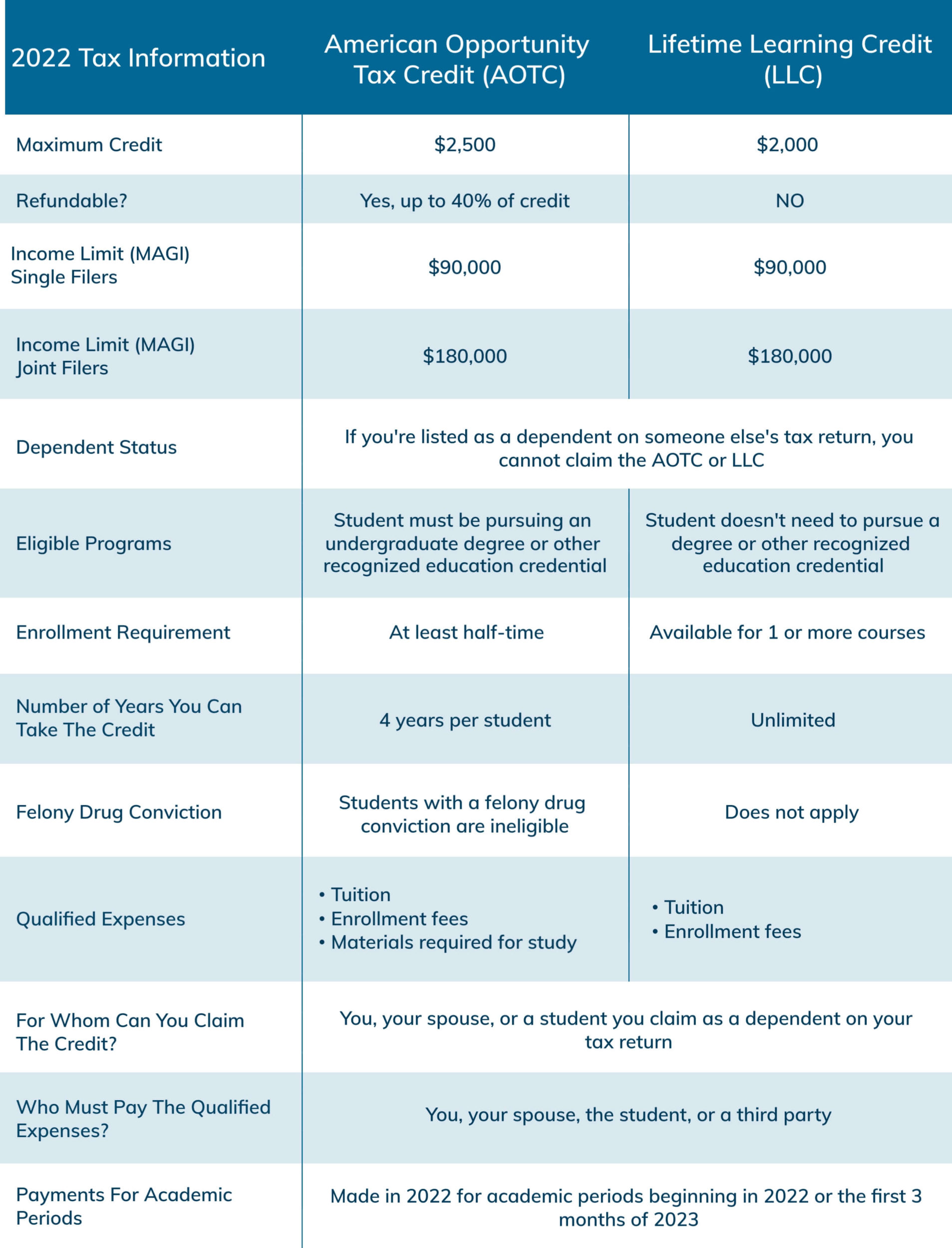

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-1907x2500.jpg

You can claim a non refundable tax credit for medical expenses you paid in the year for your dependants A dependant can be your or your spouse s or common law partner s Child or grandchild who was 18 years of age or older on Learn how to claim medical expenses on your tax return using lines 33099 and 33199 Find out which expenses are eligible how to support them with documents and what credits and

The METC is a 15 non refundable tax credit that is available for certain medical or disability related expenses For 2022 the METC is available for qualifying medical Learn how to claim medical expenses on your tax return including eligible expenses calculation documentation and examples Find out the base amounts and tax credit rates for

/GettyImages-918315214-d2ced2bbb03c48b1b05e52445005d2ad.jpg)

Medical Expenses Definition

https://www.investopedia.com/thmb/OYY8aZjCR-KV8UHGVzozXrljao8=/2121x1414/filters:fill(auto,1)/GettyImages-918315214-d2ced2bbb03c48b1b05e52445005d2ad.jpg

Did You Pay Medical Expenses In 2021 New Rule For Medical Deductions

https://westridgeaccounting.com/wp-content/uploads/2022/01/2021-Schedule-A-Medical.jpg

https://www.nerdwallet.com/article/tax…

Learn how to deduct qualified medical expenses that are more than 7 5 of your adjusted gross income for 2023 tax returns filed in 2024 Find out what counts as a medical expense how to

https://www.irs.gov/pub/irs-prior/p502--2022.pdf

Learn how to deduct medical and dental expenses on Schedule A Form 1040 for 2022 Find out the standard mileage rate the health coverage tax credit and other rules and tips for claiming

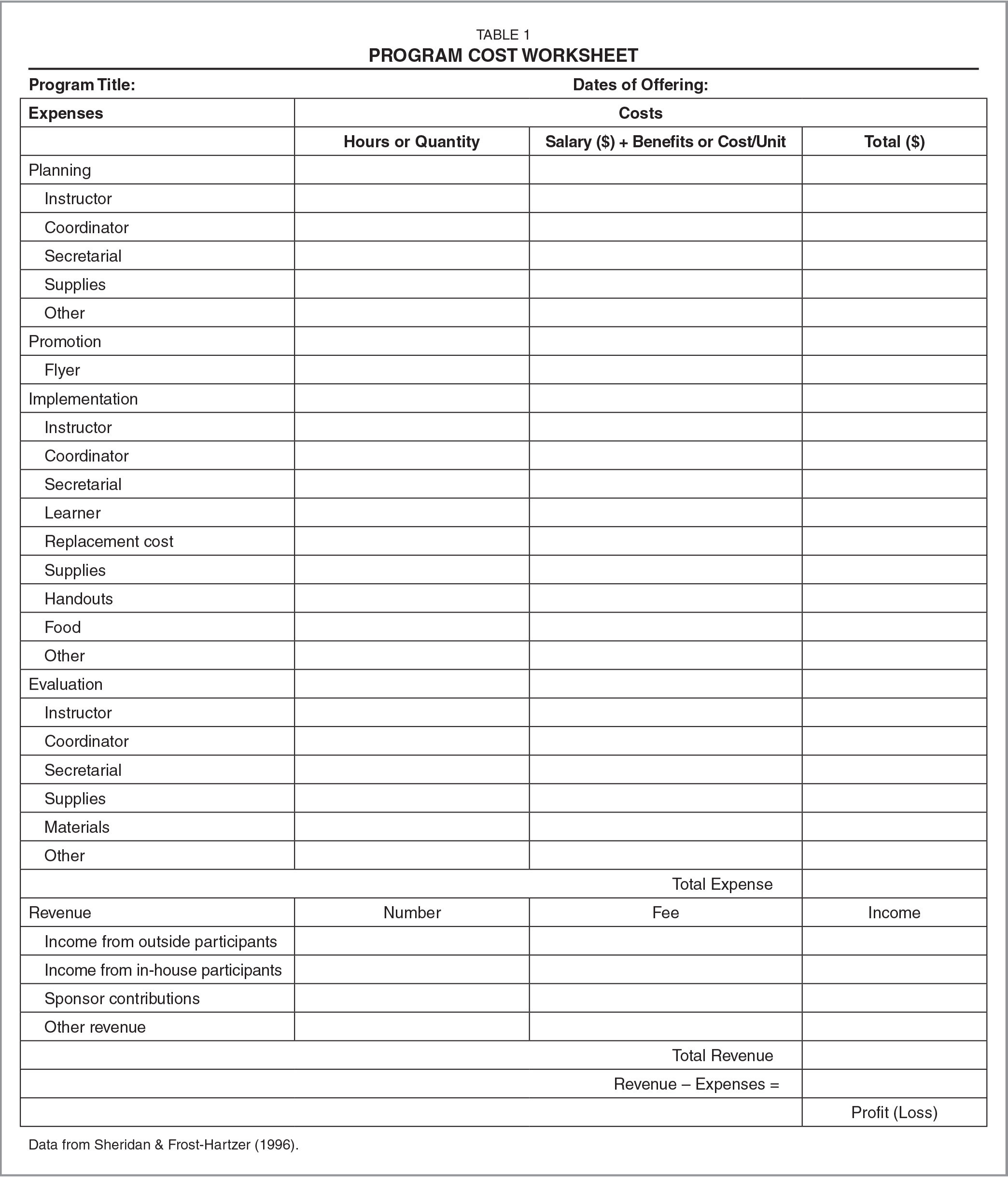

Tax Expenses Template Download In Excel Google Sheets Template

/GettyImages-918315214-d2ced2bbb03c48b1b05e52445005d2ad.jpg)

Medical Expenses Definition

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Printable Itemized Deductions Worksheet

How Medical Expenses Affect Credit And What You Can Do About It

22 Questions Answered For 2022 Tax Filing Emerald Advisors

22 Questions Answered For 2022 Tax Filing Emerald Advisors

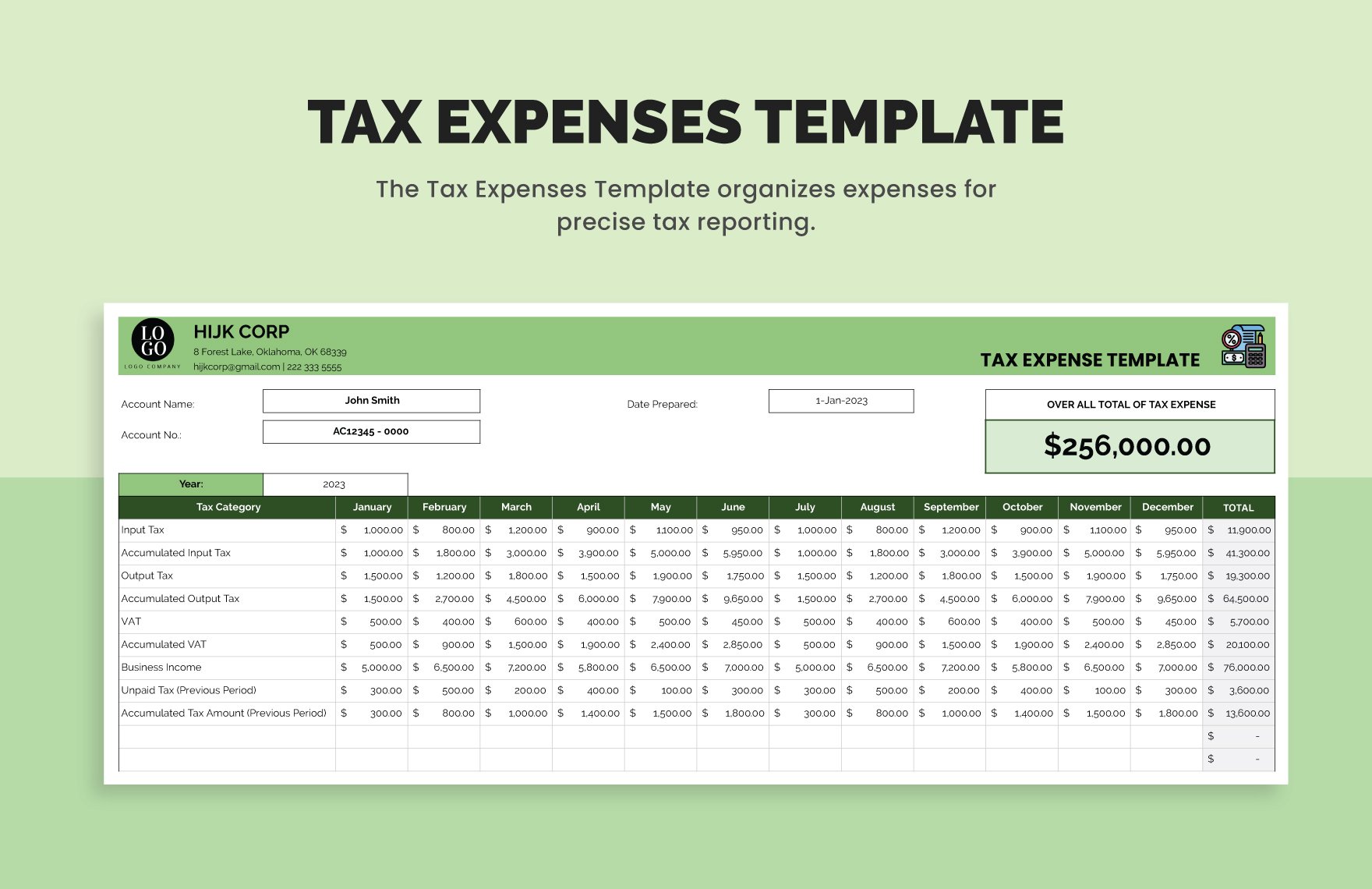

Hospital Monthly Income Expenditure Report Free Report Templates In

What Can You Claim For Tax Relief Under Medical Expenses

How To Budget For Medical Expenses

Tax Credit For Medical Expenses 2022 - Learn how to get the PTC a refundable credit that helps cover health insurance premiums by filing Form 8962 with your tax return Find out the eligibility requirements changes for 2021