What Is The Tax Deduction For Medical Expenses This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

Sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure or function of the body

What Is The Tax Deduction For Medical Expenses

What Is The Tax Deduction For Medical Expenses

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

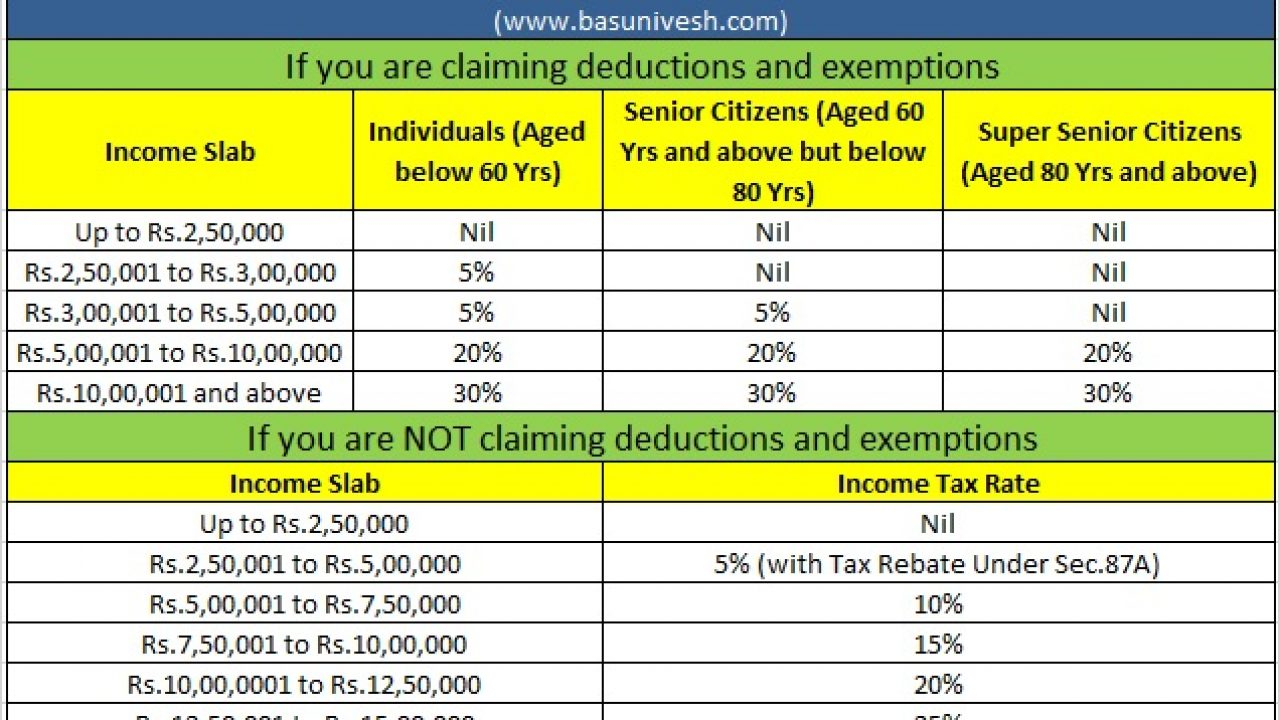

Income Tax Deduction For Medical Expenses

https://img.indiafilings.com/learn/wp-content/uploads/2017/11/12010253/Income-tax-deduction-for-medical-expenses.jpg

Medical Expense Deduction How To Claim A Tax Deduction For Medical

https://www.bankrate.com/2020/02/20184340/Medical-expense-deduction-how-to-claim-medical-expenses-on-your-taxes.jpeg

For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10 General information How to claim medical expenses Credits or deductions related to medical expenses Certain medical expenses require a certification Common medical expenses you can claim Attendant care and care in a facility Care treatment and training Construction and renovation Devices equipment and supplies

Table of Contents Are medical expenses tax deductible What medical expenses tax deductions can I claim What medical expenses are not deductible Can I deduct medical expenses for others on my taxes How much of my medical expenses can I deduct Do medical expense tax deductions only apply to costs incurred this year If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical expenses that exceed

Download What Is The Tax Deduction For Medical Expenses

More picture related to What Is The Tax Deduction For Medical Expenses

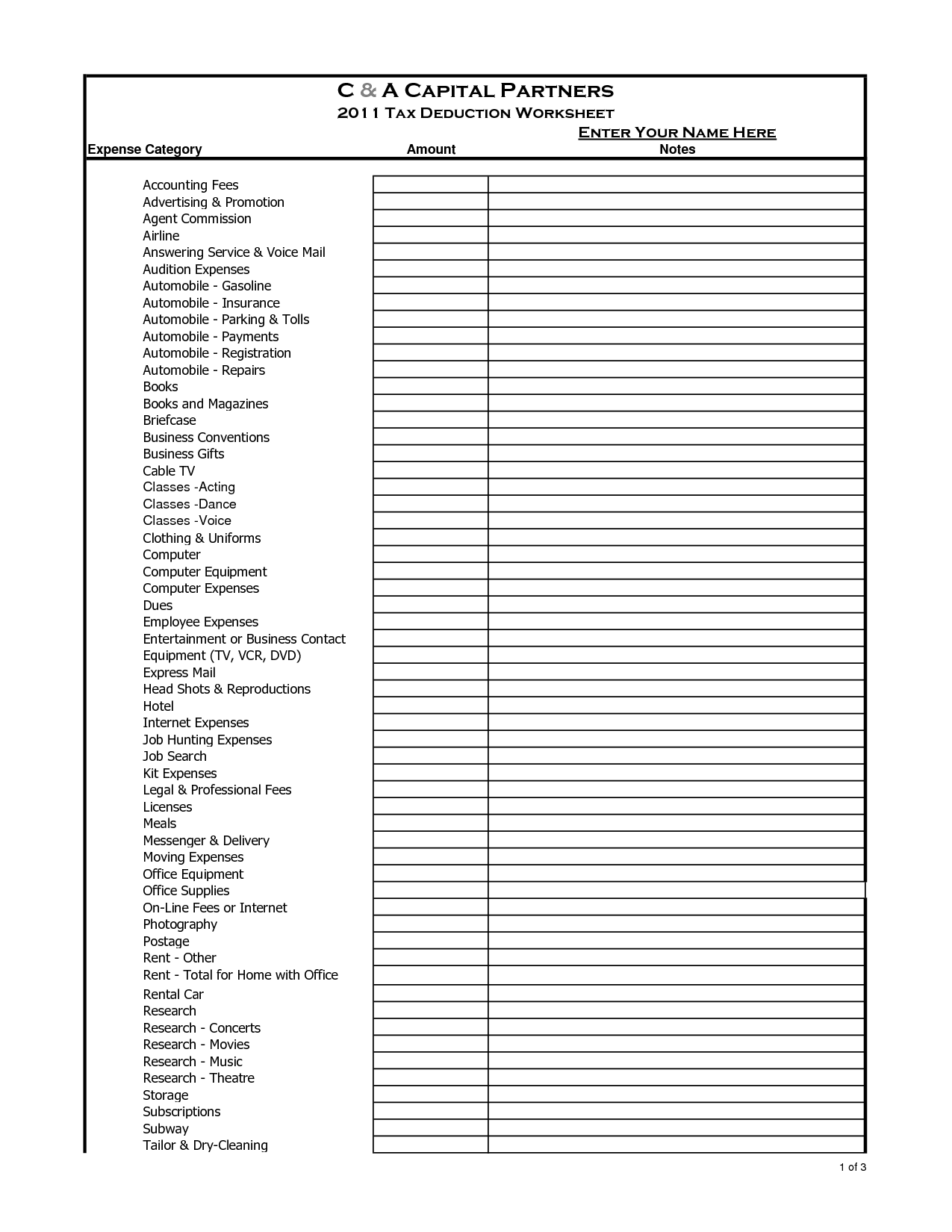

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

2021 Taxes For Retirees Explained Cardinal Guide

https://cardinalguide.com/app/uploads/2021/02/Standard_deductions_2021-751x550.jpg

If your total medical expenses are 6 000 you can deduct 2 250 of it from your taxes Note however that you ll need to itemize deductions to deduct medical expenses Section 80D of Income Tax Act Deductions Under Medical Insurance Limit Eligibility And Policies By Ektha Surana Updated on Mar 13th 2024 13 min read Health insurance provides coverage for unforeseen medical costs and hospital bills when you most require it Health insurance is one of the best ways to overcome such financial

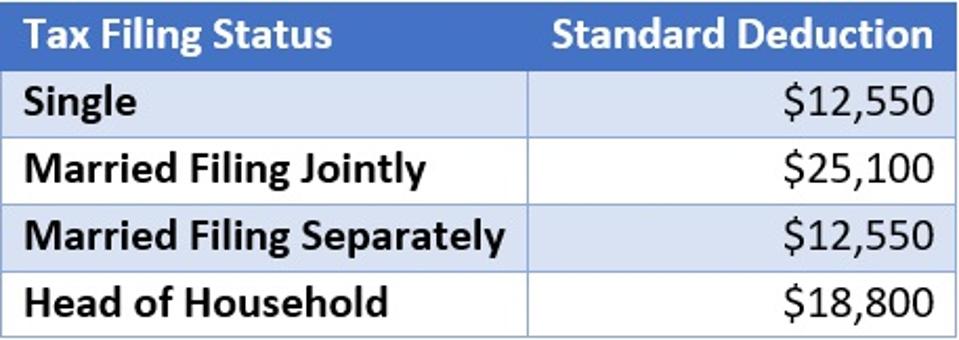

You cannot deduct the first 7 500 7 5 100 000 but you can deduct the remaining 2 500 in spending Households with very significant medical bills may get more value from itemized medical deductions than the standard deduction If you would like to check whether you can deduct your medical expenses the IRS offers an interactive Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total medical

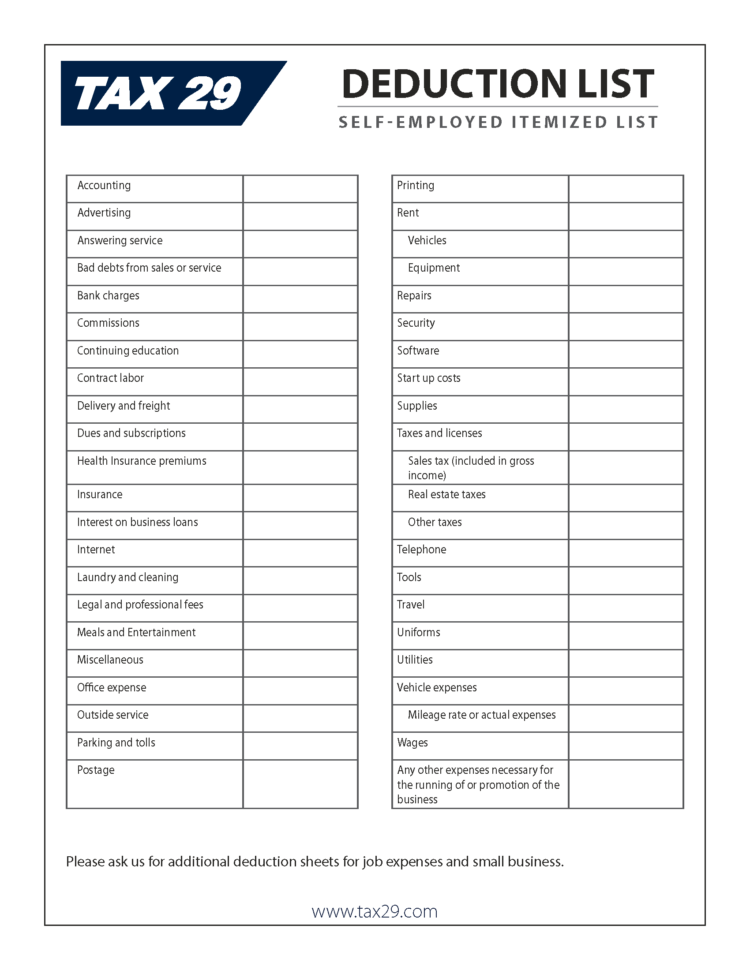

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

https://www.irs.gov/publications/p502

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction It explains how to treat reimbursements and how to figure the deduction

https://www.thebalancemoney.com/medical-expense...

Sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they itemize Learn about the rules that apply

10 2014 Itemized Deductions Worksheet Worksheeto

Qualified Business Income Deduction And The Self Employed The CPA Journal

What Is The Standard Federal Tax Deduction Ericvisser

Income Tax Deduction For Medical Treatment IndiaFilings

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Itemized Deductions Worksheet

Itemized Deductions Worksheet

Tax Deduction Template

Pin Di Worksheet

Medical Expenses Tax Deduction YouTube

What Is The Tax Deduction For Medical Expenses - If the medical bills you pay out of pocket in a year exceed 7 5 percent of your adjusted gross income AGI you may deduct only the amount of your medical expenses that exceed