Tax Deduction For Medical Expenses 2023 Medical expense deduction 2023 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income

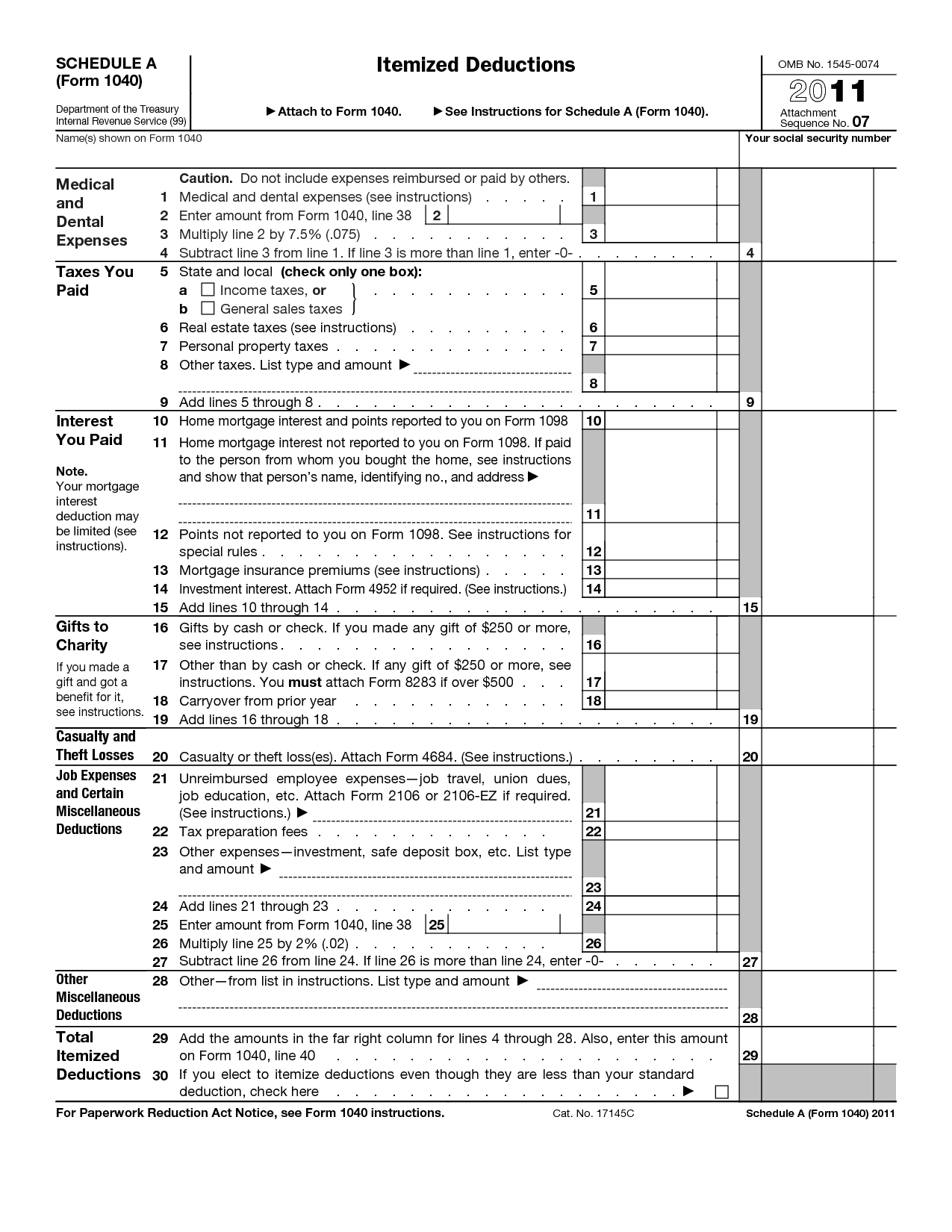

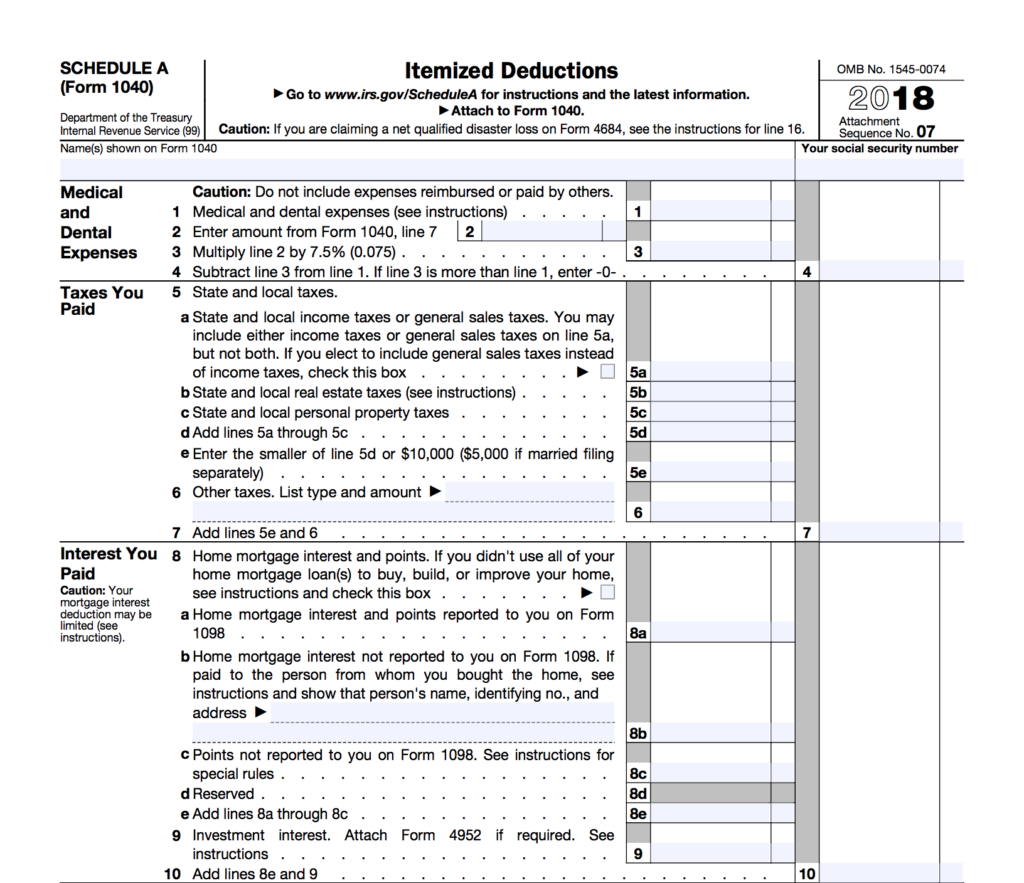

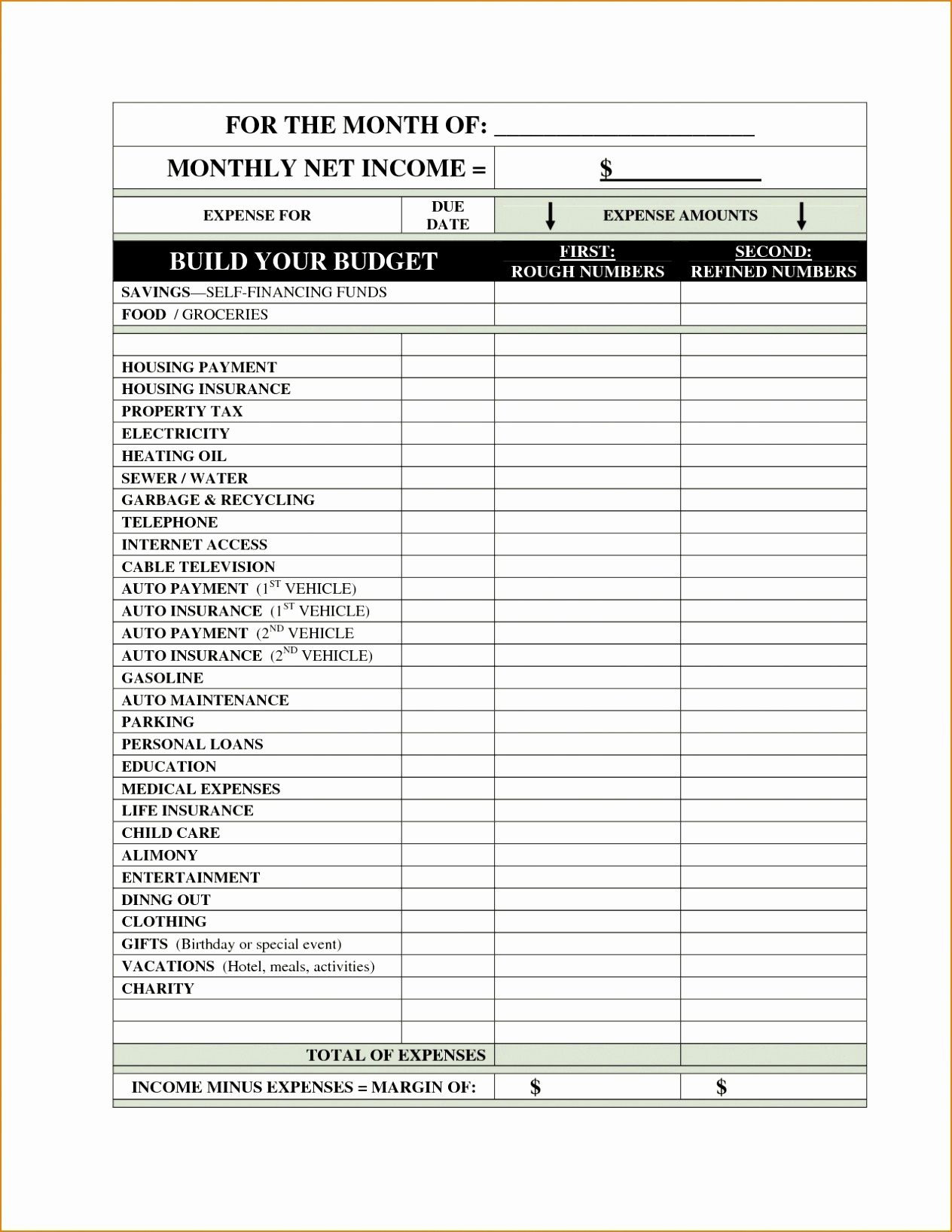

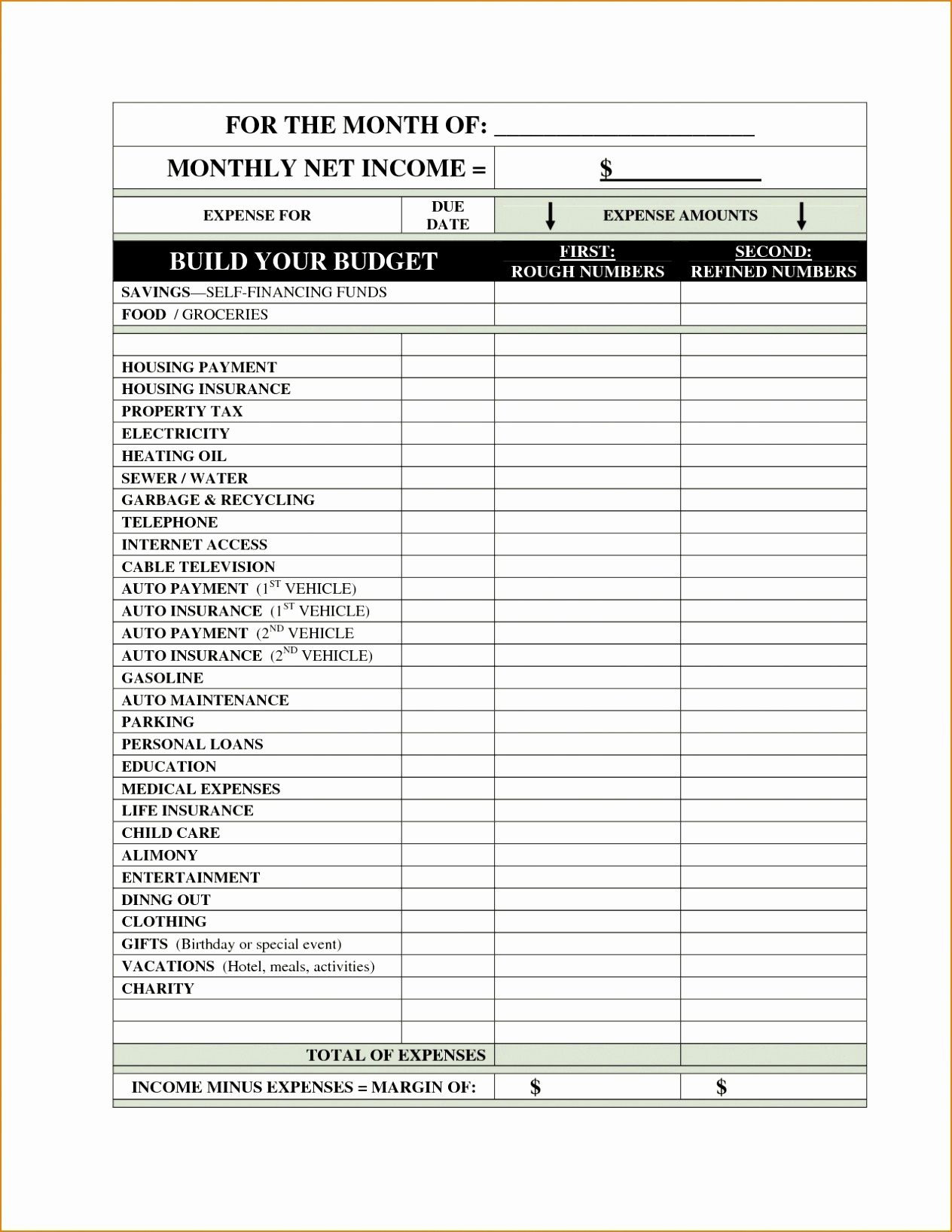

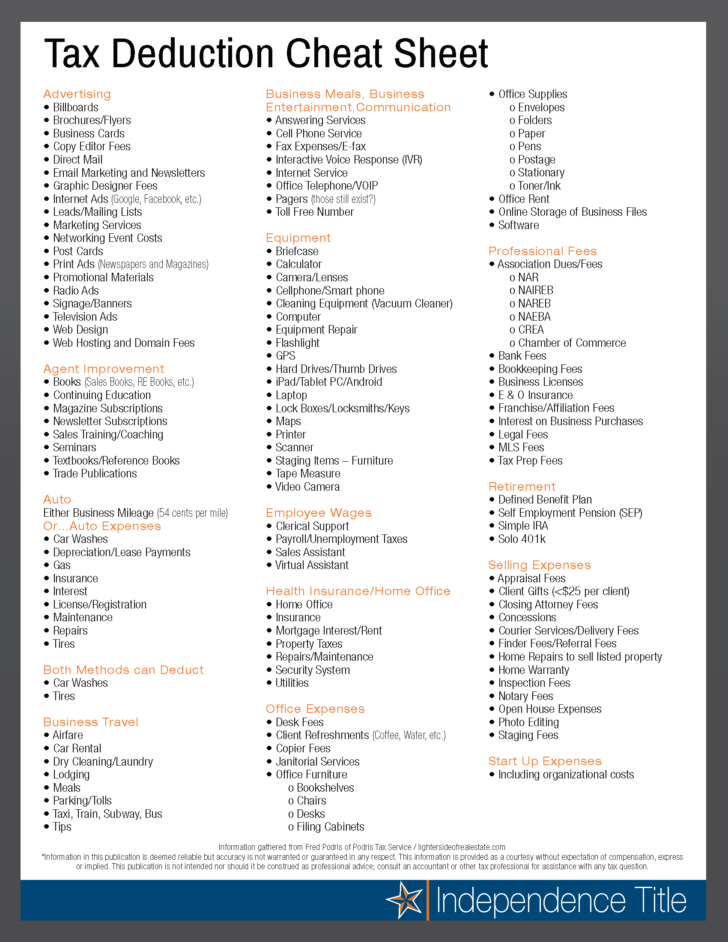

For 2023 the available standard deductions are as follows To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable contributions must be greater than your available standard deduction You can t deduct qualified medical expenses as an itemized deduction on Schedule A Form 1040 that are equal to the tax free distribution from your HSA Insurance premiums You can t treat insurance premiums as qualified medical expenses unless the premiums are for any of the following

Tax Deduction For Medical Expenses 2023

Tax Deduction For Medical Expenses 2023

https://www.ovlg.com/sites/files/uploaded_files/Can-you-claim-a-tax-deduction-for-medical-expenses.jpg

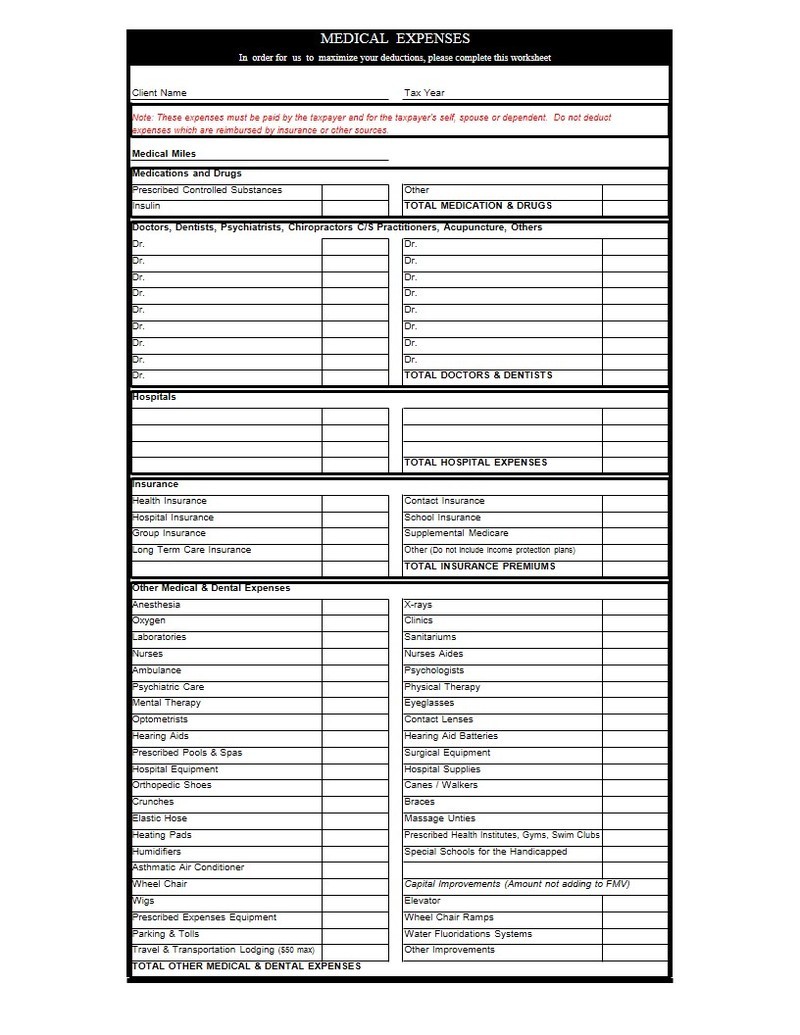

Anchor Tax Service Medical Deductions

https://www.anchor-tax-service.com/s/cc_images/cache_2322142.jpg?t=1395580404

Print Notes

https://s3.amazonaws.com/s3.documentcloud.org/documents/588113/pages/an-annotated-form-1040-p3-normal.gif

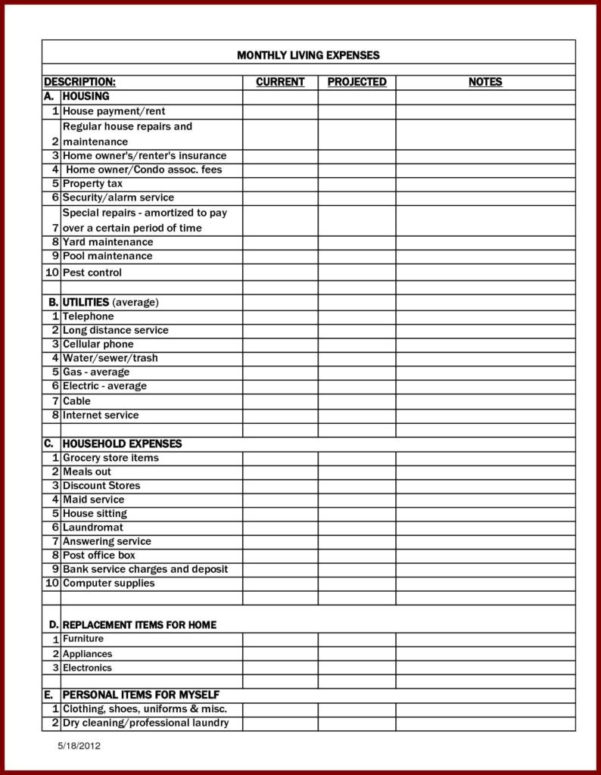

Topic no 502 Medical and dental expenses If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental expenses you paid for yourself your spouse and your dependents during the taxable year to the extent these expenses exceed 7 5 of your As per section 80D a taxpayer can claim a tax deduction on premiums paid towards medical insurance for self spouse parents and dependent children Individuals and HUF can claim this deduction This also covers the medical expenditure incurred by

For the tax year 2023 which you ll file in 2024 the standard deduction limits are as follows Single or married filing separately 13 850 15 350 if they re at least 65 Married filing jointly or qualifying widow er 27 700 Head of household 20 800 These increase for the 2024 tax year to You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return You were resident in Canada throughout 2023

Download Tax Deduction For Medical Expenses 2023

More picture related to Tax Deduction For Medical Expenses 2023

Anchor Tax Service Nurses Medical Professionals

https://www.anchor-tax-service.com/s/cc_images/cache_2322205.jpg?t=1395581512

Itemized Deductions Form 1040 Schedule A Free Download

http://www.formsbirds.com/formimg/tax-support-document/3674/itemized-deductions-form-1040-schedule-a-l1.png

Http www anchor tax service financial tools deductions medical

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

The IRS allows you to deduct expenses for many medically necessary products and services including surgeries prescription medications and dental and vision care You can t deduct medical expenses that are for general health purposes like nutritional supplements and vitamins You could claim the medical expenses tax offset for net eligible expenses relating to disability aids attendant care aged care Net expenses are your total eligible medical expenses minus refunds you or someone else receive from either National Disability Insurance Scheme NDIS private health insurers You must reduce your eligible

Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total medical The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

List Of Tax Deductions Examples And Forms

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs.png

https://www.nerdwallet.com/article/taxes/medical...

Medical expense deduction 2023 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income

https://turbotax.intuit.com/tax-tips/health-care/...

For 2023 the available standard deductions are as follows To benefit from medical expense deductions your total itemized deductions deductible medical expenses state and local taxes home mortgage interest and charitable contributions must be greater than your available standard deduction

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

List Of Tax Deductions Examples And Forms

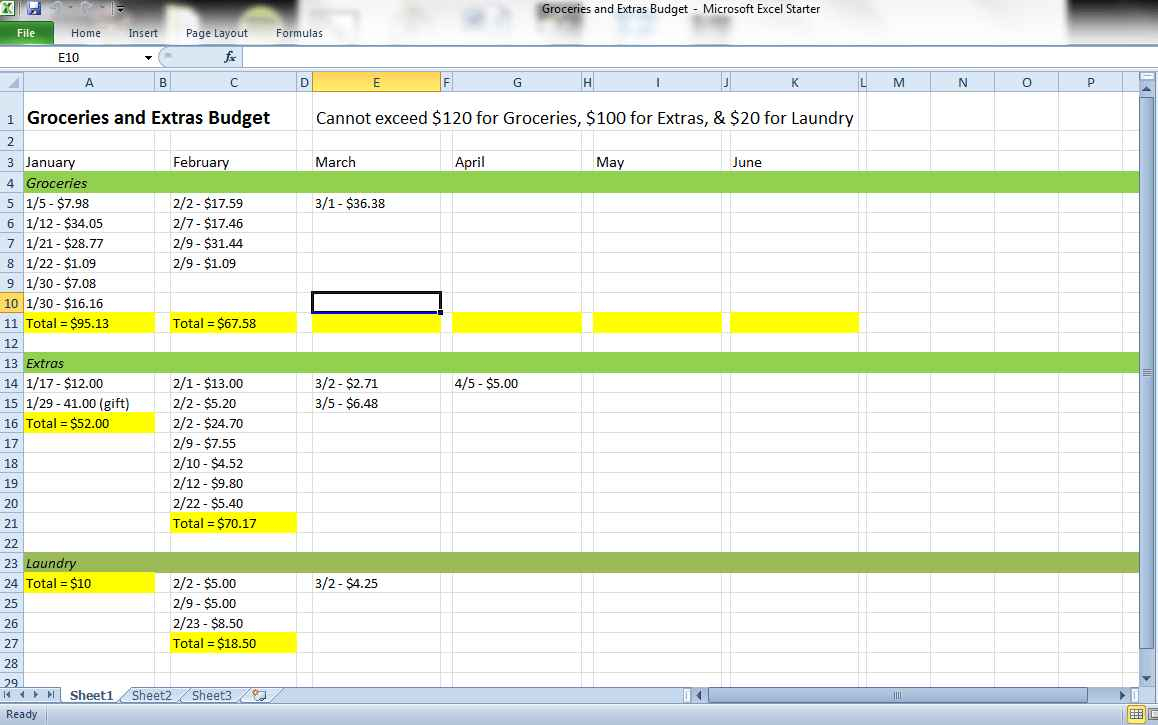

Keep Track Of Medical Expenses Spreadsheet Regarding Track Expenses And

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

Self Employed Tax Deductions Worksheet Worksheet Resume Examples

Itemized Donation List Printable Printable World Holiday

Itemized Donation List Printable Printable World Holiday

5 Itemized Tax Deduction Worksheet Worksheeto

Tax Deduction Spreadsheet Excel For Tax Deduction Spreadsheet Excel On

Printable Tax Deduction Worksheet Db excel

Tax Deduction For Medical Expenses 2023 - If you re paying a lot of healthcare costs out of your own pocket can you deduct those medical expenses from your taxes The short answer is yes but there are some limitations