Tax Deduction For Medical Expenses India Taxpayers can claim a deduction under section 80DDB for medical treatment of dependents with specified diseases The certificate can be obtained from specialists and reimbursement received affects the deduction amount

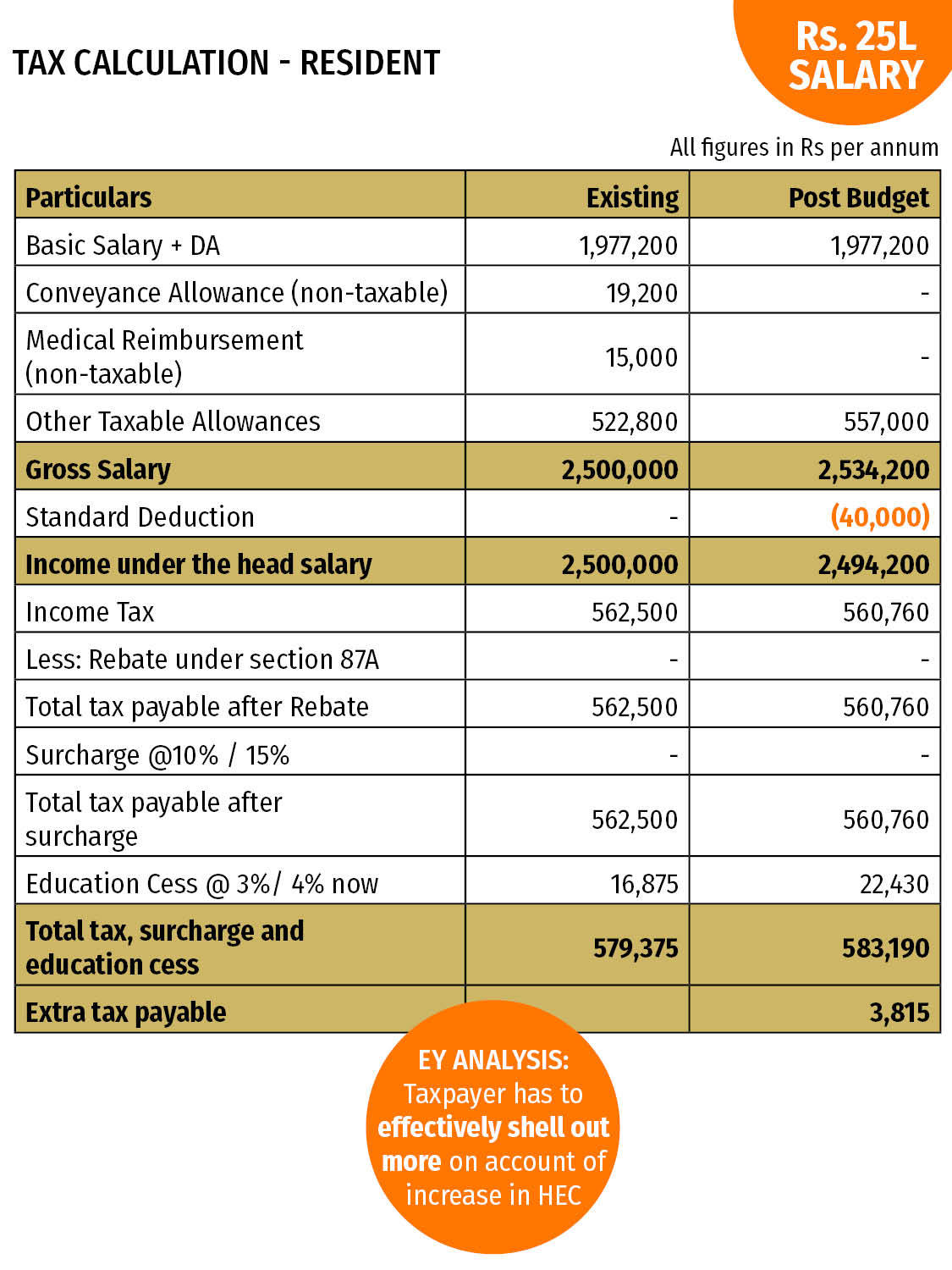

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been raised to Rs 50 000 from FY 2019 20 Medical Reimbursement allows tax exemption of up to Rs 15 000 on expenses incurred by the employee Section 80D deduction can be claimed by taxpayers from gross total income for health insurance premium contribution to Central Government Health Scheme and preventive health checkup Know more about Section 80D Deduction

Tax Deduction For Medical Expenses India

Tax Deduction For Medical Expenses India

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Medical Expenses Deduction 2021 Taxes The Finance Gourmet

https://financegourmet.com/blog/wp-content/uploads/2021/11/adjusted-gross-income.jpg

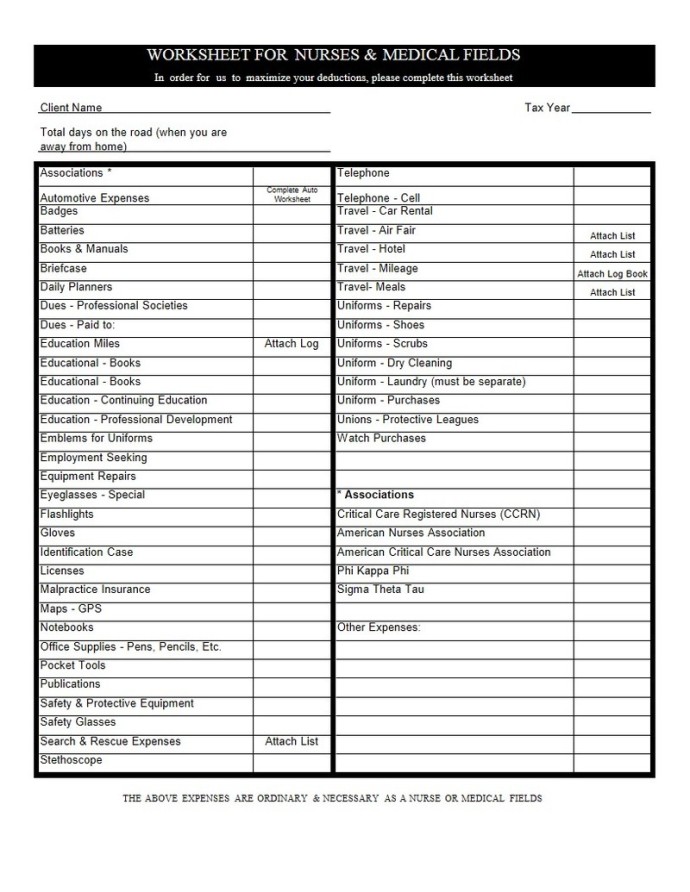

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions are satisfied

Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of medical Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers and the

Download Tax Deduction For Medical Expenses India

More picture related to Tax Deduction For Medical Expenses India

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

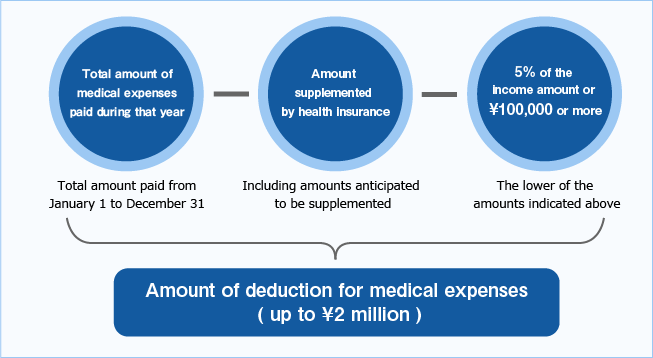

Medical Expenses Deductions Health Insurance System Works

https://www.wapg-kenpo.jp/eng/images/iryouhi_keisan.png

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

Section 80D of the income tax act allows tax deductions of up to Rs 25 000 every financial year on health insurance premiums With Section 80D you can also avail an additional deduction Rs 5 000 on any expenses incurred for You can raise a claim of up to Rs 75 000 in a single financial year under Section 80DD of the Income Tax Act on the medical expenses incurred while getting a dependent treated who has certain disability A tax deduction of Rs 1 25 000 in a single financial year is allowed if the disability is severe

1 Section 80DDB offers a beneficial tax deduction for medical expenses for treatment of specified diseases 2 Cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic renal failure are among the specified ailments Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Enhanced Medical Expense Deductions

https://info.ongandcompany.com/hubfs/medical-tax-deduction.jpg#keepProtocol

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Taxpayers can claim a deduction under section 80DDB for medical treatment of dependents with specified diseases The certificate can be obtained from specialists and reimbursement received affects the deduction amount

https://cleartax.in/s/income-tax-benefit-employee...

Tax exemption on medical reimbursement and transport allowance has been replaced with a standard deduction of Rs 40 000 The standard deduction has been raised to Rs 50 000 from FY 2019 20 Medical Reimbursement allows tax exemption of up to Rs 15 000 on expenses incurred by the employee

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

13 Car Expenses Worksheet Worksheeto

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

How To Maximize The Forgotten Tax Deduction Medical Expenses

Qualified Business Income Deduction And The Self Employed The CPA Journal

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

How Do I Get A Tax Deduction For My Car Repayments Costs One Car Group

Standard Deduction 2020 Self Employed Standard Deduction 2021

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Printable Itemized Deductions Worksheet

Tax Deduction For Medical Expenses India - Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and their family In addition to the deduction for health insurance premiums the section allows a deduction for expenses incurred on preventive health check ups