Tax Credit For New Furnace 2022 Web Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Web 10 Dez 2023 nbsp 0183 32 The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property The Inflation Reduction Act extended and modified the existing energy credit through 2034 modified the Web IR 2022 225 December 22 2022 The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits

Tax Credit For New Furnace 2022

Tax Credit For New Furnace 2022

https://www.supertechhvac.com/wp-content/uploads/2021/03/Form-5695-for-AC-Furnace-together1.png

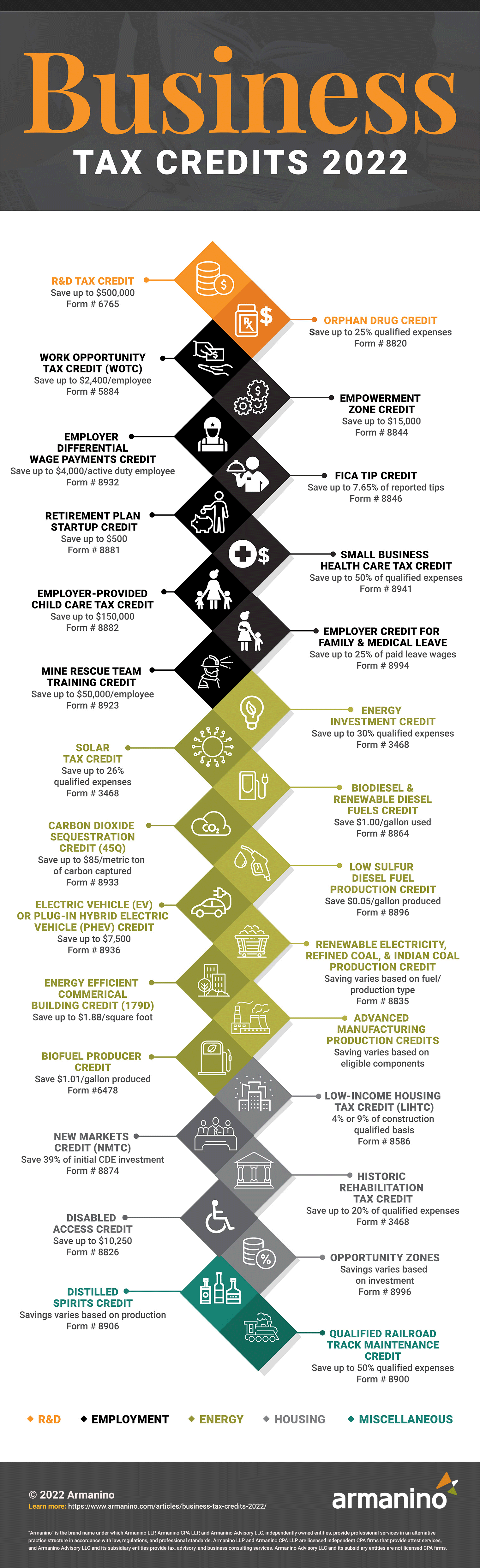

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

New Federal Tax Credits Make Replacing Your Furnace Easier

https://mastersheatcool.com/wp-content/uploads/2022/11/New-Federal-Tax-Credits-Make-Replacing-Your-Furnace-Easier.jpeg

Web Vor 3 Tagen nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 Web 30 Dez 2022 nbsp 0183 32 Furnaces Natural Gas Oil Tax Credits Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home

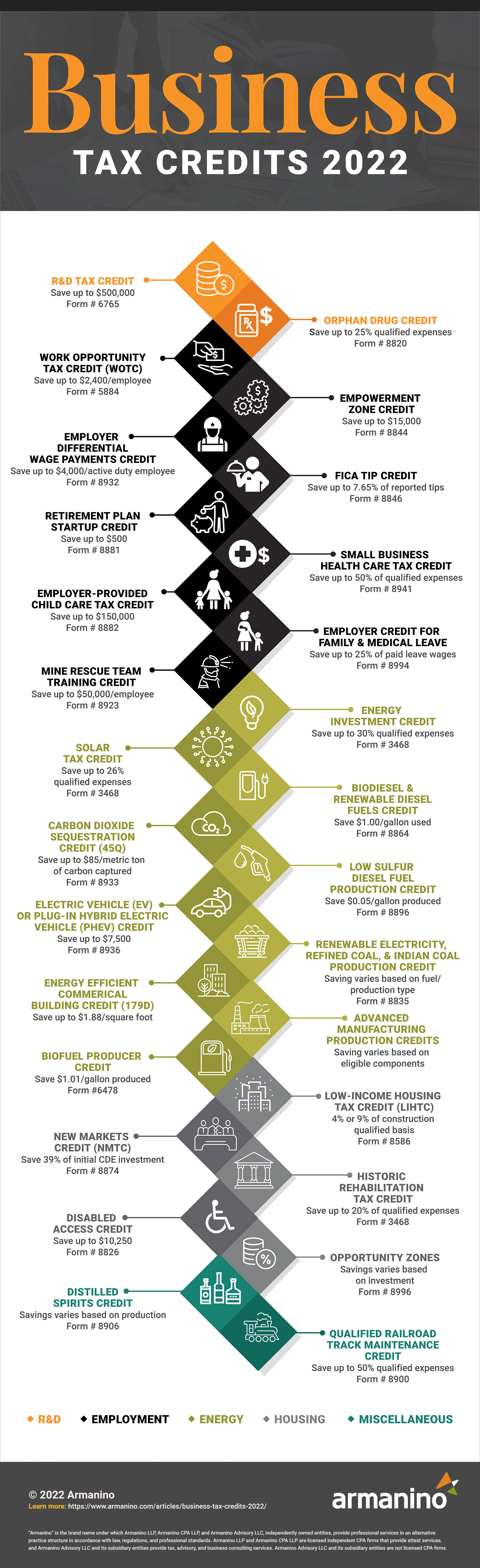

Web 30 Dez 2022 nbsp 0183 32 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 Details Must be placed in service in an existing home which is your principal residence by December 31 2022 New construction and rentals do not apply Residential Energy Property Costs Web 12 Dez 2023 nbsp 0183 32 Beginning with the 2023 tax year the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass stoves

Download Tax Credit For New Furnace 2022

More picture related to Tax Credit For New Furnace 2022

Furnace Qualify For Tax Credit Cozy Heat

https://i.imgur.com/llBZV43.jpg

Massive Tax Credits For Replacing Your Furnace And A C In 2023

https://onespeedservices.com/wp-content/uploads/2023/02/B215ADC8-5182-4898-9932-06FD70E634FB_1_201_a-1024x768.jpeg

5 Place To Get Latest Tax Credit Rebate For Heat Pump AC Gas Furnace

https://www.pickhvac.com/wp-content/uploads/2016/06/tax-credit.png

Web The maximum lifetime credit for all types of property combined is 500 for tax year 2022 and all prior years No more than 200 can be for exterior windows The property must be original use property installed in your main home in the United States The nonbusiness energy tax credit can be claimed on your 2022 taxes via Form 5695 Web Getting Ready 2022 Inflation Reduction Act Money Saving HVAC Federal Tax Credits and Rebates Helping Homeowners Save Money On August 16 2022 the U S government signed into law the Inflation Reduction Act IRA in an effort to reduce greenhouse gas GHG emissions by 40 by 2030

Web 19 Aug 2022 nbsp 0183 32 The credit amount for installing clean household energy such as solar wind or geothermal has been raised from 26 to 30 from 2022 to 2032 It then falls to 26 for 2033 and 22 for 2034 On the Web 13 Apr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Tax Credit For New Furnace And Air Conditioner 2022

https://i2.wp.com/www.conejovalleyair.com/wp-content/uploads/2018/07/air-conditioning-services.jpg

https://www.energystar.gov/about/federal_tax_credits

Web Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

https://turbotax.intuit.com/tax-tips/home-ownership/energy-tax-credit...

Web 10 Dez 2023 nbsp 0183 32 The Residential Clean Energy RCE Credit is a renewable energy tax credit extended and expanded by the 2022 Inflation Reduction Act The credit is worth 30 of certain qualified expenses for residential clean energy property The Inflation Reduction Act extended and modified the existing energy credit through 2034 modified the

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

2022 Education Tax Credits Are You Eligible

Tax Credits For Qualified ACs Furnaces And Heat Pumps

High efficiency Furnaces Can Save You Money Provide Tax Credit Mlive

HVAC Tax Credit For New HVAC Systems

Tax Credit For New Furnace And Air Conditioner 2022

Tax Credit For New Furnace And Air Conditioner 2022

Rebates Tax Credits On Energy Efficient HVAC Equipment BETLEM

New Furnace Rebates 2022 Printable Rebate Form

How To Find Federal Tax Credits Rebates For HVAC Upgrades

Tax Credit For New Furnace 2022 - Web 30 Dez 2022 nbsp 0183 32 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 Details Must be placed in service in an existing home which is your principal residence by December 31 2022 New construction and rentals do not apply Residential Energy Property Costs