Tax Deduction For Ev Vehicle You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in

Tax Deduction For Ev Vehicle

Tax Deduction For Ev Vehicle

https://protaxsolutions.com.au/wp-content/uploads/2021/06/CARRO-1.jpg

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog4.png

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500

Key Takeaways The Inflation Reduction Act established changes to the EV tax credit a federal incentive to encourage consumers to purchase electric vehicles Those who meet the income requirements For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

Download Tax Deduction For Ev Vehicle

More picture related to Tax Deduction For Ev Vehicle

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Vehicle Deduction Limits Padgett

https://www.countbeans.com/wp-content/uploads/2021/02/Automobile-Expenses-Paadgett.jpg

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Electric Vehicle Tax Credit What To Know For 2020 Action News Jax

https://cmg-cmg-tv-10050-prod.cdn.arcpublishing.com/resizer/fxWDPB5OeMjSyTd96KEnjXgh9yY=/1440x0/filters:format(png):quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png

To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable

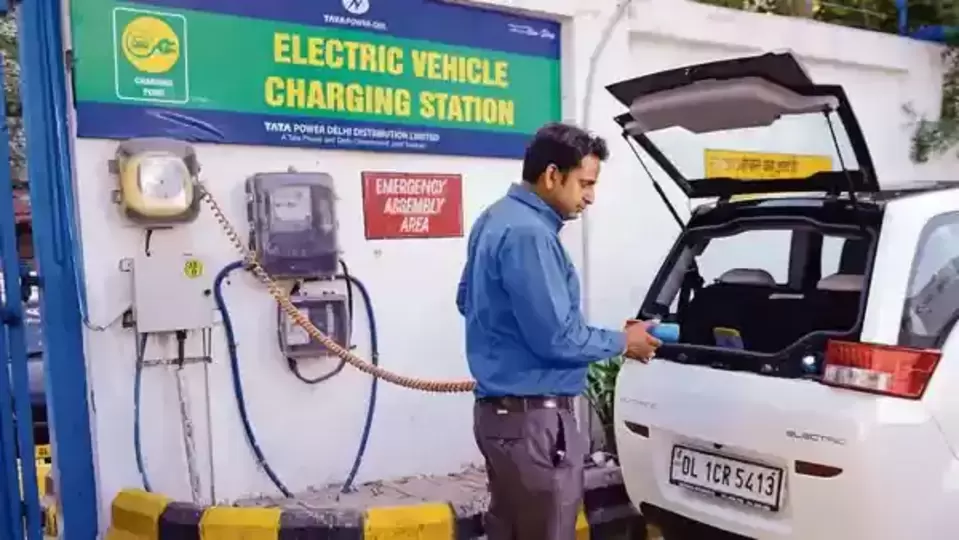

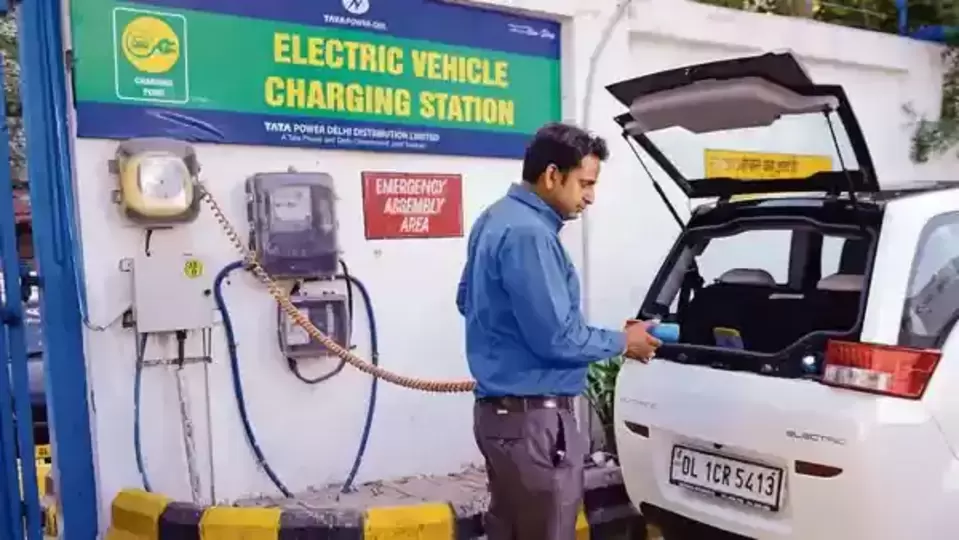

Tax Deduction To EV Customers

https://images.hindustantimes.com/telugu/img/2022/12/21/960x540/Statiq_1671634466431_1671634466624_1671634466624_1671636488559_1671636500435_1671636500435.webp

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

https://www.irs.gov/credits-deductions/credits-for...

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

Tax Deduction To EV Customers

Simple Guide To Deduction U S 80EEB For Purchasing Of EV SAG Infotech

The Inflation Reduction Act Discourages Electric Vehicle Buyers From

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Deduct The Batmobile Vehicle Tax Deduction For Real Estate Agents

Deduct The Batmobile Vehicle Tax Deduction For Real Estate Agents

13 Car Expenses Worksheet Worksheeto

About That Property Tax Deduction For Vets NJMoneyHelp

The New EV Tax Credit In 2023 Everything You Need To Know Updated

Tax Deduction For Ev Vehicle - The EV charger tax credit is back thanks to the Inflation Reduction Act IRA massive climate energy tax and healthcare legislation You may have heard