Tax Rebate For Insurance Premium Web 26 juin 2020 nbsp 0183 32 Tax treatment of rebates In several technical interpretations the Canada Revenue Agency CRA has indicated that where a rebate

Web 5 oct 2022 nbsp 0183 32 The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it Web Total amount of contributions from YA 2023 onwards Less than 5 000 Amount of Life Insurance Relief allowed You may claim the lower of a the difference between 5 000

Tax Rebate For Insurance Premium

Tax Rebate For Insurance Premium

https://i.ytimg.com/vi/PRhWDClWUPU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGB8gZSg-MA8=&rs=AOn4CLC6wA0e-EnyaFEZKmxBef3ja6XgEA

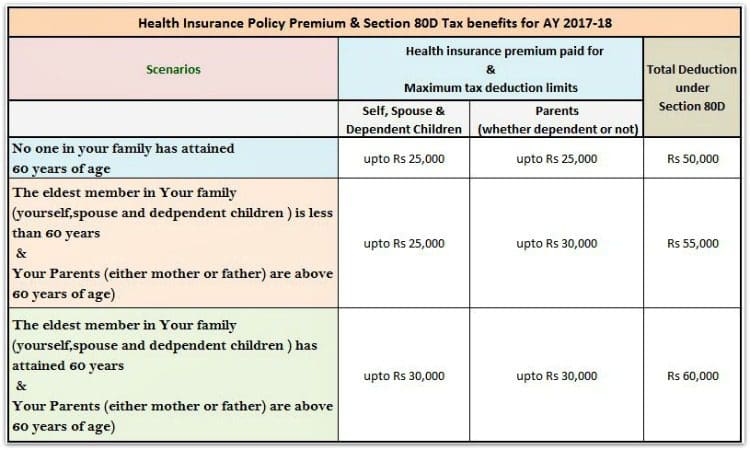

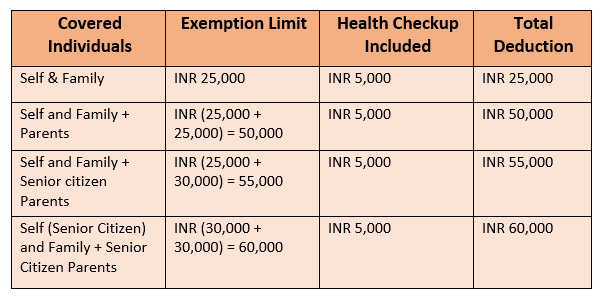

Income Tax Deductions FY 2016 17 AY 2017 18 Details

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Premium Calculator Of State Life Insurance Savings Tax rebate

https://i.pinimg.com/originals/1b/f7/1f/1bf71f3892b43d8202305bb537e6baa5.png

Web 18 mai 2021 nbsp 0183 32 The American Rescue Plan provides a temporary 100 reduction in the premium that individuals would have to pay when they elect COBRA continuation health Web 25 f 233 vr 2022 nbsp 0183 32 In one of the new answers for example the IRS notes that a taxpayer can exclude unemployment compensation paid in 2021 from the modified adjusted

Web 17 juil 2023 nbsp 0183 32 July 17 2023 Insurance Tax Written by iMoney Editorial If there is one part of filing income tax that you can actually enjoy its claiming your tax reliefs and tax Web You ll use Form 1095 A to quot reconcile quot your 2022 premium tax credits when you file your 2022 taxes If you got excess advance payments of the premium tax credit APTC for

Download Tax Rebate For Insurance Premium

More picture related to Tax Rebate For Insurance Premium

Health Insurance Premium Rebate Distribution Financial Report

https://i2.wp.com/www.liebertpub.com/cms/10.1089/dia.2019.0395/asset/images/large/dia.2019.0395_figure3.jpeg

Insurance Premium Tax Calculator CALCULATORSA

https://i2.wp.com/greatoutdoorsabq.com/wp-content/uploads/parser/mortgage-insurance-premium-calculator-1.png

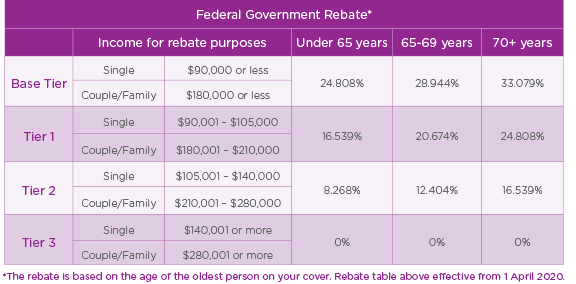

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Web 24 juil 2023 nbsp 0183 32 Last modified Jul 24 2023 What is rebating in insurance It s a term used in the insurance industry to describe the process of returning a portion of an insurance Web Title Tax Leaflet Final CTP Created Date 10 12 2021 6 00 42 PM

Web 24 f 233 vr 2022 nbsp 0183 32 The Basics Q1 What is the premium tax credit updated February 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance Web 7 f 233 vr 2022 nbsp 0183 32 You can withdraw or deduct up to 450 tax free to pay long term care premiums in 2021 and 2022 if you re age 40 or younger 850 if you re 41 to 50 1 690 if you re 51 to 60 4 510 4 520

Ambetter Health Insurance Premium Rebate Financial Report

https://i2.wp.com/achi.net/wp-content/uploads/2019/10/191023C_MLR-Rebates-2018-Graphs.png

![]()

General Insurance Rebate Form Information Premium Photo Rawpixel

https://images.rawpixel.com/image_1300/cHJpdmF0ZS9sci9pbWFnZXMvd2Vic2l0ZS8yMDIyLTA5L2stczctbmF0LTEwOTc4LWx5ajIwNTEtNS1nZW5lcmFsaW5zdXJhbmNlLmpwZw.jpg

https://www.advisor.ca/insurance/life/underst…

Web 26 juin 2020 nbsp 0183 32 Tax treatment of rebates In several technical interpretations the Canada Revenue Agency CRA has indicated that where a rebate

https://www.thebalancemoney.com/do-i-qualif…

Web 5 oct 2022 nbsp 0183 32 The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it

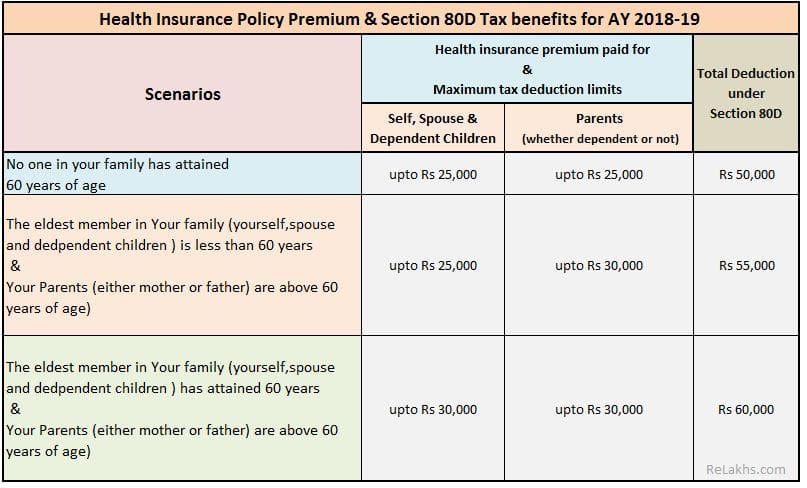

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

Ambetter Health Insurance Premium Rebate Financial Report

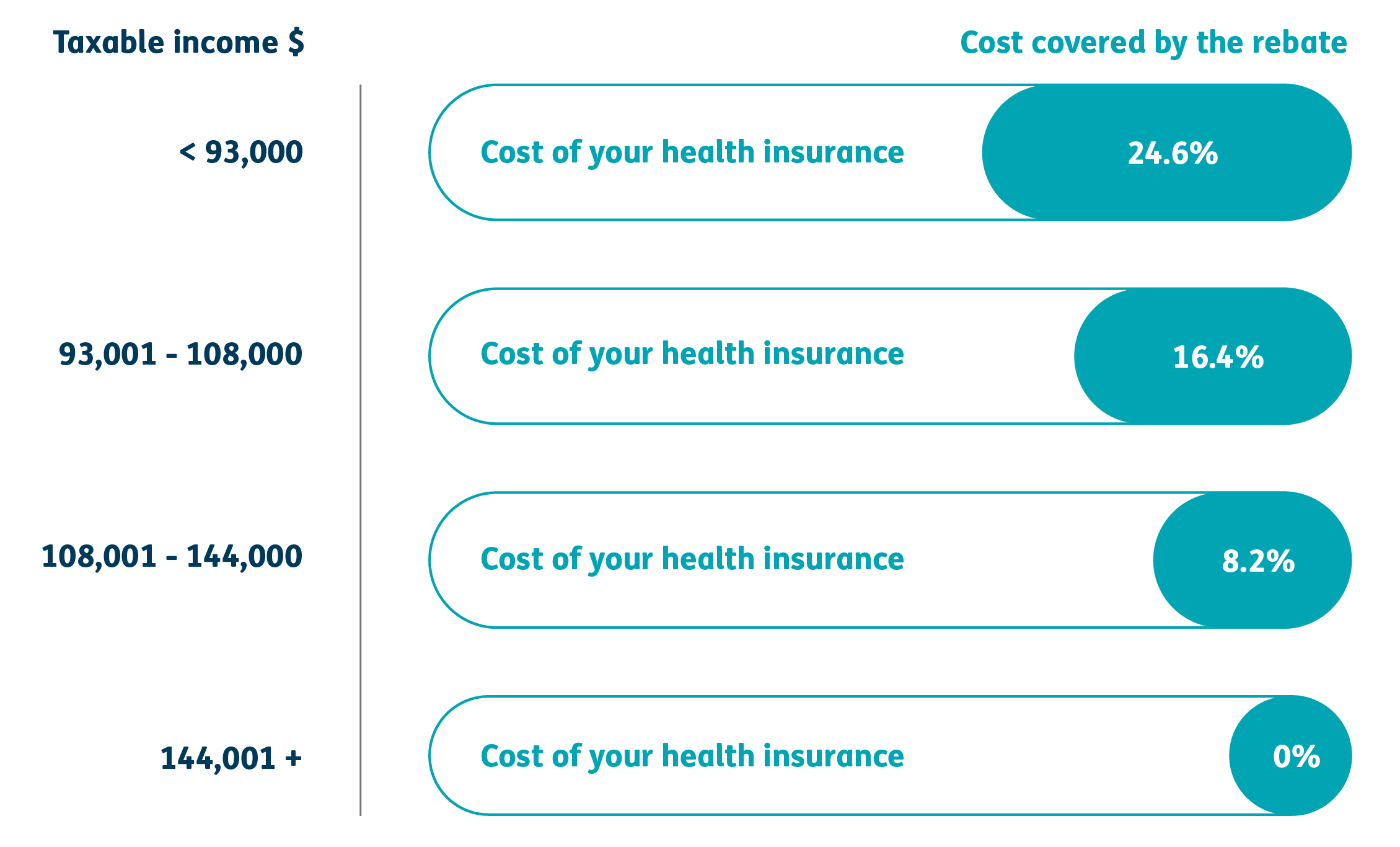

Tax And Rebates HBF Health Insurance

Replacement P60 Online National Insurance Number Office Names

2007 Tax Rebate Tax Deduction Rebates

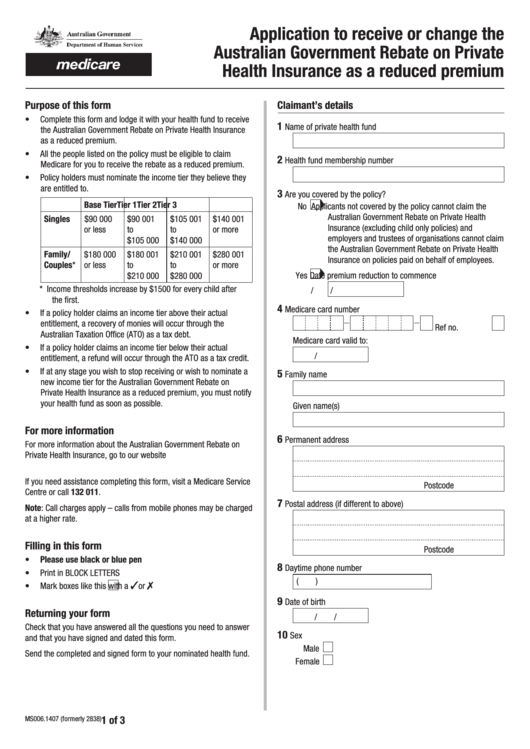

What Is Australian Government Rebate On Private Health Insurance

What Is Australian Government Rebate On Private Health Insurance

Fillable Application To Receive Or Change The Australian Government

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Nextcare Reimbursement Form Fill Online Printable Fillable Blank

Tax Rebate For Insurance Premium - Web 17 juil 2023 nbsp 0183 32 July 17 2023 Insurance Tax Written by iMoney Editorial If there is one part of filing income tax that you can actually enjoy its claiming your tax reliefs and tax