Tax Deduction For Geothermal Heat Pump Geothermal heat pumps Fuel cells Battery storage technology beginning in 2023 Used previously owned clean energy property is not eligible Qualified expenses may include labor costs for onsite preparation assembly or original installation of the property and for piping or wiring to connect it to the home

2023 General Instructions Future Developments For the latest information about developments related to Form 5695 and its instructions such as legislation enacted after they were published go to IRS gov Form5695 What s New Residential clean energy credit TAX INCENTIVES For Commercial Geothermal Heat Pumps Up to 30 Tax Credit Up to 10 Bonus Tax Credit Domestic Content Up to 10 Bonus Tax Credit Energy Community Accelerated 5 Year Depreciation Deduction Up to

Tax Deduction For Geothermal Heat Pump

Tax Deduction For Geothermal Heat Pump

http://media.npr.org/assets/img/2011/03/16/geotherm1_custom.jpg

A Guide To Geothermal Heat Pumps Family Handyman

https://www.familyhandyman.com/wp-content/uploads/2020/06/geothermal-heat-pump-GettyImages-547233216.jpg?w=1200

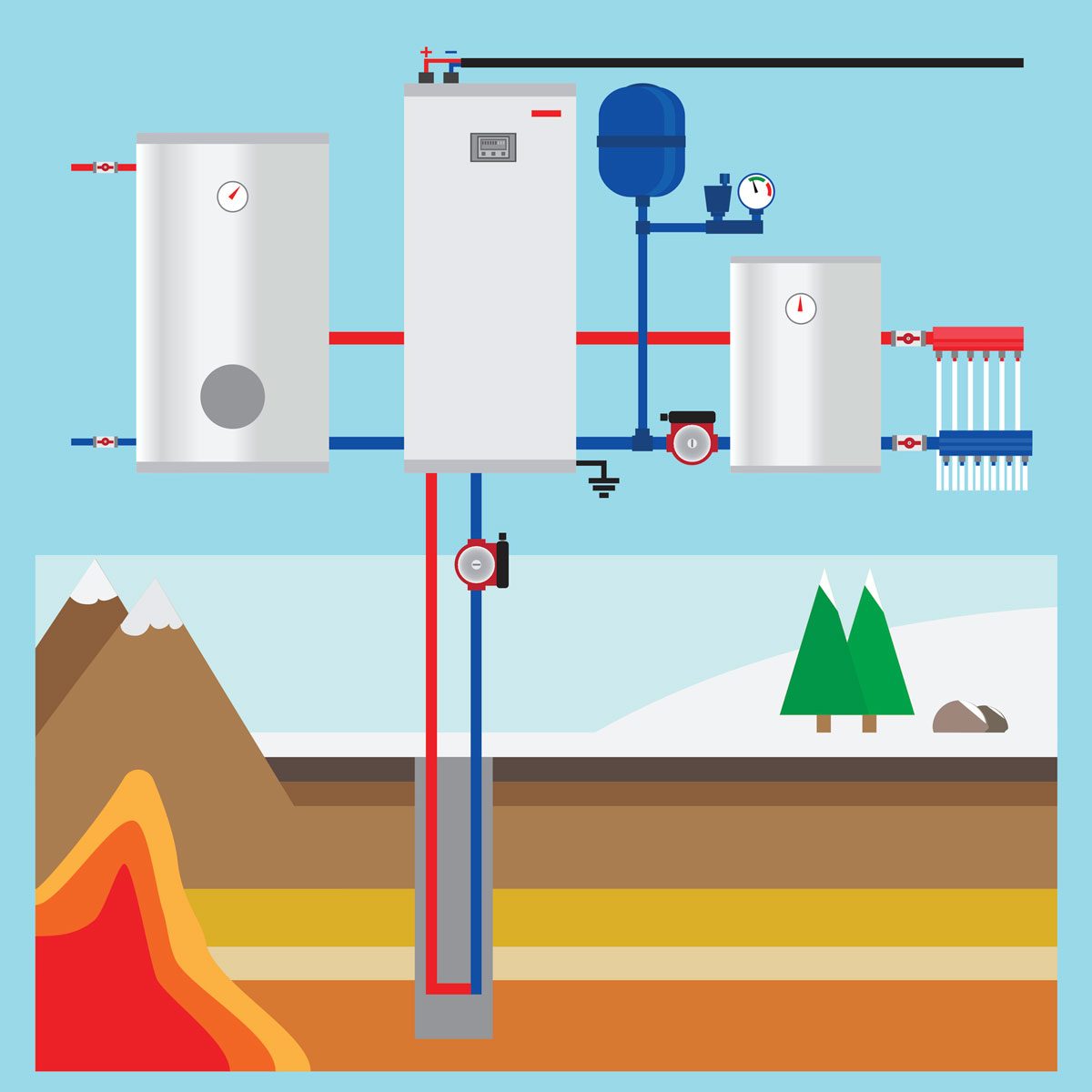

How Does A Geothermal Heat Pump Work Environment Buddy

https://www.environmentbuddy.com/wp-content/uploads/2020/05/Geothermal-Heat-pump.png

Business taxpayers are allowed an additional first year depreciation deduction of 50 bonus depreciation on the cost of commercial GHP equipment that is placed into service during 2015 2016 and 2017 The bonus depreciation then phases down with 40 in 2018 and 30 in 2019 A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are installed in 2033 and 22 in 2034 so act quickly to save the most on your installation View Residential Tax Incentive Guide Energy Star Compliance Certificate

In a massive environmentally focused year end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source heat pumps GSHP installed before 12 31 2022 The bill was signed into law on December 27 by president Donald Trump The taxpayer spends 12 000 to install a new geothermal heat pump property in 2022 The geothermal heat pump is replacing a prior geothermal heat pump previously installed in 1995 2022 Tax Credit 12 000 x 30 3 600 Qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements

Download Tax Deduction For Geothermal Heat Pump

More picture related to Tax Deduction For Geothermal Heat Pump

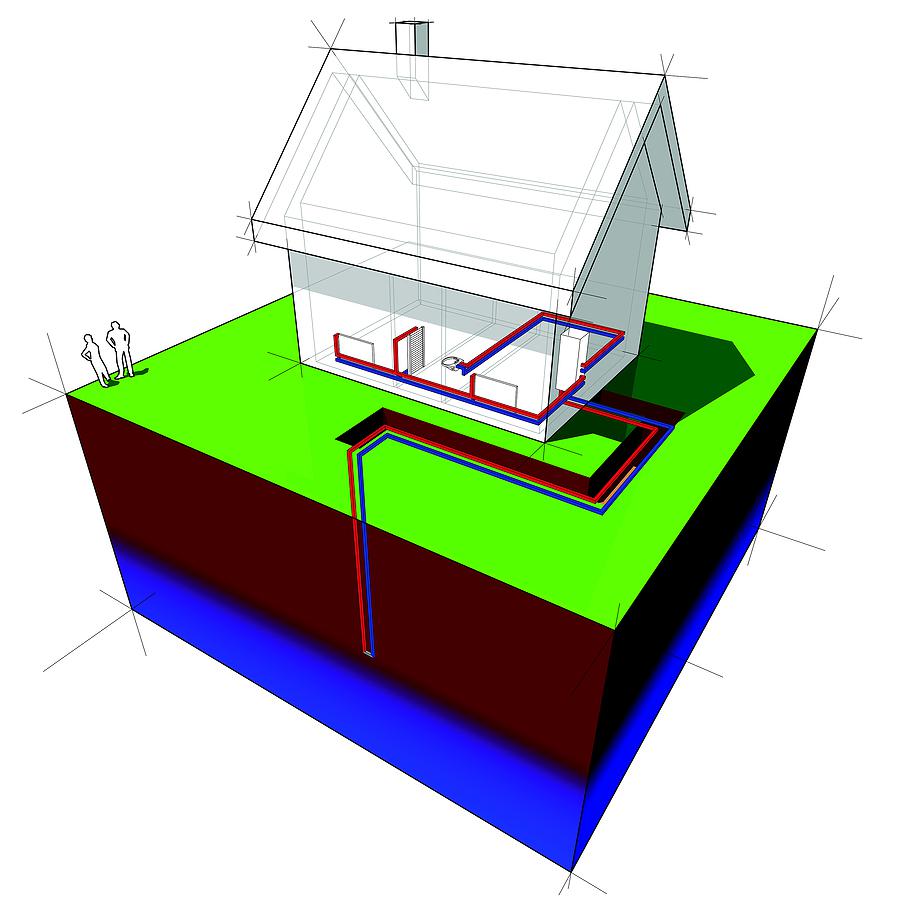

How Does A Geothermal Heat Pump Work Blog Ottawa

https://blogottawa.ca/wp-content/uploads/2014/06/Heat-Pump.jpg

Geothermal Heat Pumps The Next Generation Seeking Alpha

https://static.seekingalpha.com/uploads/2012/6/6/saupload_bigstock-geothermal-heat-pump-diagram-11998763.jpg

Congress Extends Tax Benefits For Geothermal Heat Pumps Colorado

https://www.cogeothermal.com/wp-content/uploads/2020/09/image1-3-1510x1200.jpeg

However geothermal heat pumps will continue to be eligible for the Section 48 credit through 2034 at the following rates 10 2021 10 OR 30 bonus 6 base 2022 There is a potential drafting error in how the The Bipartisan Budget Act of 2018 signed in February 2018 reinstated the tax credit of geothermal heat pumps to 25D of the Internal Revenue Code The property credit provides 30 for systems place in service by 12 31 2019 26 between 12 31 19 and 1 1 2020 and 22 between 12 31 2020 and 1 1 2022 Significantly The American

The renewable energy tax credit covers 30 of the total system cost including installation of GeoThermal heat pumps meeting the requirements of the ENERGY STAR program Under the Inflation Reduction Act in August 2022 the GeoThermal tax credits have been extended through December 31 2034 Given the extraordinary efficiency of geothermal heat pumps a retrofit by means of geothermal will most likely qualify for the immediate 60 cent per square foot HVAC deduction and can potentially reduce energy use enough to trigger 1 20 to 1 80 per square foot EPAct tax deductions on its own

The Best Mini Split Geothermal Heat Pump Vertical Package Unit

https://1.bp.blogspot.com/-8SVYC-uRdqs/YPhgi8kIGsI/AAAAAAAAH14/2nhUmLhRRXUtz8X_s-aL8sfFKl3Q64VKACLcBGAsYHQ/s600/1578452567683_2-ton-27.6-eer-coldflow-geothermal-heat-pump-vertical-package-unit-ha18143-01.2549.jpg

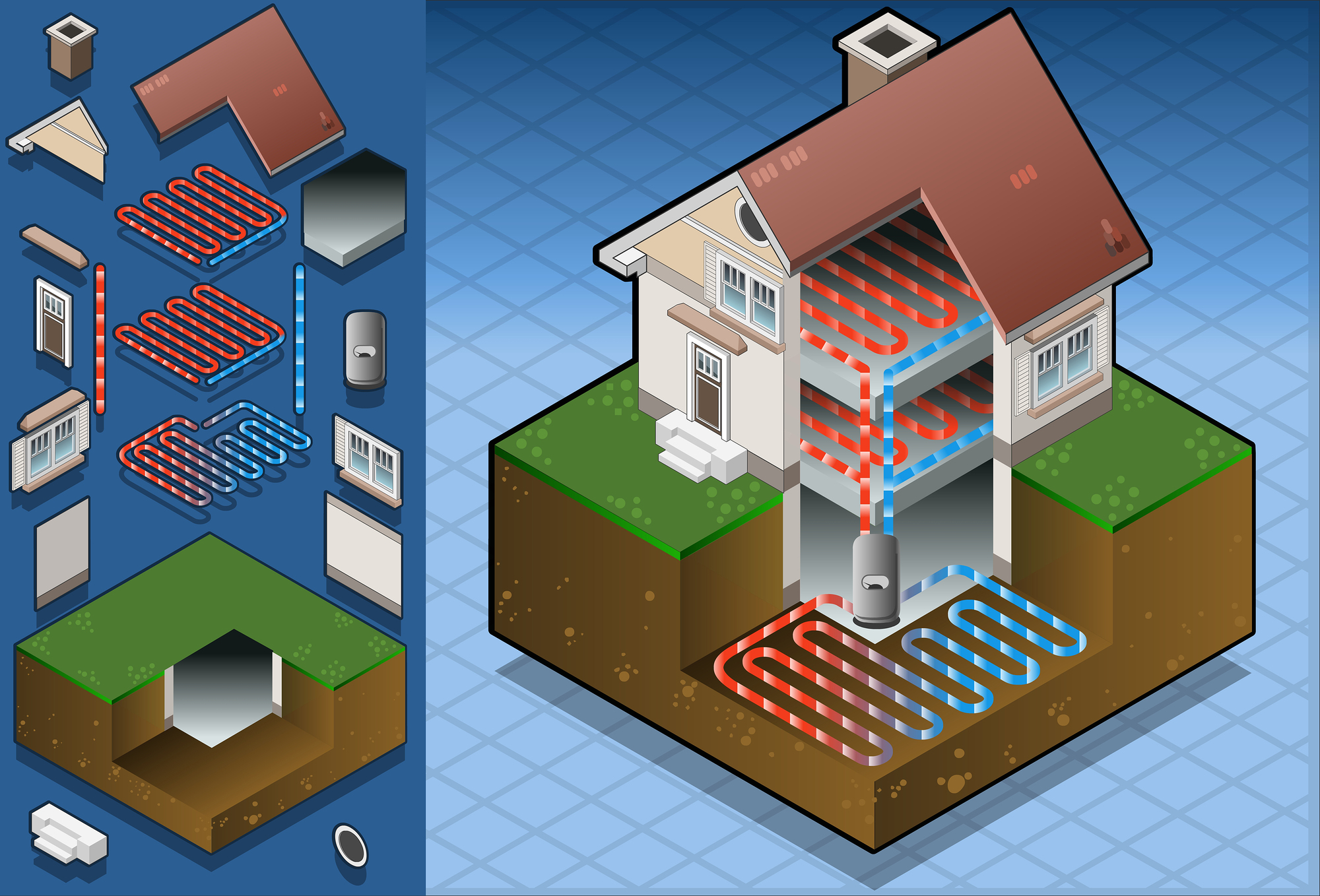

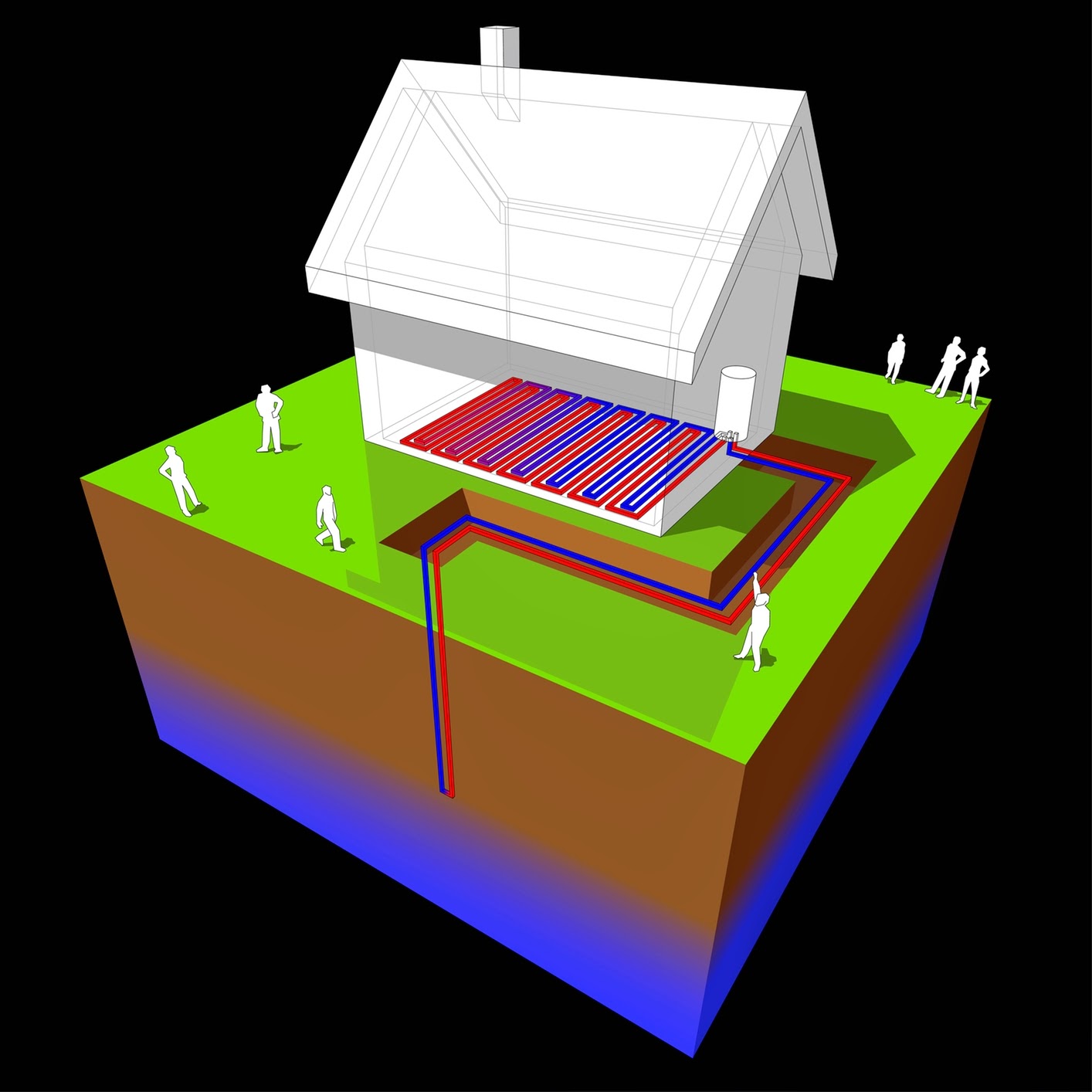

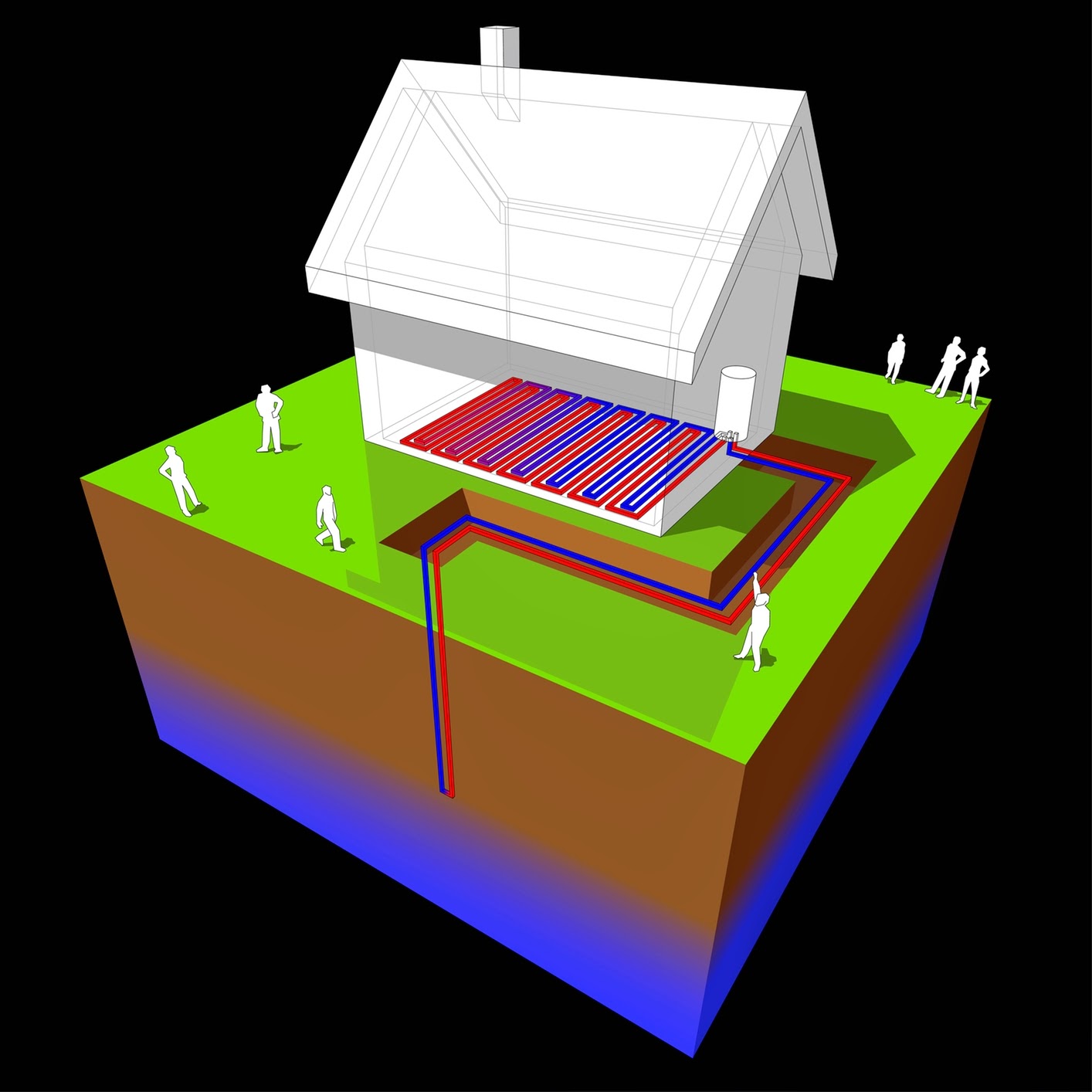

Geothermal Heat Pump underfloorheating Diagram Losch Services

https://losch.services/wp-content/uploads/2017/08/geothermal-heating.jpg

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Geothermal heat pumps Fuel cells Battery storage technology beginning in 2023 Used previously owned clean energy property is not eligible Qualified expenses may include labor costs for onsite preparation assembly or original installation of the property and for piping or wiring to connect it to the home

https://www.irs.gov/instructions/i5695

2023 General Instructions Future Developments For the latest information about developments related to Form 5695 and its instructions such as legislation enacted after they were published go to IRS gov Form5695 What s New Residential clean energy credit

Geothermal Heat Pumps Perfect For Multi Residential And Commercial

The Best Mini Split Geothermal Heat Pump Vertical Package Unit

What Is A Geothermal Heat Pump How A Heat Pump Works HubPages

Australia Announces Tax Deduction For Geothermal Exploration Think

Geothermal Heat Pumps In Scranton Wilkes Barre PA T E Spall

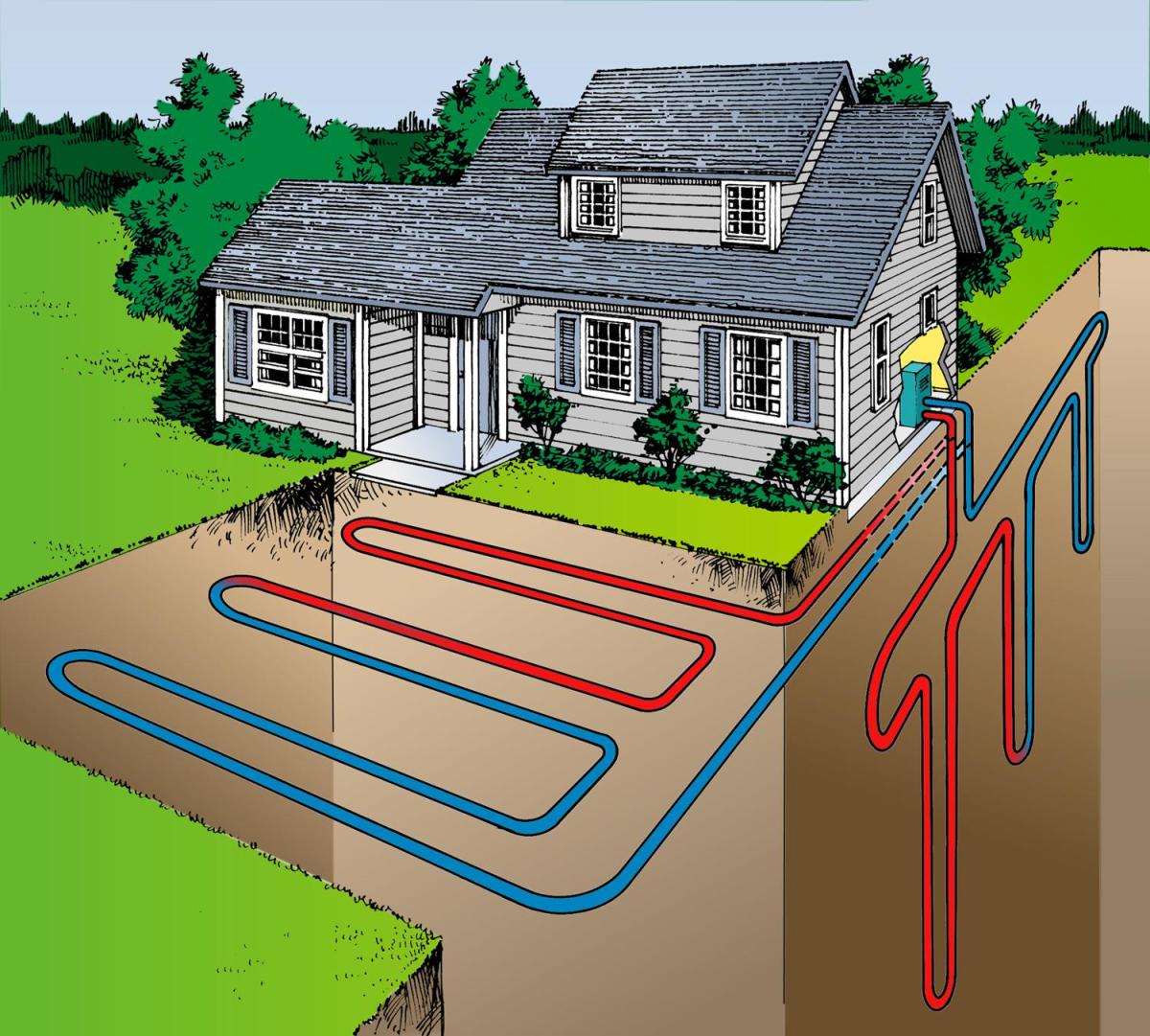

Geothermal Heating And Cooling Systems How Do Geothermal Heat Pump

Geothermal Heating And Cooling Systems How Do Geothermal Heat Pump

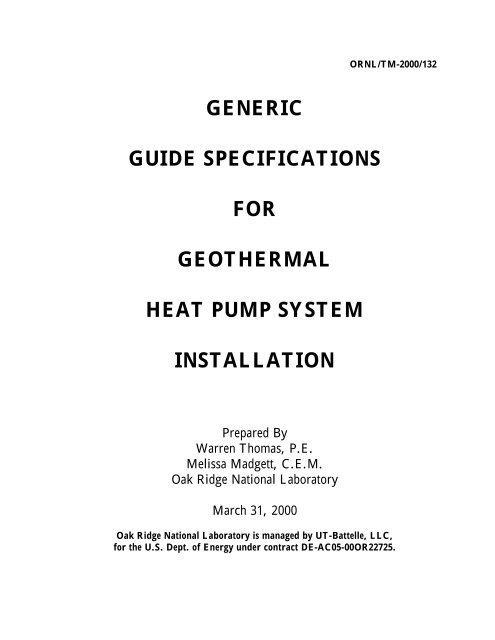

Generic Guide Specifications For Geothermal Heat Pump System

Geothermal Heat Pumps More Than A Niche Green Energy Times

How Much Does A Geothermal Heat Pump Cost Flipboard

Tax Deduction For Geothermal Heat Pump - The taxpayer spends 12 000 to install a new geothermal heat pump property in 2022 The geothermal heat pump is replacing a prior geothermal heat pump previously installed in 1995 2022 Tax Credit 12 000 x 30 3 600 Qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements