Tax Deduction For Home Mortgage Interest You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to

Tax Deduction For Home Mortgage Interest

Tax Deduction For Home Mortgage Interest

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Is The Mortgage Interest Deduction In Play B Logics

https://i0.wp.com/blogics.loanlogics.com/wp-content/uploads/2016/10/mortgage-interest-deductions-in-jeopardy.jpg?fit=1238%2C856&ssl=1

Home Mortgage Deduction Home Sweet Home Modern Livingroom

https://u.realgeeks.media/propertytucson/home_mortgage_interest_tax_deduction.png

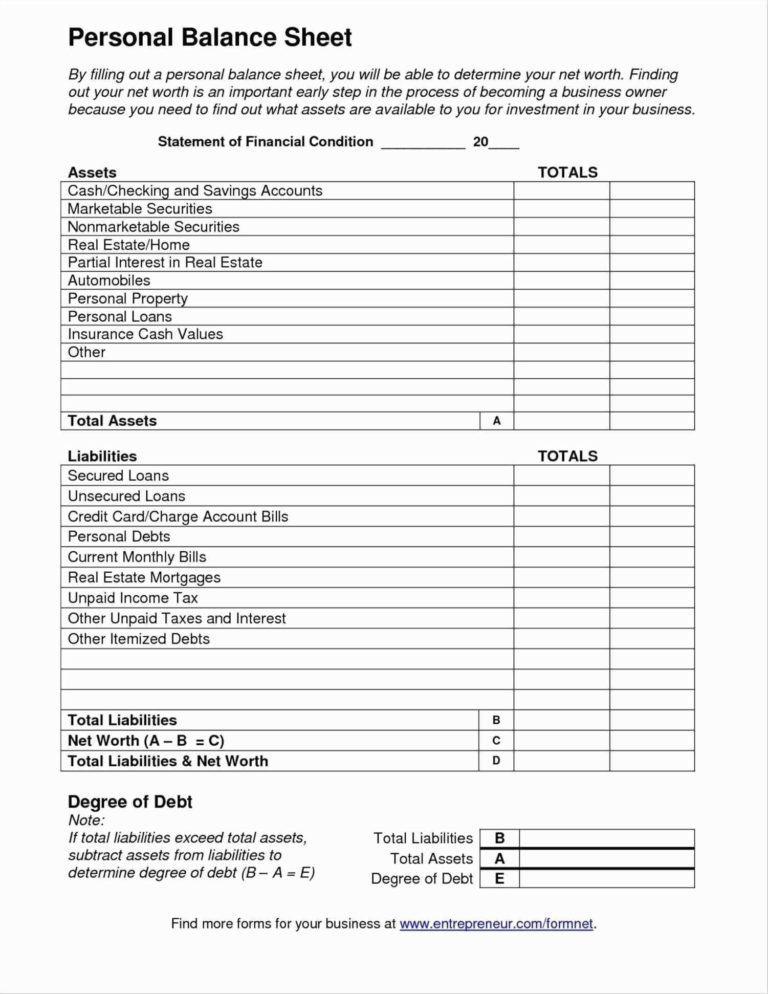

Under current law the home mortgage interest deduction HMID allows homeowners who itemize their tax returns to deduct mortgage interest paid on up to 750 000 worth of principal on either their first or second residence The mortgage interest deduction helps homeowners lower the amount of tax owed These deductions are reported on Form 1098 and Schedule A or Schedule E depending on the type of deduction

The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large mortgage For homeowners with a mortgage the mortgage interest deduction is one of several homeowner tax deductions provided by the Internal Revenue Service IRS Learn more about this valuable deduction and how to claim it on your taxes this year

Download Tax Deduction For Home Mortgage Interest

More picture related to Tax Deduction For Home Mortgage Interest

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Home Loan Mortgage Interest Tax Deduction For 2015 2016

http://filemytaxesonline.org/wp-content/uploads/2015/07/Home-Mortgage-Large.jpg

Printable Small Business Tax Deductions Worksheet

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

The mortgage interest deduction allows homeowners to deduct the interest they pay on their home mortgage from their taxable income This can help homeowners lower tax bills by reducing 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income through this itemized deduction of mortgage interest In the past homeowners could deduct up to 1 million in mortgage interest However the Tax Cuts and Jobs Act has reduced this limit to

To reduce your taxable income you can deduct the interest you pay each tax year on your individual income tax return which is of value amidst rising mortgage rates Understanding the tax rules including the mortgage interest deduction limit is The mortgage interest deduction is a tax incentive for people who own homes as it allows them to write off some of the interest charged by their home loan The deduction allows you to reduce

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

http://4.bp.blogspot.com/-1n-pssIhuMA/UBhfE1xILOI/AAAAAAAAC9Q/SQjPSp6h2fc/s1600/HIExample.png

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Home Mortgage Interest Deduction Second Home Home Sweet Home

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

https://www.nerdwallet.com/article/taxes/mortgage...

You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

https://www.investopedia.com/articles/mortgages...

The home mortgage interest deduction HMID allows homeowners who itemize on their tax returns to deduct mortgage interest paid on up to 750 000 worth of their loan principal The HMID is one

Mortgage Interest Tax Relief Calculator DermotHilary

The Stephenson Fam Is Home Mortgage Interest Deduction A Good Idea

Mortgage Interest Deduction HUGE Impact In Tennessee TN REALTORS

Income Tax Deductions For The FY 2019 20 ComparePolicy

Itemized Deductions Spreadsheet In Business Itemized Deductions

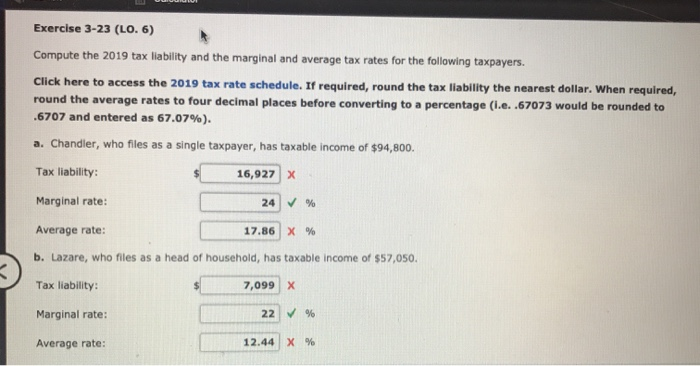

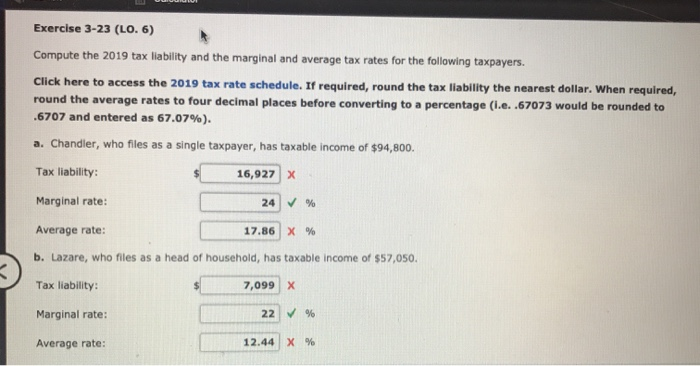

Solved Exercise 3 23 LO 6 Compute The 2019 Tax Liability Chegg

Solved Exercise 3 23 LO 6 Compute The 2019 Tax Liability Chegg

Keep The Mortgage For The Home Mortgage Interest Deduction

How To Deduct Property Taxes On IRS Tax Forms

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Tax Deduction For Home Mortgage Interest - For homeowners with a mortgage the mortgage interest deduction is one of several homeowner tax deductions provided by the Internal Revenue Service IRS Learn more about this valuable deduction and how to claim it on your taxes this year