Tax Deduction For Individual Deductions what kind of tax deductions can I get You may be entitled to several different deductions and credits that reduce the total amount of taxes you must pay Some

You can file travel expenses a credit for household expenses expenses for the production of income a deduction for second home for work or a credit due to maintenance Find out how to pay less tax Learn more on tax reliefs deductions rebates for individuals to maximise your tax savings

Tax Deduction For Individual

Tax Deduction For Individual

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

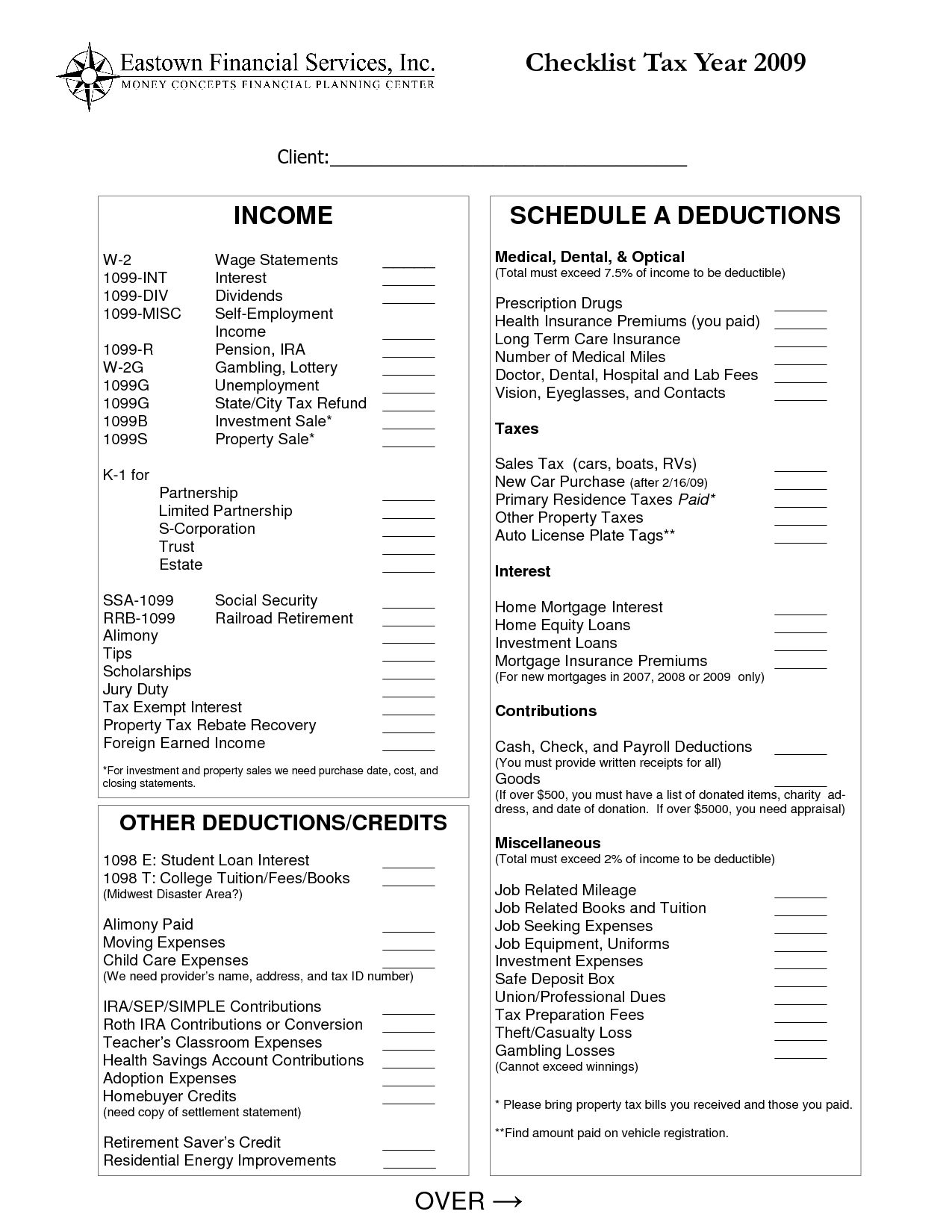

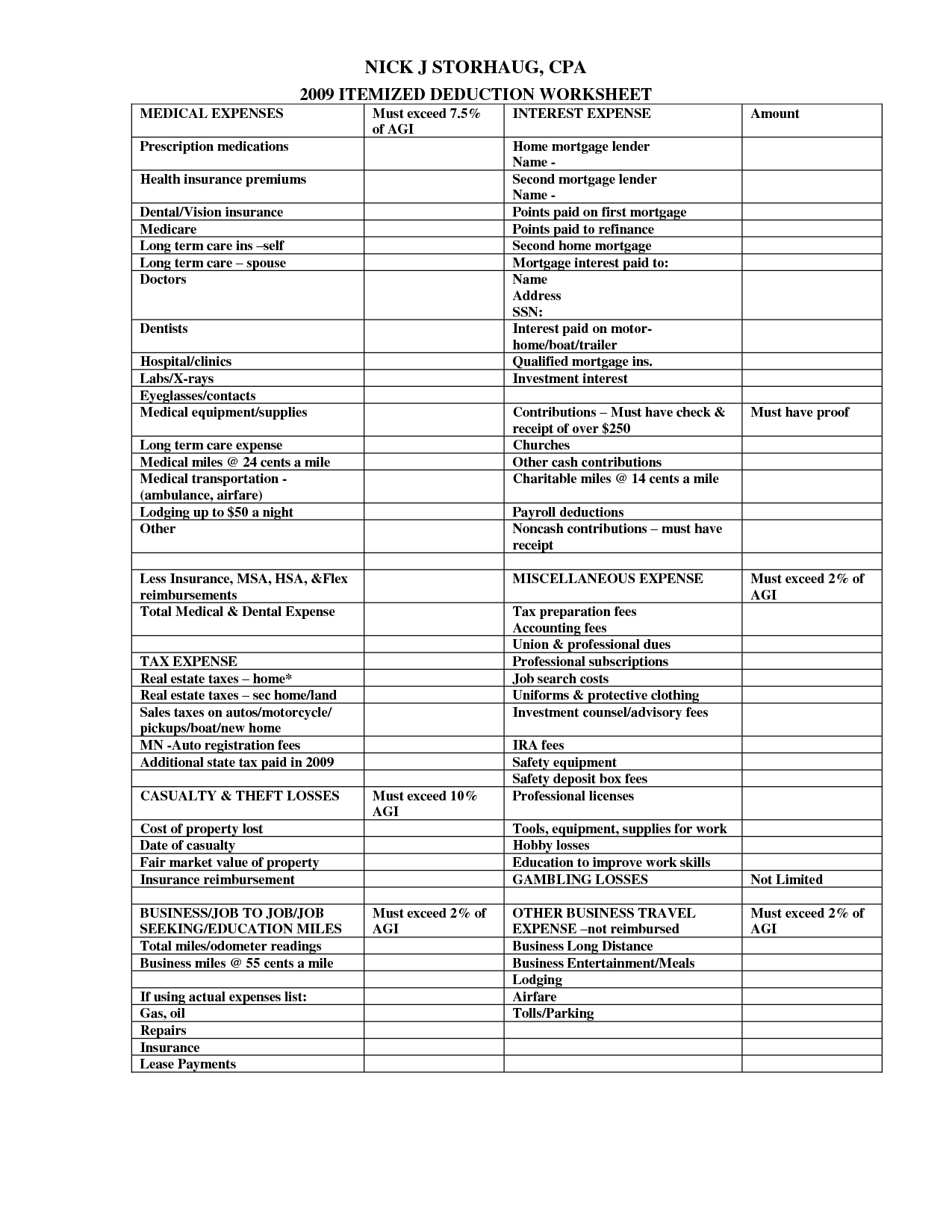

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

Taxpayers can take advantage of numerous deductions and credits on their taxes each year that can help them pay a lower amount of taxes or receive a refund from the IRS You may be able to claim A deduction is an amount you subtract from your income when you file so you don t pay tax on it By lowering your income deductions lower your tax You need documents to show expenses

A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now What is a tax deduction Popular tax deductions to claim on your tax return 1 Standard Deduction 2 IRA contributions deduction 3 Health savings account HSA deduction 4 State and local taxes deduction 5

Download Tax Deduction For Individual

More picture related to Tax Deduction For Individual

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.ntu.org/Library/imglib/2021/11/2021-22-single-tax-brackets-2-.png

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/printable-tax-deduction-checklist_472226.png

2022 Tax Brackets Irs Calculator

https://i1.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

Examples of these deductions include one half of self employment tax paid by self employed individuals deductible contributions to IRAs and contributions to certain self employed retirement plans Capital losses A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them

The IRS has released the standard deduction amounts for the 2024 2025 tax year Find the new rates and information on extra benefits for people over 65 Citizens and resident aliens can deduct the following common items Qualified residence interest State and local income or sales taxes and property taxes up to an

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.millerkaplan.com/wp-content/uploads/2021/11/Ordinary-Income-Tax-Brackets_2022-1024x914.png

Pin On Business Template

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

https://www.vero.fi › en › individuals › deductions › what-can-I-deduct

Deductions what kind of tax deductions can I get You may be entitled to several different deductions and credits that reduce the total amount of taxes you must pay Some

https://www.vero.fi › en › individuals › deductions › how...

You can file travel expenses a credit for household expenses expenses for the production of income a deduction for second home for work or a credit due to maintenance

Standard Deduction 2020 Self Employed Standard Deduction 2021

2022 Federal Tax Brackets And Standard Deduction Printable Form

Standard Deduction 2020 Over 65 Standard Deduction 2021

2022 Federal Tax Brackets And Standard Deduction Printable Form

Small Business Tax Deductions Business Tax Deductions Small Business Tax

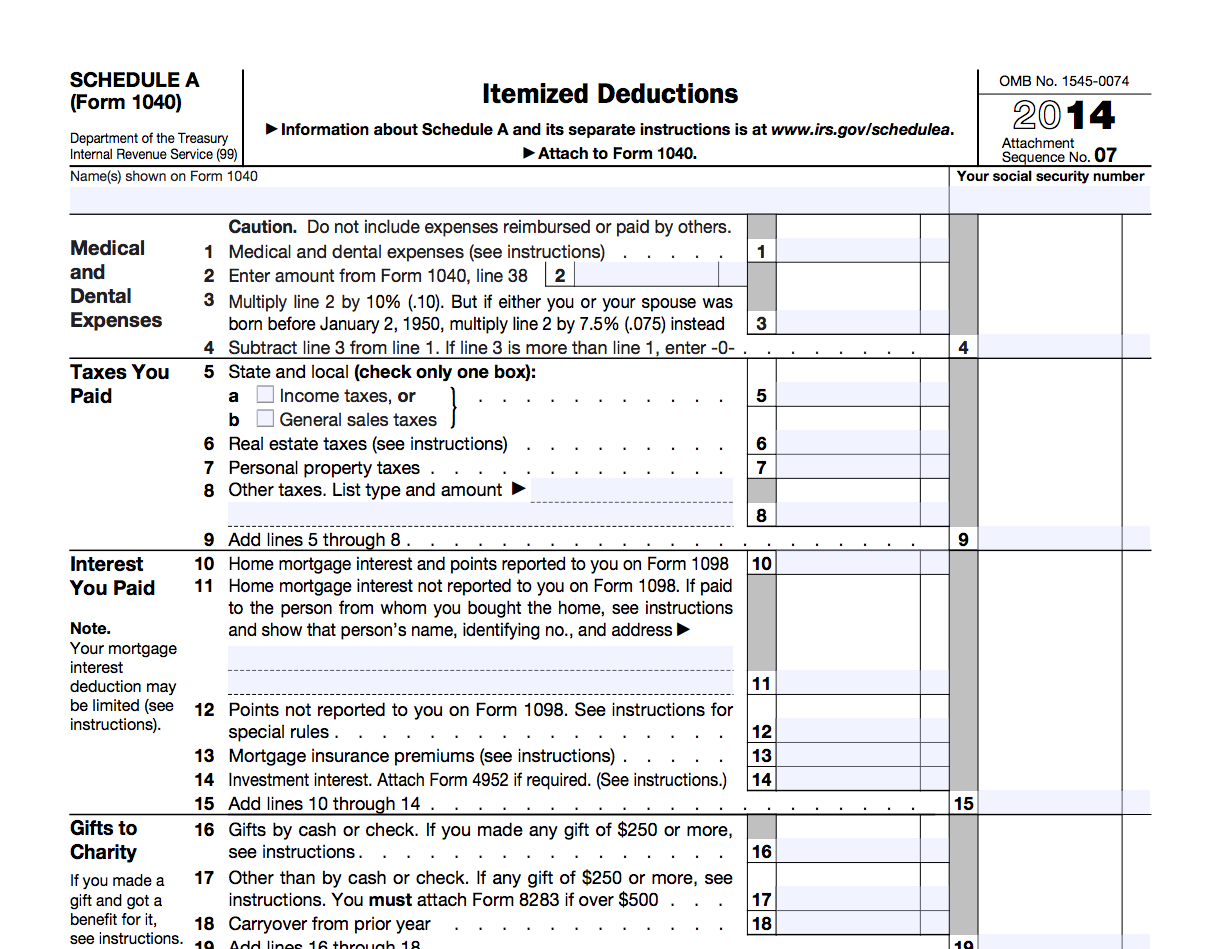

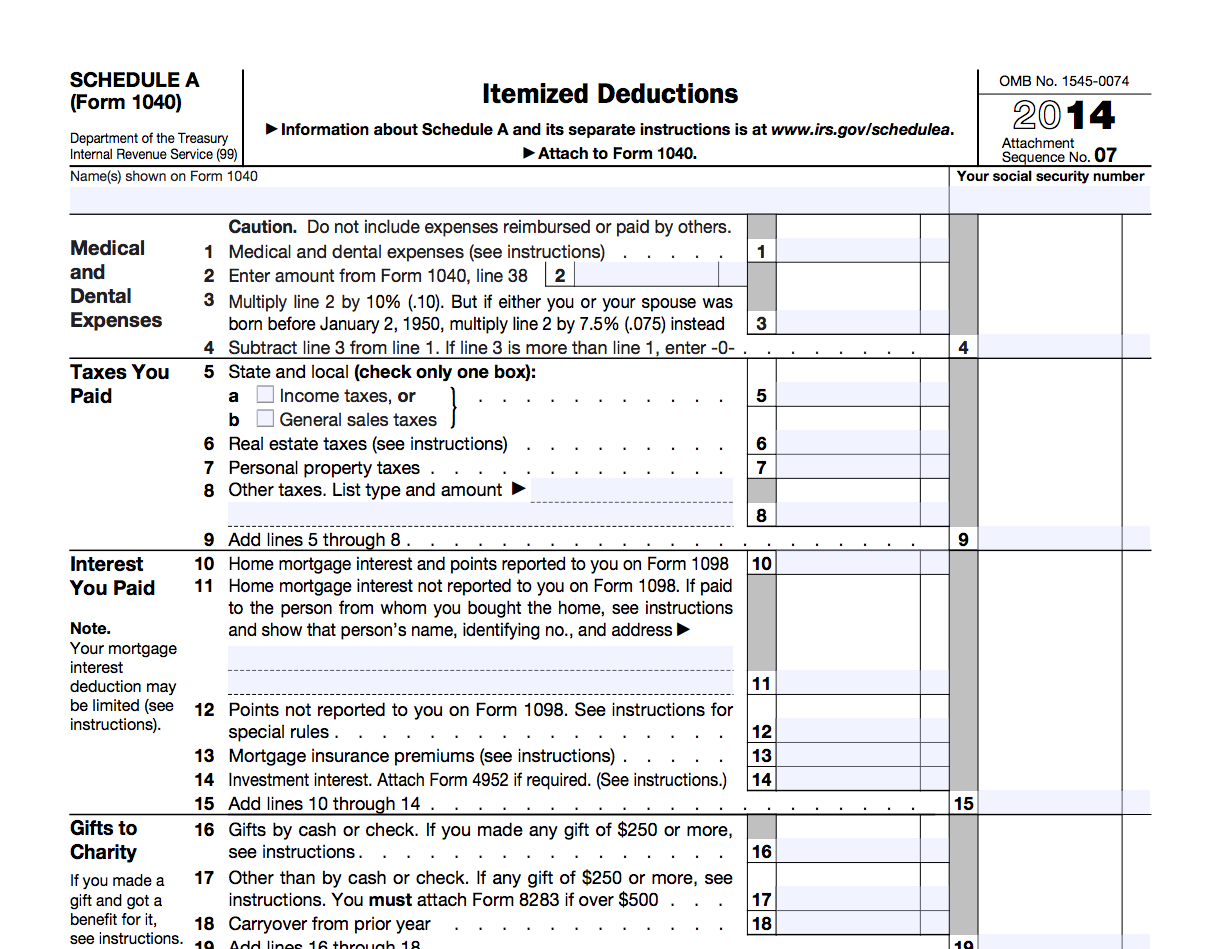

Itemized Tax Deductions McKinley Hutchings CPA PLLC

Itemized Tax Deductions McKinley Hutchings CPA PLLC

Tax Deduction Tracker Spreadsheet Spreadsheet Downloa Tax Deduction

Printable Itemized Deductions Worksheet

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Tax Deduction For Individual - A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now