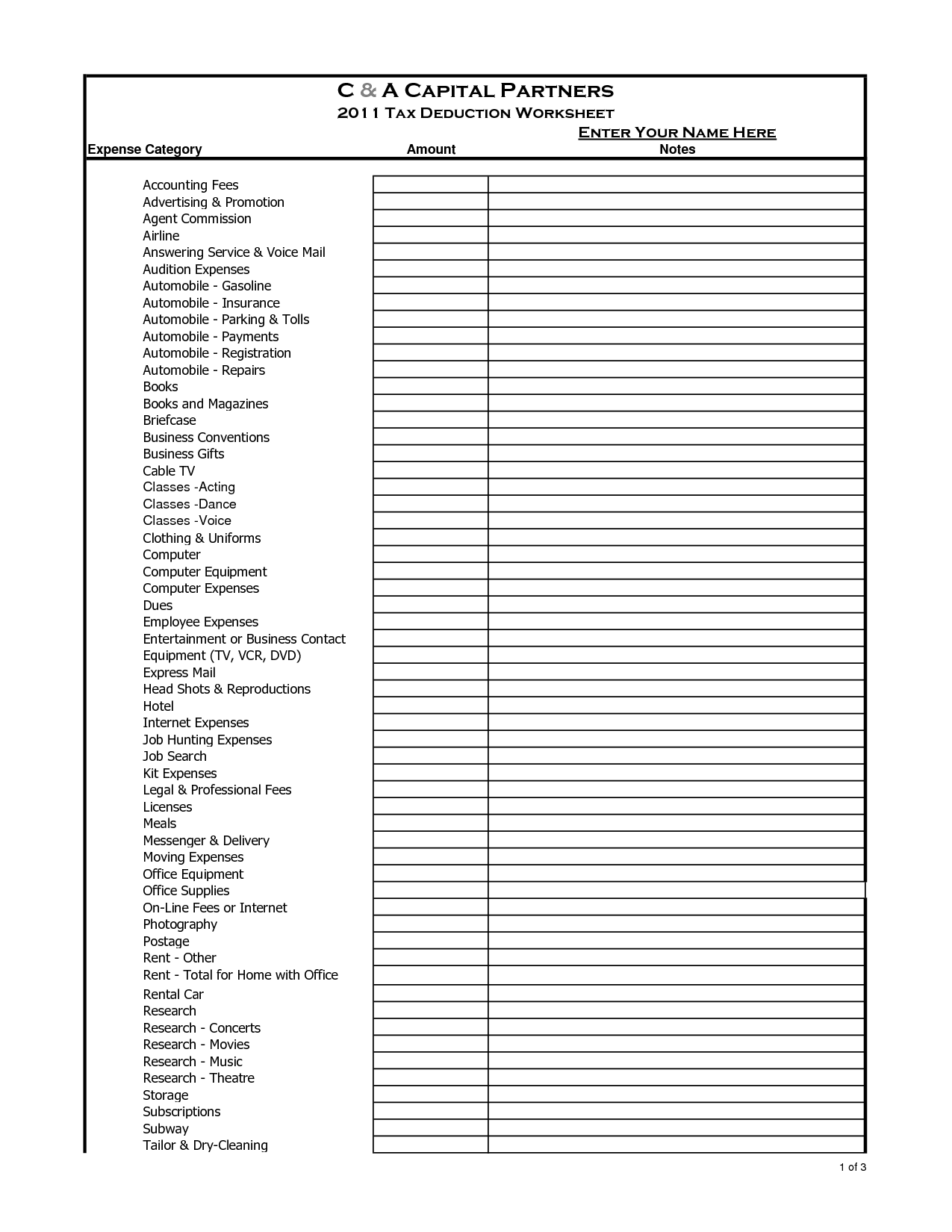

Tax Deduction For Moving Expenses 2020 Verkko 29 tammik 2021 nbsp 0183 32 The deductible expenses include the cost of packing and transporting household goods and travel expenses in transit storage moving pets lodging and airfare costs during the

Verkko 19 toukok 2022 nbsp 0183 32 Claiming the Deduction in 2021 Moving expenses for the 2021 tax year as with tax years 2018 2019 and 2020 are calculated and recorded on Form 3903 The process for claiming the Verkko 16 toukok 2021 nbsp 0183 32 Military members and civilians with hyper specific qualifications can file moving expenses as tax deductions on their 2020 federal income tax return If you re

Tax Deduction For Moving Expenses 2020

Tax Deduction For Moving Expenses 2020

https://i.pinimg.com/originals/58/2a/de/582ade01e6d62ac9790027d0bdf27d7d.jpg

Moving Expenses During And After College

https://byeuni.com/wp-content/uploads/2021/10/taxes.jpeg

Stock Donations Pets Alive

https://petsaliveindiana.org/wp-content/uploads/2019/02/Untitled-design-5.png

Verkko 19 lokak 2023 nbsp 0183 32 You can deduct your unreimbursed moving expenses for you your spouse and your dependents You can t deduct expenses that are reimbursed or Verkko For 2020 the standard mileage rate for using your vehicle to move to a new home is 17 cents a mile New checkbox A new checkbox was added to certify that you meet the

Verkko 4 huhtik 2017 nbsp 0183 32 To be deductible moving expenses must be incurred within one year of starting at a new workplace You must work full time at the new location for at least 39 Verkko 2020 Moving Expenses Attachment Sequence No 170 Name s shown on return Your social security number Before you begin You can deduct moving expenses

Download Tax Deduction For Moving Expenses 2020

More picture related to Tax Deduction For Moving Expenses 2020

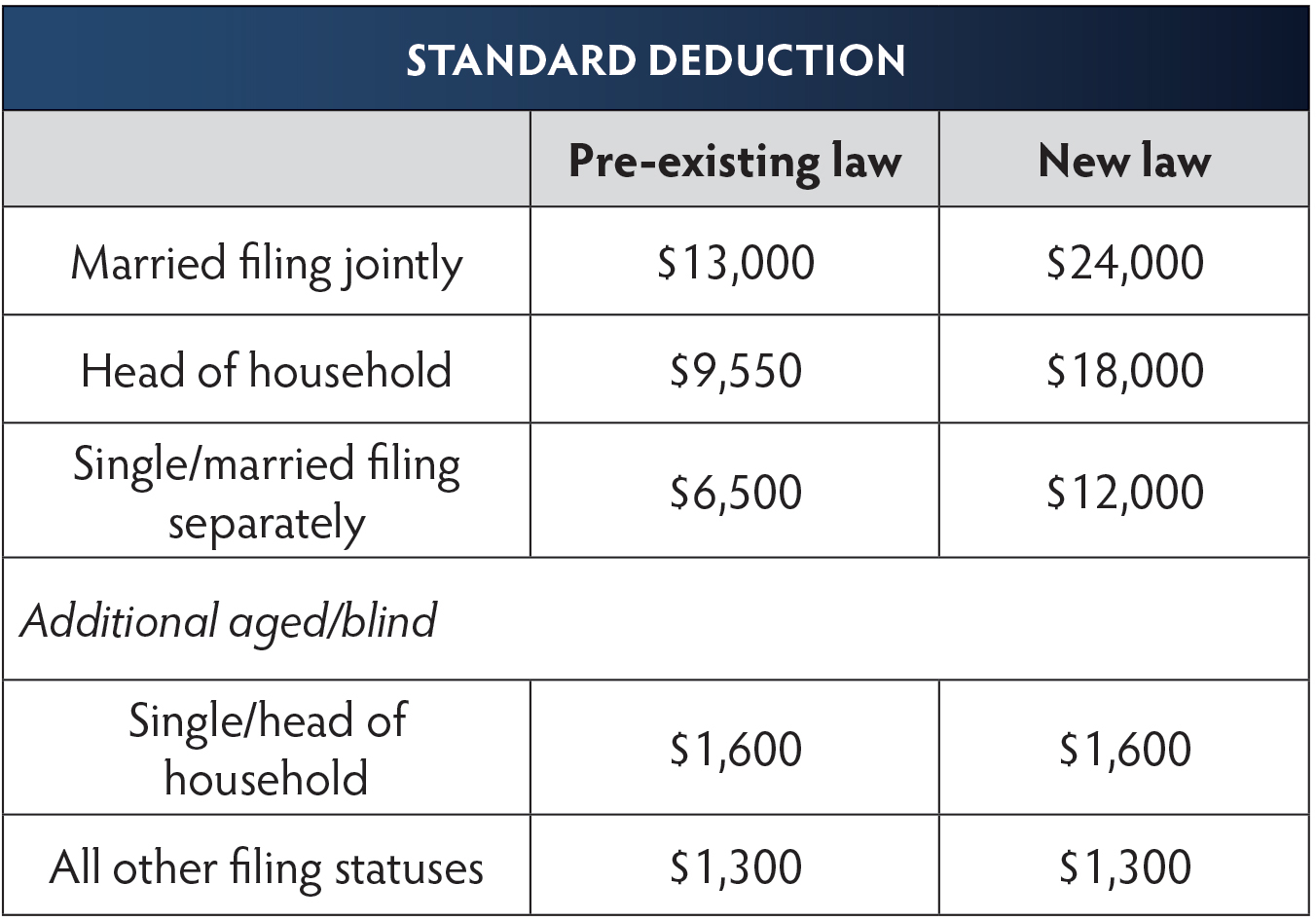

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Are Financial Planning Or Investment Management Fees Deductible

https://i.pinimg.com/originals/d9/6b/eb/d96beb262180b8a6f75be205841af569.jpg

2020 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-1.jpg

Verkko 12 maalisk 2020 nbsp 0183 32 Are you considering a job relocation this year Make sure to read our guide on tax deducations for moving expenses to carefully plan your relocation budget Verkko Income from which you can deduct eligible moving expenses carry forward and expenses paid after the move Expenses you can deduct Eligible moving

Verkko 24 syysk 2023 nbsp 0183 32 The Distance Test In order to claim tax deductions on your moving expenses the distance from your current home and new place of residence are also Verkko Qualified Moving Expenses Reimbursements No Longer Excluded from Employees Income with Two Exceptions For 2018 through 2025 employers must include

The U S Is A Mobile Society And A Move Related To New Employment Is

https://i.pinimg.com/originals/c4/a5/23/c4a523996f3290c81f24ab4d4e462b6c.png

The Standard Deduction And Itemized Deductions After Tax Reform

https://www.coastalwealthmanagement24.com/wp-content/uploads/2018/03/The-Standard-Deduction-and-Itemized-Deductions-After-Tax-Reform-Coastal-Wealth-Management.gif

https://updater.com/moving-tips/are-moving-…

Verkko 29 tammik 2021 nbsp 0183 32 The deductible expenses include the cost of packing and transporting household goods and travel expenses in transit storage moving pets lodging and airfare costs during the

https://www.thebalancemoney.com/moving-e…

Verkko 19 toukok 2022 nbsp 0183 32 Claiming the Deduction in 2021 Moving expenses for the 2021 tax year as with tax years 2018 2019 and 2020 are calculated and recorded on Form 3903 The process for claiming the

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

The U S Is A Mobile Society And A Move Related To New Employment Is

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

When Can You Claim Moving Expenses As A Tax Deduction UNITS Moving

7 Things To Know About Tax Deductions When Moving Tamara Like Camera

Tax Deduction For Moving Expenses

Tax Deduction For Moving Expenses

Are Moving Expenses Tax Deductible Under The New Tax Bill

About That Property Tax Deduction For Vets NJMoneyHelp

10 2014 Itemized Deductions Worksheet Worksheeto

Tax Deduction For Moving Expenses 2020 - Verkko 5 huhtik 2021 nbsp 0183 32 What moving expenses are tax deductible in the tax year 2020 Tax deductions are a complicated business They re constantly changing and the IRS