Tax Deduction On New Car Purchase You can enter the sales tax you paid for the car you purchased in 2023 by going to Federal Deductions and Credits Estimates and Other Taxes Paid Sales Tax You will be

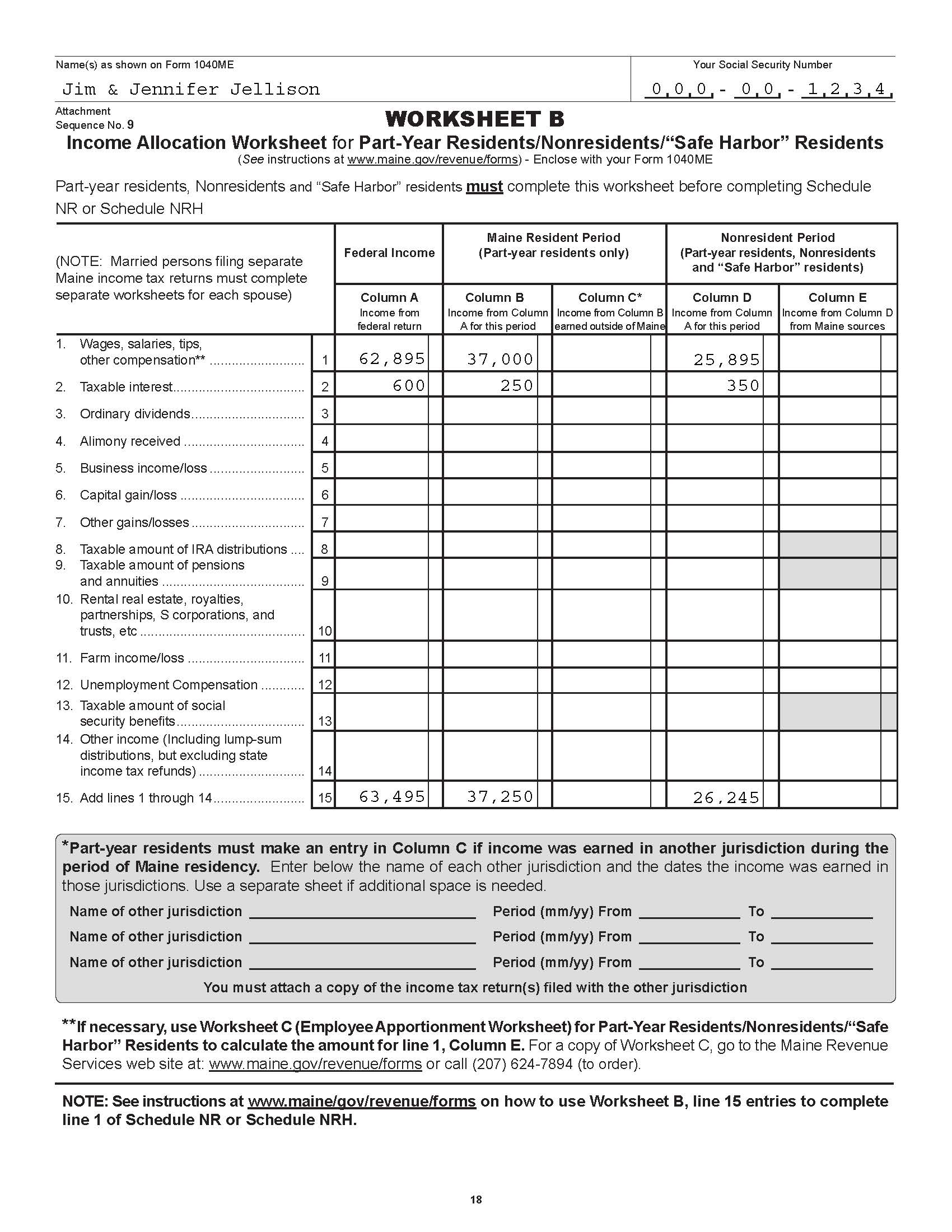

In certain states individuals can deduct sales tax paid on a new car purchase if they itemize deductions on Schedule A Form 1040 Consult with a tax professional to determine if this Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction limit in 2024 is

Tax Deduction On New Car Purchase

Tax Deduction On New Car Purchase

https://blog.carvana.com/wp-content/uploads/2020/02/022120-How-to-qualify-for-the-vehicle-sales-tax-deduction_Blog4.png

Tax Deductions Investment Watch

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-scaled.jpg

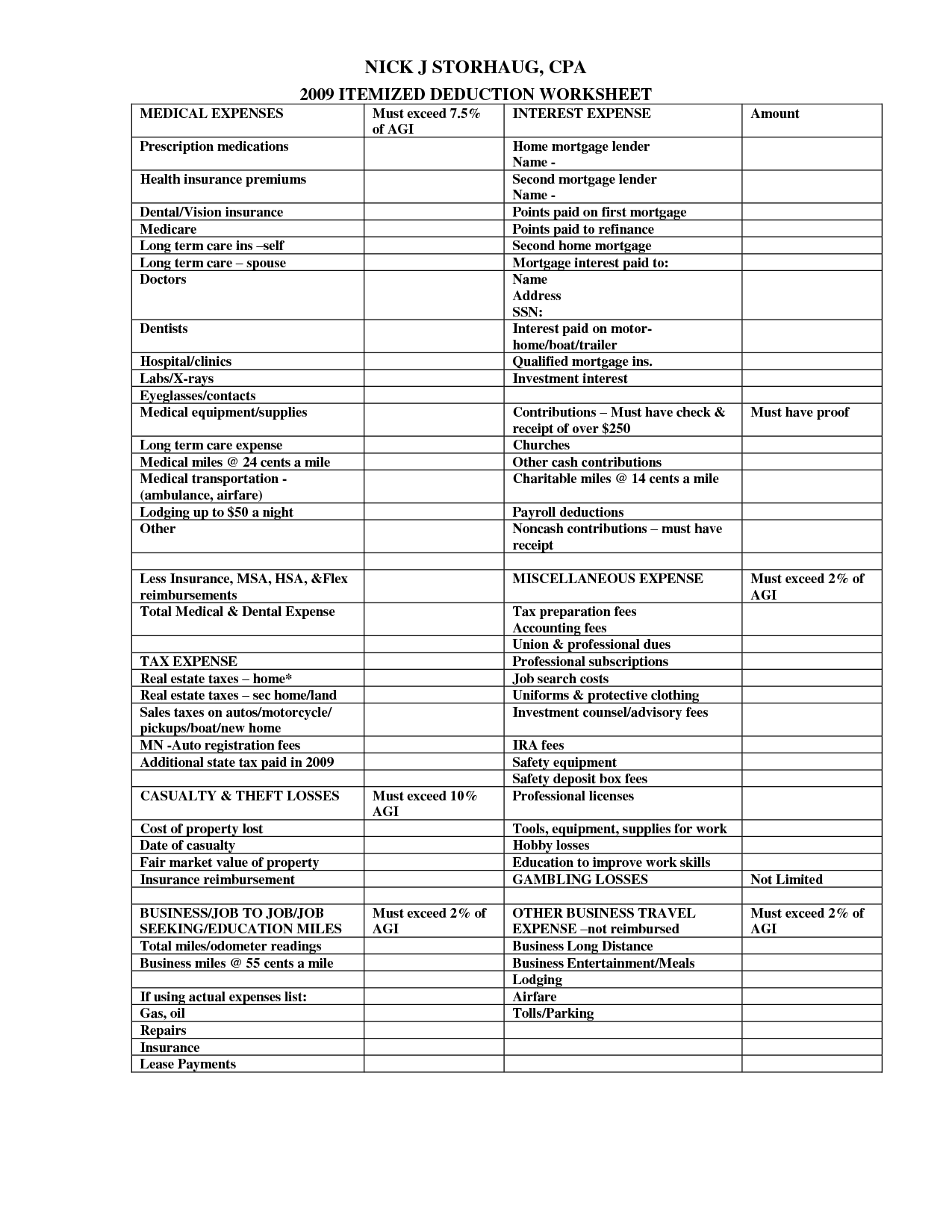

13 Car Expenses Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/10/tax-deduction-worksheet_449321.png

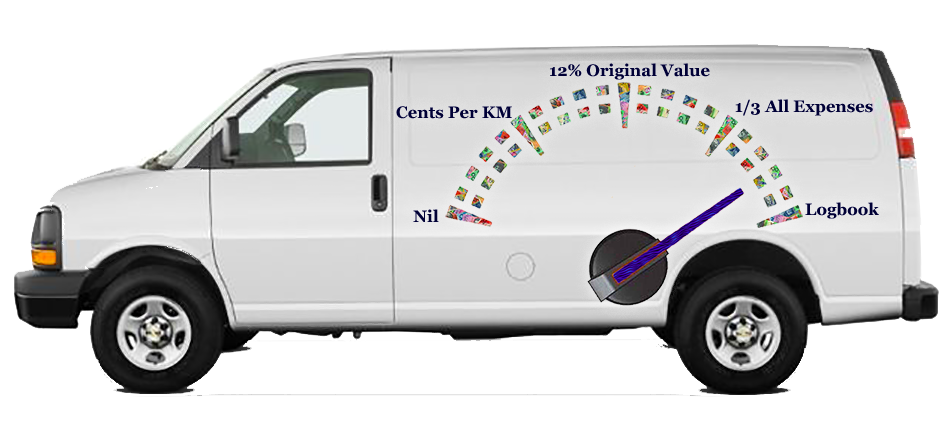

How much tax do I pay when I buy a new car Car taxation is best explained by splitting it up into three separate components New car VAT Every new car sold has a VAT component that is charged at the standard 20 rate You can deduct the operating costs of using the car for business or charitable pursuits via the standard mileage rate determined by the IRS which was 65 5 cents per mile for 2023 or your

You can claim the deduction if you live in a state where vehicle sales tax is imposed To do this you need to either itemize your deductions in the tax return form or go for You may qualify for a vehicle tax deduction that applies to a portion of your car s state and local personal property tax You can do this on Schedule C or Schedule F on Form 1040 Tolls and parking fees

Download Tax Deduction On New Car Purchase

More picture related to Tax Deduction On New Car Purchase

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

New Car Purchase Tax Deduction How Much Of A New Car Can You Write Off

https://phantom-marca.unidadeditorial.es/cc64fa27eb692d6375ea6e8be2264ec2/crop/89x0/1156x711/resize/1320/f/jpg/assets/multimedia/imagenes/2023/02/19/16767981217503.png

How To Write Off Taxes On New Car Purchase Tax Relief Center In 2021

https://i.pinimg.com/736x/f4/b4/e1/f4b4e18d54ca0ee7d6971a8f54c9cb0e.jpg

Is buying a new car tax deductible You can get a tax credit for buying a car if it meets the IRS criteria You can also claim sales business expenses and charitable expense This deduction depends on the vehicle and the percentage of time you drive it for your business and there are several exceptions Find out if your work vehicle qualifies for a business vehicle

As an SUV owner and a small business owner this article will highlight the latest automobile tax deduction rules for 2024 and beyond New cars trucks and SUVs are If you trade in your old car to buy a new car the sales tax you pay will depend on local and state sales tax rates and whether the taxable sale price is calculated before or after

How To Make Your Car A Tax Deduction YouTube

https://i.ytimg.com/vi/X-YJc2vswGk/maxresdefault.jpg

16 Insurance Comparison Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/06/tax-itemized-deduction-worksheet_615535.png

https://ttlc.intuit.com/community/tax-credits...

You can enter the sales tax you paid for the car you purchased in 2023 by going to Federal Deductions and Credits Estimates and Other Taxes Paid Sales Tax You will be

https://www.autocheatsheet.com/blog/new-car...

In certain states individuals can deduct sales tax paid on a new car purchase if they itemize deductions on Schedule A Form 1040 Consult with a tax professional to determine if this

Pin On Business Template

How To Make Your Car A Tax Deduction YouTube

BEST Vehicle Tax Deduction 2023 it s Not Section 179 Deduction YouTube

NickolasropMays

Can You Claim Tax Deductions For Your Car The Finance Guy

Tax Deductions Template For Freelancers Google Sheets

Tax Deductions Template For Freelancers Google Sheets

Can You Claim A Tax Deduction For Your Car Purchase

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

Standard Deduction 2020 Self Employed Standard Deduction 2021

Tax Deduction On New Car Purchase - To deduct the sales tax from your new vehicle you must itemize your deductions using Schedule A This form calculates the specific expenses you can write off from your tax