Tax Write Off New Car Purchase H R 5376 commonly called the Inflation Reduction Act of 2022 IRA provides taxpayers with credits for qualified new previously owned and qualified commercial clean

How do you write off a car on your taxes Vehicles used for business purposes can often be written off using a few different tax deductions the standard mileage rate the actual expense deduction or the Section 179 Individuals can deduct sales tax in certain states on a new car purchase This deduction is available for taxpayers who itemize their deductions on Schedule A Form 1040

Tax Write Off New Car Purchase

Tax Write Off New Car Purchase

https://www.bookstime.com/wp-content/uploads/2022/02/what-is-a-tax-write-off-definition-and-examples-scaled-1.jpeg

You Can Get A Tax Write Off By Using Hawaii Digital Marketing Services

https://nickponte.com/wp-content/uploads/2022/12/Tax-Return-Maui-Sunrise-Photo-2048x1365.jpg

Tax Write Off Ideas For Your Videography Business YouTube

https://i.ytimg.com/vi/_0NLOaGFsgQ/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AYwCgALgA4oCDAgAEAEYciBBKDUwDw==&rs=AOn4CLCOguVobencUdR71QGOXDimMwFYqg

You could write off all or some of your original purchase price after the first year using the Section 179 deduction This special deduction is an IRS Tax Code section that To deduct vehicle sales tax you can either Save all sales receipts and deduct actual sales taxes paid throughout the year or Use the IRS sales tax tables to figure your deduction These tables calculate the estimated sales tax you paid

You may be able to write off your business auto loan interest when you file your taxes Like mileage deductions the amount of interest you can write off depends on how much you use your vehicle for business So Are you eligible for vehicle tax deductions Learn about standard mileage rate actual expenses and other frequently asked questions about car write offs

Download Tax Write Off New Car Purchase

More picture related to Tax Write Off New Car Purchase

What s A Tax Write Off YouTube

https://i.ytimg.com/vi/gOrXmwYPmZ4/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgWShHMA8=&rs=AOn4CLCZtlyvxa_o0hiYbwuStIXSPFY-fA

Tax Write off Template Just One Dime

https://assets-global.website-files.com/587085787820e72372341592/618050774a484669e948c31e_tax write off T.png

Donating A Car For A Tax Write off Veteran Car Donations

https://www.veterancardonations.org/wp-content/uploads/2018/03/Donate-My-Car-for-a-Tax-Write-Off.jpg

For a car you purchased between 2017 and 2022 the IRS allowed you to write off 100 of the cost in year one After that it started to phase out that helpful subsidy by 20 every year culminating when it vanishes entirely Automobile Tax Deduction Rule Section 179 You can only write off 100 if the vehicle is used 100 for business Keep in mind commuting from your home to and from your business in the vehicle is not considered

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both business and If your freelancing 1099 contracting or small business involves driving then you can claim car related tax write offs Here s how to save on your car expenses at tax time

Dodge Charger Tax Write Off 2021 2022 Best Tax Deduction

https://taxsaversonline.com/wp-content/uploads/2022/06/Dodge-Charger-Tax-Write-Off.png

Used Car Sales Agreement Template HQ Printable Documents

https://www.dealersupplyshop.com/assets/images/bob.jpg

https://kpmg.com/us/en/taxnewsflash/news/2024/04/...

H R 5376 commonly called the Inflation Reduction Act of 2022 IRA provides taxpayers with credits for qualified new previously owned and qualified commercial clean

https://www.thebalancemoney.com/vehi…

How do you write off a car on your taxes Vehicles used for business purposes can often be written off using a few different tax deductions the standard mileage rate the actual expense deduction or the Section 179

.png)

Did You Miss Any Of These Small Business Tax Deductions

Dodge Charger Tax Write Off 2021 2022 Best Tax Deduction

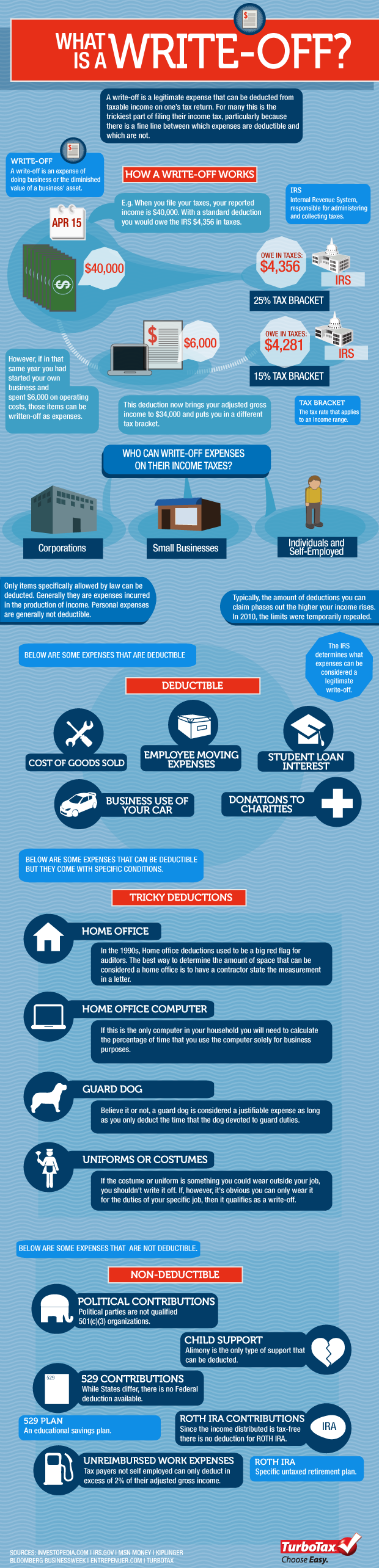

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

Used Vehicle Automotive Bill Of Sale Purchase Agreement 2 Part Auto

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Need A Tax Write Off Donate To These Awesome Idaho Nonprofits

Need A Tax Write Off Donate To These Awesome Idaho Nonprofits

Lexus NX Tax Write Off 2021 2022 Best Tax Deduction

What s The Best Way Of Financing A New Car Purchase Green Flag

Buick Envision Tax Write Off 2021 2022 Best Tax Deduction

Tax Write Off New Car Purchase - You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle