Tax Deduction Vehicle Purchase Business Section 179 of the tax code lets you write off some or all of the purchase price of a vehicle you buy for your business provided you meet the requirements To take the deduction you must use the car for

Work out how to claim motor vehicle expenses depending on your business structure and the type of vehicle Cents per kilometre method Check how sole traders and some A Section 179 tax deduction vehicle can be purchased new or used but the vehicle must be utilized more than 50 of the time for business purposes Even if you

Tax Deduction Vehicle Purchase Business

Tax Deduction Vehicle Purchase Business

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1140xN.5462529921_cvyy.jpg

Work Vehicles Are Eligible For A Tax Deduction RideSmart Auto LLC

https://dcdws.blob.core.windows.net/dws-8835208-14676-media/sites/14676/2020/12/pYEi4oh2.png

Buying or leasing a car for business comes with several tax benefits Find out when it makes sense to buy or lease and how to claim the tax deductions for each If you own a business you should know the tax rules for buying a SUV or a truck You can and should deduct the operating expense of your vehicle if you use it for your business But you can

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year The deduction Business Use of Vehicles If you use vehicles in your small business how and when you deduct for the business use of those vehicles can have significant tax

Download Tax Deduction Vehicle Purchase Business

More picture related to Tax Deduction Vehicle Purchase Business

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

https://www.creativefabrica.com/wp-content/uploads/2021/07/17/Tax-Deduction-Planner-Graphics-14848059-3.jpg

10 Best Vehicles For Income Tax Deduction In 2022

https://taxsaversonline.com/wp-content/uploads/2022/04/Best-Vehicles-for-Income-Tax-Deduction-768x512.jpg

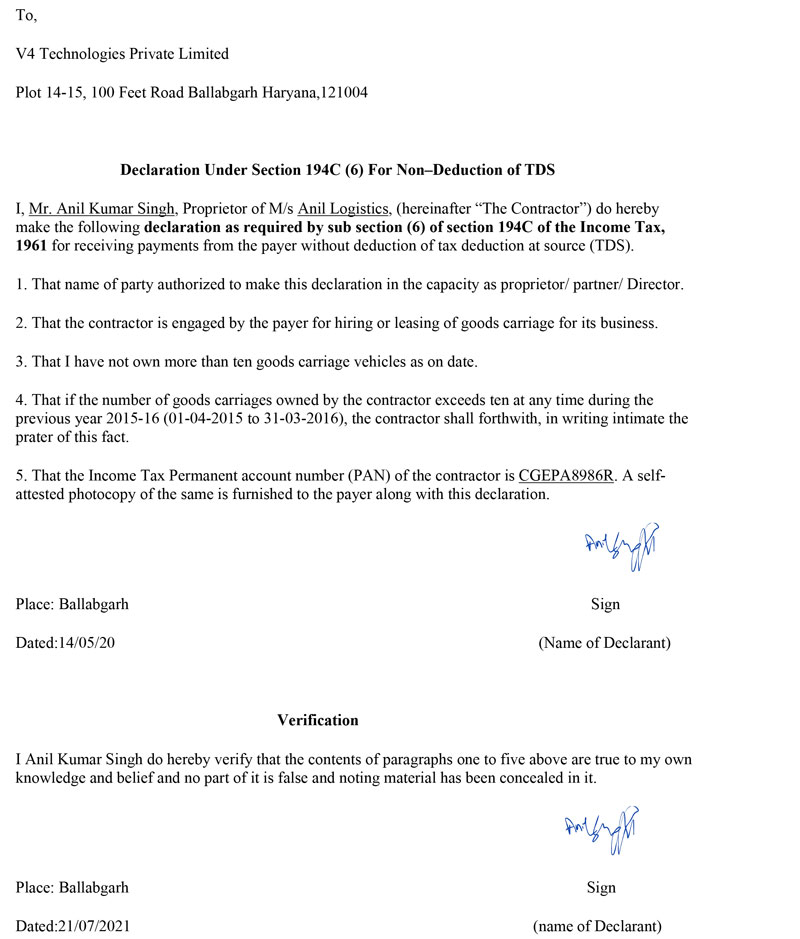

Tds Declaration Letter Format IMAGESEE

https://legalvidur.com/wp-content/uploads/2021/11/transporter-declaration-format-for-non-deduction-of-tds.jpg

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for Can you deduct taxes for the business use of your car The self employed can score a business tax deduction for using their personal car for business Tax

Using a Section 179 deduction you can write off all or part of a vehicle purchase as long as the vehicle is new to you and used at least 50 of the time for business purposes If you re a business owner and use a car for business purposes you may be eligible for a tax deduction for business use of car You can claim a business vehicle tax

Kurzstudie Tax Deduction Scheme Belgien EUKI

https://www.euki.de/wp-content/uploads/2019/09/20180827_BE_Tax-deductions_Study-pdf.webp

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

https://www.thebalancemoney.com/section-17…

Section 179 of the tax code lets you write off some or all of the purchase price of a vehicle you buy for your business provided you meet the requirements To take the deduction you must use the car for

https://www.ato.gov.au/businesses-and...

Work out how to claim motor vehicle expenses depending on your business structure and the type of vehicle Cents per kilometre method Check how sole traders and some

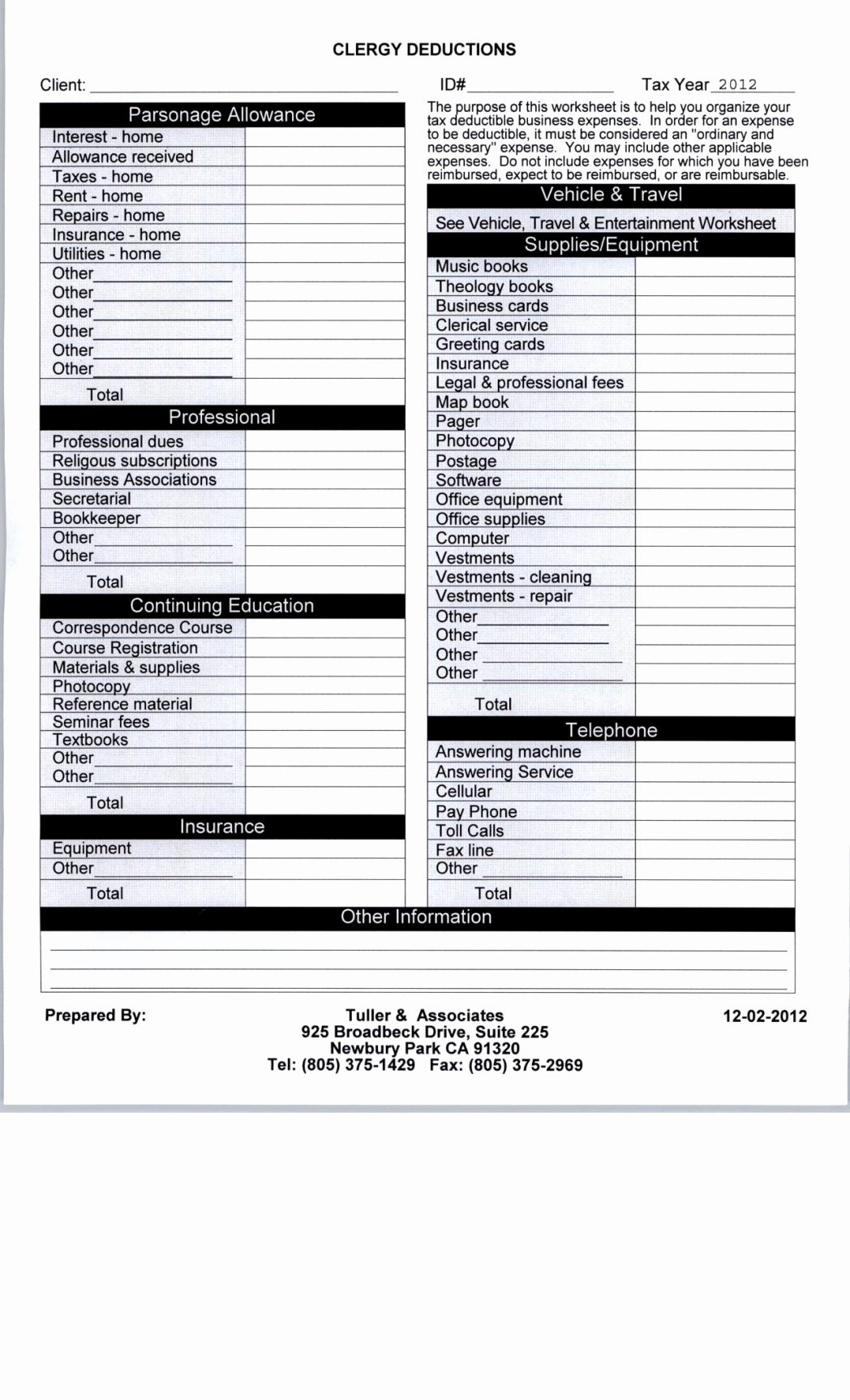

Goodwill Donation Spreadsheet Template Throughout Clothing Donation

Kurzstudie Tax Deduction Scheme Belgien EUKI

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

Small Business Expenses Tax Deductions 2023 QuickBooks

Tax Deduction On Payment To Release Bumi Lot Sep 01 2022 Johor

Pin On TAX Deduction

Pin On TAX Deduction

Tax Prep Documents Checklist H R Block Top 11 Construction

Corporation Prepaid Insurance Tax Deduction Financial Report

What Are Pre tax Deductions Before Tax Deduction Guide

Tax Deduction Vehicle Purchase Business - You can deduct expenses for a vehicle you use for your business If you use the vehicle for both personal and business purposes you can deduct only the costs for business