Tax Deductions Corporations Corporate Tax Deductions Corporations are permitted to reduce taxable income by certain necessary and ordinary business expenditures All current expenses required for the operation of the

A business or corporate tax deduction refers to an item that is subtracted from revenue in order to determine a company s taxable income Tax deductions are considered a form of tax relief for the company Companies will file their appropriate tax returns at least annually Tax deductions allow corporations to reduce their taxable income by deducting certain expenses and investments By taking advantage of eligible deductions corporations can lower their tax liability and retain more of their earnings

Tax Deductions Corporations

Tax Deductions Corporations

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM-1536x1187.png

What Mortgage Refinance Costs Can You Deduct From Your Taxes Lendgo

https://d1h86g9h1jpeic.cloudfront.net/2021/03/LG-taxes.jpg

5 Deductions That Will Greatly Increase Your Tax Refund Tax Refund

https://i.pinimg.com/originals/e6/97/88/e697885c772ebc04e72ebb01c99fd6ae.jpg

Lea D Uradu Fact checked by Vikki Velasquez What Are Business Expenses Business expenses are costs incurred in the ordinary course of business Every business from the smallest corner Employee Benefit Programs Corporations can deduct expenses for employee benefit programs which include health insurance life insurance and education assistance These deductions not only reduce taxable income but also aid in attracting and retaining a talented workforce Charitable Contributions and Sponsorships

Types Corporate tax encompasses several types including taxes on company profits capital gains and dividends Who Pays Corporate Tax All incorporated businesses must pay corporate taxes on their earnings or profit Deductions Allowed Businesses can deduct expenses like salaries and costs of goods sold from their taxable 2 Take the home office deduction Work from home may also deduct the percentage of your home used exclusively for business And according to the IRS S corp owners can also deduct a corresponding percentage of expenses such as rent or mortgage interest utilities business related phone expenses insurance and costs for or

Download Tax Deductions Corporations

More picture related to Tax Deductions Corporations

Allowable Tax Deductions For U S Corporations Your Business

https://img-aws.ehowcdn.com/877x500/photos.demandstudios.com/getty/article/146/81/76800060_XS.jpg

Solved Missing Amounts From Balance Sheet And Income Statement Data

https://www.coursehero.com/qa/attachment/33848033/

The Best Self Employed Tax Deductions And Credits In 2022

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

Corporate tax also known as business tax is a levy imposed on the income profits or capital gains of corporations and other legal entities It is a mandatory financial contribution that corporations make to the government typically based on their annual earnings Sec 269 a provides that any tax benefit such as a deduction credit or other allowance may be disallowed if it is obtained by a person or corporation acquiring control of another corporation with the principal purpose of

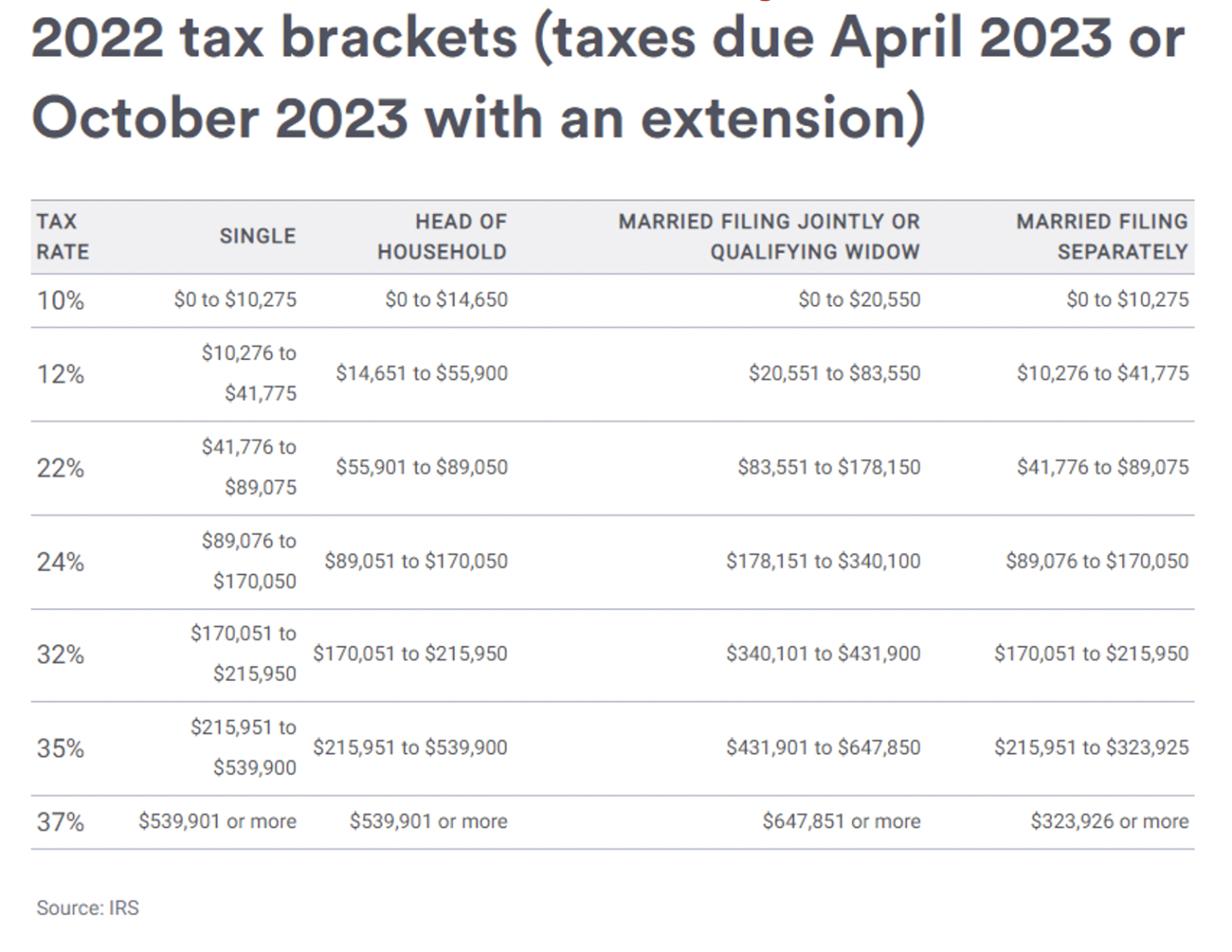

Corporations S corporations and partnerships deduct state income taxes on their business return If you are filing a Schedule C for your business you can t deduct state income taxes on this form but you can deduct sales taxes as an itemized deduction on your personal tax return Schedule A According to 2022 tax records viewed by Business Insider Michael s income was 300 106 and Eileen s was 122 403 for a total of 422 509 The bonus deductions they claimed on both properties

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

S Corporations Internal Revenue Services JD Tax Accounting

https://www.jdtaxaccounting.com/wp-content/uploads/2021/08/S-corporation-1080x675.png

https://www.investopedia.com/terms/c/corporatetax.asp

Corporate Tax Deductions Corporations are permitted to reduce taxable income by certain necessary and ordinary business expenditures All current expenses required for the operation of the

https://corporatefinanceinstitute.com/resources/...

A business or corporate tax deduction refers to an item that is subtracted from revenue in order to determine a company s taxable income Tax deductions are considered a form of tax relief for the company Companies will file their appropriate tax returns at least annually

Small Business Expenses Tax Deductions 2023 QuickBooks

Tax Deductions Armstrong Economics

Top 5 Business Tax Deductions For Employers Accountabilities

Your 2017 Tax Preparation Checklist The Motley Fool

Amazon Tax Accounting A Guide For Small Business Owners Wanting

Lets Talk Tax Deductions Shellharbour Marina Real Estate

Lets Talk Tax Deductions Shellharbour Marina Real Estate

Tax Deductions And Credits Related To Education Expenses

Small Business Expenses Tax Deductions 2023 QuickBooks

Tax Deductions For Rental Property Owners Sprint Finance

Tax Deductions Corporations - Lea D Uradu Fact checked by Vikki Velasquez What Are Business Expenses Business expenses are costs incurred in the ordinary course of business Every business from the smallest corner