Tax Deductions Michigan SmartAsset s Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next The flat income tax rate on state of Michigan returns was 4 25 in 2022 And it will be down to 4 05 in 2023 So you should owe slightly less state income taxes or receive a bigger refund

Tax Deductions Michigan

Tax Deductions Michigan

https://images.squarespace-cdn.com/content/v1/5976a036bf629ac6f2a7bfdc/1566955219012-D81E0R00F6Y7YB1PJKUE/Tax+deductions.jpg

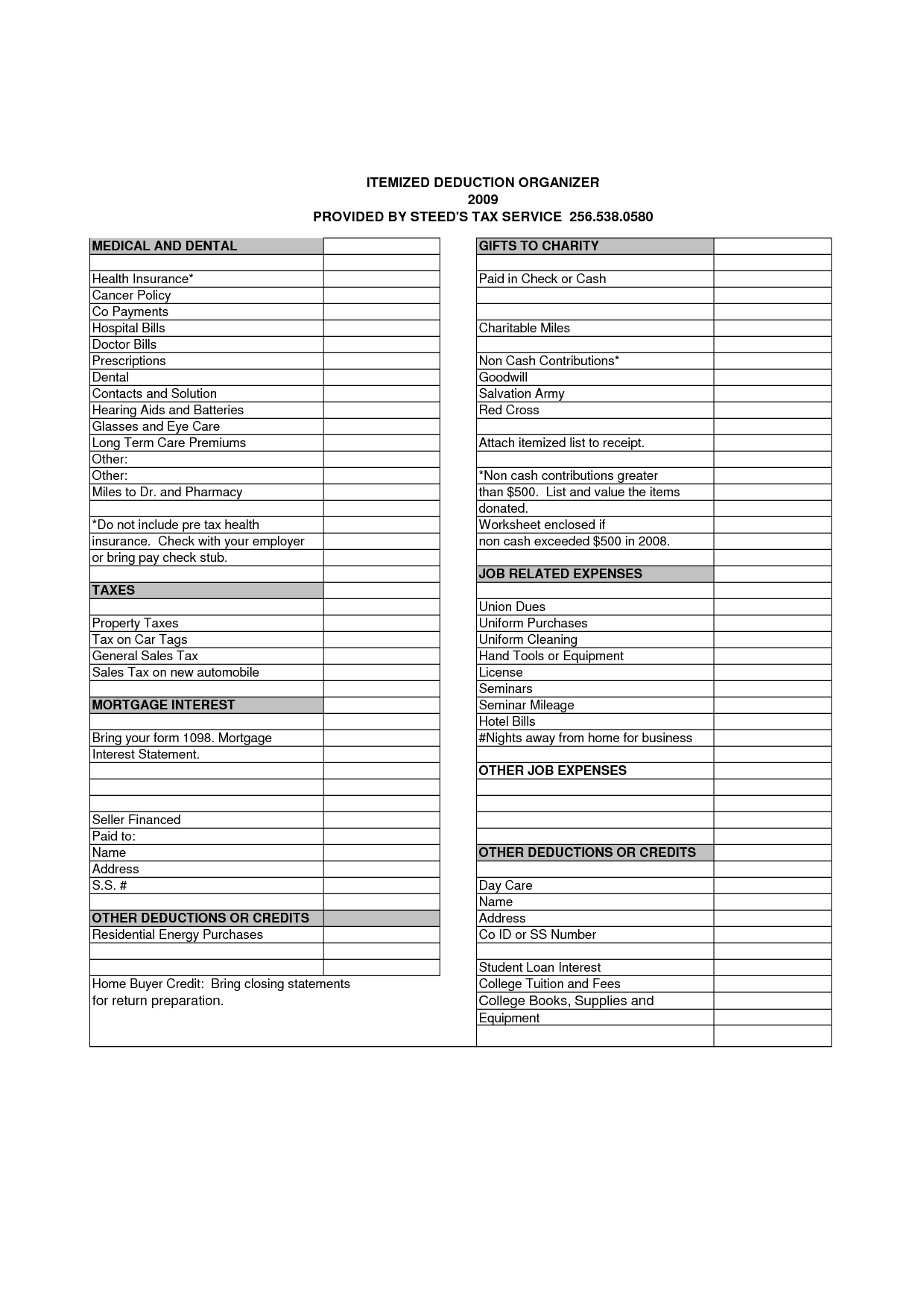

Deductions FROM Adjusted Gross Income AGI Itemized Deductions State

https://static.coggle.it/diagram/XoypUxqrZMeGAEGb/thumbnail?mtime=1586808127862

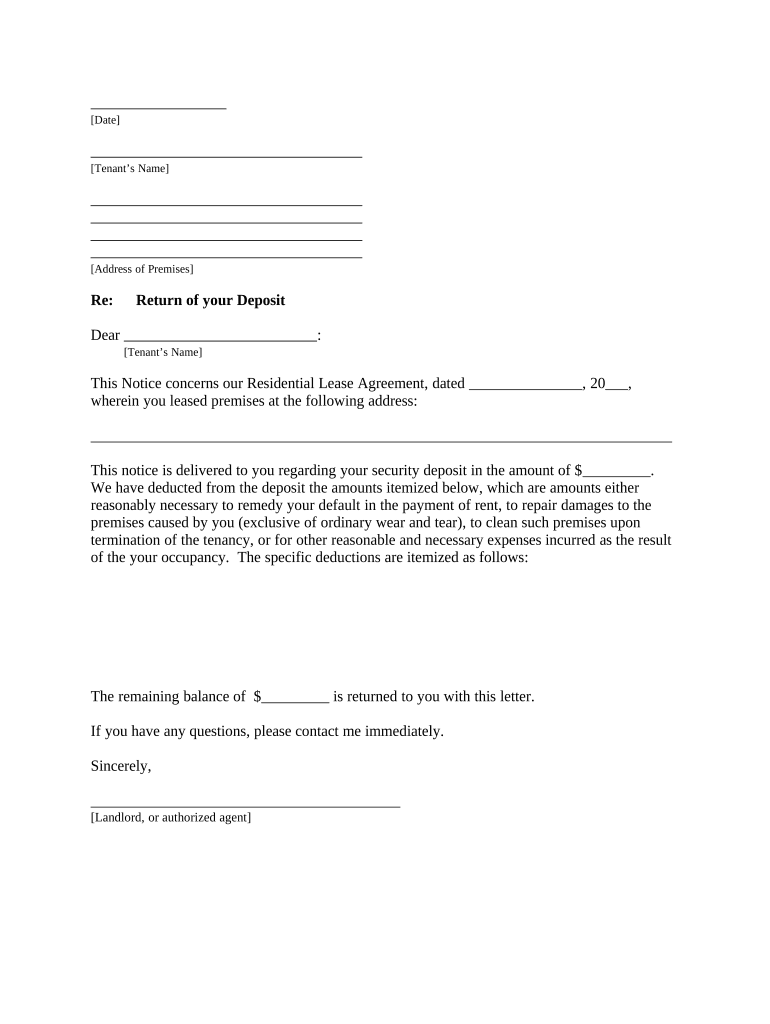

Letter From Landlord To Tenant Returning Security Deposit Less

https://www.signnow.com/preview/497/311/497311423/large.png

Michigan Tax Brackets for Tax Year 2023 Michigan is taxed at a flat tax rate of 4 05 for all levels of income Michigan Tax Brackets for Tax Year 2022 Michigan was taxed at a flat tax rate of 4 25 for all levels of income Michigan Tax Brackets for Tax Year 2021 Michigan was taxed at a flat tax rate of 4 25 for all levels of income What changed Who is impacted by this change Why was 4 05 selected for the 2023 reduced income tax rate Is this a permanent change to Michigan s income tax rate Why did the income tax rate only change for tax year 2023 Why was the 2023 income tax rate changed during the tax year

Navigating 2024 Tax Deductions and Credits in Michigan 02 28 2024 Every new year brings a new tax season With some new changes and additions at both the federal and Michigan state level we ve collected the most important tax deductions and credits for you to know about in 2024 The Michigan Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Michigan the calculator allows you to calculate income tax and payroll taxes and deductions in Michigan This includes calculations for Employees in Michigan to calculate their annual salary after tax

Download Tax Deductions Michigan

More picture related to Tax Deductions Michigan

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-1024x768.jpg

What Mortgage Refinance Costs Can You Deduct From Your Taxes Lendgo

https://d1h86g9h1jpeic.cloudfront.net/2021/03/LG-taxes.jpg

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

Michigan provides a standard Personal Exemption tax deduction of 5 000 00 in 2023 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2023 Michigan Single Filer Tax Tables Michigan Married Joint Filer Tax Tables Michigan Married separate Filer Tax Tables The Lowering MI Costs Plan Public Act 4 of 2023 was signed into law on March 7 2023 and will amend Michigan s current Income Tax Act to provide a substantial tax deduction on retirement and pension benefits The law will take effect in March 2024 and will be phased in over the 2023 2026 tax years Phasing in the Plan

This booklet contains information for your 2024 Michigan property taxes and 2023 individual income taxes homestead property tax credits farmland and open space tax relief and home heating credit program For the 2023 income tax returns the individual income tax rate for Michigan taxpayers is 4 05 percent and the personal exemption is Updated May 10 2024 Our payroll tax calculator is here to help the wide range of small businesses that make up the state of Michigan All you need to do is enter each employee s wage and W 4 information at the top of this page Our payroll calculator will take care of the rest Federal payroll taxes for Michigan employers

Home Office Deduction Worksheet Excel Osakiroegner 99

https://i.pinimg.com/originals/5b/f1/1c/5bf11ce4adb7b2d7f007c6ab2ba2a967.png

FunctionalBest Of Self Employed Tax Deductions Worksheet

https://i.pinimg.com/474x/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

https://smartasset.com/taxes/michigan-paycheck-calculator

SmartAsset s Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

https://smartasset.com/taxes/michigan …

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next

8 Tax Itemized Deduction Worksheet Worksheeto

Home Office Deduction Worksheet Excel Osakiroegner 99

Lets Talk Tax Deductions Shellharbour Marina Real Estate

Top 5 Tax Deductions For Home Sellers Www elikarealestate Flickr

List Of Tax Deductions Here s What You Can Deduct

Tax Deductions And Credits Related To Education Expenses

Tax Deductions And Credits Related To Education Expenses

10 Hair Stylist Tax Deduction Worksheet Worksheets Decoomo

Tax Deductions For Rental Property Owners Sprint Finance

New And Improved Tax Deductions For Parents Of Children With Special

Tax Deductions Michigan - The Lowering MI Costs Plan Public Act 4 of 2023 signed into Michigan law on March 7 2023 amended in part MCL 206 30 to provide taxpayers with more options to choose the best taxing situation for their retirement benefits beginning tax year 2023