Tax Deductions On Interest Payments Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject to tax Some examples of

Tax deductible interest is the interest you ve paid for various purposes that can be used to reduce your taxable income Not all interest is tax deductible In general tax deductible interest is interest you pay on your Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies and where to take the deduction When you prepay interest you must allocate the interest over the tax years to which the interest applies

Tax Deductions On Interest Payments

Tax Deductions On Interest Payments

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

List Of Tax Deductions Here s What You Can Deduct

https://s.yimg.com/uu/api/res/1.2/PZHKfKkv5p.BgGeZMfyACA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/gobankingrates_644/d87a23f0b34a2e279043d0f64d549859

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

If you borrow money to buy shares or related investments from which you earn dividends or other assessable income you can claim a deduction for the interest you pay Only interest expenses you incur for an income producing purpose are deductible Tax deductions for interest payments Certain types of interest payments can serve as eligible tax deductions The mortgage interest deduction is a popular tax break for homeowners because it can

You pay tax on any interest over your allowance at your usual rate of Income Tax If you re employed or get a pension HMRC will change your tax code so you pay the tax automatically The interest you pay on a business loan is tax deductible if you meet specific criteria defined by the IRS Here s what you need to know about these criteria

Download Tax Deductions On Interest Payments

More picture related to Tax Deductions On Interest Payments

Investment Expenses What s Tax Deductible Charles Schwab

https://www.schwab.com/learn/sites/g/files/eyrktu1246/files/Example-2.png

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

https://i.etsystatic.com/24598192/r/il/e3c7c0/3985544266/il_1588xN.3985544266_82sm.jpg

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Under the current U S income tax system most interest paid is deductible and interest received is usually taxable The ideal one might imagine is to tally up everyone s income with interest receipts counting as positive income and interest payments to others counting as negative income Ending the tax deductibility of interest payments forbidding companies that have too much debt to pay dividends banning share buybacks and taxing profits in the country in which the

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable donations The provisions relating to the tax treatment of interest expense are S33 1 general deductibility of expenses S33 1 a specific deductibility of interest expense S33 4 and 5 interest deductible when due to be paid and relevant compliance requirement

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

Small Business Expenses Tax Deductions 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/standard-vs-itemized-deductions.png

https://www.investopedia.com/terms/i/interest-deduction.asp

Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject to tax Some examples of

https://www.thebalancemoney.com/what-is-tax...

Tax deductible interest is the interest you ve paid for various purposes that can be used to reduce your taxable income Not all interest is tax deductible In general tax deductible interest is interest you pay on your

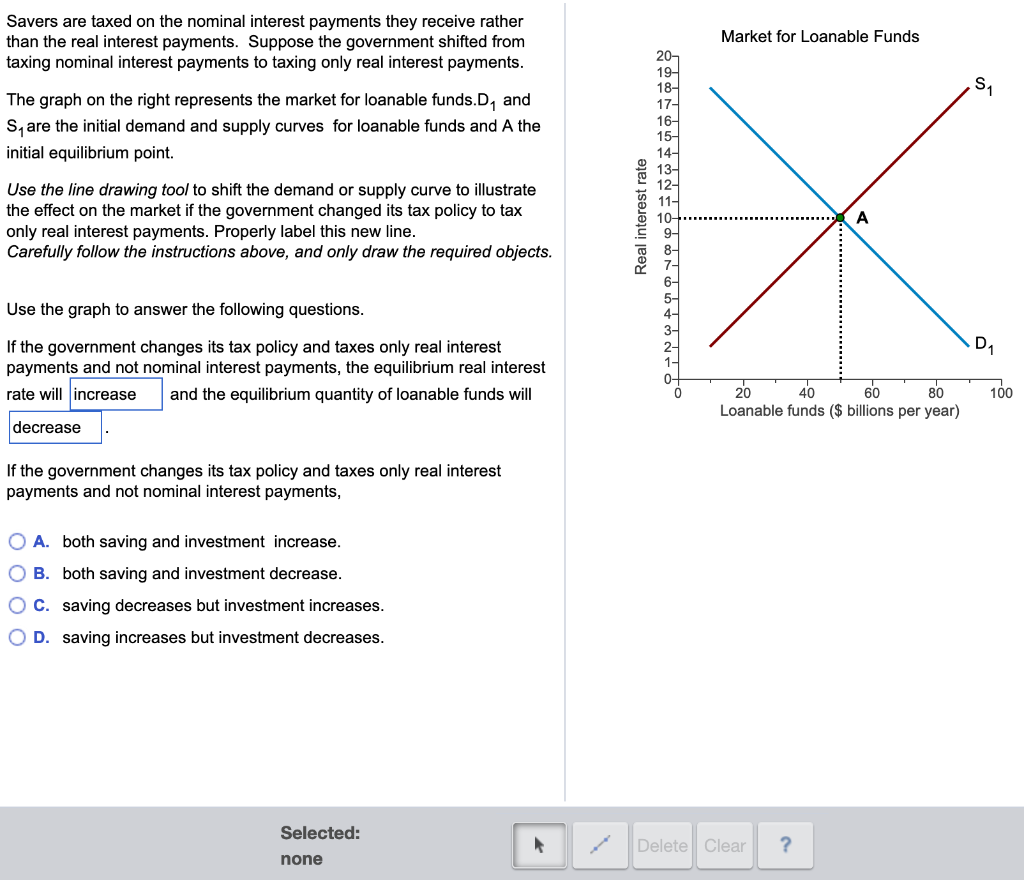

Solved Savers Are Taxed On The Nominal Interest Payments Chegg

Tax Savings Deductions Under Chapter VI A Learn By Quicko

S Corp Tax Deductions Everything You Need To Know

Allowable Deductions From Income While Filing Return Of Income

1040 Deductions 2016 2021 Tax Forms 1040 Printable

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

Small Business Tax Write Off List Authenticwes

Top 6 Tax Deduction Examples You Probably Didn t Know About

Tax Deductions Template For Freelancers Google Sheets

Tax Deductions On Interest Payments - You pay tax on any interest over your allowance at your usual rate of Income Tax If you re employed or get a pension HMRC will change your tax code so you pay the tax automatically