Tax Exemption For Savings Bank Interest First understand that savings bank interest is taxable under Income from Other Sources with an exemption limit of 10 000 under Section 80TTA for individuals and Hindu

Interest from savings account is exempted from tax for an amount up to 10 000 during a financial year This deduction can be availed under Section 80TTA of the Income Tax While you might not think of a savings account as an investment they earn interest just like stocks bonds and other assets do and are not exempt from state and federal taxes

Tax Exemption For Savings Bank Interest

Tax Exemption For Savings Bank Interest

https://news.coincu.com/wp-content/uploads/2022/06/Russia-Approves-Potential-Tax-Exemption-for-Issuers-of-Digital-Assets.png

Land Tax Exemption For PPR Construction renovation

https://img1.wsimg.com/isteam/ip/3c3bf6dc-20de-47e0-ae92-9e904b35b9d8/land tax exemption.png

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

The IRS treats interest earned on a savings account as earned income meaning it can be taxed So if you received 125 in interest on a high yield savings account in 2023 Yes you can claim deduction under Section 80TTB on both interest from savings and deposit accounts with banks but the deduction amount is limited to Rs 50 000 How can I

The deduction under section 80TTA can be claimed for interest earned on savings accounts held with a bank co operative bank or a post office For interest earned from other sources such as fixed deposit recurring While certain types of interest are tax exempt such as interest earned from some government bonds interest on money in a savings account is eligible to be taxed How much interest on savings is tax free

Download Tax Exemption For Savings Bank Interest

More picture related to Tax Exemption For Savings Bank Interest

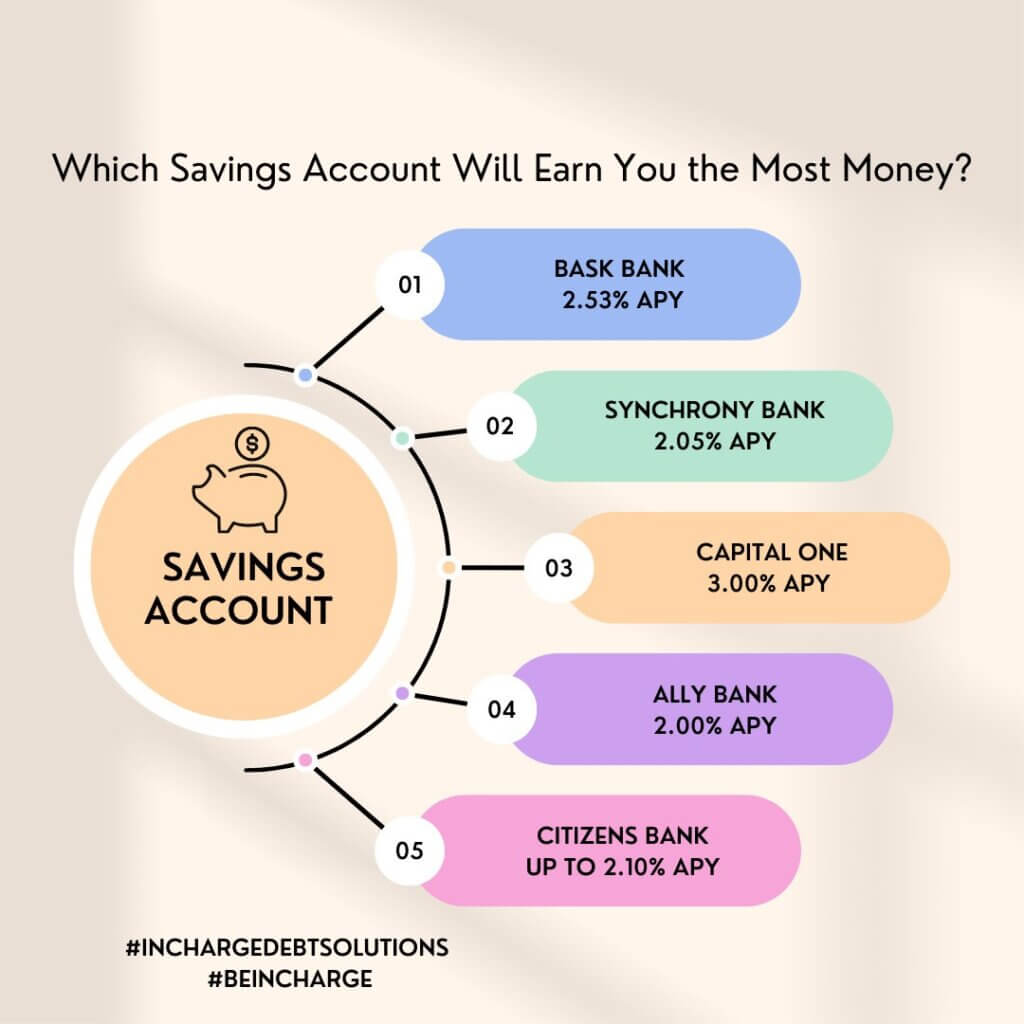

How To Get Highest Savings Account Interest Rate Investdunia Free

https://investdunia.com/wp-content/uploads/2017/11/Savings-account-interest-rate-Dec-2020.png

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Tax Exemption On Behance

https://mir-s3-cdn-cf.behance.net/project_modules/1400/35e4cf111674031.600692193312f.jpg

Interest generated on a savings bank account is tax free up to 10 000 under section 80TTA of the Income Tax Act The interest on the savings account will be taxable in the hands of the recipient if the interest earned from The move is aimed at encouraging the lower middle and middle income salaried classes to save more via EPFO and enable them to build a reasonable retirement kitty The

IR 2024 273 Oct 22 2024 WASHINGTON The Internal Revenue Service announced today the annual inflation adjustments for tax year 2025 Revenue Procedure 2024 40 PDF provides You can earn tax free interest with any savings account so long as you don t exceed your annual personal savings allowance Otherwise you might like to explore tax free ISAs Just be

Singapore Startup Tax Exemption Scheme For New Startups

https://osome.com/content/images/size/w1200h800/2023/09/tax-exemption-new-startups.web.png

Which Savings Account Will Earn You The Most Money

https://www.incharge.org/wp-content/uploads/2022/09/high-yield-savings-accounts-1024x1024.jpg

https://tax2win.in › guide › income-tax-on-saving-bank-interest

First understand that savings bank interest is taxable under Income from Other Sources with an exemption limit of 10 000 under Section 80TTA for individuals and Hindu

https://www.livemint.com › news › india › explained-how...

Interest from savings account is exempted from tax for an amount up to 10 000 during a financial year This deduction can be availed under Section 80TTA of the Income Tax

Solved Please Note That This Is Based On Philippine Tax System Please

Singapore Startup Tax Exemption Scheme For New Startups

2017 PAFPI Certificate of TAX Exemption Certificate Of

Duty Exemption And Remission Scheme DEARS

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Estate Tax Exemption Amount Goes Up In 2023

Estate Tax Exemption Amount Goes Up In 2023

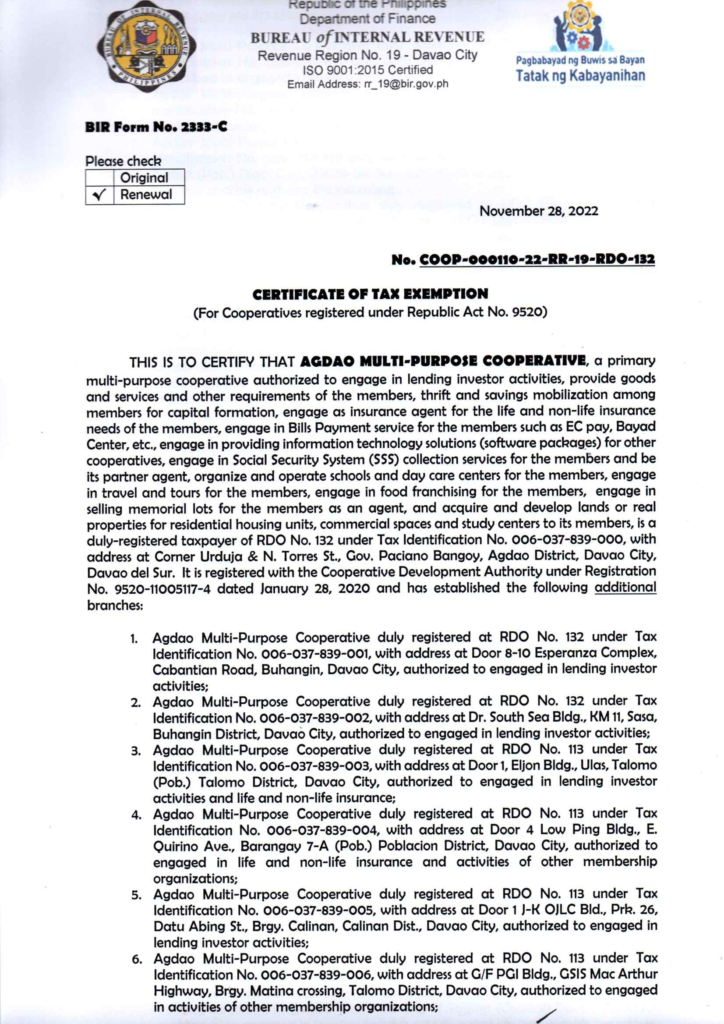

BIR Certificate Of Tax Exemption AMPC

State Lodging Tax Exempt Forms ExemptForm

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

Tax Exemption For Savings Bank Interest - While certain types of interest are tax exempt such as interest earned from some government bonds interest on money in a savings account is eligible to be taxed How much interest on savings is tax free