Is Bank Interest Tax Deductible If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you You will not be taxed on the 10 000 principal amount

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies Not all interest is tax deductible In general tax deductible interest is interest you pay on your mortgage student loans and some investments Tax deductible interest might be an adjustment to income

Is Bank Interest Tax Deductible

Is Bank Interest Tax Deductible

https://i.ytimg.com/vi/vlLTI8XKn8E/maxresdefault.jpg

Taxation On Savings Bank Account Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2018/07/taxation-on-savings-bank-account.png?w=445

Mortgage Interest Tax Relief Calculator DermotHilary

https://www.annuity.org/wp-content/uploads/mortgage-interest-deduction-formula-640x0-c-default.jpg

That s why the IRS requires you to report and pay taxes on the interest that you earn from your bank accounts The IRS treats that money exactly the same as if your employer paid it to you in the Only interest expenses you incur for an income producing purpose are deductible If you use the money you borrow for both private and income producing purposes you

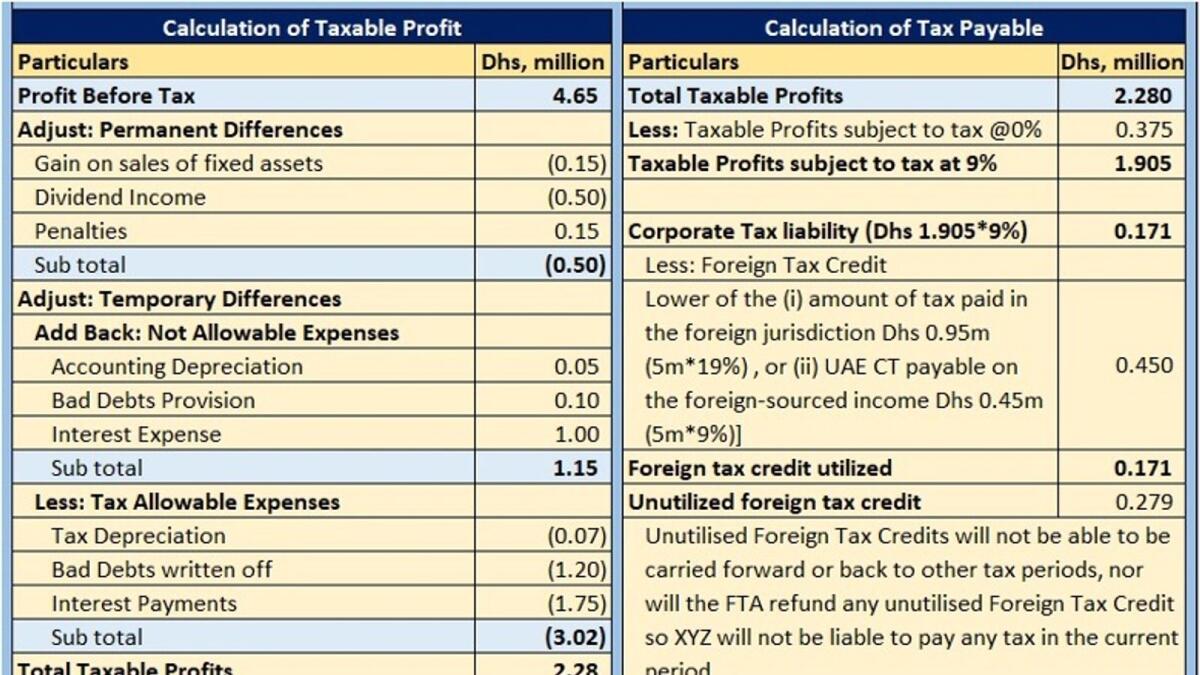

Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject to tax Investment interest is deductible as an itemized deduction but limited to net investment income Net investment income is defined as the excess of investment income over investment expenses Sec 163

Download Is Bank Interest Tax Deductible

More picture related to Is Bank Interest Tax Deductible

Lower Your Taxes 10 Deductible Expenses In The Philippines

https://una-acctg.com/wp-content/uploads/2022/12/Lower-Your-Taxes-10-Deductible-Expenses-in-the-Philippines-scaled.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

HELOC Is The Interest Tax Deductible YouTube

https://i.ytimg.com/vi/SKMnUEmDjlU/maxresdefault.jpg

Standard deduction amounts The standard deduction for 2023 is 13 850 for single or married filing separately 27 700 for married couples filing jointly or The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some

Without your overseas address tax is withheld at 47 You don t include this interest as income on your Australian tax return For more information about tax The interest you pay on a business loan is tax deductible if you meet specific criteria defined by the IRS Here s what you need to know about these criteria

Mortgage Interest Tax Deductible 2023

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/shutterstock_1613352049-1280x720.jpg

The Deduction Of Interest On Mortgages Is More Delicate With The New

https://cbsnews2.cbsistatic.com/hub/i/r/2018/05/11/544003b6-8a03-4bfe-bf80-9925d8c0616a/thumbnail/1200x630/a6a32c86c1c42ea9dfe5c87ce10ddfb2/istock-121277713.jpg

https://www.investopedia.com/ask/answer…

If your savings account has 10 000 and earns 0 2 interest you are only taxed on the 20 interest the bank pays you You will not be taxed on the 10 000 principal amount

https://www.irs.gov/taxtopics/tc505

Some interest can be claimed as a deduction or as a credit To deduct interest you paid on a debt review each interest expense to determine how it qualifies

Is Credit Card Interest Tax Deductible CreditCards

Mortgage Interest Tax Deductible 2023

Is HELOC Interest Tax Deductible Can You Write Off The Interest You

Is Your Interest Tax Deductible ShineWing TY TEOH

Student Loan Interest Deduction 2013 PriorTax Blog

Investment Expenses What s Tax Deductible Charles Schwab

Investment Expenses What s Tax Deductible Charles Schwab

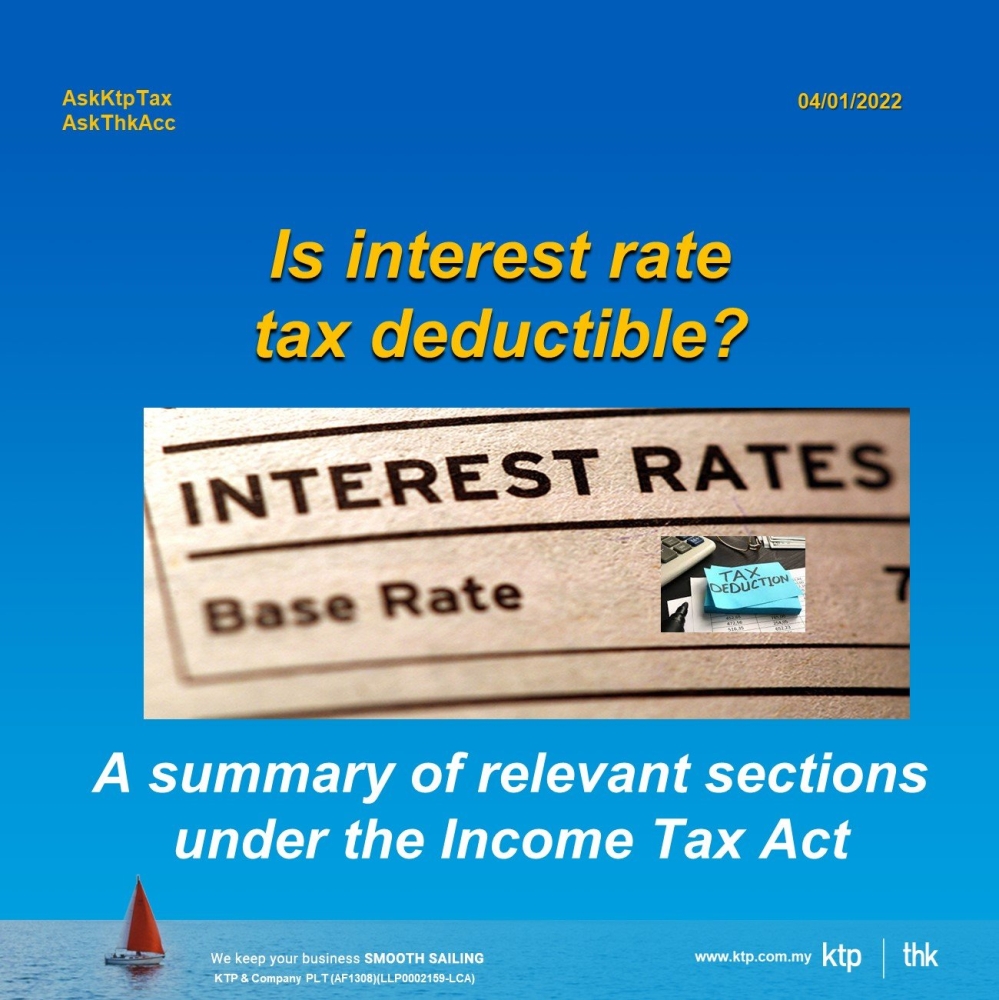

Is Interest Rate Tax deductible Jan 04 2022 Johor Bahru JB

Solved Please Note That This Is Based On Philippine Tax System Please

How To Calculate Income Tax Payable And Adjust Foreign Tax Credits

Is Bank Interest Tax Deductible - Interest deduction causes a reduction in taxable income If a taxpayer or business pays interest in certain cases the interest may be deducted from income subject to tax