Tax Exemption Limit On Housing Loan A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property

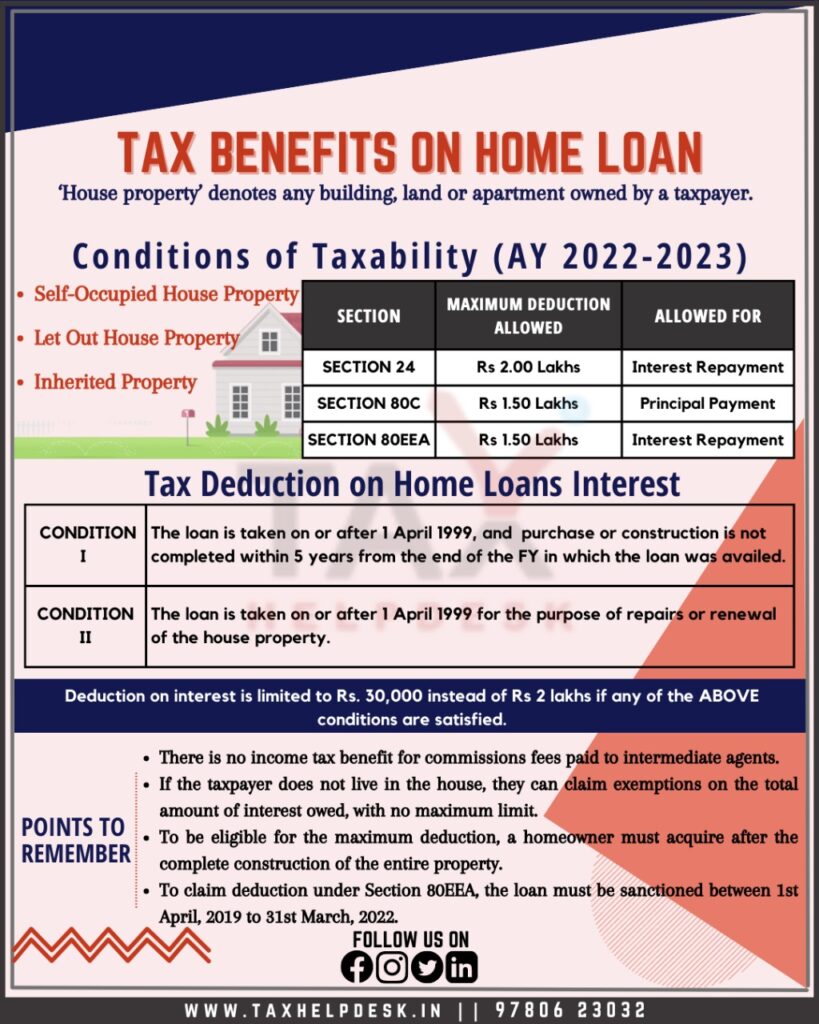

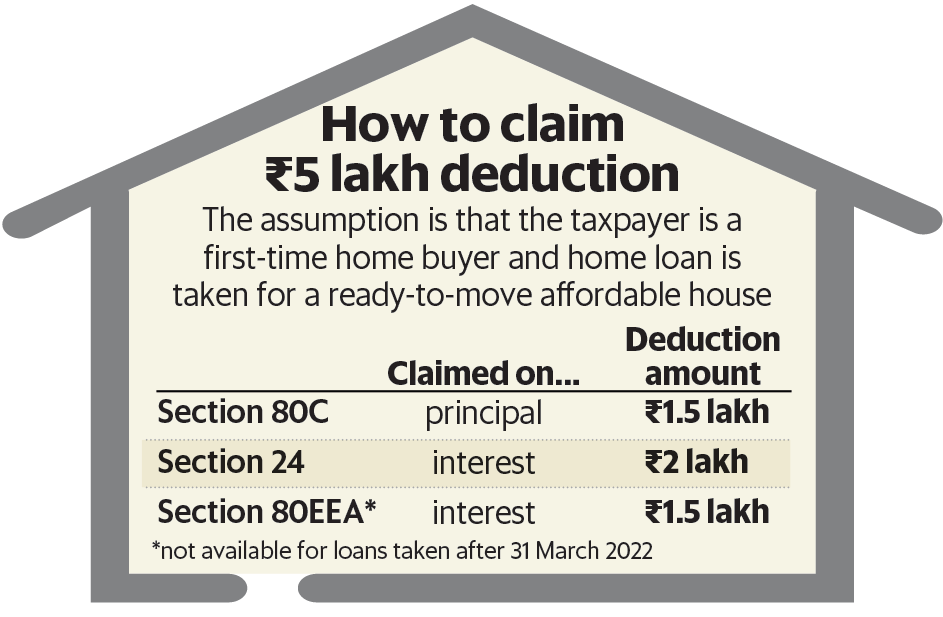

Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and

Tax Exemption Limit On Housing Loan

Tax Exemption Limit On Housing Loan

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

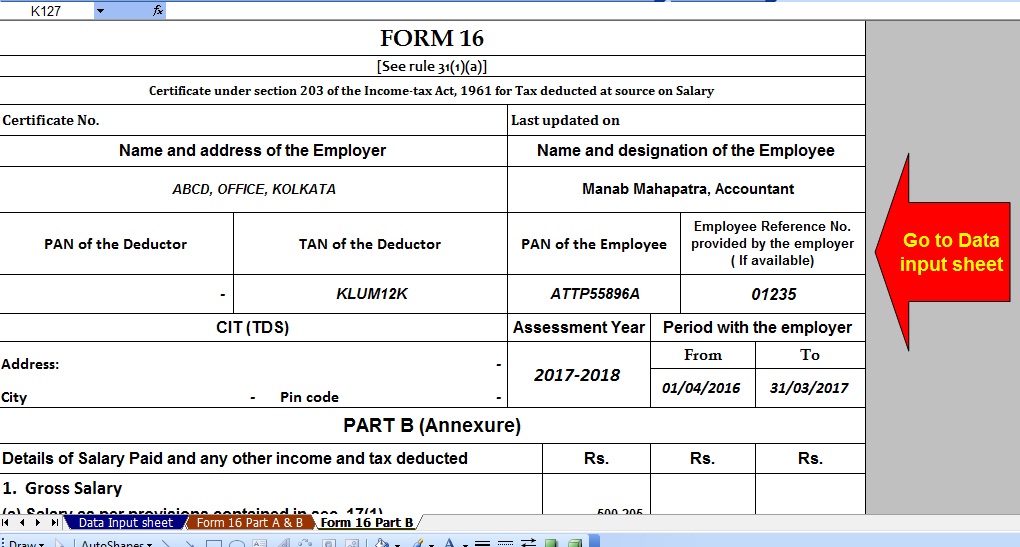

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

1 Section 80C Tax Deduction On Principal Amount It allows you to claim a yearly tax exemption of Rs 1 5 lakh from your taxable income on the principal These home loan tax exemptions can only be claimed to purchase houses with a stamped value of up to Rs 45 lakh Thus borrowers will be able to claim a maximum income tax

Tax deduction under section 80 c of the Income Tax Act can be claimed for stamp duty and registration fees as well but it must be within the overall limit of Rs 1 5 lakh applied to principal repayment This benefit can be If you got an 800 000 mortgage to buy a house in 2017 and you pay 25 000 in interest on that loan during 2024 you probably can deduct all 25 000 of that

Download Tax Exemption Limit On Housing Loan

More picture related to Tax Exemption Limit On Housing Loan

Income Tax Exemption Limit May Get Doubled To Rs 2 Lacs

http://blog.getdistributors.com/wp-content/uploads/2014/07/Tax-cut.jpg

Lok Sabha Election Result Now That They Have Got The Votes They

https://akm-img-a-in.tosshub.com/businesstoday/images/story/201905/income_taxpayers_660_052319101306.jpg?size=948:533

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

https://www.realestate-tokyo.com/media/15205/housing-loan-tax-exemption.jpg

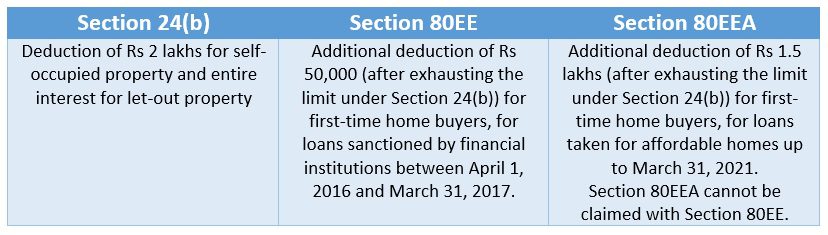

You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting The maximum income tax exemption on a Home Loan in India is the sum of the deductions that can be claimed under Section 24 b and Section 80EEA subject to the conditions

In case you are living in the house for which home loan is taken both of you shall be entitled to deduction in the ratio 3 1 on account of interest on borrowed money Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March

Modi Gift To Homebuyers Your Home Loan EMI Burden Will Reduce How You

https://cdn.zeebiz.com/sites/default/files/2019/07/08/93937-housing.png

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

https://taxguru.in/wp-content/uploads/2022/01/Conditions-to-claim.jpg

https://m.economictimes.com/wealth/tax/tax...

A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan In the case of self occupied property

https://housing.com/news/home-loans-guide …

Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax rebate Rs 1 50 lakhs per annum Upper limit on tax

Housing Loan Authorization Letter Template

Modi Gift To Homebuyers Your Home Loan EMI Burden Will Reduce How You

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

Stamp Duty Exemption 2019 Warren Churchill

Income Tax Exemption Limit Likely To Be Enhanced In Budget

Union Budget 2019 India Interim Budget News Expectations Tax

Union Budget 2019 India Interim Budget News Expectations Tax

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Writing Religious Exemption Letters

Tax Exemption Limit On Housing Loan - No matter when the indebtedness was incurred for tax years beginning in 2018 through 2025 you cannot deduct the interest from a loan secured by your home to the extent the