Tax Rebate Australia Web 29 mars 2022 nbsp 0183 32 Those eligible for the offset currently receive between 255 and 1 080 when they file their taxes but under the changes they will now receive between 675

Web If you bring goods back into Australia for which a GST refund via the TRS has been claimed the goods must be declared and if the value of those goods combined with any Web 29 juin 2023 nbsp 0183 32 Other tax offsets include offsets for those residing in isolated areas a Seniors and Pensioners Tax Offset and rebates for certain lump sums received in arrears The

Tax Rebate Australia

Tax Rebate Australia

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig2/AS:433972418224137@1480478495792/Western-Australias-average-daily-maximum-temperature-for-January-Source-Australian_Q640.jpg

Tax Rebate For Individual It Is The Refund Which An Individual Can

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

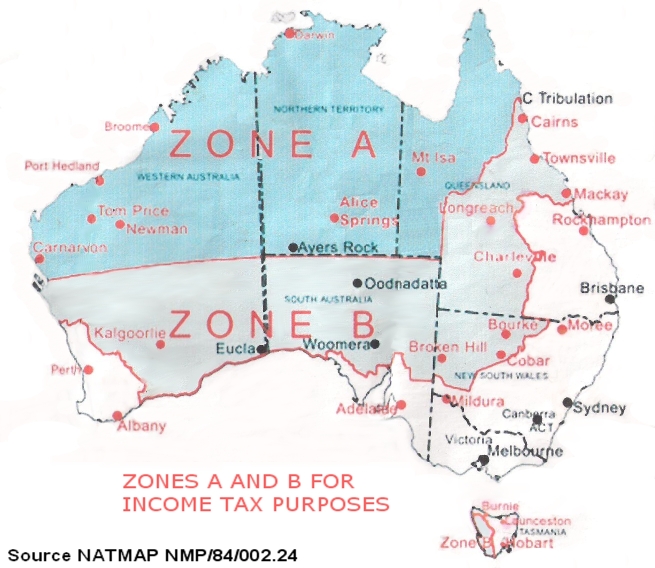

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig1/AS:433972418224133@1480478495629/Map-of-Australia-illustrating-the-2006-Remoteness-Structure-Source-ABS-the-2006_Q640.jpg

Web Information about the tax allowances and rebates payable in Australia All taxpayers can claim allowances from their taxable income and rebates in addition to a credit for tax Web 18 avr 2023 nbsp 0183 32 The Tourist Refund Scheme TRS allows travellers to claim a 10 rebate on the price paid for almost anything bought in Australia That 10 is initially paid up front in the form of the broad based 10 GST

Web A simple tax calculator is available to help you calculate the tax on your taxable income The Income tax estimator gives you an estimate of the amount of your tax refund or Web 6 mai 2022 nbsp 0183 32 In the past 3 years you would have received a 255 low and middle income tax offset but thanks to the additional 420 cost of living tax offset that has been

Download Tax Rebate Australia

More picture related to Tax Rebate Australia

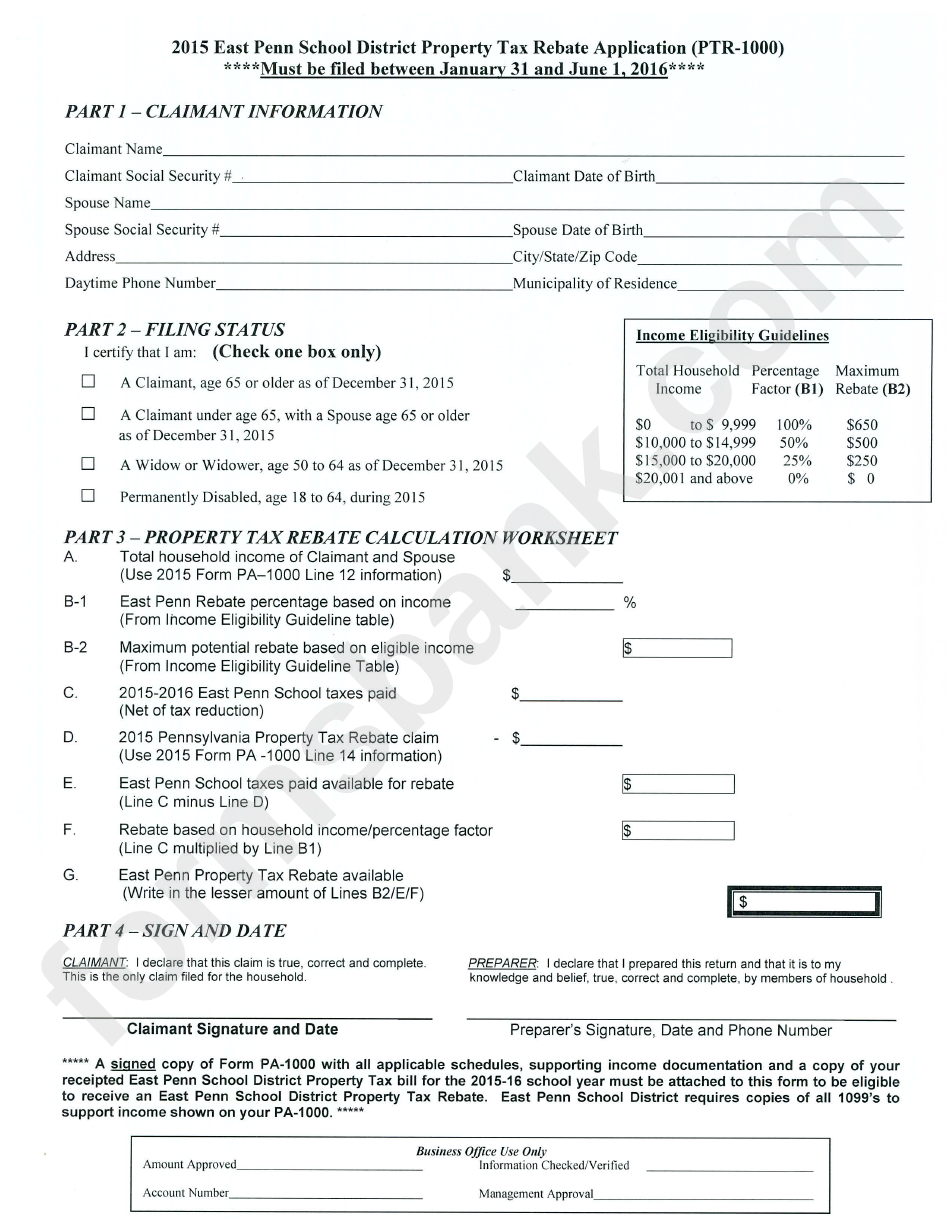

Australian Government Rebate Application Form Service Industries

https://imgv2-2-f.scribdassets.com/img/document/124455696/original/0ad89d8d91/1581407541?v=1

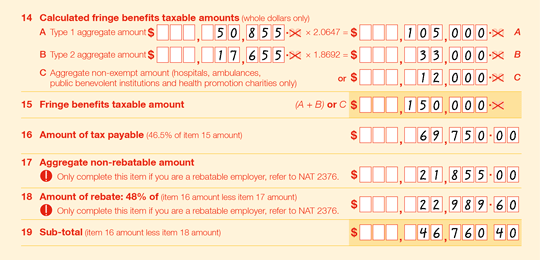

Non profit Organisations Operating An Eligible Public Benevolent

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_10.png?n=2499

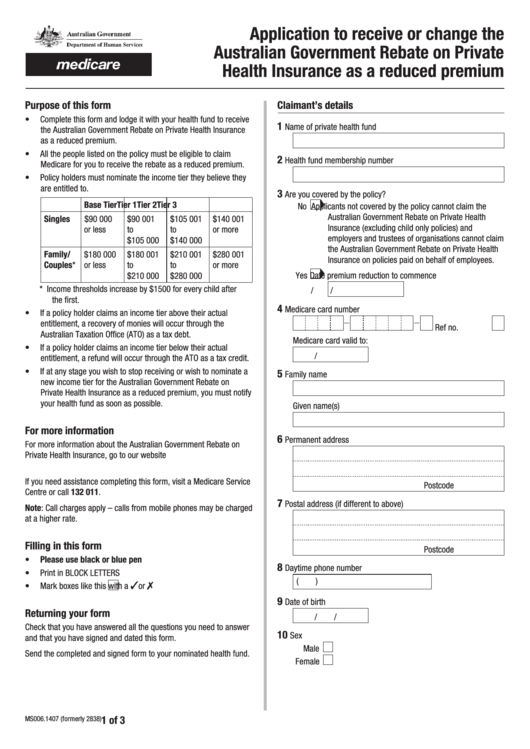

Fillable Application To Receive Or Change The Australian Government

https://data.formsbank.com/pdf_docs_html/143/1438/143819/page_1_thumb_big.png

Web 9 juil 2023 nbsp 0183 32 And changes in the 2022 23 financial year mean that many tax return refunds could be lower this year with some actually having to owe the Australian Taxation Web Etax automatically calculates any relevant tax rebates in your refund estimate for 2023 Each time you add a new detail to your return the tax refund calculator re calculates your tax estimate You can see how each

Web 8 mai 2023 nbsp 0183 32 You could be due a BIG tax refund In fact the average Australian tax refund is AU 2 600 In this blog we ll explore how you can claim your maximum legal Web Australian income tax is levied at progressive tax rates The lowest bracket is 0 known as the tax free rate for individuals on low incomes Tax rates increase progressively up

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Changes To The Zone Tax Offset Rules RSM Australia

http://www.bantacs.com.au/wp-content/uploads/2016/03/taxzones.jpg

https://www.abc.net.au/news/2022-03-29/federal-budget-low-and-middle...

Web 29 mars 2022 nbsp 0183 32 Those eligible for the offset currently receive between 255 and 1 080 when they file their taxes but under the changes they will now receive between 675

https://www.abf.gov.au/entering-and-leaving-australia/tourist-refund-scheme

Web If you bring goods back into Australia for which a GST refund via the TRS has been claimed the goods must be declared and if the value of those goods combined with any

How To Register For The Australian Government Rebate YouTube

Budget Highlights For 2021 22 Nexia SAB T

Australian Government Rebate Form GU Health

2022 Deductions List Name List 2022

2007 Tax Rebate Tax Deduction Rebates

Income Tax Return Forget Rs 5 Lakh Rs 6 5 Lakh Tax Rebate First Know

Income Tax Return Forget Rs 5 Lakh Rs 6 5 Lakh Tax Rebate First Know

What Is Australian Government Rebate On Private Health Insurance

Beneficiary Tax Offset What You Need To Know The Grenfell Record

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Tax Rebate Australia - Web 18 avr 2023 nbsp 0183 32 The Tourist Refund Scheme TRS allows travellers to claim a 10 rebate on the price paid for almost anything bought in Australia That 10 is initially paid up front in the form of the broad based 10 GST