Tax Rebate Credit Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web The tax credit rate for R amp D expenditure is 30 of outlays up to 100 million per year and 5 over this limit The tax credit rate for innovation expenditure is 20 of the eligible

Tax Rebate Credit

Tax Rebate Credit

https://www.fingerlakes1.com/wp-content/uploads/2022/07/homeowner-tax-rebate-credit-coming-timeline-for-getting-your-check.jpg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Download Tax Rebate Credit

More picture related to Tax Rebate Credit

Taxes Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-3.png?w=696&h=696&crop=1&ssl=1

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

Tax Refund Or Rebate Credit Concept Businessman Hand Came From Postbox

https://thumbs.dreamstime.com/z/tax-refund-rebate-credit-concept-businessman-hand-came-postbox-offer-giving-letter-tax-refund-check-to-return-tax-217948688.jpg

Web 17 ao 251 t 2022 nbsp 0183 32 A tax credit is an amount of money that you can subtract dollar for dollar from the income taxes you owe Find out if tax credits can save you money Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted Web 12 f 233 vr 2023 nbsp 0183 32 The term tax credit refers to an amount of money that taxpayers can subtract directly from the taxes they owe This is different from tax deductions which

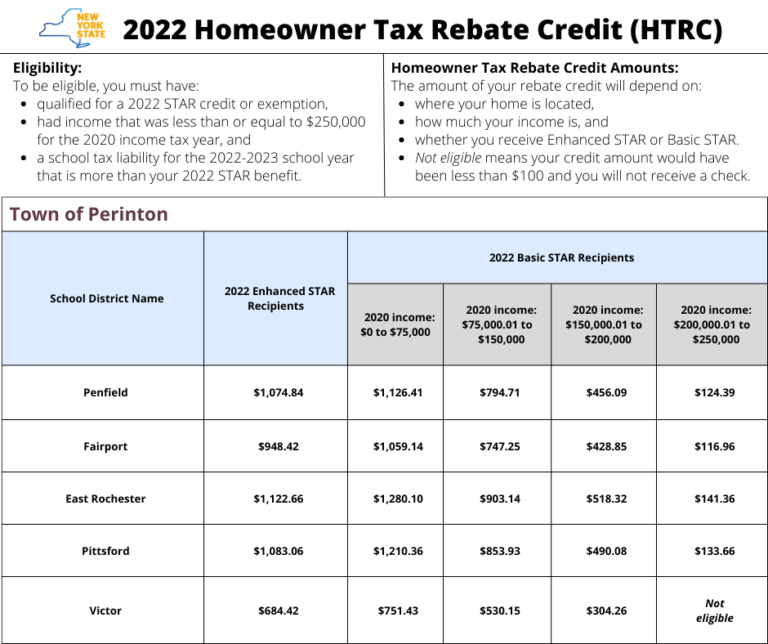

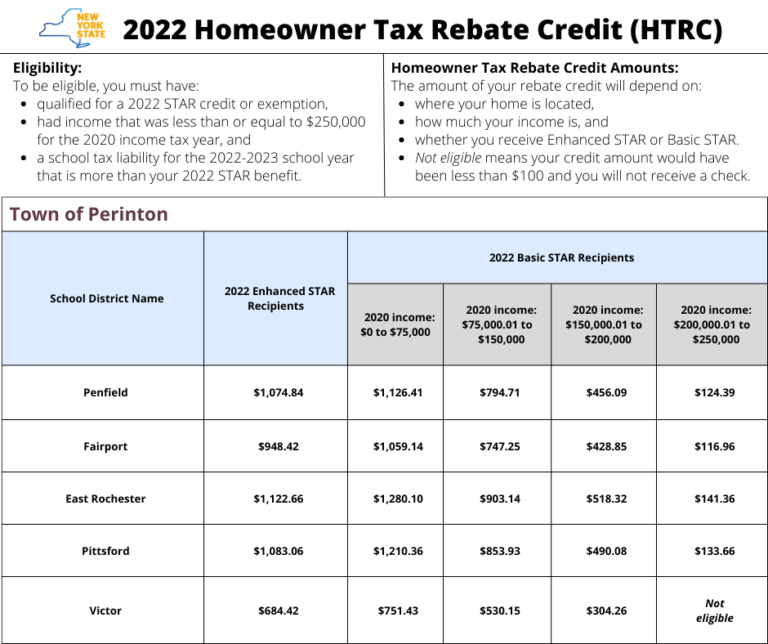

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

https://www.powerrebate.net/wp-content/uploads/2023/05/nys-homeowner-tax-rebate-credit-htrc-info-town-of-perinton.png

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

NYS Homeowner Tax Rebate Credit HTRC Info Town Of Perinton

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

Recovery Rebate Credit 2020 Calculator KwameDawson

10 Recovery Rebate Credit Worksheet

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit 2020 Calculator KwameDawson

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Tax Rebate Credit - Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal