Tax Relief Credit WASHINGTON As part of continuing efforts to help taxpayers the Internal Revenue Service today announced plans to issue automatic payments later this month to eligible people who did not claim the Recovery Rebate Credit on their 2021 tax returns

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Tax Relief Credit

Tax Relief Credit

https://brokercalls.com/wp-content/uploads/2019/06/tax-debt-relief.jpg

Application Real Property Relief Fill Online Printable Fillable

https://www.pdffiller.com/preview/258/686/258686478/large.png

Claims For Income Tax Relief Malaysia 2021 YA 2020 Funding

https://i0.wp.com/blog.fundingsocieties.com.my/wp-content/uploads/2021/03/1.png?fit=1200%2C628&ssl=1&is-pending-load=1

If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors The Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 is designed to encourage eligible employers to keep employees on their payroll despite experiencing financial hardship related to the coronavirus pandemic with an employee retention tax credit Employee Retention Credit

If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK you may be able to claim relief for the foreign tax paid This helpsheet will allow you to The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021 The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for

Download Tax Relief Credit

More picture related to Tax Relief Credit

Tax Relief Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_relief.jpg

The Best IRS Debt Relief Options And Services

https://coveville.com/wp-content/uploads/2022/10/685f247b2117ce2f59b83123c027a434.jpg

What To Look For In The Best Tax Relief Services

https://getassist.net/wp-content/uploads/2022/03/tax.jpg

Information about the tax credits reliefs and exemptions that you may be entitled to and how to claim them The American Rescue Plan extends a number of critical tax benefits particularly the Employee Retention Credit and Paid Leave Credit to small businesses

[desc-10] [desc-11]

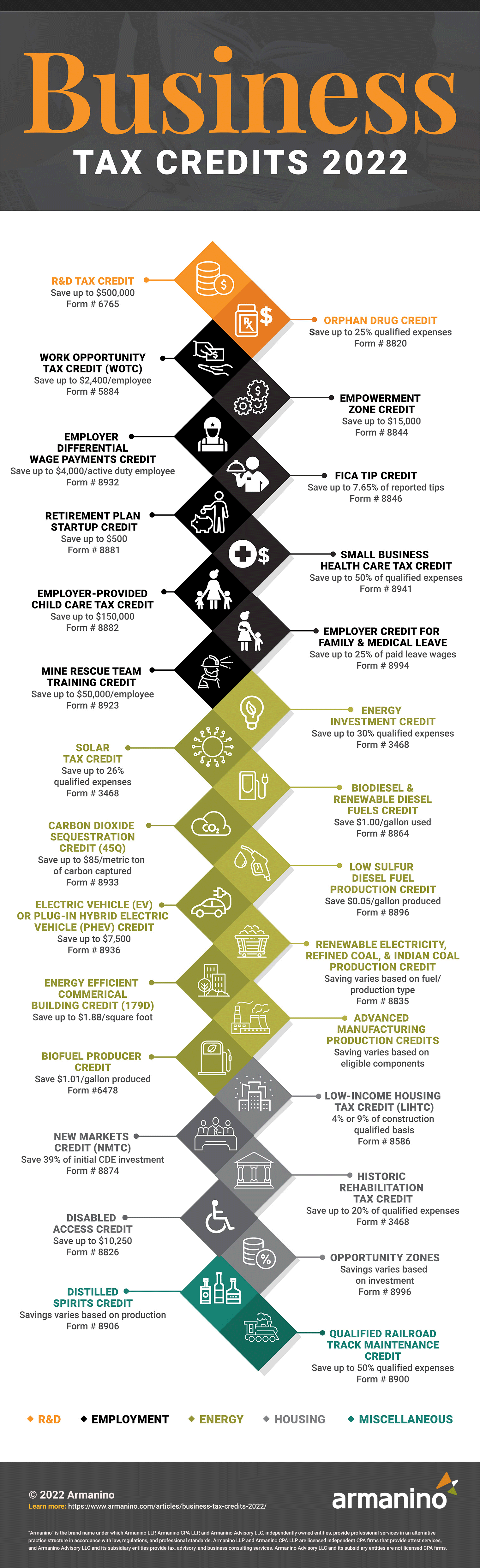

R D Tax Relief In 2022 What You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983-1536x1024.jpg

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

https://www.irs.gov › newsroom › irs-announces-special...

WASHINGTON As part of continuing efforts to help taxpayers the Internal Revenue Service today announced plans to issue automatic payments later this month to eligible people who did not claim the Recovery Rebate Credit on their 2021 tax returns

https://www.irs.gov › newsroom

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Here s The Real Story On Tax Relief RateMuse

R D Tax Relief In 2022 What You Need To Know

IRS Tax Debt Relief 9 Ways To Settle Your Tax Debts Tax Relief

More Tax Relief Shaila Chamberlain

Tax Relief For Children 2021 Fill In The Declaration Now

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

Tax Tip How To Know If You Qualify For A Tax Relief Program Tax Help

/GettyImages-1153812676-0ac08ff7c07b4cd2842e24f081ab6d9b.jpg)

Tax Relief Definition

Pension Tax Relief Concise Wealth Management LTD

Tax Relief Poster IPU

Tax Relief Credit - The Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020 is designed to encourage eligible employers to keep employees on their payroll despite experiencing financial hardship related to the coronavirus pandemic with an employee retention tax credit Employee Retention Credit