Tax Rebate For Home Improvement Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 22 juin 2023 nbsp 0183 32 Windows and doors Replacing leaky doors and windows brings a 30 credit on the cost up from 10 last year Credits are capped at 600 for windows and Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up

Tax Rebate For Home Improvement

Tax Rebate For Home Improvement

https://wilsonexteriors.com/wp-content/uploads/2023/05/Featured-image-223-768x432.png

Home Energy Efficient Improvements Tax Rebates

https://mccannwindow.com/wp-content/uploads/2022/09/mccann-sept-energy-1200-1024x600.png

Working From Home Tax Rebate Form 2022 Printable Rebate Form

https://www.printablerebateform.com/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021.jpg

Web Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is Web 1 d 233 c 2022 nbsp 0183 32 You can get a federal tax credit of 30 of the cost of qualifying geothermal heat pumps solar water heaters solar panels small wind turbines or fuel cells placed in service for an existing or

Web 17 mars 2023 nbsp 0183 32 However starting this year 2023 the credit is equal to 30 of the costs for all eligible home improvements made during the year It is also expanded to cover the cost of certain biomass Web 8 mars 2021 nbsp 0183 32 Published on Mar 8 2021 7 minute read By Rebecca Henderson Riley Adams CPA Tax credits reduce your tax bill on a dollar for dollar basis However

Download Tax Rebate For Home Improvement

More picture related to Tax Rebate For Home Improvement

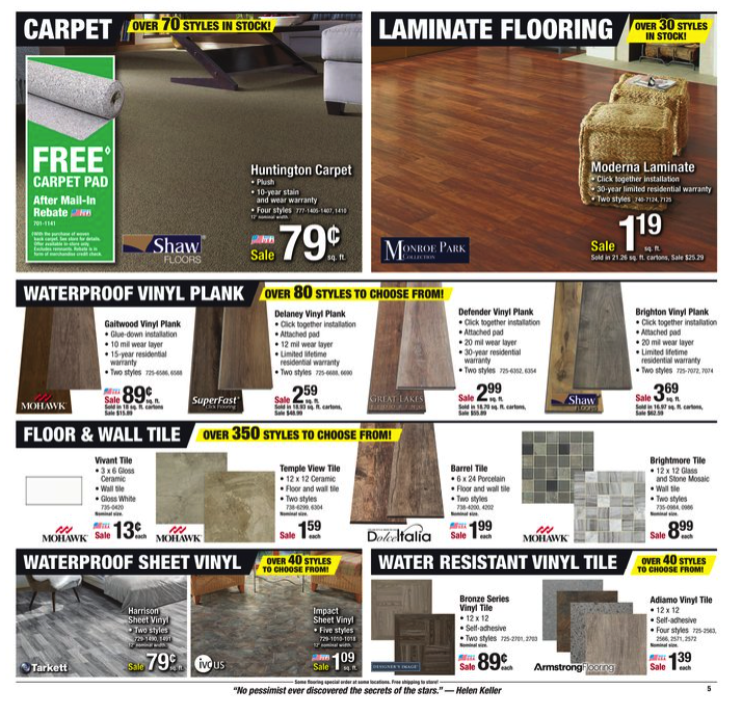

Download Blank Menards Rebate Form Printable 2023 MenardsRebateForms

https://www.menardsrebateforms.com/wp-content/uploads/2023/02/Menards-Rebate-for-Home-Improvement-2023.png

Ouc Rebates Pdf Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/46/88/46088304/large.png

Florida Energy Rebates For Air Conditioners Fcs3266 Fy1032 Energy

https://rinaldis.com/wp-content/uploads/2019/04/man-filling-out-paperwork.jpg

Web 19 ao 251 t 2022 nbsp 0183 32 The tax credit will be equal to 30 of the costs for all eligible home improvements made during the year It has also been expanded to cover things such as Web 9 ao 251 t 2023 nbsp 0183 32 New Tax Rules Can Save You Thousands on Home Renovations Coming rebates for energy efficient upgrades can be combined with existing tax credits PHOTO

Web How to get an IRA rebate if you re a homeowner The IRA offers rebates for new technology and for sealing and insulating a home Within a certain income bracket you can get 8 000 back for a Web 20 d 233 c 2022 nbsp 0183 32 The law provides up to 14 000 in rebates and tax credits per household with the goal of lowering Americans carbon footprint Although the act technically takes effect

Menards Rebate Form 4468 MenardsRebateForms

https://i0.wp.com/struggleville.net/wp-content/uploads/2018/08/MenardsRebate4468.jpg

Pin On Canada Home Tax Rebate

https://i.pinimg.com/originals/e9/39/8c/e9398cd21460fc812f7644a4047c23cc.png

https://www.irs.gov/.../energy-efficient-home-improvement-credit

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.familyhandyman.com/article/what-home-improvements-are-t…

Web 22 juin 2023 nbsp 0183 32 Windows and doors Replacing leaky doors and windows brings a 30 credit on the cost up from 10 last year Credits are capped at 600 for windows and

Ptr Tax Rebate Libracha

Menards Rebate Form 4468 MenardsRebateForms

Menard 11 Rebate 2022 11Rebate

Incentives And Rebates For Residential Energy Efficiency Improvements

5 Home Improvement Projects Worth Spending Your Tax Refund On Maison

Energy Efficiency Rebates And Incentives Carolina Home Performance Inc

Energy Efficiency Rebates And Incentives Carolina Home Performance Inc

Rentalfreebie Home Improvement Home Improvement Loans Home

Top Mass Save Rebate Form Templates Free To Download In PDF Format

How To Save Money On Home Improvements With Energy Efficiency Tax

Tax Rebate For Home Improvement - Web Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is