Tax Rebate In New Tax Regime Learn how to save tax in the new tax regime of 2024 25 which offers lower tax rates and fewer deductions than the old regime Find out which taxpayers are eligible what exemptions are

In Budget 2023 under the new tax regime a tax rebate was introduced on an income less than or equal to Rs 7 lakhs It implies that taxpayers who choose the new tax In Budget 2023 a tax rebate on an income up to 7 lakhs was introduced under the new tax regime This means that taxpayers with an income of up to 7 lakhs will not have to pay any

Tax Rebate In New Tax Regime

Tax Rebate In New Tax Regime

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Rebate Under Section 87A AY 2021 22 Old New Tax Regimes

https://www.relakhs.com/wp-content/uploads/2021/01/Income-Tax-Rebate-Vs-Tax-Exemption-Vs-Tax-Deduction-FY-2020-21-AY-2021-22.jpg

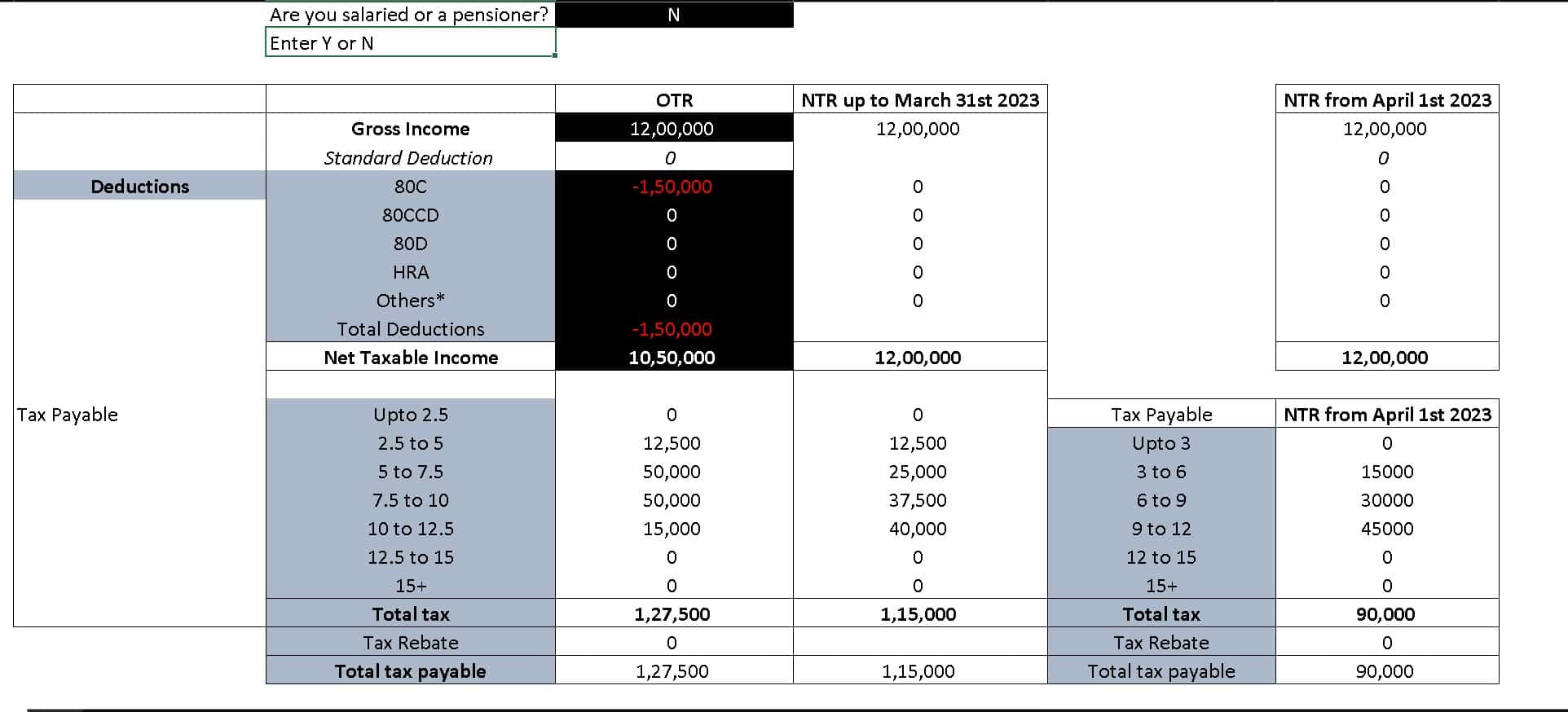

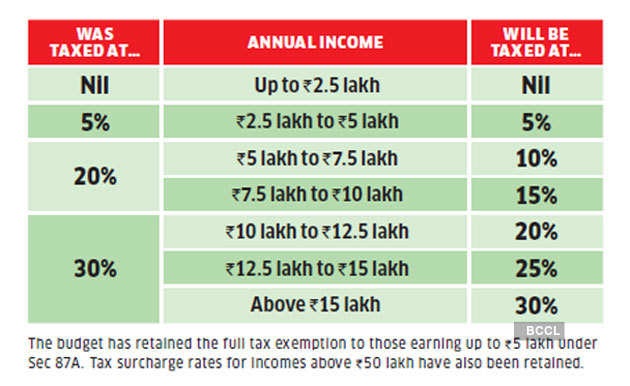

Changes In New Tax Regime All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2023/03/Changes-In-New-Tax-Regime-2.png

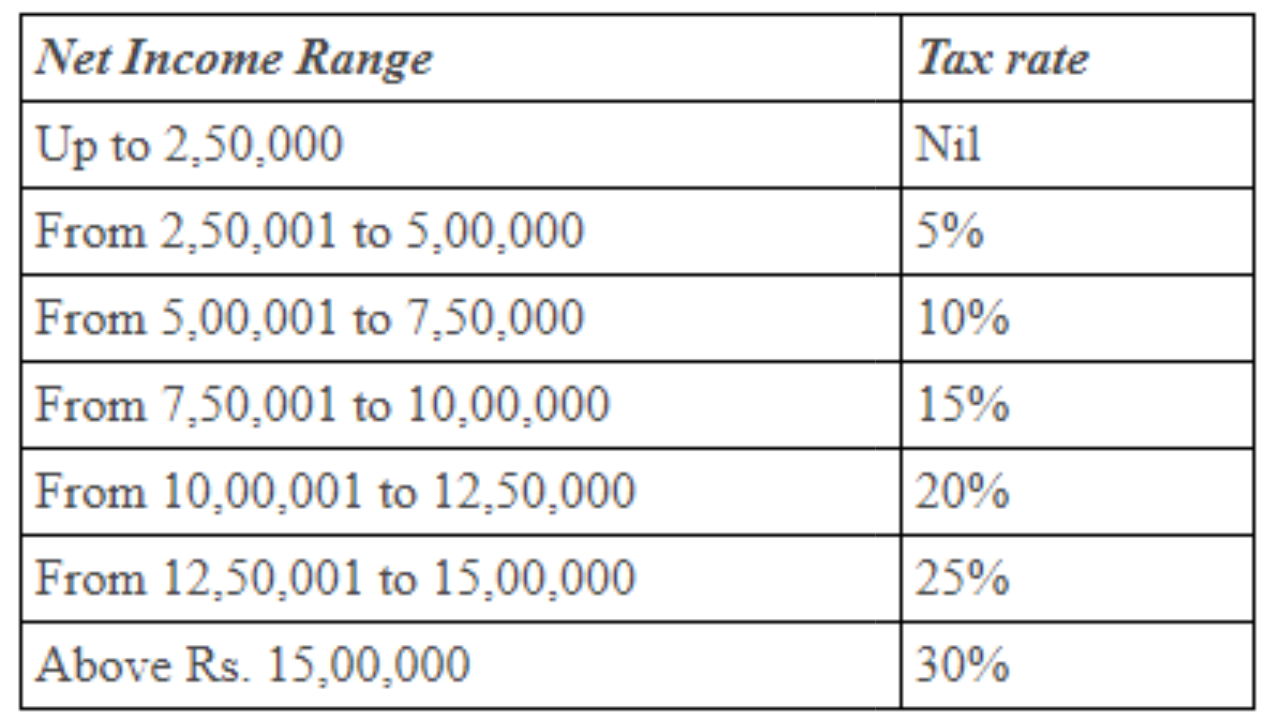

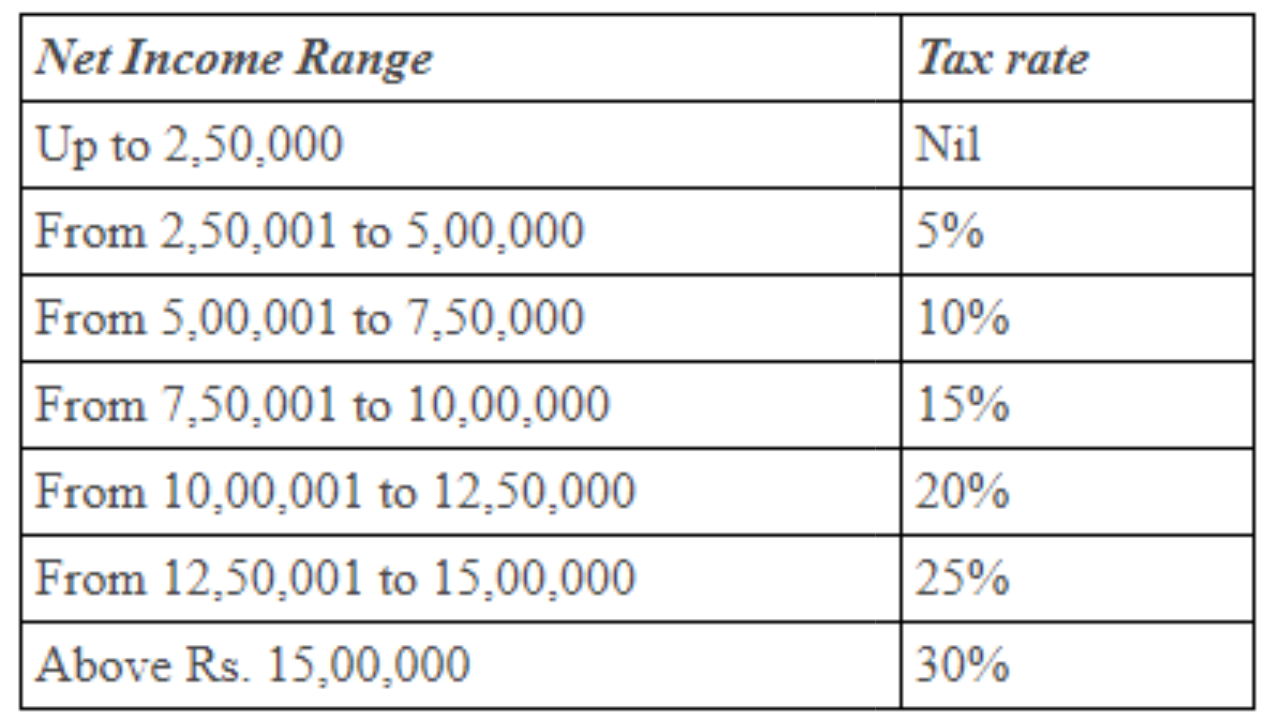

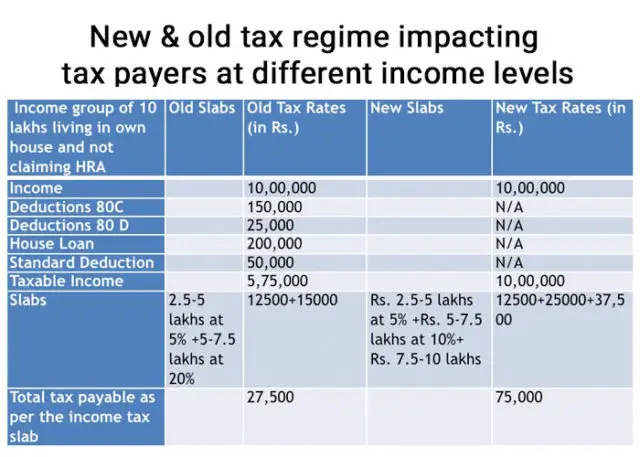

Learn about the tax slabs rebate standard deduction and limited deductions available under the new tax regime for FY 2023 24 and AY 2024 2025 Find out how to save taxes using employer s PF and NPS contributions Learn about the revised income tax slabs rates exemptions and deductions under the new tax regime for FY 2023 24 Find out how to choose between the new and old tax regimes and what are the benefits and

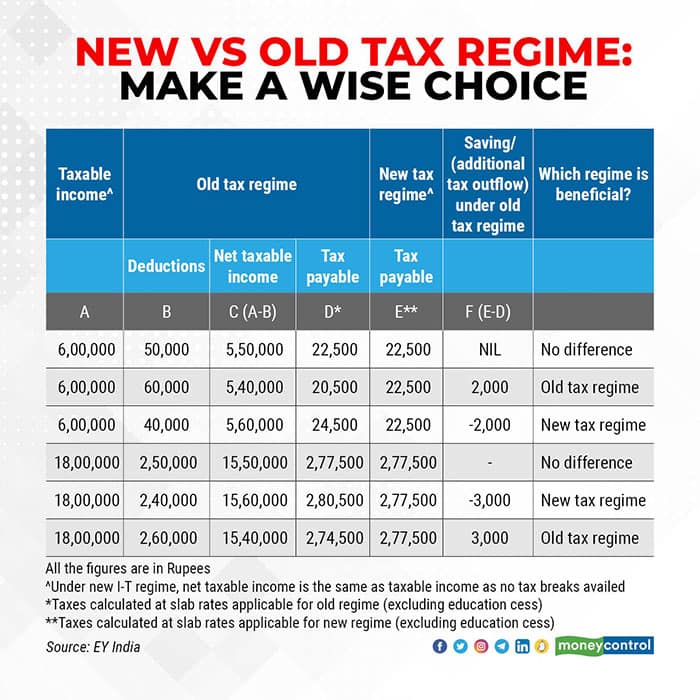

Finance Minister announced major changes in personal income tax including increasing the rebate limit to Rs 7 lakh reducing the number of slabs to five and extending the standard deduction to the new regime The new tax Learn how to calculate the tax rebate under section 87A of Income Tax Act 1961 for individuals who opt for the new tax regime u s 115BAC 1A from FY 2023 24 Compare the old and new marginal schemes and see the

Download Tax Rebate In New Tax Regime

More picture related to Tax Rebate In New Tax Regime

Budget 2023 Old Vs New Tax Regimes Who Should Make The Switch

https://images.moneycontrol.com/static-mcnews/2023/02/Old-vs-new-tax-regime-0202_002-2.jpg

Difference Old Tax Regime Vs New Tax Regime Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2021/01/25145130/1_gfLrs55yjby4zuBhxBnuUA-1024x512.jpeg

Additional Benefit In New Tax Regime For Those With Net Taxable Income

https://freefincal.com/wp-content/uploads/2020/02/Screenshot-of-new-tax-regime-vs-old-tax-regime-comparison-table.jpg

Learn about the new tax slabs basic exemption limit rebate amount and other changes in the new tax regime announced in Budget 2023 and during the year Find out how they will affect your income tax liability and Tax Rebate The Rebate U S 87A provides benefit on tax payment to a Resident Individual The condition to avail of the benefit is that total taxable income shall not exceed the threshold limit of Rs 7 00 000 The rebate is hiked

Calculate your income tax and rebate under the new tax regime applicable to individuals and HUFs for AY 2024 25 Learn about the benefits features and examples of the new tax regime Under the new income tax regime also known as the Concessional Tax Regime for the financial year 2024 25 the eligibility limit for rebate is at Rs 7 00 000 This means that

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208345/101208345.jpg

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

https://finance.zohocorp.com/wp-content/uploads/2020/03/New-tax-rate-1536x972-1.png

https://www.forbesindia.com › article › ex…

Learn how to save tax in the new tax regime of 2024 25 which offers lower tax rates and fewer deductions than the old regime Find out which taxpayers are eligible what exemptions are

https://cleartax.in

In Budget 2023 under the new tax regime a tax rebate was introduced on an income less than or equal to Rs 7 lakhs It implies that taxpayers who choose the new tax

New Income Tax Slabs Check New Income Tax Rates Here India Today

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

New Income Tax Slabs Will You Gain By Switching To New Regime The

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment

Comparison Between The New Tax Regime Vs Old Tax Regime In India And

Income Tax Rebate 10 7 Slab 2 5

Income Tax Rebate 10 7 Slab 2 5

Existing Income Tax Regime V s New Income Tax Regime Onlineideation

Decoding Section 87A Rebate Provision Under Income Tax Act

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

Tax Rebate In New Tax Regime - Learn about the tax slabs rebate standard deduction and limited deductions available under the new tax regime for FY 2023 24 and AY 2024 2025 Find out how to save taxes using employer s PF and NPS contributions