Tax Rebate In Old Regime In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs

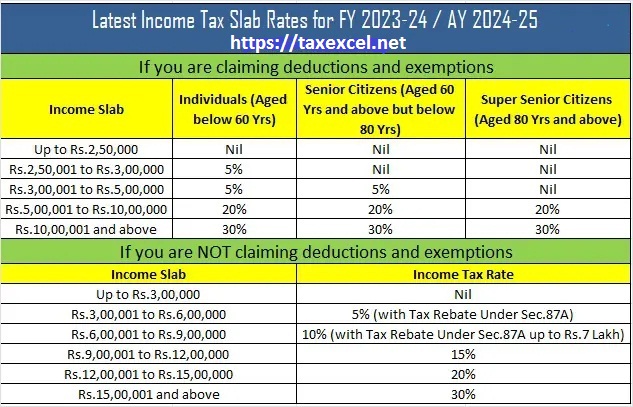

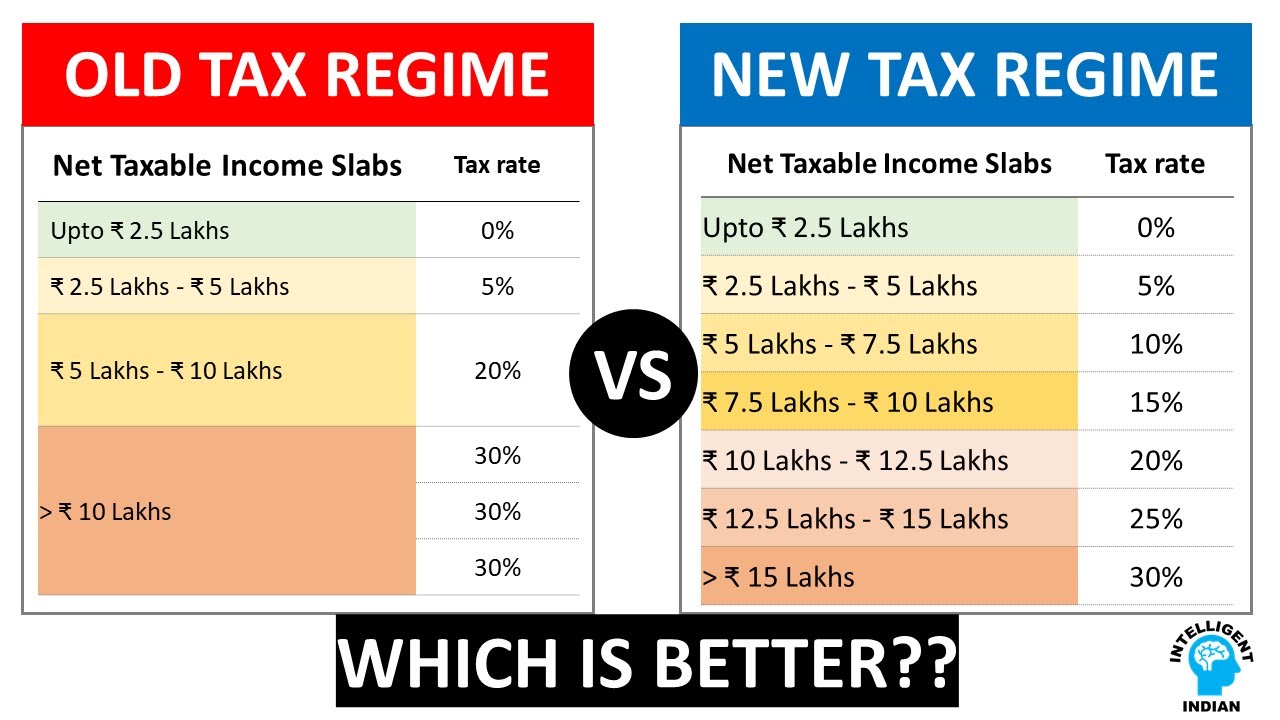

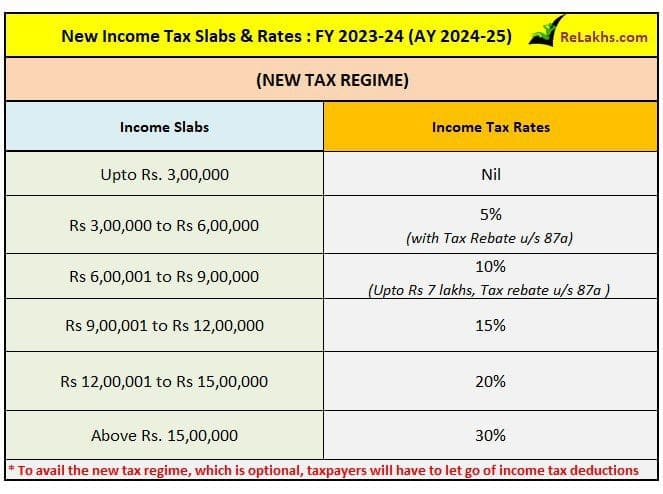

Higher Tax Rebate Limit Full tax rebate on an income up to 7 lakhs has been introduced Whereas this threshold is 5 lakhs under the old tax regime This means that taxpayers with an income of up to 7 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime

Tax Rebate In Old Regime

Tax Rebate In Old Regime

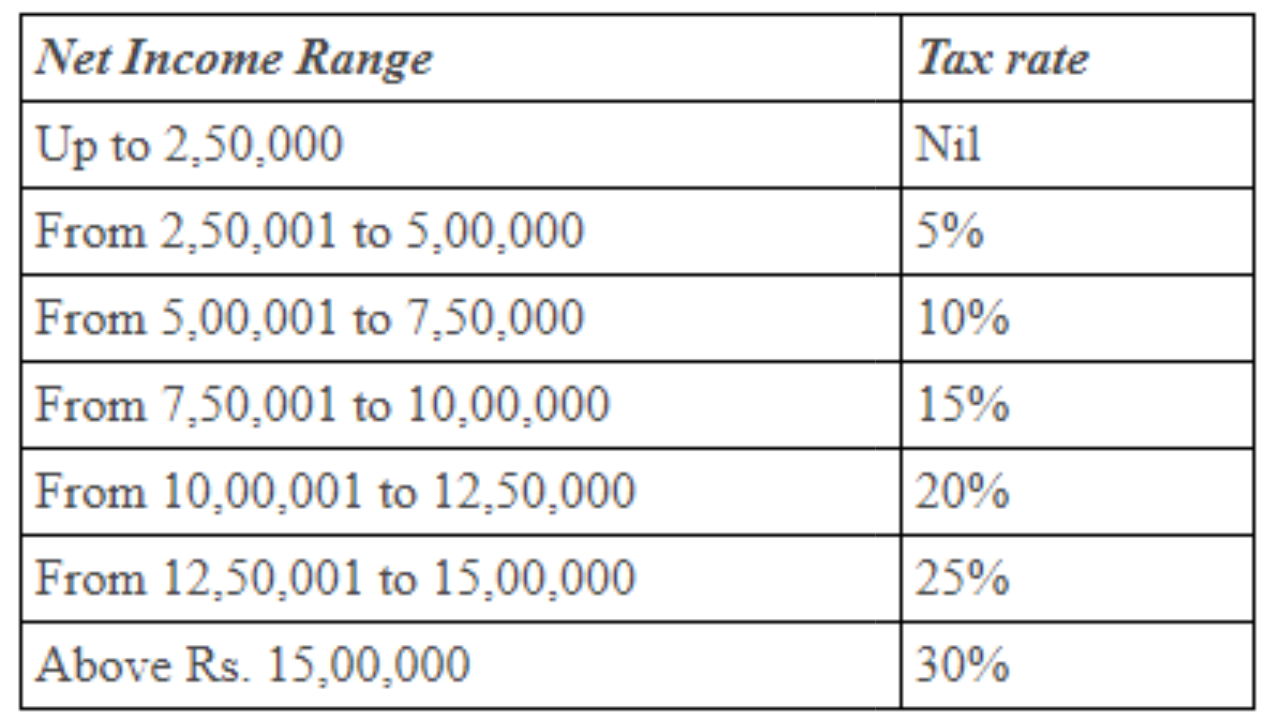

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

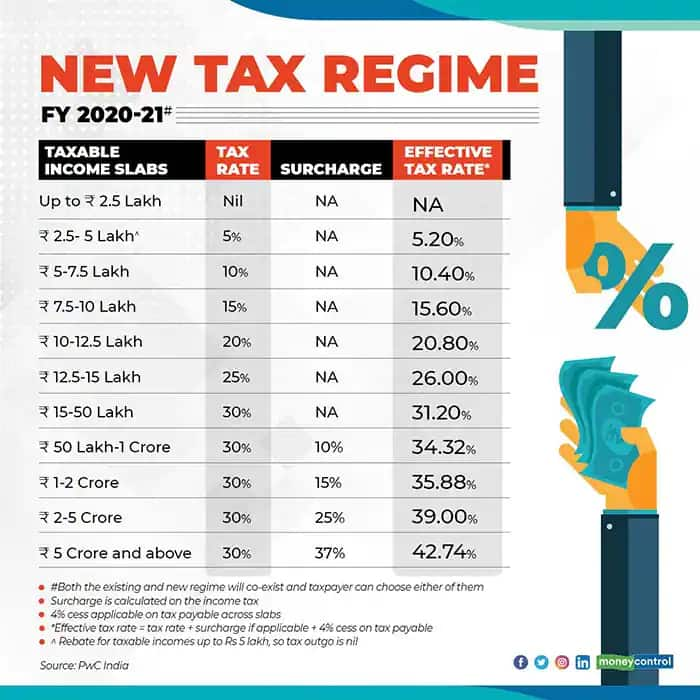

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/illustration_1.jpg?itok=kH6KXKc9

If your income is INR 20 lakh the best regime will depend on the tax deductions you are eligible for If the tax saving investments are greater than INR 3 75 000 you should go for the old Additionally taxpayers with taxable income of 7 lakh can claim a rebate under Section 87A up to an amount of 25 000 The old tax regime remains intact

Tax Rebate Income upto Rs 7 lakh is eligible for a tax rebate which means even if taxable income is upto 7 lakh there will be zero tax due to rebate benefits Reduced Tax Slabs Compared to the In old tax regime tax rebate of up to Rs 12 500 under Section 87A is available Surcharges under old new tax regime Surcharge is levied on the total

Download Tax Rebate In Old Regime

More picture related to Tax Rebate In Old Regime

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

https://images.livemint.com/img/2023/02/03/original/G-old_vs_new_tax_regime_1675401085867.jpg

Under the new regime individuals can get a rebate of up to Rs 25 000 making incomes up to Rs 7 lakh tax free In contrast the old tax regime offers a rebate Currently section 87A allows individuals to claim a tax rebate of Rs 12 500 under the old tax regime and Rs 25 000 under the new tax regime This means that

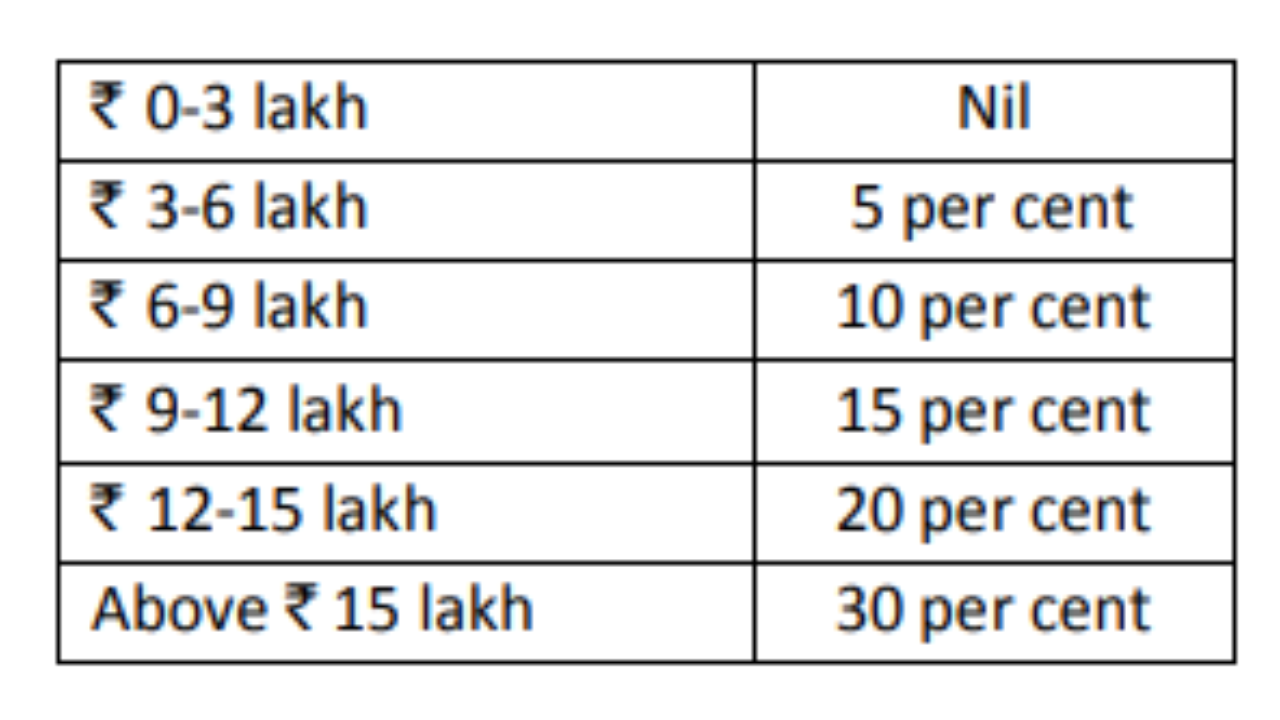

The new tax slabs under the new income tax regime will be effective from April 1 2024 Assessment Year 2025 26 The proposed structure widens the income slabs The Old Tax Regime OTR was left untouched in the Union Budget for 2024 25 and the additional savings offered under the NTR may be seen as further

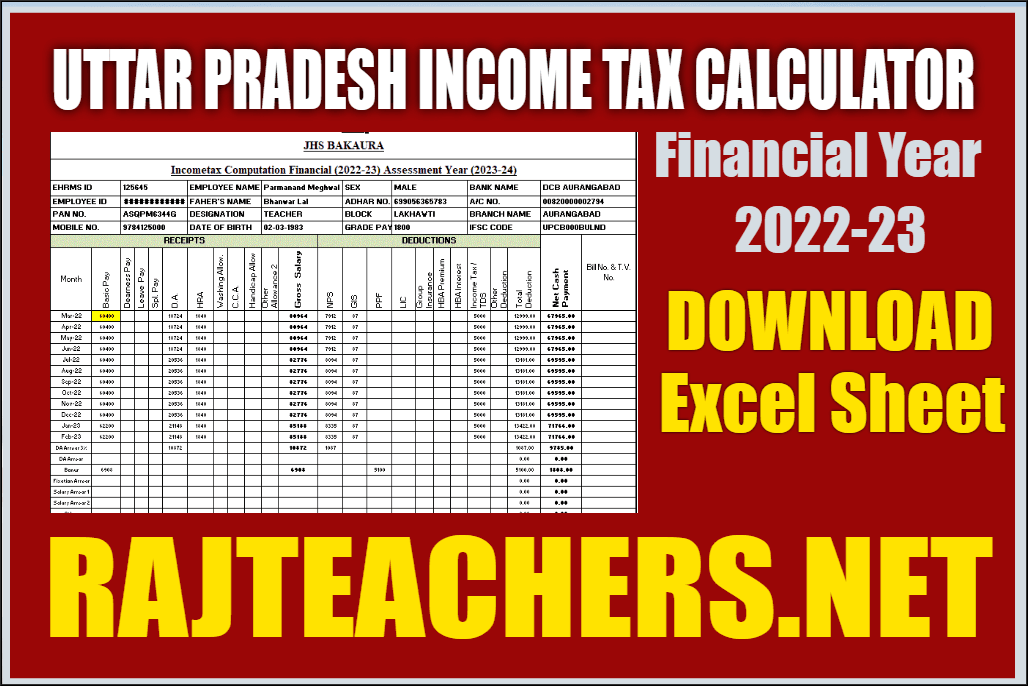

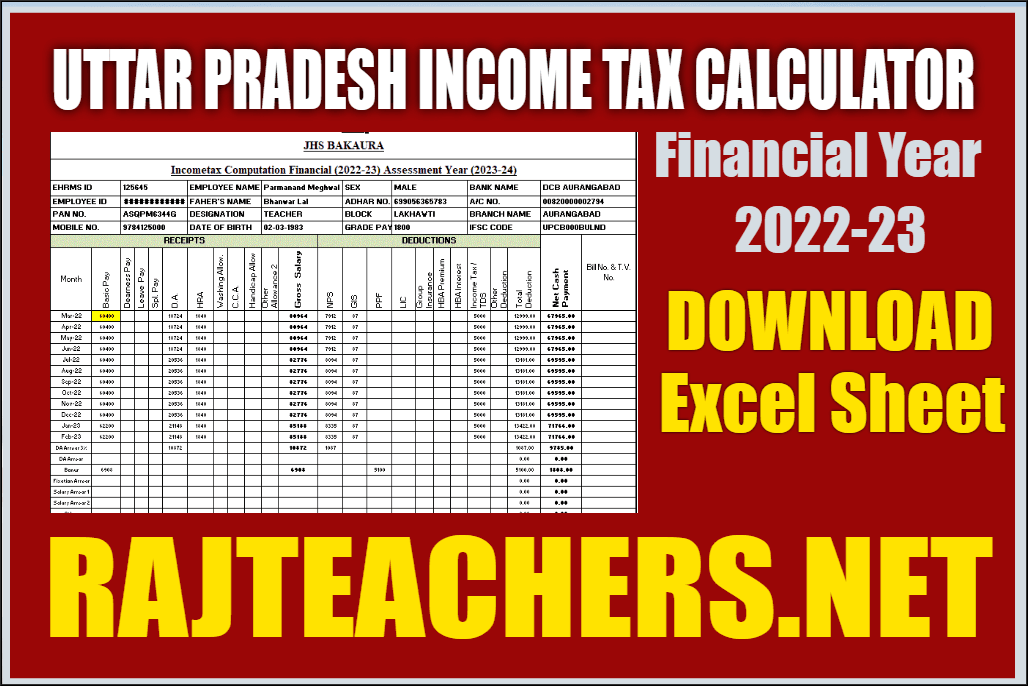

Uttar Pradesh Incometax Calculator UP Incometax Calculator Excel 2022

https://rajteachers.net/wp-content/uploads/2022/09/download-1-1.png

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

https://static.tnn.in/photo/msid-101208384/101208384.jpg

https://www.incometax.gov.in/iec/foportal/sites...

In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs

https://cleartax.in/s/old-tax-regime-vs-n…

Higher Tax Rebate Limit Full tax rebate on an income up to 7 lakhs has been introduced Whereas this threshold is 5 lakhs under the old tax regime This means that taxpayers with an income of up to 7

Old And New Tax Regime Which Is Better Max Secure Financial Planners

Uttar Pradesh Incometax Calculator UP Incometax Calculator Excel 2022

Income Tax Rebate 10 7 Slab 2 5

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Income Tax Rebate Under Section 87A

Exemptions Still Available In New Tax Regime with English Subtitles

Exemptions Still Available In New Tax Regime with English Subtitles

Income Tax Slabs In India Salary Wise Details Of New Tax Regime Old

New Tax Regime Vs Old Tax Regime Best Tax Regime How To Choose

Income Tax Deductions List FY 2023 24 Old New Tax Regimes

Tax Rebate In Old Regime - Tax Rebate Income upto Rs 7 lakh is eligible for a tax rebate which means even if taxable income is upto 7 lakh there will be zero tax due to rebate benefits Reduced Tax Slabs Compared to the