Tax Rebate Investment In Bangladesh Web 2 juin 2021 nbsp 0183 32 At present tax rebates are available on investments in nine sectors including savings certificates and donations in 13 sectors Investment up to 25 of a taxpayer s total annual income in these sectors is considered concessional

Web 14 ao 251 t 2017 nbsp 0183 32 Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could Web According to the new Income Tax Bill 2023 which was placed in Parliament on Thursday the government is going to establish a limit of up to Tk 0 5 million for the first time

Tax Rebate Investment In Bangladesh

Tax Rebate Investment In Bangladesh

https://i.pinimg.com/originals/ab/bd/fd/abbdfdbd7d1bde572d822e1c573ff9e2.jpg

Investment Plan Rebate Under Income Tax Ordinance 1984 In Bangladesh

https://i.ytimg.com/vi/zeFzDcIi_qU/maxresdefault.jpg

Where To Invest For Tax Rebate

https://i.ytimg.com/vi/wHMetXXJeXU/maxresdefault.jpg

Web 14 juin 2022 nbsp 0183 32 In the finance bill the finance minister has proposed making the rebate 15 for all and reducing the allowable investment limit from 25 to 20 Say a taxpayer has Web 13 ao 251 t 2023 nbsp 0183 32 However as you have got the tax credit amount now calculate the investment amount dividing the Tk 30 000 by tax rebate rate 15 or 0 15 and the

Web The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is approved by parliament In that case Web 10 oct 2021 nbsp 0183 32 If your annual income is less than Tk15 lakh you will get 15 tax exemption of total investment and donation Tax exemption at the rate of 10 will be available if it exceeds Tk 15 lakh And to avail such

Download Tax Rebate Investment In Bangladesh

More picture related to Tax Rebate Investment In Bangladesh

Tax Credit Or Tax Rebate In Bangladesh

https://i.ytimg.com/vi/IAs9ku69PyE/maxresdefault.jpg

Tax Rebate Lanka Bangla Asset Management Company Limited

https://lbamcl.com/tax-rebate/wp-content/uploads/2022/06/Untitled-1.png

Bangladesh

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhTgeAhYKnCBOnBLE3FhAZ8xS98aswvu7JSyBBWR2GKFEGtEaEr9gR9RfnnBdpID3aKAGfYh8Gz6sMOuRR9VvBTnpjs_EVAvqb2a6hCSahF9skISSn98Emye9bosly8U5vL684lNsTpv1Amg38L1crTNi5i3aswHediKStA6tTZM7pG5J_2fxGcn3p4/s842/Tax Rebate.jpg

Web 18 ao 251 t 2017 nbsp 0183 32 At first we will calculate the total investment allowance based on total taxable amount i e BDT 954 000 So your investment allowance will be BDT 190 800 Web Currently the investment amount is allowed up to 25 per cent The Finance Bill 2022 has proposed a cut in the eligible amount of investment for getting tax credit to 20 per cent

Web Area of Tax rebate Bangladesh There is total 22 sector where you can invest for tax rebate Stock Mutual Fund amp Debenture Treasury bond investment Life Insurance Web Investment tax credit will be allowed at 15 of the eligible amount irrespective of the total income of the individual However it will be restricted to 7 5 of the eligible amount if a

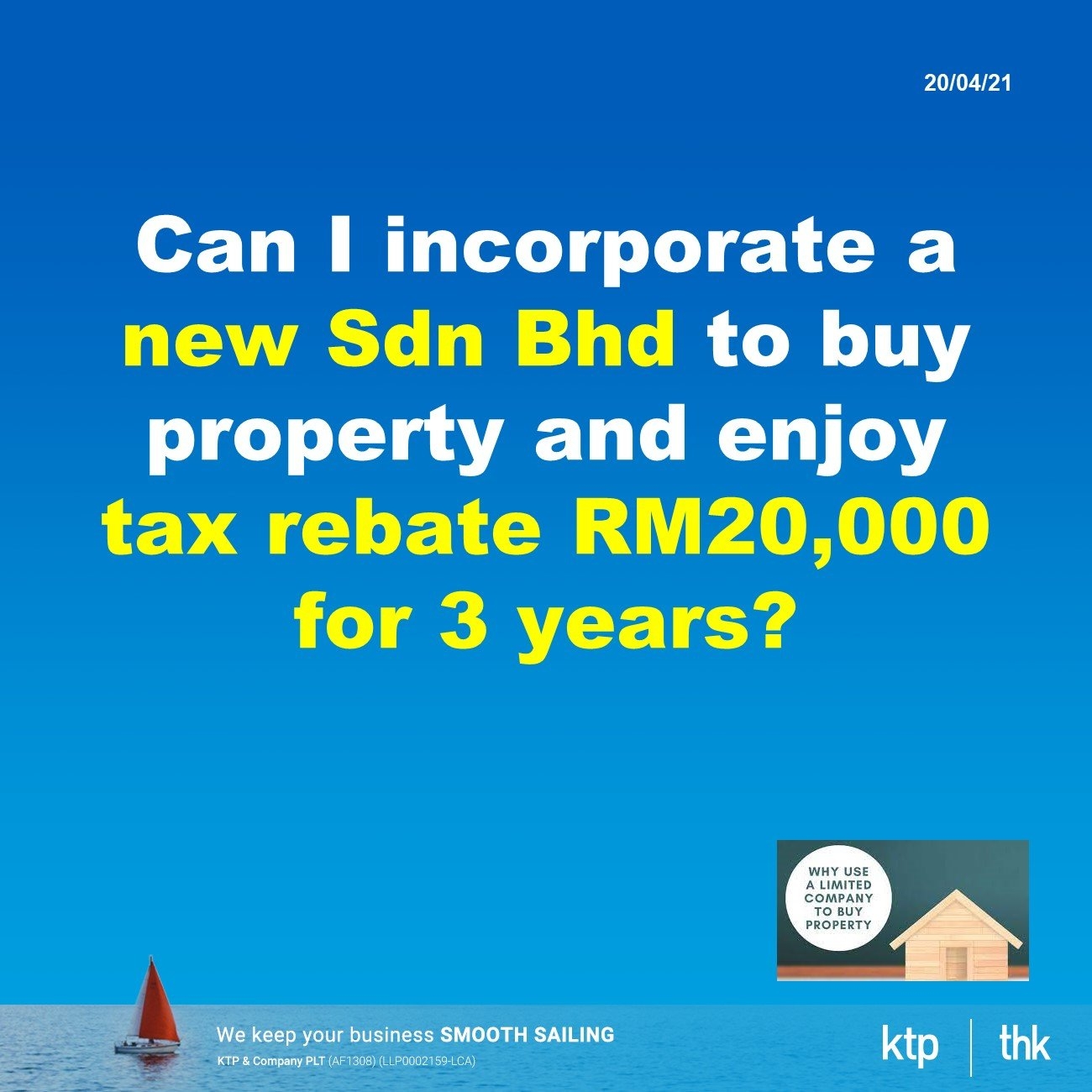

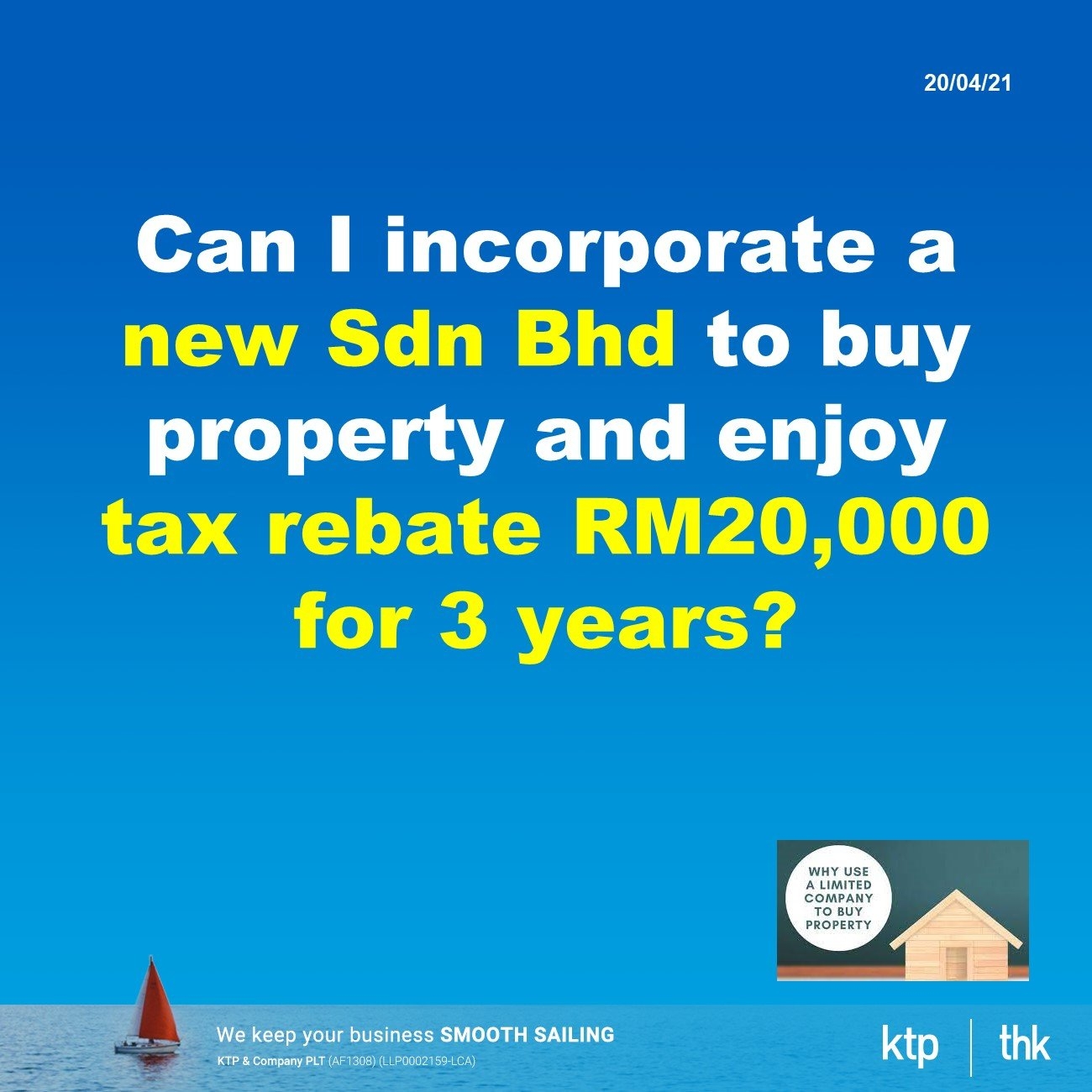

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Income Tax Rebate Calculation In BD Income Tax

https://i.ytimg.com/vi/CULYf1LWscA/maxresdefault.jpg

https://www.dhakatribune.com/business/economy/248432/budget-fy22-tax...

Web 2 juin 2021 nbsp 0183 32 At present tax rebates are available on investments in nine sectors including savings certificates and donations in 13 sectors Investment up to 25 of a taxpayer s total annual income in these sectors is considered concessional

http://www.jasimrasel.com/invest-for-tax-reb…

Web 14 ao 251 t 2017 nbsp 0183 32 Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could

How Can NBR Clarifications Resolve Tax Disputes In Bangladesh

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Income Tax Rebate 2023 22 Bangladesh Bank Info

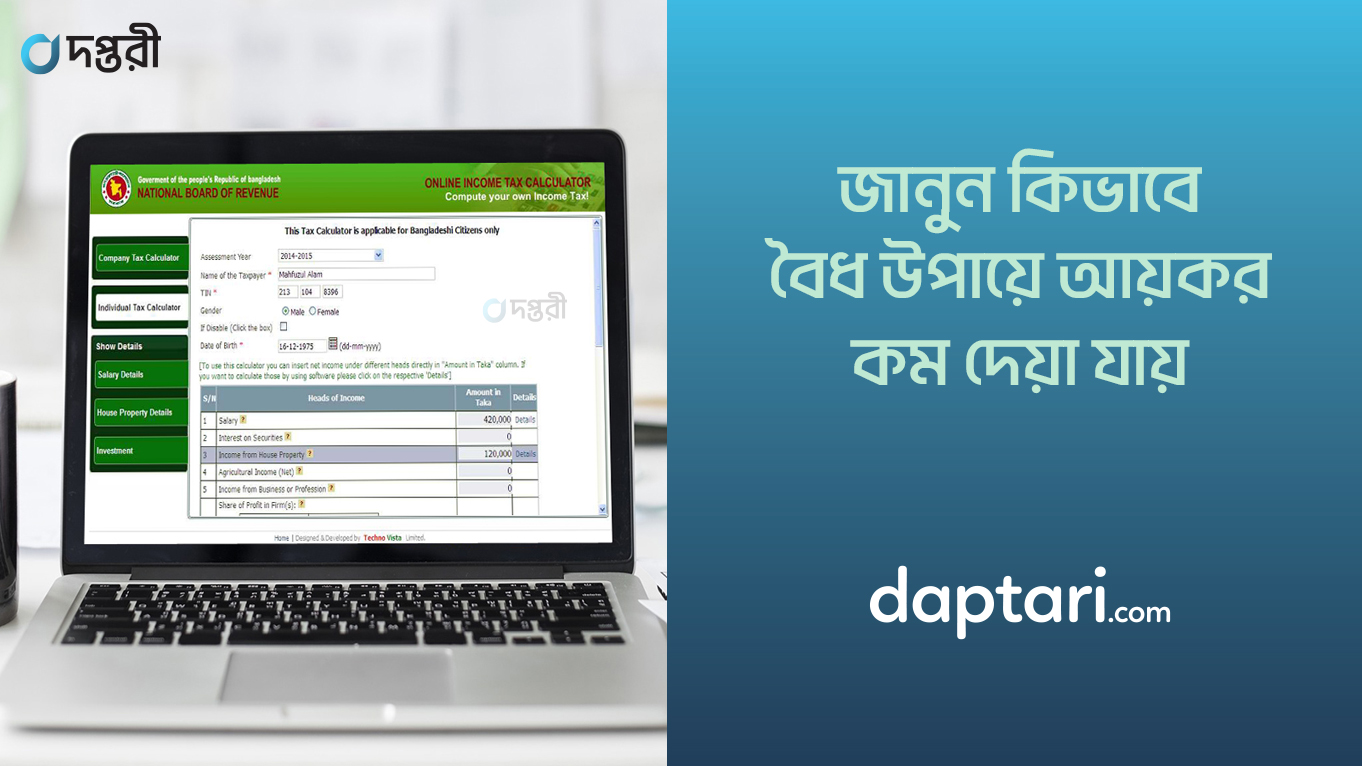

Daptari

How To Calculate Tax Rebate In Income Tax Of Bangladesh BDesheba Com

How To Calculate Tax Rebate In Income Tax Of Bangladesh

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Investment For Tax Rebate In Bangladesh

Tickmill Bangladesh

Investment For Tax Rebate In Bangladesh

Tax Rebate Investment In Bangladesh - Web The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is approved by parliament In that case