Tax Rebate On Retirement Annuity Web 22 ao 251 t 2023 nbsp 0183 32 Getty Much like taxes annuities just aren t very popular No one likes paying taxes to Uncle Sam and a mere 17 of American households led by someone between 40 and 85 owns an annuity

Web 24 janv 2023 nbsp 0183 32 A tax rebate on a retirement annuity refers to the reduction in taxes that an individual can claim when they contribute to a retirement annuity account Retirement annuity tax deduction South Africa Web 6 sept 2023 nbsp 0183 32 When you take distributions or withdraw from the annuity later in retirement you will be taxed on the growth at your then current tax rate explained annuity and

Tax Rebate On Retirement Annuity

Tax Rebate On Retirement Annuity

https://gg.myggsa.co.za/how_much_tax_do_i_get_back_from_retirement_annuity.PNG

![]()

How Does Retirement Annuity Reduce Tax Camellia Mcclintock

https://www.ameriprise.com/binaries/content/gallery/ampcom/financial-goals--priorities/icons--logos/tax-annuities-graphic-new.png

Inherited Annuity Taxation Irs Right Smart Personal Website Portrait

https://www.retireguide.com/wp-content/uploads/qualified-vs-non-qualified-annuities-1-768x0-c-default.jpg

Web 7 d 233 c 2021 nbsp 0183 32 If he s not depending on his age might be worth him considering packing that policy in and investing in something more modern Obviously that constitutes financial Web Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an

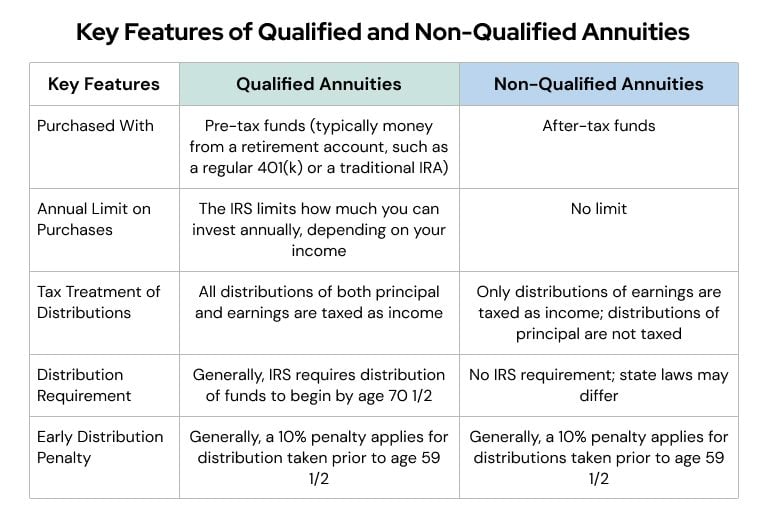

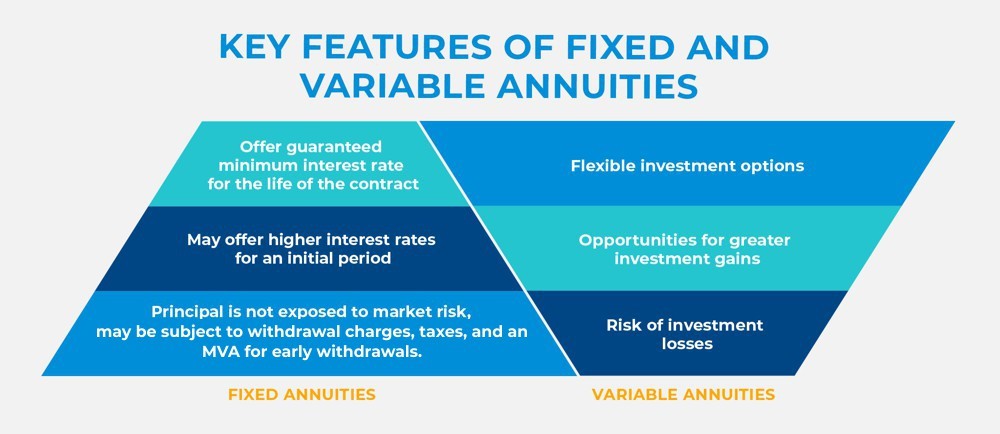

Web If you have an annuity there are different potential implications for your retirement savings and income based on the type of annuity you have and when you withdraw funds To Web 1 mars 2021 nbsp 0183 32 Using the SARS tax tables and current primary rebate of R15 714 we calculate that you would have paid income tax of R106 725 if you didn t contribute any

Download Tax Rebate On Retirement Annuity

More picture related to Tax Rebate On Retirement Annuity

Free Annuity Calculator For Excel Retirement Annuity Calculator

https://cdn.vertex42.com/Calculators/Images/basic-annuity-calculator.png

Are Annuity Death Benefits Tax Free

https://www.annuity.org/wp-content/uploads/Qualified-Annuity-Taxation.jpg

Can You Rollover A Fixed Annuity Choosing Your Gold IRA

https://www.annuity.org/wp-content/uploads/Taxes-on-Annuity-Withdrawals-and-Sales.png

Web 28 sept 2020 nbsp 0183 32 IR 2020 223 September 28 2020 WASHINGTON The U S Department of the Treasury and the Internal Revenue Service today issued final regulations updating the federal income tax withholding rules Web The Standard Personal Allowance is 163 12 570 2023 24 This means you re able to earn or receive up to 163 12 570 in the 2023 24 tax year 6 April to 5 April and not pay any tax

Web 31 mai 2022 nbsp 0183 32 The retirement fund lump sum benefit on which normal tax will be calculated amounts to R682 000 less R50 000 which equals R632 000 R632 000 falls Web Annuities offer tax deferred growth it s one of their primary benefits Tax deferral provides a significant advantage for two reasons First it means that you can defer income tax on

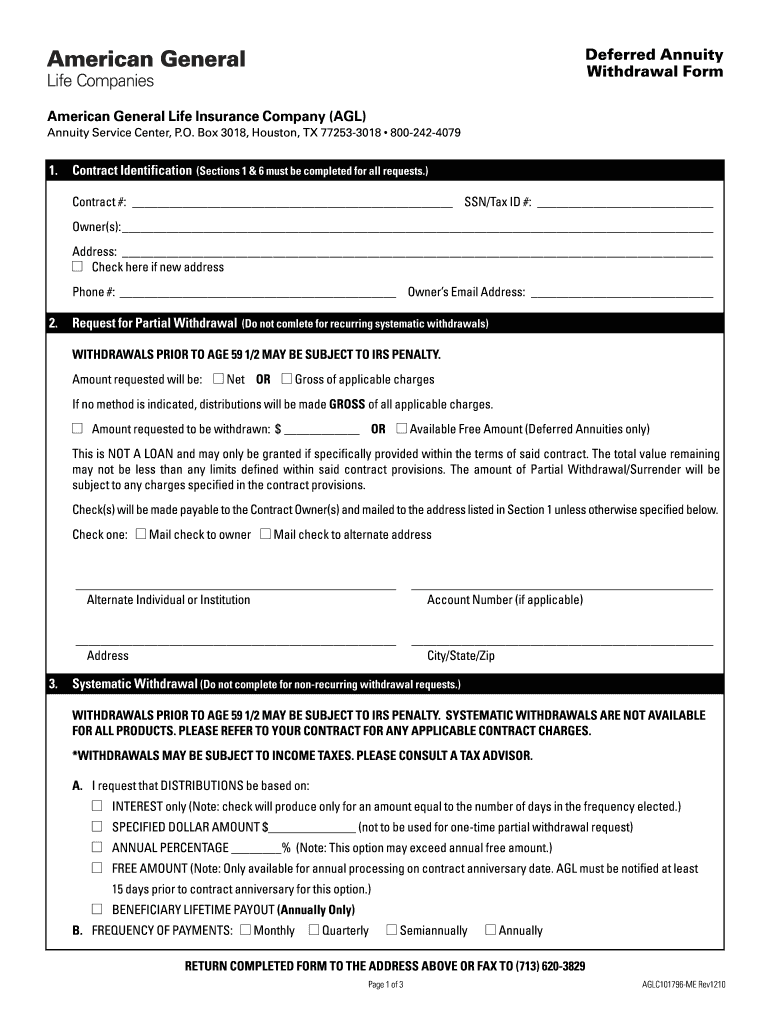

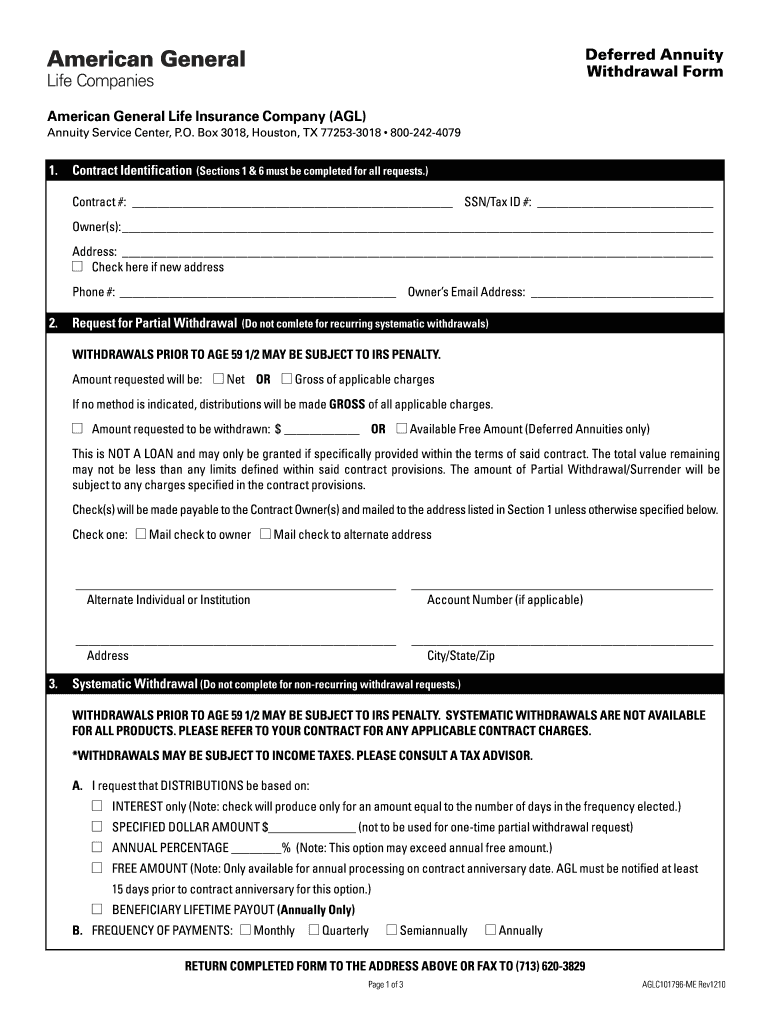

American General Annuity Withdrawal Form 2020 2022 Fill And Sign

https://www.pdffiller.com/preview/0/163/163150/large.png

Can I Convert A Qualified Annuity To A Roth Ira Choosing Your Gold IRA

https://www.annuity.org/wp-content/uploads/key-features-of-qualifies-and-non-qualified-annuities.jpg

https://www.forbes.com/advisor/retirement/an…

Web 22 ao 251 t 2023 nbsp 0183 32 Getty Much like taxes annuities just aren t very popular No one likes paying taxes to Uncle Sam and a mere 17 of American households led by someone between 40 and 85 owns an annuity

https://bayswatercapital.co.za/what-is-tax-reb…

Web 24 janv 2023 nbsp 0183 32 A tax rebate on a retirement annuity refers to the reduction in taxes that an individual can claim when they contribute to a retirement annuity account Retirement annuity tax deduction South Africa

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What s The Difference

American General Annuity Withdrawal Form 2020 2022 Fill And Sign

T4A Statement Of Pension Retirement Annuity And Other Income Canada ca

What Is Tax Rebate On A Retirement Annuity

Railroadretirement Inflation Protection

The 50 Best Annuities Barron s

The 50 Best Annuities Barron s

How Annuities Can Boost Your Retirement Savings

11 Retirement Annuity Templates In DOC PDF

Reimbursement Request Form Fill Out Sign Online DocHub

Tax Rebate On Retirement Annuity - Web If you have an annuity there are different potential implications for your retirement savings and income based on the type of annuity you have and when you withdraw funds To