Tax Relief Retirement Annuity Contract Contributions Tax relief on an individual s pension contributions can be given in one of three ways This is determined by the type of scheme you re in Payments to retirement annuity

Both employees and self employees can claim tax relief as a deduction from their earned income for payments to a retirement annuity Contributions are made gross and relief is given Are you contributing to a retirement annuity contract that you started before 6 April 1988 Then the pension provider doesn t usually claim and add any tax relief to your pension pot This

Tax Relief Retirement Annuity Contract Contributions

Tax Relief Retirement Annuity Contract Contributions

https://simcontent.sanlam.co.za/wp-content/uploads/2019/fence-1280x720.jpg

Mac Financial Making Pension Contributions Before The End Of The Tax

http://macfinancial.uk.com/wp-content/uploads/2016/02/pension1.jpg

Qualified Vs Non Qualified Annuities Taxation And Distribution

https://www.annuity.org/wp-content/uploads/key-features-of-qualifies-and-non-qualified-annuities.jpg

Retirement annuity contracts Relief for contributions made to retirement annuity contracts is not required to be given under the RAS system it can be given by making a claim If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable

Learn more about tax relief on member pension contributions from M G Wealth Adviser including eligibility methods of claiming tax relief and case studies The IRS has announced that the amount of tax favored funds that you can sock away for retirement is increasing In 2025 the amount most individuals can contribute to their

Download Tax Relief Retirement Annuity Contract Contributions

More picture related to Tax Relief Retirement Annuity Contract Contributions

Pension Tax Relief In The United Kingdom UK Pension Help

http://ukpensionhelp.com/wp-content/uploads/2021/03/5.png

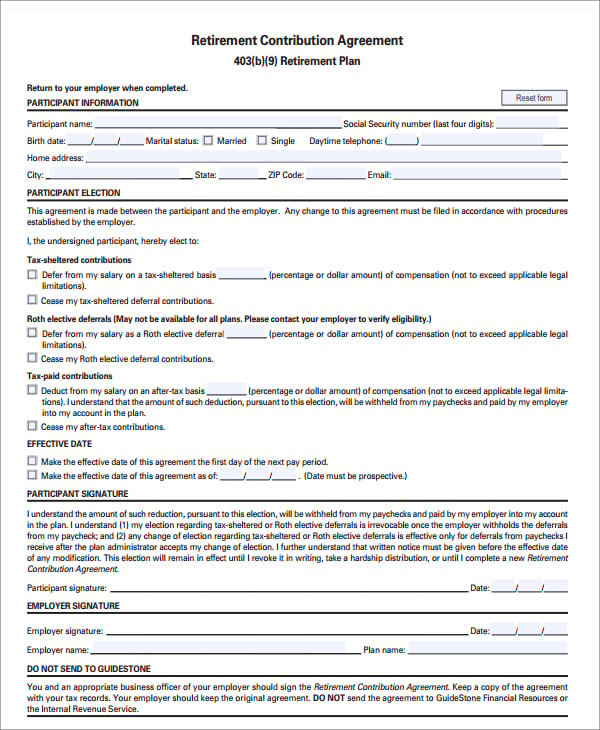

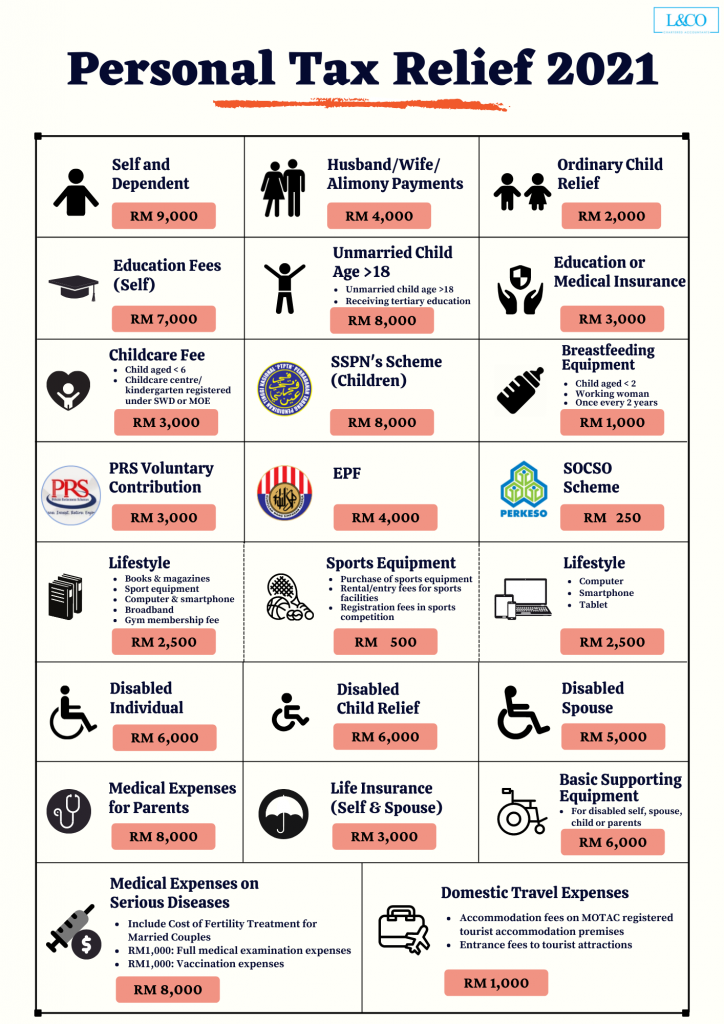

List Of Personal Tax Relief And Incentives In Malaysia 2023

https://iqiglobal.com/blog/wp-content/uploads/2023/01/IQI-Global-Media-Post-01-819x1024.webp

Minimizing Your Tax Burden With A Retirement Annuity Olemera Blog

https://www.olemera.com/Portals/80/tax-benefits-of-retirement-annuity.jpg

To ensure pension contributions are tax efficient you must consider first tax relief and second annual allowance rules Your client is only entitled to tax relief on a contribution You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it yourself

The IRS has issued Notice 2024 80 which contains the 2025 cost of living increases for qualified retirement plan dollar limitations on benefits and contributions under the Internal If an individual s earnings are below 3 600pa and they have a retirement annuity contract to which they make gross contributions they will only be able to claim tax relief on up to 100

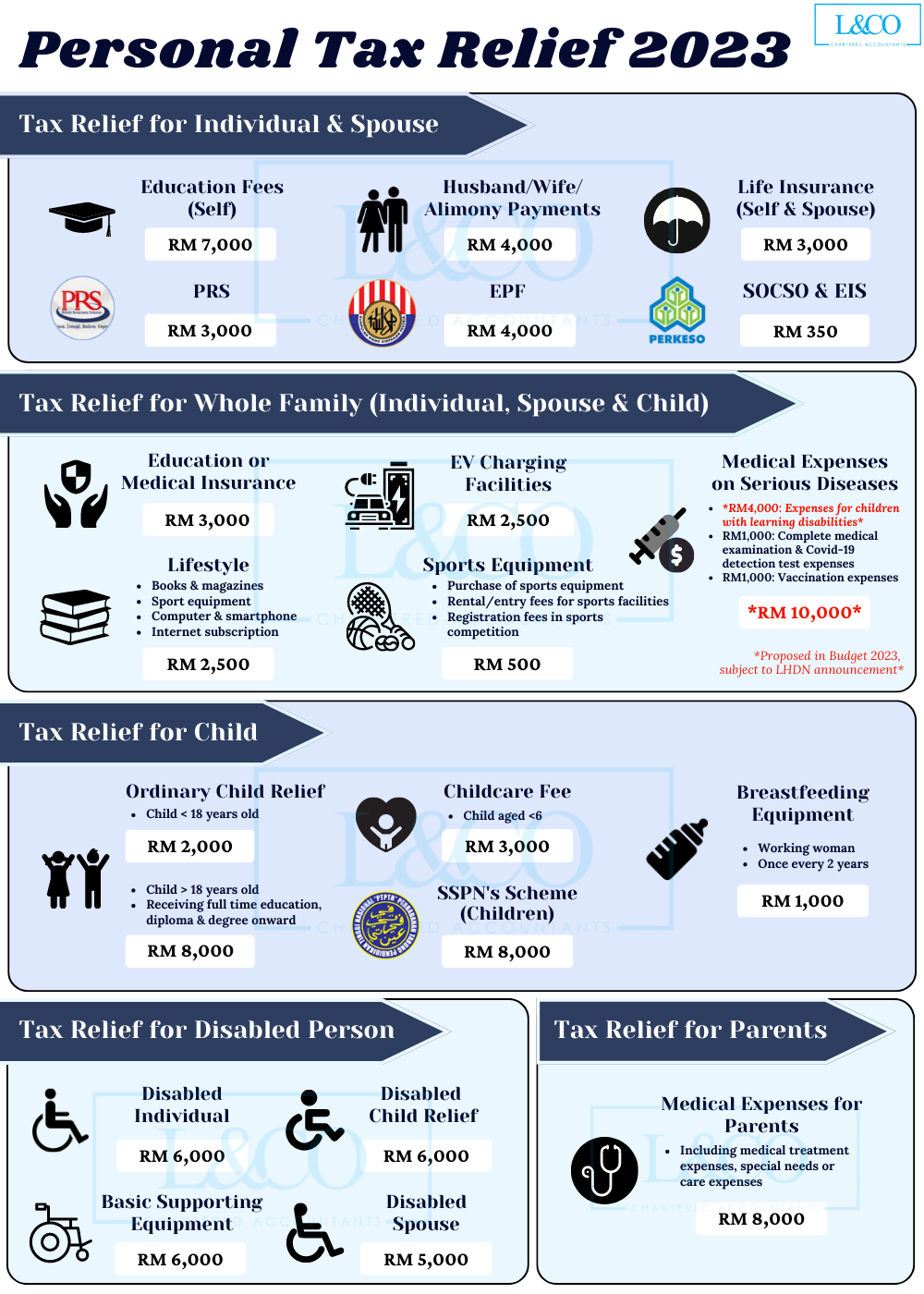

Compensation Agreement Template

https://images.template.net/wp-content/uploads/2018/05/Retirement-Contribution-Agreement.jpg

Are There Any Other Types Of Annuities Due

https://cdn.due.com/blog/wp-content/uploads/2021/06/Few-Types-of-Annuities-scaled.jpg

https://techzone.abrdn.com › public › pensions › Guide...

Tax relief on an individual s pension contributions can be given in one of three ways This is determined by the type of scheme you re in Payments to retirement annuity

https://help.sbc.sage.com › en-gb › personal-tax-dt › C...

Both employees and self employees can claim tax relief as a deduction from their earned income for payments to a retirement annuity Contributions are made gross and relief is given

Personal Tax Relief Y A 2023 L Co Accountants

Compensation Agreement Template

Save It For Another Day Pension Tax Relief And Options For Reform

Retirement Income Should I Consider An Annuity Farrow Financial

Recently I Wrote About Theoretical Retirement Income Options From A

Pension Tax Relief Calculator TaxScouts

Pension Tax Relief Calculator TaxScouts

Personal Tax Relief 2021 L Co Accountants

Retirement Annuity Retirement Annuity Contract YouTube

Tax Relief On Pension Contributions Nicole Harney Business Solutions

Tax Relief Retirement Annuity Contract Contributions - You can get Income Tax relief against earnings from your employment for your pension contributions including Additional Voluntary Contributions AVCs Pension