Tax Rebates On Heating And Air Conditioning Verkko 13 huhtik 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit Verkko 27 marrask 2023 nbsp 0183 32 The new rebate programs and enhanced tax credits are good through 2032 HVAC rebates may be available to

Tax Rebates On Heating And Air Conditioning

Tax Rebates On Heating And Air Conditioning

https://img.a-better-place.com/yer/bond-heating-and-air-conditioning-607835.jpg

Springfield MO Duct Cleaning Experts One Hour Heating And Air

http://ww1.prweb.com/prfiles/2014/04/13/11743864/springfield-mo-duct-cleaning-one-hour-heating-and-air-conditioning.jpg

Right Now Heating And Air Conditioning Reviews Ratings Heating Air

https://ddjkm7nmu27lx.cloudfront.net/165516001752560/cover/460d504813254bcb98dc7ff375401a05.jpeg

Verkko These home energy rebates will help American households save money on energy bills upgrade to clean energy equipment and improve energy efficiency and reduce indoor Verkko 27 huhtik 2021 nbsp 0183 32 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy

Verkko Information updated 12 30 2022 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce Verkko 22 jouluk 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs

Download Tax Rebates On Heating And Air Conditioning

More picture related to Tax Rebates On Heating And Air Conditioning

Inflation Reduction Act Summary What It Means For New HVAC Systems

https://www.ecicomfort.com/hubfs/IRA Heat Pump Rebates %26 Tax Credits-png.png

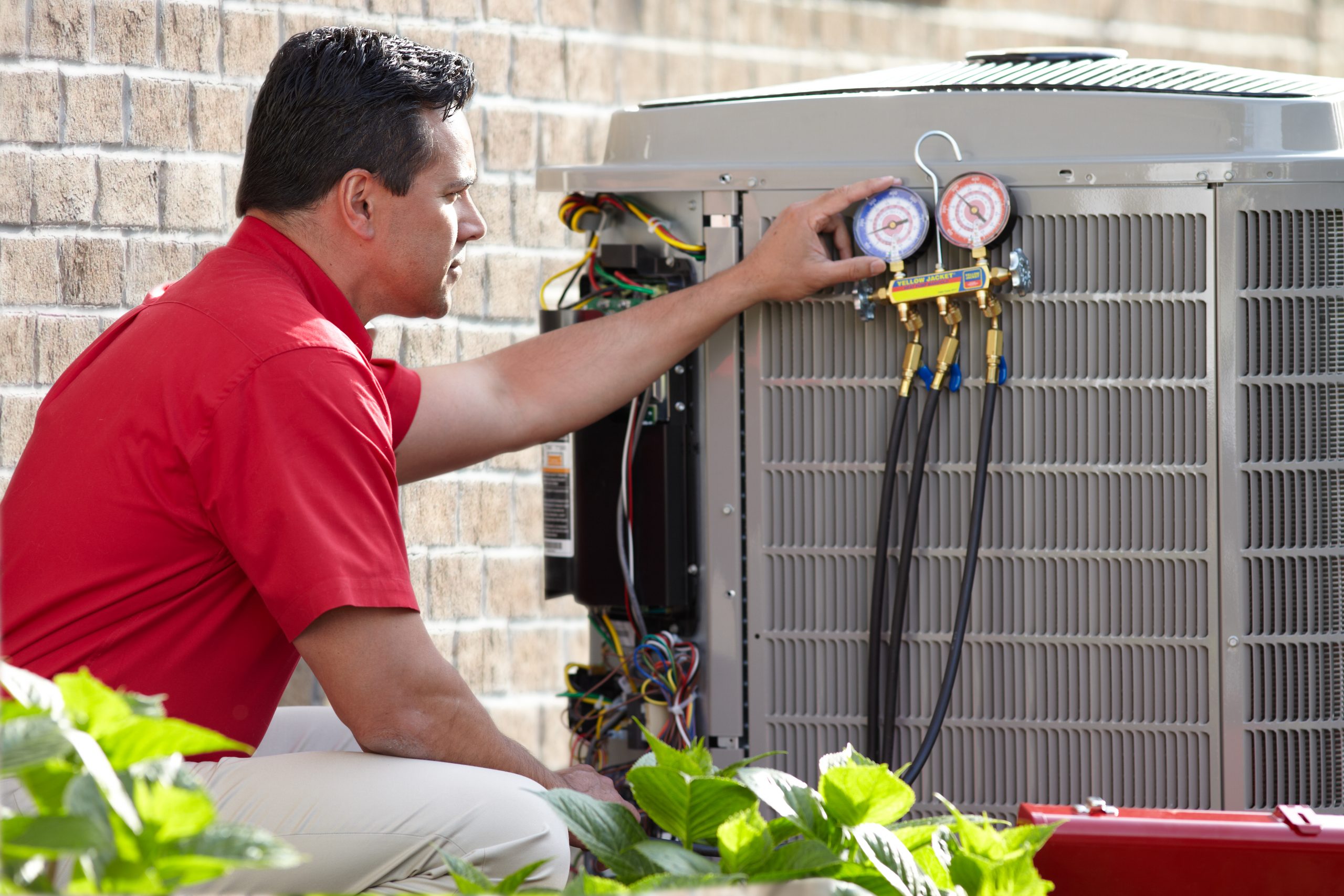

Heating And Air Conditioning In Kearny Mesa CA Atlas HVAC Inc

https://atlascoolingandheating.com/wp-content/uploads/2020/11/CheckingGauge2HP-scaled.jpg

Heating Ventilation And Air Conditioning Systems Are Important In

https://i.pinimg.com/originals/0a/e6/ce/0ae6ce6f7df7d8ab292a7cafa80a734a.jpg

Verkko 20 syysk 2023 nbsp 0183 32 For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of the total project with a max Verkko 30 jouluk 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

Verkko Find and compare ENERGY STAR products to see how they stack up Start Here Product Rebate Finder Enter your zip code to find rebates and other special offers Verkko 10 jouluk 2023 nbsp 0183 32 Generally yes Not only can energy efficiency home improvements lower the cost of heating and cooling your home these credits help to lower the cost

Hvac Air Conditioning Air Conditioning Maintenance Hvac Maintenance

https://i.pinimg.com/originals/03/43/e4/0343e41701b5882ef0f4ed8976612192.jpg

Up To 1 600 In Rebates Hvac System Hvac Rebates

https://i.pinimg.com/originals/4a/fa/6c/4afa6ce33108041dcc62b70126e6ee21.png

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

Verkko 13 huhtik 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit

Universal Heating And Air Conditioning Cool Product Evaluations

Hvac Air Conditioning Air Conditioning Maintenance Hvac Maintenance

FINDING AN AMAZING AIR CONDITIONING HEATING CONTRACTOR ArticleCity

How Air Conditioning Changed The World Apollo Heating Air

Contact Us Right Away Heating Air Conditioning Air Conditioning

Average Cost To Replace Heating And Air Conditioning American Home

Average Cost To Replace Heating And Air Conditioning American Home

Heating And Air Conditioning Service Fort Worth Texas One Hour Air

Hvac Companie AC And Heater Combo Heating And Air Tulsa

Heating And Air Conditioning Installation

Tax Rebates On Heating And Air Conditioning - Verkko Tax Section 25C Nonbusiness Energy Property Credit Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency