Tax Refund 2023 Child Tax Credit Web 14 Apr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Dec 31 2022 For

Web 3 Jan 2024 nbsp 0183 32 Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child Web 27 Juni 2023 nbsp 0183 32 For taxes filed in 2023 and afterward you can only claim benefits of 2 000 for every child under 17 years old The tax credit was temporarily raised in the 2021 tax year which was filed in 2022 It boosted to 3 600 for children 5 years old and under and 3 000 for children between 6 17 years old

Tax Refund 2023 Child Tax Credit

Tax Refund 2023 Child Tax Credit

https://i.ytimg.com/vi/cZ-f0xO-DJc/maxresdefault.jpg

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

https://cdn.cheapism.com/images/2023-eitc.width-1000.png

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Web 14 Dez 2023 nbsp 0183 32 For 2023 the refundable portion of the credit is 1 600 Last year only 1 500 was refundable Note Keep in mind that not everyone can receive the full amount of the 2023 child tax Web 3 Jan 2024 nbsp 0183 32 For 2023 2022 2020 and earlier tax years the Child Tax Credit is nonrefundable if your credit exceeds your tax liability your tax bill is reduced to zero and any remaining unused credit is lost However you may be able to claim a refundable Additional Child Tax Credit for the unused balance

Web Vor 6 Tagen nbsp 0183 32 The child tax credit pays up to 2 000 for each qualifying child under age 17 Up to 1 600 of the payout is refundable for 2023 taxes There are also 14 states that offer their own child tax Web 30 Aug 2022 nbsp 0183 32 The FSA 2 0 would increase the maximum annual child tax credit from 2 000 to 4 200 for each child under age 6 and 3 000 for each child ages 6 through 17 paid out in monthly installments

Download Tax Refund 2023 Child Tax Credit

More picture related to Tax Refund 2023 Child Tax Credit

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4200&ssl=1

Web 3 Jan 2024 nbsp 0183 32 However you may be able to claim the Additional Child Tax Credit which allows you to receive up to 1 600 of the 2 000 Child Tax Credit per child as a refund for 2023 and 2024 This means you get a check for the remaining Child Tax Credit up to 1 600 per child after your tax bill is reduced to zero To determine whether you re Web January 10 2024 at 4 36 p m EST Congress is nearing a deal to partially restore an expansion of the child tax credit which expired in 2021 in exchange for extending some corporate tax

Web 15 Dez 2023 nbsp 0183 32 The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers Web 24 Aug 2023 nbsp 0183 32 You qualify for the full amount of the 2022 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

Tax Return 2022 With Eic Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T12-0177.GIF

Monthly Child Tax Credit Payments Understand The Options Articles

https://www.advisorperspectives.com/articles/thumbnails/4118aa8c879e135103a6d7bb1d297c8d026fada2.jpeg

https://www.cnet.com/personal-finance/taxes/how-much-is-the-chil…

Web 14 Apr 2023 nbsp 0183 32 How much is the child tax credit in 2023 The maximum tax credit available per child has reverted to its pre expansion level of 2 000 for each child under 17 on Dec 31 2022 For

https://www.usatoday.com/.../2024/01/03/child-tax-credit-2023/719…

Web 3 Jan 2024 nbsp 0183 32 Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child

Child Tax Credit How Much Is It For 2024

Tax Return 2022 With Eic Latest News Update

Details From IRS About Enhanced Child Tax Credits

3 Ways To Use Your Tax Refund To Solve Your Debt Problem AZ Consumer

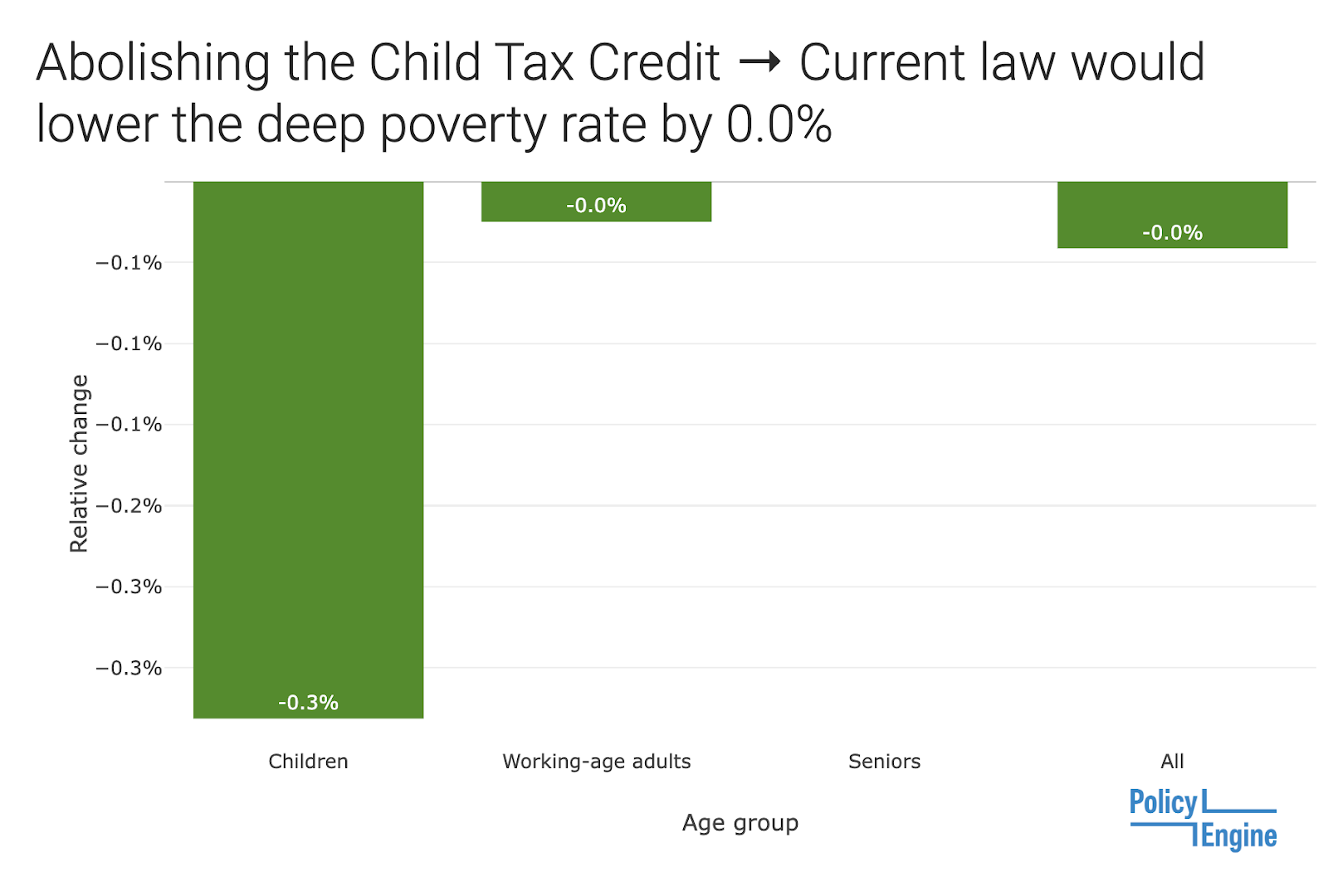

The Child Tax Credit In 2023 PolicyEngine US

2022 Tax Refund Schedule Chart Eitc Veche

2022 Tax Refund Schedule Chart Eitc Veche

See The EIC Earned Income Credit Table Income Tax Return Income

Child Tax Credit 2023 What You Need To Know

Care Credit Printable Application Printable Word Searches

Tax Refund 2023 Child Tax Credit - Web 3 Jan 2024 nbsp 0183 32 For 2023 2022 2020 and earlier tax years the Child Tax Credit is nonrefundable if your credit exceeds your tax liability your tax bill is reduced to zero and any remaining unused credit is lost However you may be able to claim a refundable Additional Child Tax Credit for the unused balance