Tax Refund Dates 2023 Child Tax Credit If you claimed the Earned Income Tax Credit EITC or the Additional Child Tax Credit ACTC you can expect to get your refund by February 27 if You file your return online You choose to get your refund by direct deposit We found no issues with your return

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October 2022 So early tax filers who are a due a refund can often see it as

Tax Refund Dates 2023 Child Tax Credit

Tax Refund Dates 2023 Child Tax Credit

https://s.hdnux.com/photos/01/35/74/61/24628288/5/rawImage.jpg

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Child Tax Credit 2021 American Parents Could Owe Money After Monthly

https://cdn.abcotvs.com/dip/images/11421664_010322-ktrk-ewn-4pm-NNA-child-tax-credit-MON-matt-vid.jpg?w=1600

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you may For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the income phase out information below

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit When Will the IRS Start Accepting 2023 Tax Returns and Issuing Refunds The IRS has announced it will start accepting tax returns on January 23 2023 as we predicted as far back as October

Download Tax Refund Dates 2023 Child Tax Credit

More picture related to Tax Refund Dates 2023 Child Tax Credit

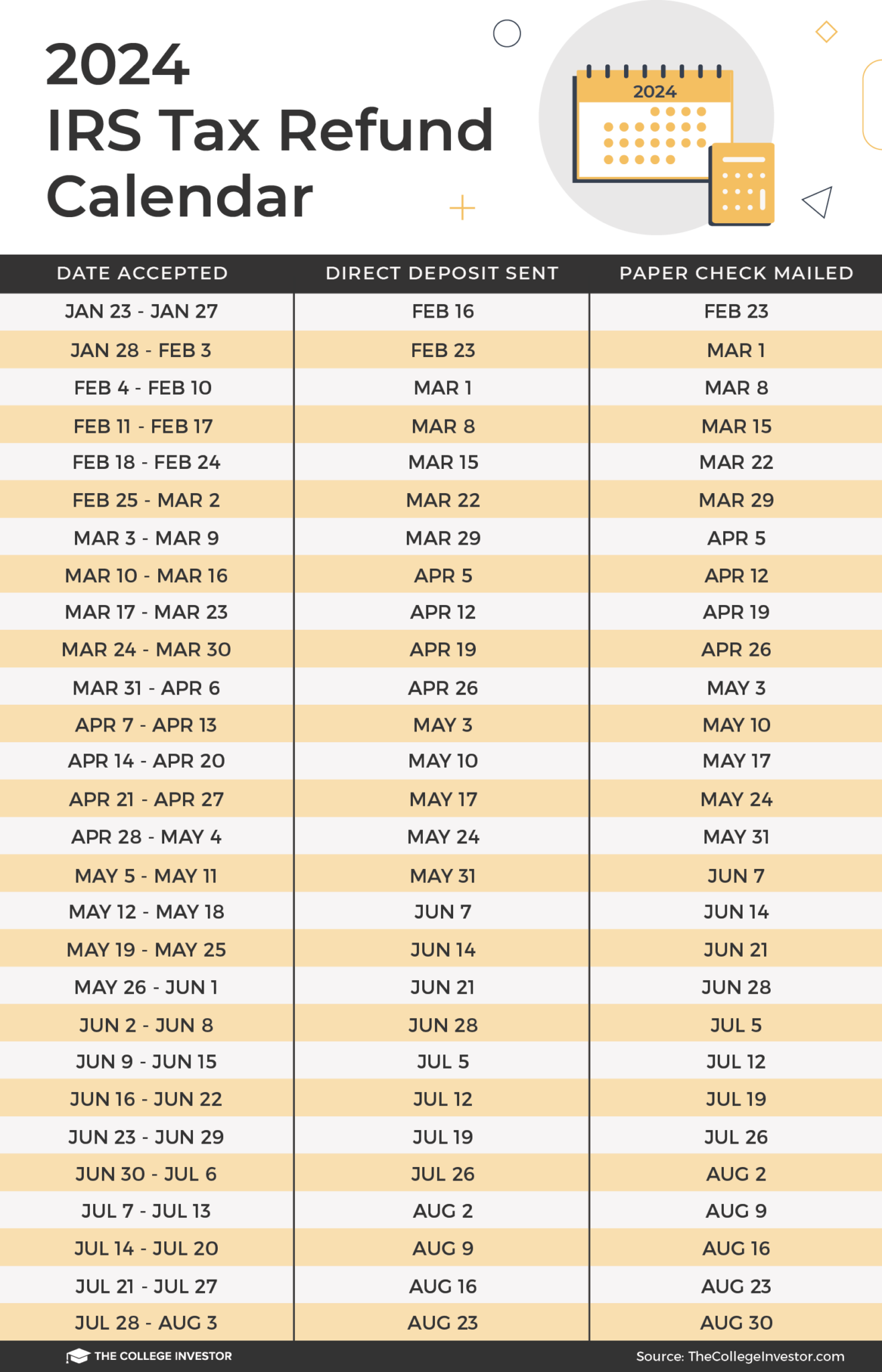

Irs Tax Refund Calendar 2024 Sybil Catarina

https://thecollegeinvestor.com/wp-content/uploads/2023/11/TCI_-_2024-TAX-REFUND-CALENDAR-1316x2048.png

Here Is The IRS Opening Date For 2023 Tax Season With Estimated Refund

https://i1.wp.com/hardgeconnections.com/wp-content/uploads/2023/01/1.png?w=1080&ssl=1

3rd Round Of Child Tax Credit Payments Go Out This Week The Daily World

https://www.thedailyworld.com/wp-content/uploads/2021/09/26463542_web1_ChildTaxCredit-ADW-210914-TreasuryCheck_1.jpg

The IRS will issue advance CTC payments July 15 Aug 13 Sept 15 Oct 15 Nov 15 and Dec 15 Who needs to take action now If you haven t filed or registered with the IRS now is the time to take action The sooner you do the sooner you will begin receiving monthly payments Enacted in 1997 the credit currently provides up to 2 000 per child to about 40 million families every year The American Rescue Plan made historic expansions to the Child Tax Credit

If you have the Earned Income Tax Credit or Additional Child Tax Credit your refund does not start processing until February 15 Your 21 day average starts from this point so you can usually expect your tax refund the last week of February or first week of March The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar basis Some

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Simplifying The Complexities Of R D Tax Credits TriNet

https://images.contentstack.io/v3/assets/blt9ccc5b591c9e2640/blt64bfb078a74eaa48/643963cd9074ca2928c792b6/RD-Tax-Credits-thumbnail.jpg

https://www.irs.gov › credits-deductions › individuals › ...

If you claimed the Earned Income Tax Credit EITC or the Additional Child Tax Credit ACTC you can expect to get your refund by February 27 if You file your return online You choose to get your refund by direct deposit We found no issues with your return

https://turbotax.intuit.com › tax-tips › family › child-tax-credit

ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses

Pin On Money

Taking A Stand For Children Through The Child Tax Credit Tax Credits

Income Tax 2022 Deposit Dates Latest News Update

Watch CBS Mornings Child Tax Credit Set To Expire Full Show On

Monthly Child Tax Credit Payments Understand The Options Articles

November 15th Deadline Approaching For Missed Tax Credits Here s How

November 15th Deadline Approaching For Missed Tax Credits Here s How

VERIFY Yes You Have A Choice In The Child tax Credit 13wmaz

2021 Child Tax Credit Schedule Veche info 29

Child Tax Credit How Much Is It For 2024

Tax Refund Dates 2023 Child Tax Credit - When to expect your child tax credit refund For early filers the IRS told CNET that most child tax credit and earned income tax credit refunds would be available in bank accounts or on debit