Tax Refund After Ppi Claim Web 27 Apr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If the overpayment arose in 2019 20 you have until 5 April 2024 to put in your claim and so on

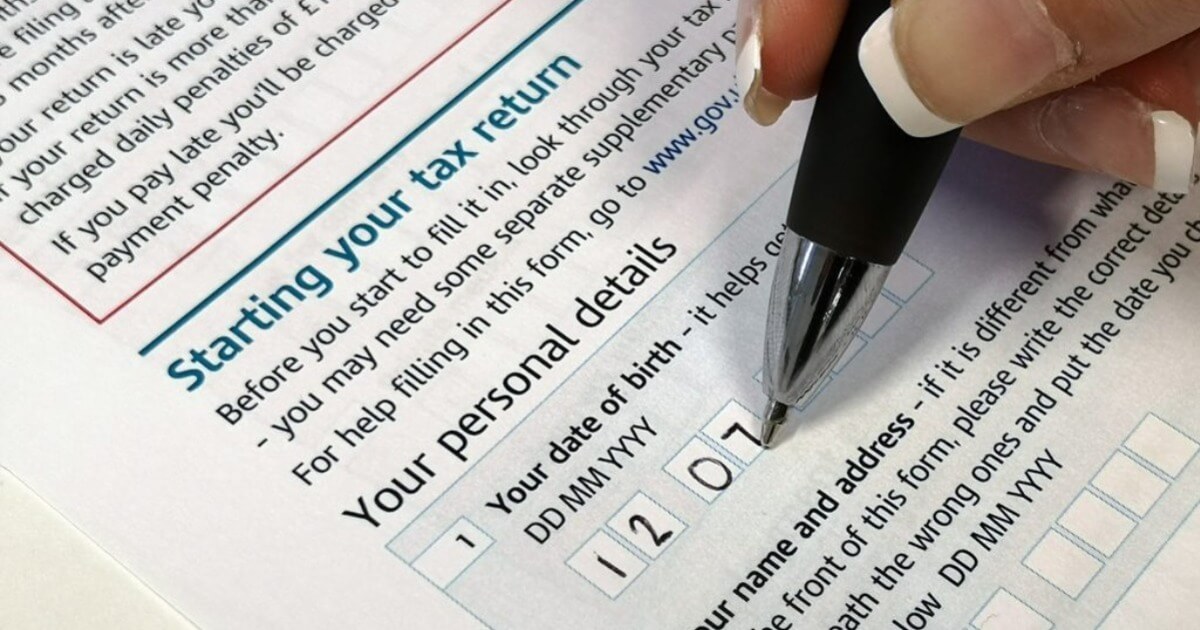

Web If you believe that you may be entitled to claim back some tax paid on your PPI compensation you can make your claim for free via gov uk using the R40 R43 form As well as providing basic personal details you ll have to Web interest from savings or payment protection insurance PPI income from a life or pension annuity foreign income You cannot claim a refund using this tool

Tax Refund After Ppi Claim

Tax Refund After Ppi Claim

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

Federal Tax Refund Status Where Is My Federal Tax Refund

https://golookup-live.s3.amazonaws.com/articles/Mip1aDCdp3SHXJtM4fohKs2ckJCPPxV5OzFlsH7Z.jpeg

Taxes Are Due July 15 Experts Say Save 90 Money

https://img.money.com/2020/03/mm_ds_33_income_tax_refund-2.gif

Web 30 M 228 rz 2022 nbsp 0183 32 Some customers who made a PPI claim through a third party have found their signature and national insurance number transposed on to a deed so that a company can cash in on any pending tax refunds Web 19 M 228 rz 2021 nbsp 0183 32 You can reclaim the tax on PPI payments going back four tax years and the current tax year is due to end on April 5 2021 This means you only have days left to reclaim tax for any PPI

Web 6 Dez 2023 nbsp 0183 32 On 26 October 2023 HMRC paused processing of all claims for PPI tax refunds on the R40 form while they considered the best way to manage the risks such as those identified by LITRG Any forms that HMRC have paused since this date will be returned to the taxpayer They will need to be resubmitted with evidence of the original Web Updated 4 December 2023 A new no win no fee group legal claim the biggest of its kind has launched aiming to recoup 163 18 BILLION in payment protection insurance PPI premiums It s free to join and if successful could be worth 163 1 000s to claimants including some who ve already been paid back mis sold PPI

Download Tax Refund After Ppi Claim

More picture related to Tax Refund After Ppi Claim

How To Declare A PPI Refund On Your Tax Return PPI Rebates

https://www.ppirebates.co.uk/wp-content/uploads/ppi-refund-tax-return.jpeg

Ppi Tax Refund Calculator

https://i2.wp.com/claimmytaxback.co.uk/wp-content/uploads/2020/06/shutterstock_199894478-scaled.jpg

IRS Issues New Warning Ahead Of Tax Deadline You Could Lose Your Tax

https://ijr.com/wp-content/uploads/2023/03/GettyImages-1137415864.jpg

Web Vor einem Tag nbsp 0183 32 If you received a larger 163 15 000 PPI pay out and took out the loan 5 years ago you could get 163 900 tax back or 163 1 470 for PPI taken out 10 years ago Web 15 M 228 rz 2022 nbsp 0183 32 If you receive a PPI settlement you should declare the interest element and tax deduction on your self assessment tax return relating to the year you received the money Our team can help you amend your earlier tax return to declare any PPI interest and claim a tax refund so please feel free to contact us

Web 20 Okt 2021 nbsp 0183 32 If you think you could be owed tax on your PPI refund one way to get that tax back is to use HMRC s R40 or R43 for those living abroad form known as the Claim a refund of income tax deducted from savings and investment form Web 3 Apr 2023 nbsp 0183 32 You can use form R40 to make a claim for repayment of tax in certain circumstances you are not within Self Assessment that is you do not have to submit an annual tax return you have paid too much tax on interest from your savings and investments including purchased life annuities or PPI payouts and

Claim PPI Tax Back What Is PPI Tax All Questions Answered Reclaim

https://reclaimmyppitax.co.uk/wp-content/uploads/2020/07/Blvdkicks.png

HMRC PPI Tax Refund In UK EmployeeTax

https://employeetax.co.uk/wp-content/uploads/2020/08/8-min-768x216.jpg

https://www.litrg.org.uk/tax-guides/tax-basics/how-do-i-claim-tax-back/...

Web 27 Apr 2023 nbsp 0183 32 You normally have four years from the end of the tax year in which the overpayment arose to claim a refund So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim If the overpayment arose in 2019 20 you have until 5 April 2024 to put in your claim and so on

https://news.resolver.co.uk/ppi-tax-rebates-claims

Web If you believe that you may be entitled to claim back some tax paid on your PPI compensation you can make your claim for free via gov uk using the R40 R43 form As well as providing basic personal details you ll have to

How To Claim Tax Back On PPI Interest Refund EasyFinance4u

Claim PPI Tax Back What Is PPI Tax All Questions Answered Reclaim

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

Your Tax Refund Is The Key To Homeownership

5 Ways To Use Your Tax Refund To Establish Financial Confidence Tax

It s Official Today The IRS Announced The Tax Season 2015 Start Date

It s Official Today The IRS Announced The Tax Season 2015 Start Date

What Do I Need To Know About PPI Tax Claims Gowing Law

Here s The Average IRS Tax Refund Amount By State GOBankingRates

HMRC PPI Refund Of Tax Claim My Tax Back

Tax Refund After Ppi Claim - Web 1 Juni 2021 nbsp 0183 32 How long do I have to claim back the tax on my PPI Pay out You normally have up to 4 years from the end of the tax year in which you received the PPI pay out to claim a refund on the tax deducted So if you received your PPI refund in 2022 23 you have until 5 April 2027 to submit a claim