Tax Refund And Tax Credit Tax credits reduce the amount of tax you owe Taxes are calculated first then credits are applied to the taxes you have to pay Some credits called refundable credits will even give you a refund if you don t owe any tax Other credits are nonrefundable meaning that if you don t owe any federal taxes you don t get the credit Or if

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions

Tax Refund And Tax Credit

Tax Refund And Tax Credit

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Taxes 2019 Why Is My Refund Smaller This Year

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

Refundable tax credits can also get you a tax refund when you don t owe any tax Refundable credits can provide you with a refund Refundable tax credits are called refundable because if you qualify for a refundable credit and the amount of the credit is larger than the tax you owe you will receive a refund for the difference A refundable tax credit is a credit you can get as a refund even if you don t owe any tax Tax credits are amounts you subtract from your bottom line tax due when you file your tax return Most tax credits can reduce your tax only until it reaches 0 Refundable credits go beyond that to give you any remaining credit as a refund

First of all you could end up with a refund via a tax credit And if you re not eligible for a refund you still may need to file to avoid a penalty for filing late or not filing Key Tax Credits Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value Most tax credits are nonrefundable that is they cannot reduce a filer s income tax liability below zero

Download Tax Refund And Tax Credit

More picture related to Tax Refund And Tax Credit

Taxes What To Do If You Really Need Your Tax Refund Fast

https://www.gannett-cdn.com/-mm-/f1b9f8bfb499d8802d458de2dc965881db65eb99/c=0-101-2732-1644&r=x1683&c=3200x1680/local/-/media/2018/02/16/USATODAY/USATODAY/636543893899472736-tax-refund-stamp.jpg

It s Official Today The IRS Announced The Tax Season 2015 Start Date

https://refundschedule.com/wp-content/uploads/2014/12/refund-schedule1.jpg

Do You Know How To Track Your Tax Refund Here s How

https://townsquare.media/site/194/files/2020/02/federal-income-tax-refunds11_11403754.png?w=1200&h=0&zc=1&s=0&a=t&q=89

A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in your tax filing software If you file a paper return you ll need to complete a form and attach it A refundable tax credit is a state or federal credit that can put cash in your pocket regardless of your tax liability First a refundable credit reduces your tax

When you have a refundable tax credit like the Earned Income Tax Credit you receive part of the credit as a tax refund if it reduces your tax bill to a negative number In other words if you receive a 1 000 refundable tax credit but your tax bill is only 500 you ll get a 500 tax refund Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 for instance lowers your tax bill by the

NCDRC Directs Unitech To Refund Over Rs 1 Crore To Two Home Buyers

https://img.staticmb.com/mbcontent/images/uploads/2019/8/refund.jpg

Everything You Know About Getting A Tax Refund Is Wrong AOL Finance

http://o.aolcdn.com/dims-shared/dims3/GLOB/crop/4790x2618+259+386/resize/604x327!/format/jpg/quality/85/http://o.aolcdn.com/hss/storage/adam/1384f924728ace9e7a2aa85ac6a136ff/BGX923.jpg

https://www.britannica.com/money/tax-credit-deduction-refund

Tax credits reduce the amount of tax you owe Taxes are calculated first then credits are applied to the taxes you have to pay Some credits called refundable credits will even give you a refund if you don t owe any tax Other credits are nonrefundable meaning that if you don t owe any federal taxes you don t get the credit Or if

https://www.irs.gov/newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

Tax Refund Meaning In Hindi TAXIRIN

NCDRC Directs Unitech To Refund Over Rs 1 Crore To Two Home Buyers

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

5 Myths About Your 2017 Tax Refund And 2018 Tax Reform

John Barker s Mortgage Blog Turn Your Tax Refund Into A New Home

Global VAT Refund For The Interational Tourists Tax Refund And Tax

Global VAT Refund For The Interational Tourists Tax Refund And Tax

Taxes Are Due July 15 Experts Say Save 90 Money

A Quick Look At Tax Tourist Refund Schemes Economy Traveller

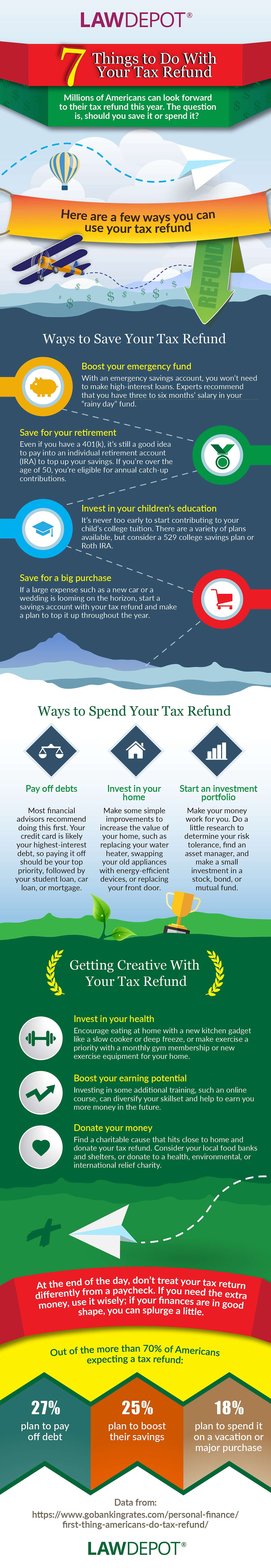

7 Things To Do With Your Tax Refund Infographic LawDepot Blog

Tax Refund And Tax Credit - First of all you could end up with a refund via a tax credit And if you re not eligible for a refund you still may need to file to avoid a penalty for filing late or not filing Key