Tax Refund Donations Verkko Because the gifts were given by the same donor within a period of 3 years the amounts are added up 5 000 20 000 25 000 Gift tax on a gift worth 25 000 is 1 300

Verkko 10 jouluk 2021 nbsp 0183 32 That means individual taxpayers can take a deduction of up to 300 for cash donations made this year when they file their federal tax returns in 2022 Verkko 27 marrask 2023 nbsp 0183 32 To claim a tax deductible donation you must itemize on your taxes Your donation must meet certain guidelines to qualify The amount of charitable

Tax Refund Donations

Tax Refund Donations

https://www.drbcapital.com/wp-content/uploads/2018/01/tax-refund.jpg

Claiming Donations On Your Tax Return Tax Refund How To Claim YouTube

https://i.ytimg.com/vi/FSuIB3QyeFw/maxresdefault.jpg

How To Get 10 000 Student Loan Payment Refund After Paying Off Your

https://i.ytimg.com/vi/ZxgntWqIZhc/maxresdefault.jpg

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Although the federal deadline for filing a federal income tax return is not until April 15 2024 if you wish to make a tax deductible donation the deadline is Verkko 12 jouluk 2023 nbsp 0183 32 The donor itemizes income tax deductions and meets the IRS s substantiation requirements So he s entitled to take a deduction for the donation The nonprofit is happy to accept his gift and uses

Verkko 19 lokak 2023 nbsp 0183 32 Key Takeaways For tax years 2020 and 2021 you can deduct up to 300 of qualified charitable cash contributions 600 if married filing a joint tax Verkko 12 jouluk 2022 nbsp 0183 32 That s because charitable contributions can impact your federal taxes Some taxpayers itemize charitable deductions on their federal tax returns which can reduce their tax bill or even get them a

Download Tax Refund Donations

More picture related to Tax Refund Donations

Expats Guide Tax Refund In The Philippines Expat ph

https://expat.com.ph/wp-content/uploads/sites/277/2018/05/tax-refund-philippines.jpg

Pin On Money

https://i.pinimg.com/originals/bd/fc/61/bdfc61093339587b842cb921b92aee62.png

Give A Donation Craigieburn Trails

http://www.craigieburntrails.org.nz/wp-content/uploads/2015/04/donations-giving-donate-charity-FinanceFox.jpg

Verkko 3 marrask 2021 nbsp 0183 32 Krey 242 l ayisyen IR 2021 214 November 3 2021 WASHINGTON The Internal Revenue Service today reminded taxpayers that a special tax provision Verkko 15 jouluk 2022 nbsp 0183 32 For the 2022 tax year the standard deduction is 12 950 for single filers and 25 900 for married couples filing jointly and in 2023 that will increase to 13 850 for individuals and 27 700 for

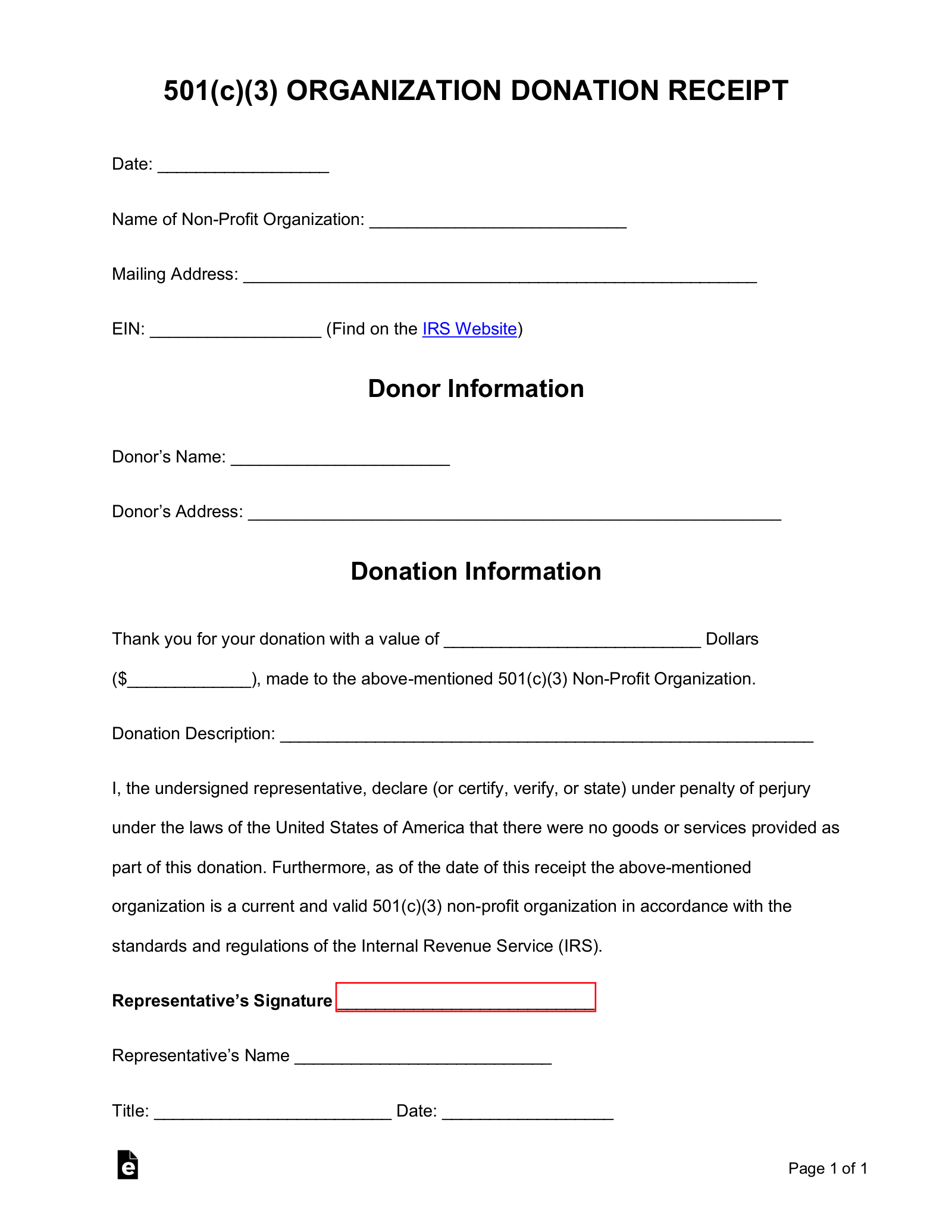

Verkko 2 lokak 2023 nbsp 0183 32 4 Fill out Form 8283 on Section B if your donations exceeded 5 000 Large donations require additional work on the second page of the 8283 form Here Verkko The easiest way to claim your donation tax credit is online in myIR and you ll receive your refund sooner Using myIR means we can work out your tax credit without you

6 Wise Things To Do With Your Tax Refund Tax Refund Money Making

https://i.pinimg.com/originals/63/ca/18/63ca186ca394d3ff771b9cac46fc66cf.jpg

2018 Arizona Tax Credit Donations

https://eforms.com/images/2018/04/501c3-Donation-Receipt-Template.png

https://www.vero.fi/.../property/gifts/taxable-gifts-and-tax-exempt-gifts

Verkko Because the gifts were given by the same donor within a period of 3 years the amounts are added up 5 000 20 000 25 000 Gift tax on a gift worth 25 000 is 1 300

https://www.nytimes.com/2021/12/10/your-money/tax-break-donations.html

Verkko 10 jouluk 2021 nbsp 0183 32 That means individual taxpayers can take a deduction of up to 300 for cash donations made this year when they file their federal tax returns in 2022

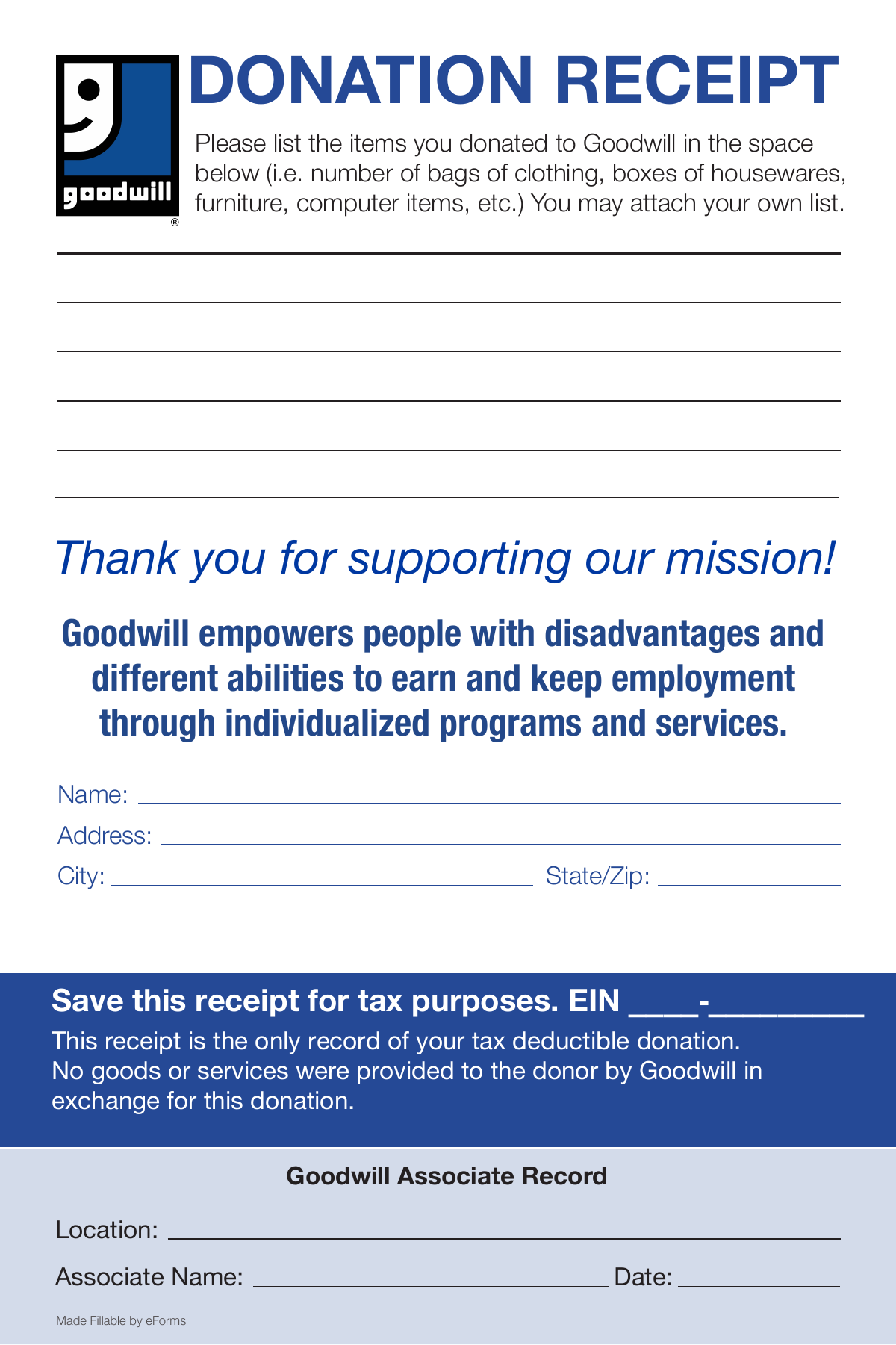

Free Goodwill Donation Receipt Template PDF EForms

6 Wise Things To Do With Your Tax Refund Tax Refund Money Making

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Get Our Printable Tax Deductible Donation Receipt Template Receipt

Unsolicited Donations USAID CIDI USAID CIDI

Where Is My Tax Refund YouTube

Where Is My Tax Refund YouTube

25 Donation Freedom Fostering

Ascentra Le Da Ideas Para Su Reembolso De Impuestos Hola America News

How To Avoid Tax Refund Scams In The UK

Tax Refund Donations - Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Although the federal deadline for filing a federal income tax return is not until April 15 2024 if you wish to make a tax deductible donation the deadline is