Tax Relief For Child Singapore Verkko Mr Ang claims the full amount of Qualifying Child Relief QCR of 8 000 i e 4 000 x 2 on their two children while Mrs Ang claims Working Mother s Child Relief WMCR

Verkko Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim Verkko If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third

Tax Relief For Child Singapore

Tax Relief For Child Singapore

https://homecarematters.ie/wp-content/uploads/2021/01/t2.png

Tax Relief For Children 2021 Fill In The Declaration Now

https://sb-bg.com/app/uploads/2021/10/Tax-relief_tumb_en.png

Forms 3520 3520 A RESP Tax Relief Effisca

https://www.effisca.com/wp-content/uploads/2021/04/form-3520-RESP-tax-relief-effisca-tax-scaled.jpg

Verkko 13 maalisk 2023 nbsp 0183 32 Tax reliefs For whom Amount Qualifying Child Relief Both parents S 4 000 per child S 7 500 if handicapped Working Mother s Child Relief Working mothers 15 for first child Verkko 18 maalisk 2022 nbsp 0183 32 Singaporean parents are eligible for the Qualifying Child Relief QCR or Handicapped Child Relief HCR which aim to support parents in their

Verkko In Singapore s tax structure Child Relief is a tax relief extended to taxpayers caring for their children This can come in several forms including Qualifying Child Relief Verkko 10 tammik 2022 nbsp 0183 32 Earned Income Relief All working persons are eligible for earned income relief Those below the age of 55 can claim 1 000 For those aged 55 59 the claim goes up to 6 000 For those aged 60

Download Tax Relief For Child Singapore

More picture related to Tax Relief For Child Singapore

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

2021 Stimulus Tax Relief For This Year s Taxes TheStreet

https://www.thestreet.com/.image/t_share/MTY3NTM5MzU5MzYxMjc5MzY3/no-relief-for-high-tax-states-as-federal-challenge-falls-short.png

Malaysia Personal Income Tax Relief 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s800-e60/Individual_Tax_Relief_2021.jpg

Verkko 13 jouluk 2019 nbsp 0183 32 The Inland Revenue Authority of Singapore IRAS provides the Working Mother s Child Relief WMCR to working mothers in Singapore as a part of its personal tax relief programme The main Verkko 11 marrask 2021 nbsp 0183 32 Claim of 4 000 in tax relief per child that s studying full time below 16 and has an annual income of less than 4 000 Handicapped Child Relief HCR

Verkko For each Singaporean child born you will receive cash of 6 000 for your 1st and 2nd child You could use these tax reliefs to reduce your tax bill each year if you are married Some of these tax reliefs Verkko 3 jouluk 2023 nbsp 0183 32 Here is the latest guide on tax reliefs and rebates specifically for parents in Singapore with key changes to the working mother child relief Heartland

Higher Tax Relief For Families Taking Care Of Disabled Expected In

https://i.ytimg.com/vi/czcwEtfBKlE/maxresdefault.jpg

IRAS SRS Contributions And Tax Relief

https://www.iras.gov.sg/media/images/default-source/uploadedimages/pages/srs-contribution-and-tax-relief.png?sfvrsn=befc84cc_3

https://www.iras.gov.sg/.../tax-reliefs-rebates-and-deductions/tax-reliefs

Verkko Mr Ang claims the full amount of Qualifying Child Relief QCR of 8 000 i e 4 000 x 2 on their two children while Mrs Ang claims Working Mother s Child Relief WMCR

https://www.iras.gov.sg/.../tax-reliefs/parenthood-tax-rebate-(ptr)

Verkko Parenthood Tax Rebate PTR Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Higher Tax Relief For Families Taking Care Of Disabled Expected In

No Corporate Tax Relief For Large Companies In Budget India Employer

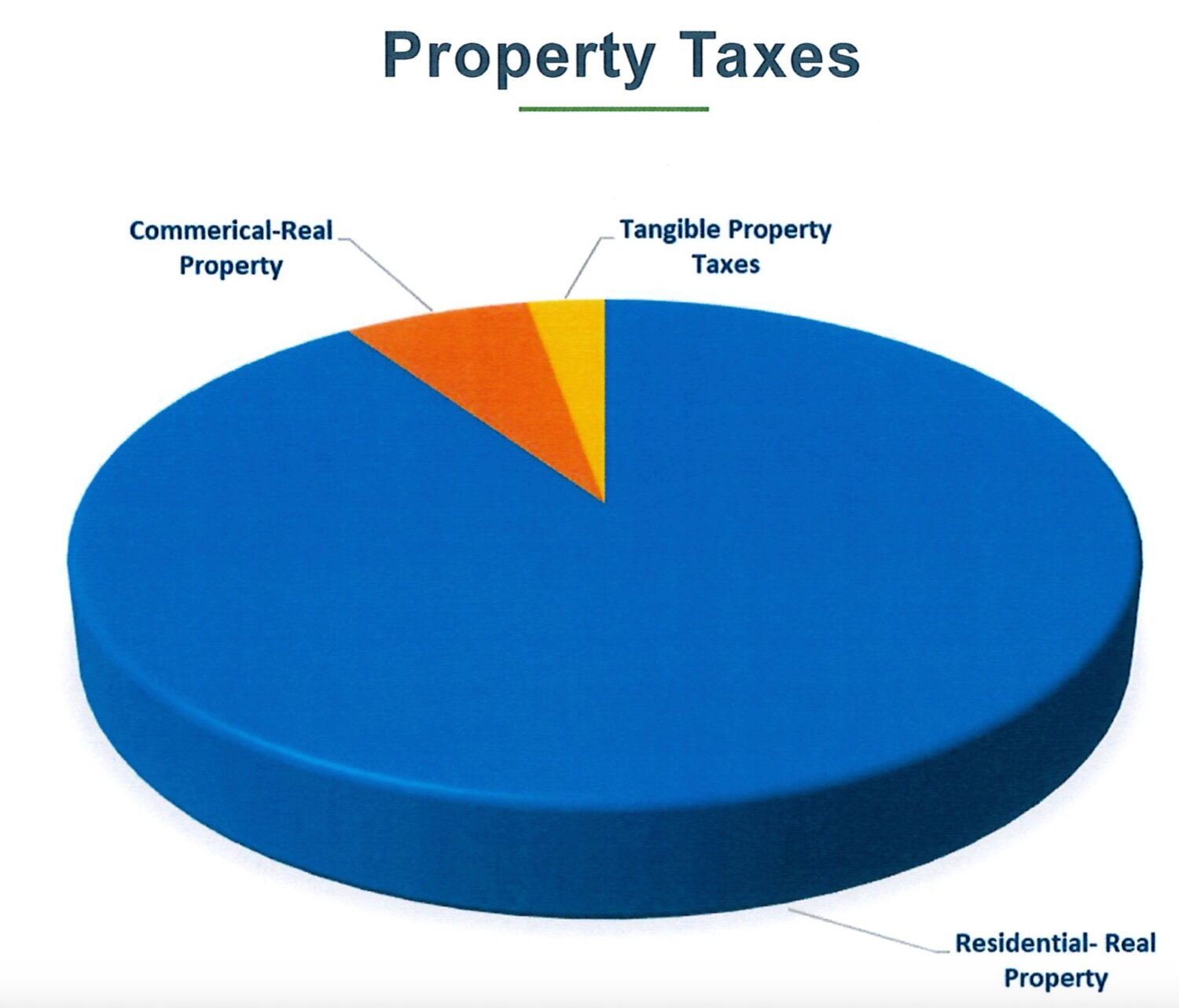

Portsmouth Seeks Tax Relief For Residential Homeowners EastBayRI

Reimagining Fundraising Generic Submission Automating Tax Benefits

More Than 436 000 Parents Have Received Tax Relief For Children

More Than 436 000 Parents Have Received Tax Relief For Children

Personal Tax Relief 2021 L Co Accountants

Tax Relief Central Business Services Accountants And Business Advisers

Research And Development Tax Relief Gatwick Accountant

Tax Relief For Child Singapore - Verkko In Singapore s tax structure Child Relief is a tax relief extended to taxpayers caring for their children This can come in several forms including Qualifying Child Relief