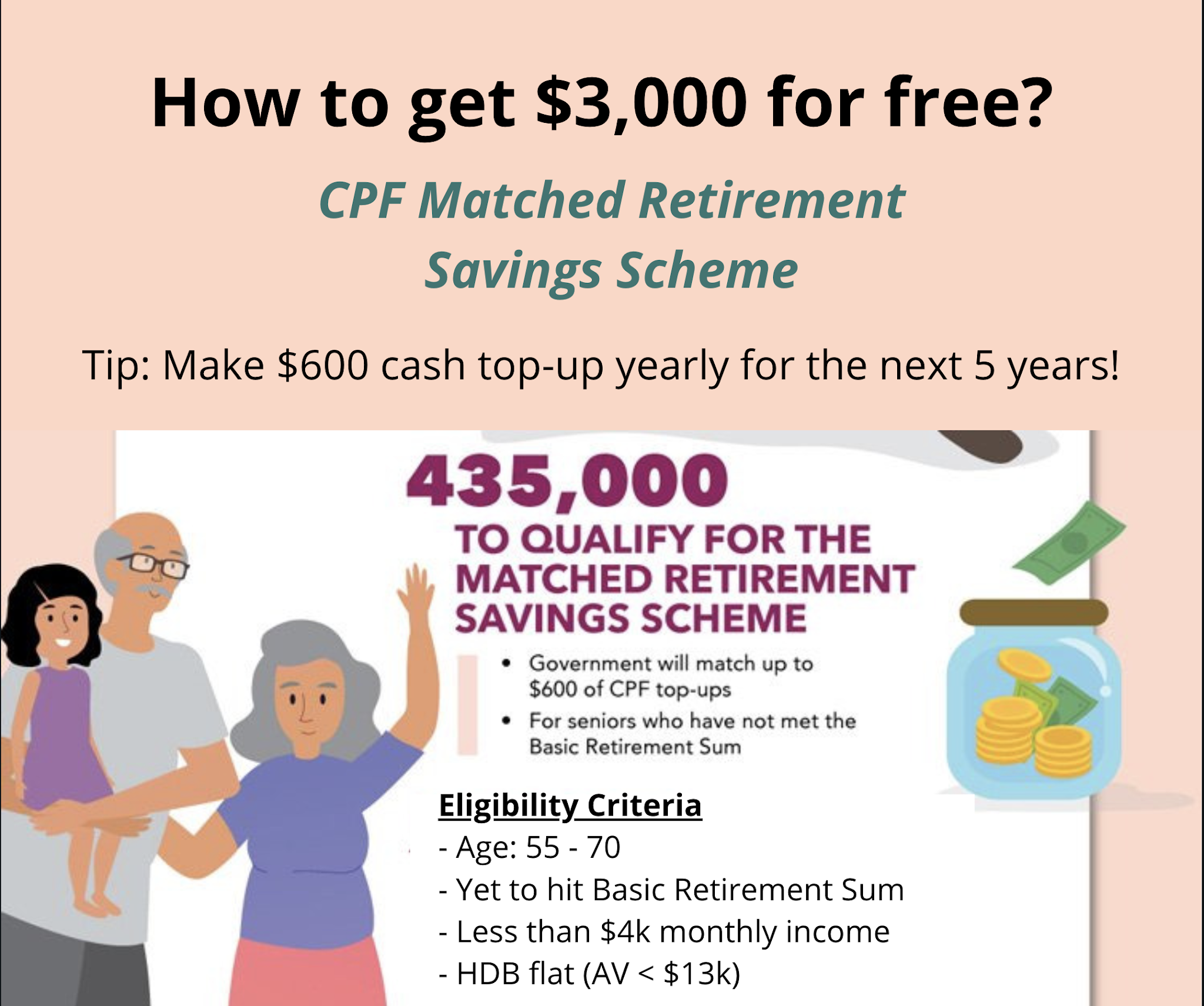

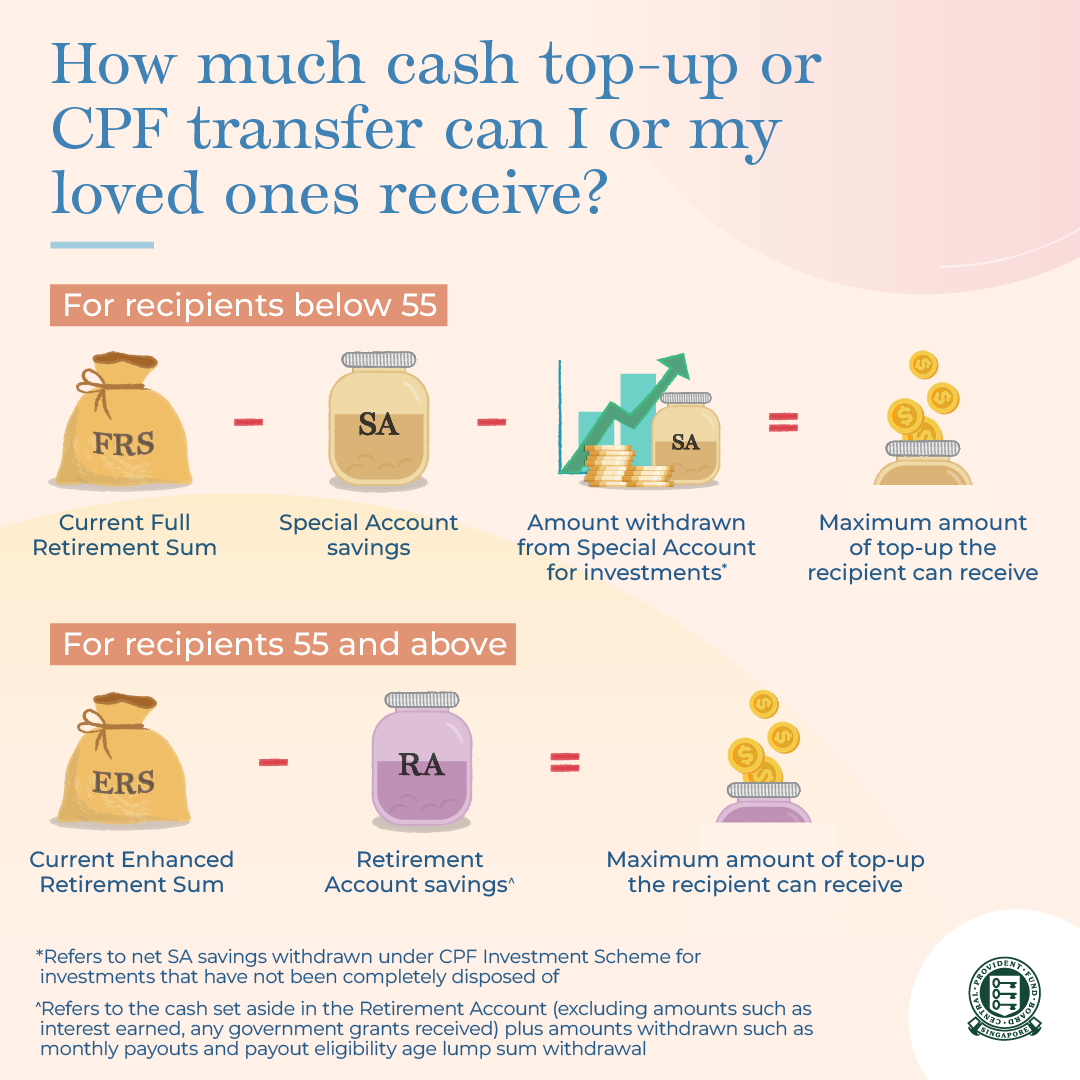

Tax Relief For Parents Cpf Top Up You can make a cash top up of any amount to your loved ones By doing so you will also benefit from tax relief of up to 8 000 for cash top ups made to your loved ones in each calendar year

You can enjoy tax relief of up to 8 000 if you make a top up to yourself and an additional 8 000 if you make a cash top up to your loved ones For cash top ups to self and your loved ones You can enjoy tax relief if you are a Singapore Citizen or Permanent Resident and make cash top ups within the current year s Full Retirement Sum for yourself your loved ones employees

Tax Relief For Parents Cpf Top Up

Tax Relief For Parents Cpf Top Up

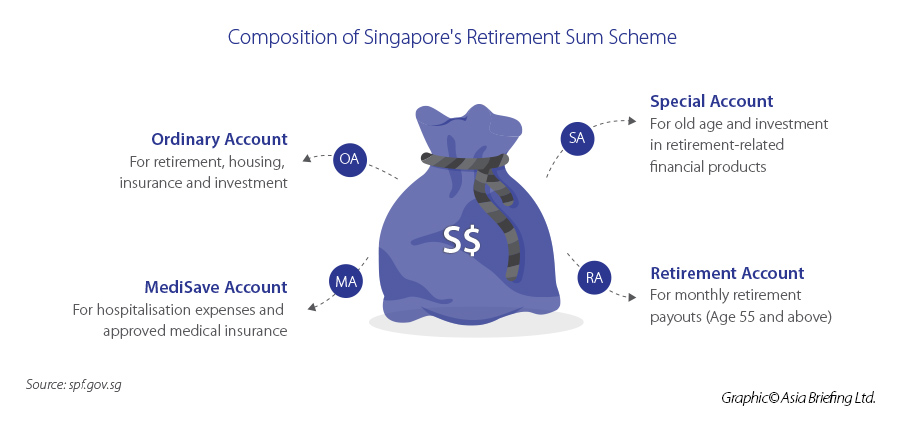

https://www.aseanbriefing.com/news/wp-content/uploads/2021/11/MicrosoftTeams-image-8.jpg

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

https://www.asiaone.com/sites/default/files/styles/a1_og_image/public/original_images/Sep2021/20210811_savings_unspalsh.jpeg?itok=m5qhrWyT

Cpf Gov Sg Login Page CPF Singapore Board Appointment 2023

https://web.bd-gov.com/wp-content/uploads/2022/06/cpf-gov-sg-login-page-CPF-Singapore-Board-Appointment.jpg

Will enjoy tax relief on your cash top up the following year as long as your application with CPF is received by 31st December How to claim the relief You do not need to claim this relief The You can enjoy tax relief if you are a Singapore Citizen or Permanent Resident and make cash top ups within the current year s Full Retirement Sum for yourself your loved

Under the Retirement Sum Topping Up Scheme RSTU you can top up your parents CPF RA and receive tax relief of up to 8 000 per calendar year However this tax relief is not per parent but for all top ups made to your You can enjoy tax relief of up to 7 000 per parent per year for cash top ups to your parents CPF SA or RA The tax relief is in addition to the relief you claim for your CPF

Download Tax Relief For Parents Cpf Top Up

More picture related to Tax Relief For Parents Cpf Top Up

CPF Minimum Sum Changes Why I Will Not Top Up My CPF and When Should You

https://i0.wp.com/financialhorse.com/wp-content/uploads/2019/02/cpf-top-up-for-more.jpg?fit=800%2C644&ssl=1

Top Up 600 Under The CPF Matched Retirement Savings Scheme

https://sgbudgetbabe.com/wp-content/uploads/2021/01/sgbb-top-up-600-CPF-matched-retirement-savings-1.png

HUGE CPF Changes For Tax Relief DO THIS NOW YouTube

https://i.ytimg.com/vi/SRKAvF1nYXk/maxresdefault.jpg

You can enjoy an equivalent amount of tax relief of up to S 8 000 per calendar year if you make a cash top up to your account and an additional S 8 000 if you make a cash By making a cash top up under the CPF retirement sum topping up scheme RSTU you can enjoy tax relief of up to 16 000 a maximum of 8 000 for yourself and

For example if your parent is 60 and currently has 200 000 in his her CPF RA this means that a top up of up to 79 000 can be done via the RSTU However one thing to note is that there are no tax benefits for top ups made beyond the For obtaining tax relief the maximum top up amount eligible for tax relief under the RSTU is 8 000 per calendar year when you top up for yourself and an additional 8 000 per

How CPF Tax Relief Are Computed Can You Save 1000 In Taxes From CPF

https://i.ytimg.com/vi/GRJH2BJwLdU/maxresdefault.jpg

3 Great Reasons To Top Up Your CPF The Straits Times

https://static1.straitstimes.com.sg/s3fs-public/styles/large30x20/public/articles/2020/12/04/cpf_4.jpg?VersionId=8E0KOMUXEfFqJHRIScrkEST1qdL.4wKE&itok=9ZLeitoQ

https://www.cpf.gov.sg › member › growing-your-savings › ...

You can make a cash top up of any amount to your loved ones By doing so you will also benefit from tax relief of up to 8 000 for cash top ups made to your loved ones in each calendar year

https://www.cpf.gov.sg › service › article › what-are...

You can enjoy tax relief of up to 8 000 if you make a top up to yourself and an additional 8 000 if you make a cash top up to your loved ones For cash top ups to self and your loved ones

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

How CPF Tax Relief Are Computed Can You Save 1000 In Taxes From CPF

Cpf Top Up Limit And Tax Relief Limit Tony Deng Images And Photos Finder

CPFB How To Top Up Your CPF And The Benefits Of Doing So

5 Ways To Make Your CPF Retirement Savings Work Harder CPF Top up Tax

Top Up CPF Retirement Account Of Parent To Save Tax

Top Up CPF Retirement Account Of Parent To Save Tax

Retirement Planning What You Must Know About CPF Top Up

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

Quick Tips On Relief Using SRS Contribution CPFSA Top Up And Voluntary

Tax Relief For Parents Cpf Top Up - Under the Retirement Sum Topping Up Scheme RSTU you can top up your parents CPF RA and obtain tax relief of up to 7 000 per calendar year However this tax relief takes into