Tax Relief On Car Lease Payments Hmrc This guide answers key questions regarding reporting and paying tax when you lease a vehicle for work if you re a self employed contractor freelancer or sole trader Here s what we ll cover the pros

You may be able to calculate your car van or motorcycle expenses using a flat rate known as simplified expenses for mileage instead of the actual costs of buying and running This means that if the car has emissions under 110g km you can get tax relief on all of the payments However if the car s emissions are above 110g km then 15 is blocked so only 85 can be claimed

Tax Relief On Car Lease Payments Hmrc

Tax Relief On Car Lease Payments Hmrc

https://www.osv.ltd.uk/wp-content/uploads/2021/04/leasing-benefits-banner.jpg

A Guide To Company Car Tax

https://carleasespecialoffers.co.uk/assets/images/Car-Tax-Calculation-c.jpg

Car Lease Tax Deduction Hmrc Jeraldine Will

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110ca9f70af240a0f6ca9e1_60d829126103922a99639c6c_Is-car-loan-interest-tax-deductible.jpeg

As explained by HMRC In some cases if you lease or hire a car you cannot claim all of the hire charges or rental payments For example if you leased a car on or after 6 April 2020 and the CO2 The tax deductible leasing costs on contract hire and finance leasing may be subject to a restriction There is a simple 15 disallowance where the leased car s emission rating

Business car leasing is typically cheaper than a personal lease as you can claim the VAT back on monthly instalments In most cases you can claim up to 50 VAT back but if Hiring or leasing a car is an allowable and tax deductible expense but you must disallow 15 of your costs if the vehicle CO2 emissions are more than 50g km This was

Download Tax Relief On Car Lease Payments Hmrc

More picture related to Tax Relief On Car Lease Payments Hmrc

Car Lease Tax Deduction Hmrc Jeraldine Will

https://www.mazumamoney.co.uk/app/uploads/2018/01/shutterstock_1921919561-scaled.jpg

.jpg?auto=compress,format)

Car Lease Tax Deduction Hmrc Jeraldine Will

https://images.prismic.io/leasefetcher/ddcb84fb-59d8-4b0f-b430-c39099df9f55_eligibility-car-lease-tax-deduction+(1).jpg?auto=compress,format

Car Lease Tax Deduction Hmrc Jeraldine Will

https://maxxia.co.uk/wp-content/uploads/2020/04/business-finance-1.jpg

Car lease payments aren t always tax deductible but with business leasing you can reclaim up to 100 of VAT Check out who s eligible and how to claim How to reclaim tax on a lease car In order to make tax deductions on a leased car you need to submit a final VAT return form to HMRC which can be done either online or via

Unless the lease is a long funding lease see BLM20000 onwards the tax treatment of finance leasing is different from the accountancy because it generally follows the legal Work out which car expenses you can submit with your HMRC tax return Although HMRC describes allowable expenses as the cost of running your car there are

Are Car Lease Payments Tax Deductible Lease Fetcher

https://images.prismic.io/leasefetcher/42a783fa-eba8-4c0c-93a8-253f80c11eac_car-lease-tax-deduction.jpg?auto=compress,format

Figure Car Lease Payments DD Figure

https://i.pinimg.com/originals/a0/c3/56/a0c356b079c93be5dcad20b9413e25fd.png

https://www.moneydonut.co.uk/blog/22/0…

This guide answers key questions regarding reporting and paying tax when you lease a vehicle for work if you re a self employed contractor freelancer or sole trader Here s what we ll cover the pros

https://www.gov.uk/expenses-if-youre-self-employed/travel

You may be able to calculate your car van or motorcycle expenses using a flat rate known as simplified expenses for mileage instead of the actual costs of buying and running

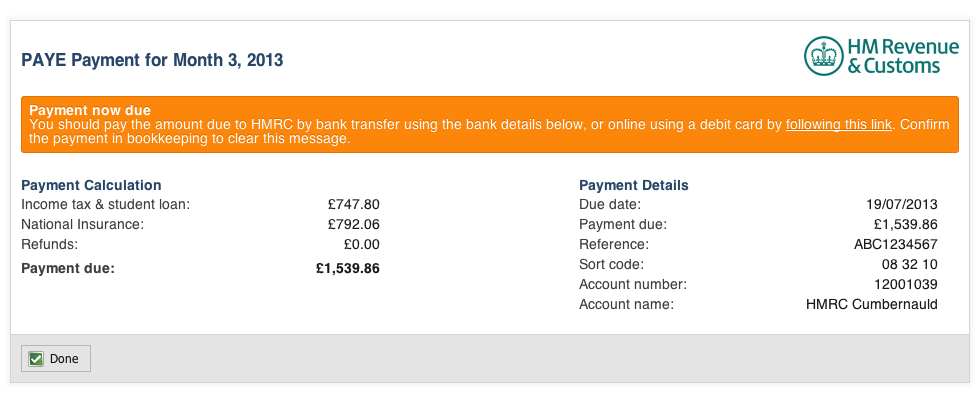

Making PAYE Payments To HMRC InniAccounts

Are Car Lease Payments Tax Deductible Lease Fetcher

What Are Income Tax Reliefs TAX

Do Car Lease Payments Help Build Credit Coulter Credit

How To Reduce Car Payments Soupcrazy1

Taxation Rules For Mileage Allowance Payments Car Allowance And

Taxation Rules For Mileage Allowance Payments Car Allowance And

Lease Takeovers Pros Cons Alternatives Bankrate

How To Claim Tax Relief On Pension Contributions From Hmrc Asbakku

HMRC GOV UK FORMS P87 PDF

Tax Relief On Car Lease Payments Hmrc - Let s see how the HMRC treats car leasing when it comes to tax relief If your company is leasing a vehicle you don t own it That means that you can claim your monthly lease