Tax Relief On Charitable Donations Uk How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This MoneysavingExpert guide takes you through how it works We recommend you go to the guide Tax relief when you donate to a charity or ask your tax adviser before completing boxes 5 to 12 in the Charitable giving section of the tax return 1 Gift Aid

Tax Relief On Charitable Donations Uk

Tax Relief On Charitable Donations Uk

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Treasury To Review Level Of Tax Relief On Charitable Donations

https://guernseypress.com/resizer/9fuchSwiNmAYkgOXrzQMRelgqMI=/1200x0/cloudfront-us-east-1.images.arcpublishing.com/mna/6LWZMI522VHDXIYN56NURJKC6E.jpg

Charity Tax Relief Tax Relief On Charitable Donations In The UK

https://chacc.co.uk/wp-content/uploads/2022/03/Tax-Relief-On-Charitable-Donations-In-The-UK.png

So in this article we ll look at the different ways to give and claim tax relief on donations to charities The easiest and simplest way for employees on the PAYE system which is the majority of people is to sign up to Payroll Giving or Give As You Earn as it is also called We can claim charity tax relief on charitable donations by UK tax payers via Gift Aid for a variety of types of charitable donations including small donations in tins buckets retail text volunteer expenses and membership

For a 40 rate taxpayer that means for every 1 you donate you can claim back 25p in tax relief You can even sell unwanted clothes books CDs and more through a UK charity shop then give the proceeds to charity under Gift Aid How is tax relief on charity donations claimed Lucy can claim tax relief on donations through her self assessment tax return Keeping proof of charity donations in your tax records for at least six years is essential in ensuring you get tax relief

Download Tax Relief On Charitable Donations Uk

More picture related to Tax Relief On Charitable Donations Uk

Tax Relief On Charitable Donations

https://www.treybridge.co.uk/_webedit/cached-images/456.jpg

Charity Tax Relief Tax Relief On Charitable Donations In The UK

https://chacc.co.uk/wp-content/uploads/2022/03/Charity-Tax-Relief.png

How To Ensure You Get Tax Relief On Charitable Donations

https://www.accountwise.co.uk/wp-content/uploads/2019/06/donations-1041971_1920-1080x675.jpg

As long as you are a UK taxpayer and sign a Gift Aid declaration the charity is able to reclaim basic rate tax which currently equates to 25p for every 1 donated a donation of 100 provides a tax repayment of 20 80ths x 100 eg 25 A 45 per cent rate taxpayer donating that exact figure to charity with a Gift Aid declaration would bring their tax bill down by 198 75 Donations are eligible for Gift Aid so long as they are

[desc-10] [desc-11]

Charitable Donation Tax Credits Tax Tip Weekly YouTube

https://i.ytimg.com/vi/swRobMRG4fw/maxresdefault.jpg

How To Get Tax Relief For Charitable Donations

https://www.thetaxdefenders.com/wp-content/uploads/2020/10/495983408.jpg

https://www.gov.uk › government › publications

How to claim relief on a Self Assessment tax return if you donate to charity through Gift Aid Payroll Giving or gifts of shares securities land or buildings

https://www.moneysavingexpert.com › family › gift-aid

If you pay UK tax and donate to charity Gift Aid means the charity gets more And if you re a higher or additional rate taxpayer you can claim extra tax relief on the donation This MoneysavingExpert guide takes you through how it works

Tax Relief On Charitable Gifts

Charitable Donation Tax Credits Tax Tip Weekly YouTube

Tax Relief On Charitable Donations Pentlands Accountants

Tips On Tax Deductions For Donations

Tax Relief On Charitable Donations Johnston Smillie

Charitable Contributions Guide

Charitable Contributions Guide

Charity Tax Relief Tax Relief On Charitable Donations In The UK

How Much Tax Relief Do I Get On Charitable Donations Accounting Firms

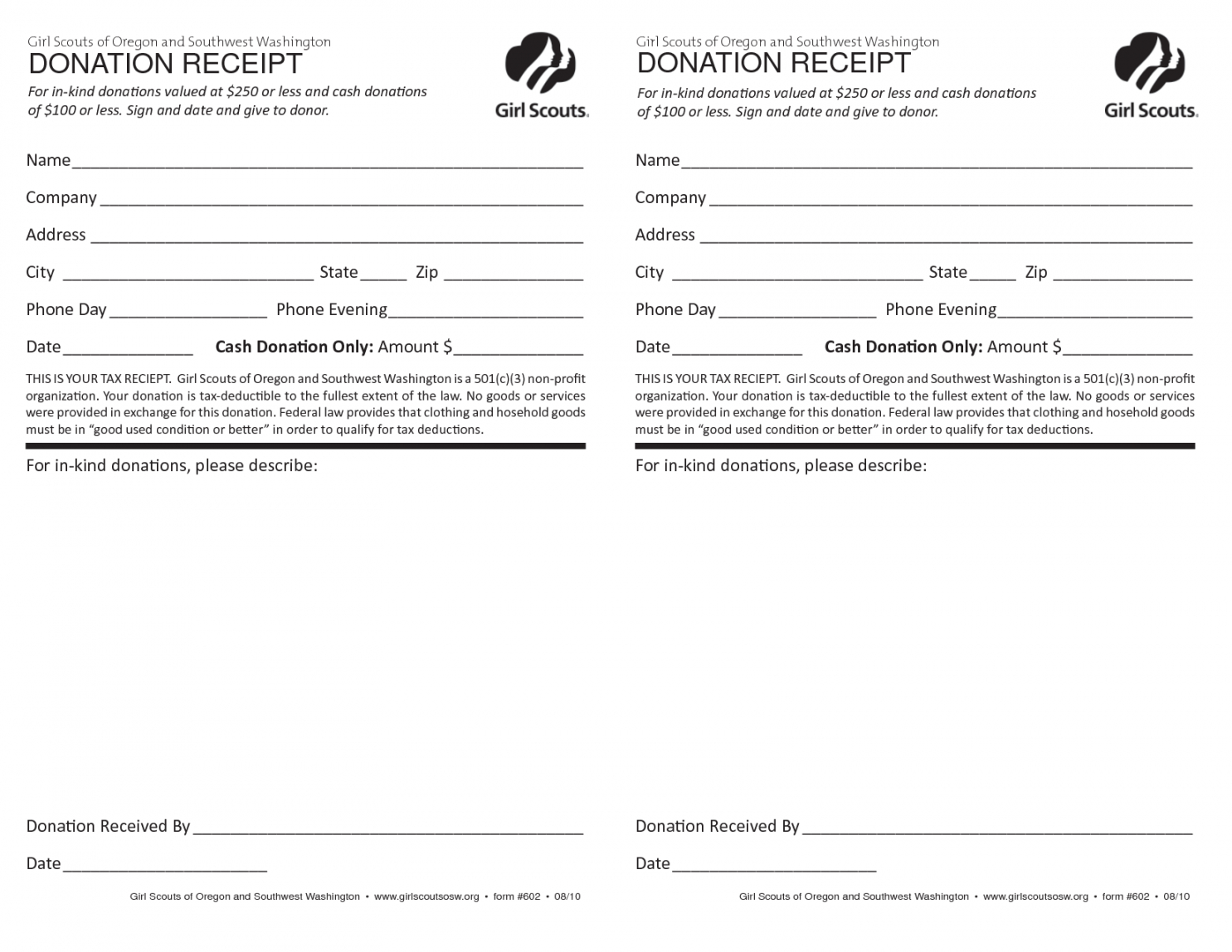

Church Tax Donation Receipt Template EmetOnlineBlog

Tax Relief On Charitable Donations Uk - How is tax relief on charity donations claimed Lucy can claim tax relief on donations through her self assessment tax return Keeping proof of charity donations in your tax records for at least six years is essential in ensuring you get tax relief