Tax Relief On College Fees Uk Item 1 of Group 6 of Schedule 9 to the Value Added Tax Act 1994 specifies the exemption is extended to the provision of education or vocational training by an eligible body

Working out how best to invest for education fees involves determining your own attitude to risk investment timeframe and how you wish to pay the fees Another option is Tax relief is available for tuition fees paid for Approved full time and part time undergraduate courses in both private and publicly funded third level colleges in any EU

Tax Relief On College Fees Uk

Tax Relief On College Fees Uk

https://comfortkeepers.ie/app/uploads/2022/08/BC_220302_1438_Final-resize.jpg

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

No your child s university fees are not tax deductible however you can structure dividend payments from your business in such a way that makes them significantly more tax efficient Find out more below Following the UK s exit from the European Union some new categories of eligibility for home fee status and student support were established for courses starting after 1 August 2021 The Department for Education has

You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at Many parents will need to be aware of the tax implications when fully financing their children s fees bills and rent In this guide we will discuss tax planning for university and how you can find the most tax efficient solution

Download Tax Relief On College Fees Uk

More picture related to Tax Relief On College Fees Uk

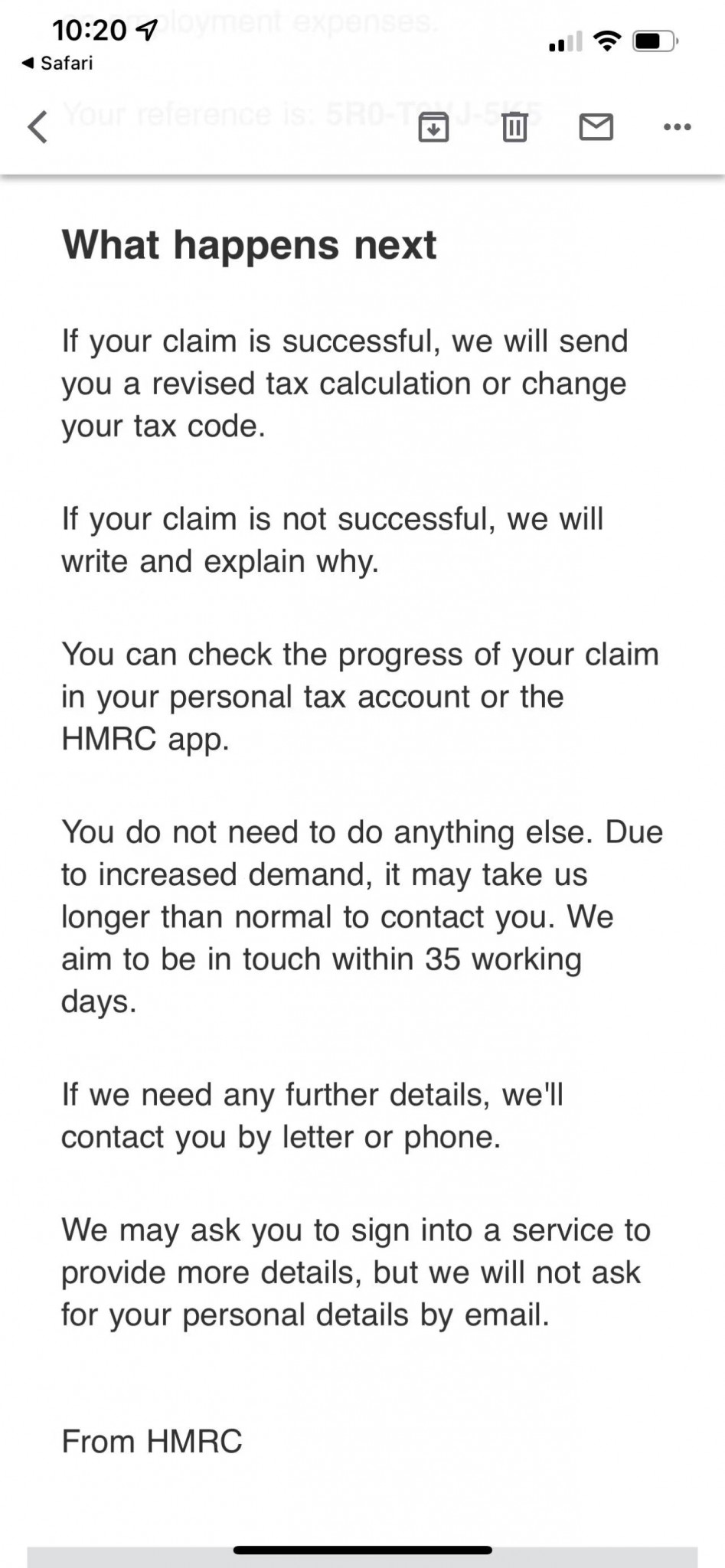

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Tax Relief Matters Abacus Advice

https://www.aaltd.co.uk/blog/wp-content/uploads/2023/07/taxre.jpg

Tax Relief On Donations And Sponsorship Payments

https://media-exp1.licdn.com/dms/image/C4D12AQE4t2OG3AWSrw/article-cover_image-shrink_600_2000/0/1617873492793?e=2147483647&v=beta&t=ucD-O6YWn3nR-T52DbniDFjW0vmMjOM607U5ePQcsyA

In a policy that has drawn much criticism and is facing ongoing backlash from the sector from January the government will remove independent schools VAT exemption and Scholarships exhibitions and bursaries held by a person receiving full time instruction at university are exempted from income tax and the business could pay them up to 15 480 per

Labour s first budget since 2010 includes 40bn worth of tax rises and spending cuts across government as well as promises to invest in infrastructure and support working people However there are ways to save this tax by utilising your child s 12 570 tax free personal allowance and their 1 000 tax free dividend allowance to take money from your

Book Keeping John Canty Accountants

http://jcantyaccountants.ie/wp-content/uploads/2020/02/img_3.jpg

Home Care Tax Relief Right At Home Ireland

https://www.rightathome.ie/-/media/rahv2/our-process/hero.jpg?h=500&w=1248&la=en-IE&hash=64C91AEED4515608054738FE8C7A60B5

https://www.gov.uk › government › publications › vat-on...

Item 1 of Group 6 of Schedule 9 to the Value Added Tax Act 1994 specifies the exemption is extended to the provision of education or vocational training by an eligible body

https://www.armstrongwatson.co.uk › news

Working out how best to invest for education fees involves determining your own attitude to risk investment timeframe and how you wish to pay the fees Another option is

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

Book Keeping John Canty Accountants

What Is Tax Relief Can You Claim It Taxoo

Families Are Losing Out By Failing To Claim Tax Relief On

CITIZENS INFORMATION Can You Claim Tax Relief On College Fees

How To Claim Higher Rate Tax Relief On Pension Contributions

How To Claim Higher Rate Tax Relief On Pension Contributions

Can I Claim Tax Relief On College Fees

Will I Lose Pension Tax Relief When I Turn 75 I Still Run A Business

Tax Relief On College Fees Uk - You can claim tax relief on qualifying fees including the student contribution that you have paid for third level education courses The qualifying fees must be paid for an approved course at