Tax Relief On Electric Cars Uk 2022 Hmrc Web From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable list price The government announced in November 2022 that the 2 rate of electric vehicles is set until April 2025 after which it will be 2025 2026 3 BIK

Web 16 Okt 2023 nbsp 0183 32 Electric vehicle charging points are eligible for 100 allowances The private use element should not be overlooked here as this may lead to the asset having to be separately pooled for CA purposes See also Vehicles 4 wheels Allowances and Vehicles 2 or 3 wheels Allowances Benefits In Kind Web Expenses and employee benefits Check if you need to pay tax for charging an employee s electric car Find out whether you or your employee need to pay tax or National Insurance for

Tax Relief On Electric Cars Uk 2022 Hmrc

Tax Relief On Electric Cars Uk 2022 Hmrc

https://i.pinimg.com/originals/3a/50/0e/3a500e39285b0cafb9b2535a1f331069.png

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/DSC04259-scaled.jpg

Web 4 Jan 2022 nbsp 0183 32 TAXline January 2022 The tax efficient benefits of electric company cars TAXline The tax efficient benefits of electric company cars Author Sam Inkersole Published 04 Jan 2022 Sam Inkersole explains how electric company cars offer a favourable benefit in kind for employers and employees alike Web Tax benefits for ultra low emission vehicles Ultra low emission vehicles ULEVs are usually defined as vehicles that emit less than 75g of carbon dioxide CO2 for every kilometre travelled

Web 12 Okt 2022 nbsp 0183 32 English Cymraeg Find out about tax reliefs and allowances available from HMRC if you run a business employ people or are self employed From HM Revenue amp Customs Published 12 October Web 6 Apr 2020 nbsp 0183 32 Electric Car Tax Benefits Summary of Electric Car Tax Benefits In his March 2020 Budget Chancellor of the Exchequer Rishi Sunak confirmed that motorists buying electric cars would continue to benefit from the Plug In Car Grant to 2022 2023 but it would reduce from 163 3 500 to 163 3 000 and cars costing 163 50 000 or more would be

Download Tax Relief On Electric Cars Uk 2022 Hmrc

More picture related to Tax Relief On Electric Cars Uk 2022 Hmrc

Best Car Insurance Uk 2022 Asuransi Terjamin 2022

https://images.drive.com.au/driveau/image/upload/c_fill,f_auto,g_auto,h_720,q_auto:best,w_1280/v1/cms/uploads/tftuxjg8xifrc6rltrrg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

BIK

https://www.ovobyus.com/transform/8e525380-7cdb-4f69-986e-f9f368404f08/?&io=transform:fill,width:900&format=png

Web 19 Feb 2021 nbsp 0183 32 Businesses that invest in electric vehicles with zero emissions benefit from enhanced capital allowances From 1st April 2021 businesses purchasing new cars with 0g km CO2 emissions can claim 100 First Year Allowance FYA The purchase of a used electric car won t be eligible for FYA Web 18 Nov 2022 nbsp 0183 32 What are EV benefit in kind rates now and in the future This year 2023 24 the electric vehicle company car tax rate stands at just 2 of an EV s taxable list price This is also known as the P11D value The following year this remains at 2 keeping the level far below petrol and diesel vehicles as well as plug in hybrids

Web 4 M 228 rz 2021 nbsp 0183 32 The road tax or Vehicle Excise Duty VED rates for all pure electric vehicles have been reduced to 163 0 until at least 2025 There are reduced VED rates for plug in hybrid electric vehicles PHEVs Capital allowances Web 24 Aug 2021 nbsp 0183 32 Understanding the tax advantages of electric vehicles RJP LLP Blog There are tax benefits for zero low emission vehicles This article explains what s on offer if you finance it through your company Give us your details and we ll be in touch asap Call meEmail me 020 8339 1930 Solving your problems Selling a business

I Help Toyota Make A Real EV Commercial EV Auto Magazine

https://i.ytimg.com/vi/PZh2iEaTsuo/maxresdefault.jpg

Infographic China Bets On Electric Cars Electric Cars Electricity

https://i.pinimg.com/736x/24/10/ca/2410ca3b190097bb38e8eba1dea6ab52.jpg

https://www.accaglobal.com/.../may/tax-implications-electric-cars.html

Web From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable list price The government announced in November 2022 that the 2 rate of electric vehicles is set until April 2025 after which it will be 2025 2026 3 BIK

https://www.rossmartin.co.uk/employers/benefits-shares/5688-electric...

Web 16 Okt 2023 nbsp 0183 32 Electric vehicle charging points are eligible for 100 allowances The private use element should not be overlooked here as this may lead to the asset having to be separately pooled for CA purposes See also Vehicles 4 wheels Allowances and Vehicles 2 or 3 wheels Allowances Benefits In Kind

How To Print Your SA302 Or Tax Year Overview From HMRC Love

I Help Toyota Make A Real EV Commercial EV Auto Magazine

Time To End Pension Tax Relief Inequality Business In The News

HMRC Revises Fuel Rates For Company Cars

How To Obtain Your Tax Calculations And Tax Year Overviews

Contact Us International Copper Association Australia

Contact Us International Copper Association Australia

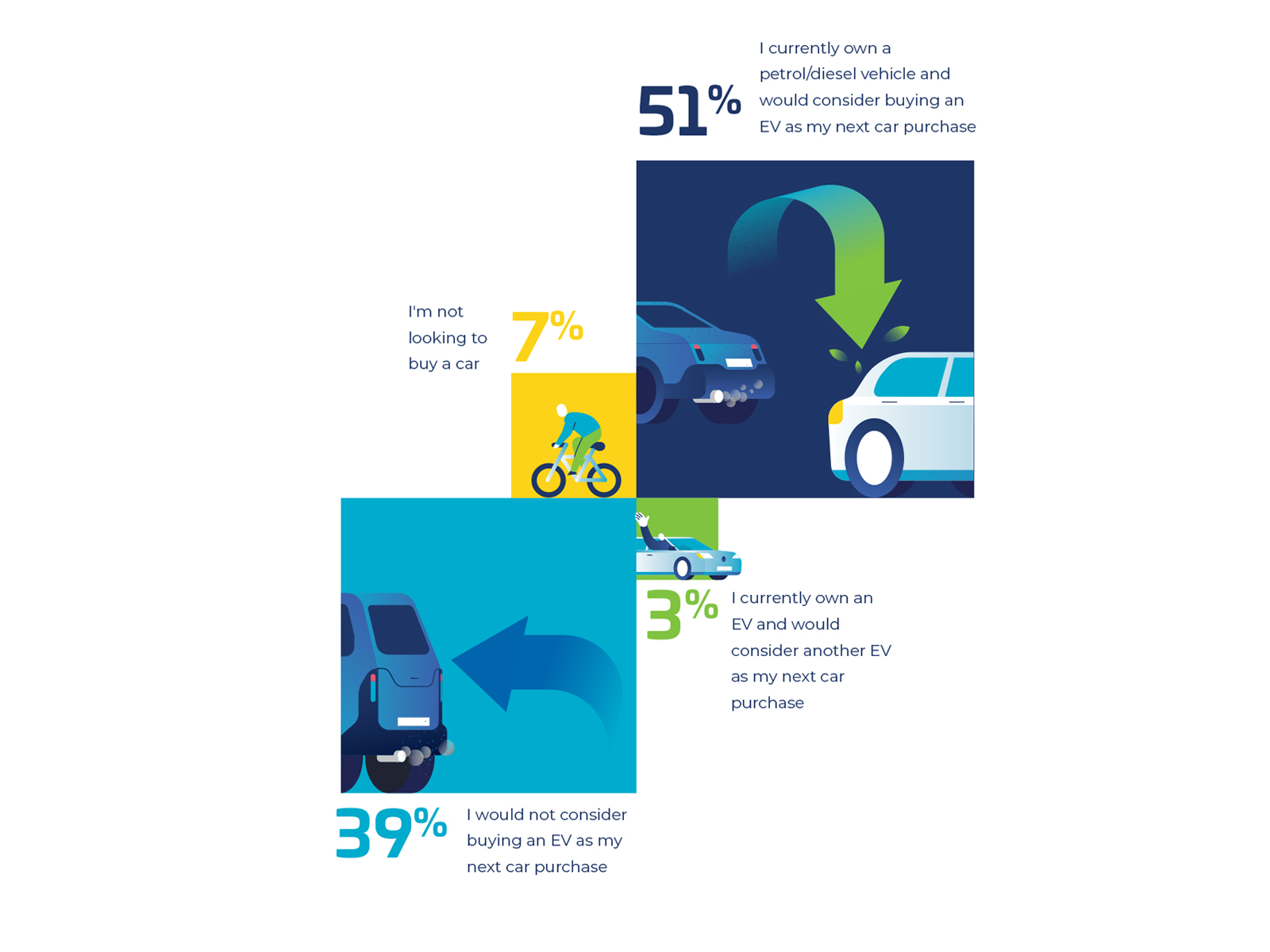

Electric Vehicle Consumer Survey Quickdata

Tech Industry s Hope For Tax Relief On Foreign Cash The Information

HMRC Tax Overview Online Self Document Templates Documents

Tax Relief On Electric Cars Uk 2022 Hmrc - Web 22 M 228 rz 2022 nbsp 0183 32 As the BIK for an electric vehicle is very low at present the saving for the employee can be substantial with the savings due to increase from April 2022 when the NIC rates go up The rates for the next three tax years