Tax Relief On Electric Cars Uk To ensure all drivers begin to pay a fairer tax contribution this meaure will bring electric vehicles which do not currently pay VED and AFVs and hybrids which pay a

Electric and low emission cars registered on or after 1 April 2025 You will need to pay the lowest first year rate of vehicle tax which applies to vehicles with CO2 emissions 1 to Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for

Tax Relief On Electric Cars Uk

Tax Relief On Electric Cars Uk

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

End Of Fuel Excise Discount Shouldn t Cause Immediate Petrol Price

https://acapmag.com.au/wp-content/uploads/2022/09/GettyImages-fuel-up.jpg

Pin On Electric Cars And Transport

https://i.pinimg.com/originals/3a/50/0e/3a500e39285b0cafb9b2535a1f331069.png

By Noor Nanji Business reporter BBC News Electric cars will no longer be exempt from vehicle excise duty from April 2025 the chancellor has said Announcing the change In most cases used electric cars are eligible for the Annual Investment Allowance AIA which allows businesses to claim tax relief on a portion of the car s cost over several

2nd Apr 2024 Share From 1 April 2025 drivers of electric vehicles will pay for road tax for the first time in the UK The new 2025 Vehicle Excise Duty VED rules will have a For tax year 2020 21 the percentage used to calculate the benefit on fully electric cars with zero emissions was 0 For tax year 2021 22 this increased to 1 and then increases to

Download Tax Relief On Electric Cars Uk

More picture related to Tax Relief On Electric Cars Uk

Mivo Link Tax Credits On Electric Cars Heat Pumps Will Help Low

https://oregoncapitalchronicle.com/wp-content/uploads/2022/09/DSC04259-scaled.jpg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

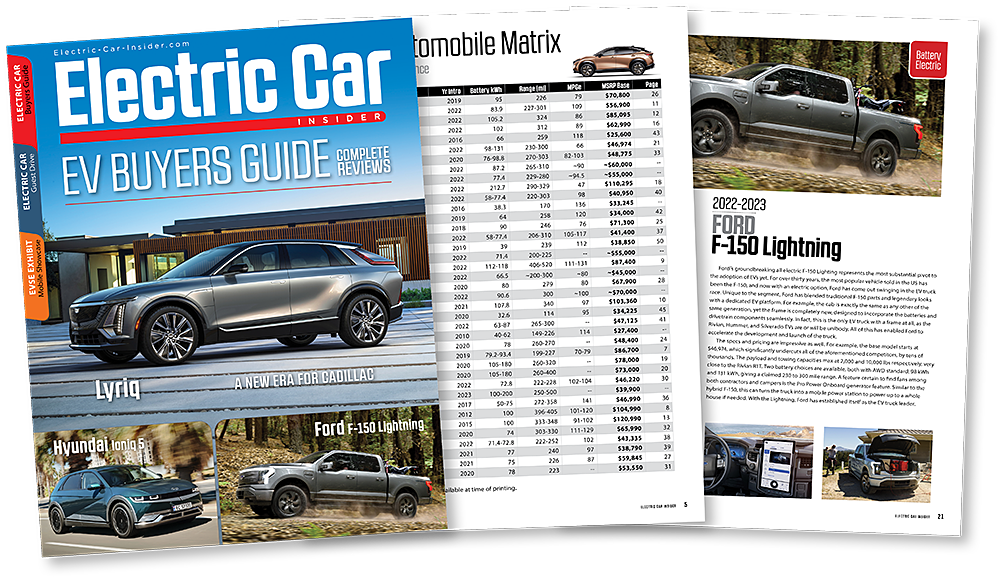

EV Buyers Guides

https://www.electric-car-insider.com/assets/images/buyers-guide-pages-2022.png

You can get tax relief up to 100 of the cost of the vehicle in the year you buy it After that you continue to get a benefit in kind charge of only around 2 per year compared to up From April 2020 the tax charge for electric only cars fell to 0 but for 2021 22 it increased to 1 and then further increases to 2 for 2022 23 There have also been reductions for

The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a 1 Capital Allowances If you purchase a brand new fully electric car through your limited company you can claim a First Year Allowance of 100 against your corporation tax bill

BIK On Electric Cars BIK Explained For EV Company Car Drivers

https://a.storyblok.com/f/121741/1500x788/39151804b8/electric-company-vehicles-and-tax-explained.png

Income Tax And Sales Tax Relief On Construction Industry For Builders

https://i.ytimg.com/vi/L3GxxqeHy-Q/maxresdefault.jpg

https://www.gov.uk/government/publications/...

To ensure all drivers begin to pay a fairer tax contribution this meaure will bring electric vehicles which do not currently pay VED and AFVs and hybrids which pay a

https://www.gov.uk/guidance/vehicle-tax-for...

Electric and low emission cars registered on or after 1 April 2025 You will need to pay the lowest first year rate of vehicle tax which applies to vehicles with CO2 emissions 1 to

Personal Tax Relief 2022 L Co Accountants

BIK On Electric Cars BIK Explained For EV Company Car Drivers

Running The Sums On Electric Cars Good With Money

I Help Toyota Make A Real EV Commercial EV Auto Magazine

Infographic China Bets On Electric Cars Electric Cars Electricity

Time To End Pension Tax Relief Inequality Business In The News

Time To End Pension Tax Relief Inequality Business In The News

Tech Industry s Hope For Tax Relief On Foreign Cash The Information

How To Claim Higher Rate Tax Relief On Pension Contributions

)

BIK On Electric Cars BIK Explained For EV Company Car Drivers

Tax Relief On Electric Cars Uk - The UK government has announced plans to make owners of electric cars pay Vehicle Excise Duty VED from 2025 a change from current rules that exempt such electric