Tax Relief On Mortgage Interest 2022 Verkko 20 hein 228 k 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable

Verkko 19 tammik 2023 nbsp 0183 32 Landlord mortgage interest tax relief in 2022 23 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill Verkko 30 jouluk 2022 nbsp 0183 32 In 2022 the standard deduction is 25 900 for married couples filing jointly and 12 950 for individuals The standard deduction is 19 400 for those filing as head of household The mortgage

Tax Relief On Mortgage Interest 2022

Tax Relief On Mortgage Interest 2022

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Tax-Breaks-for-Homeowners-and-Renters-min-8.jpg

PERSONAL INCOME TAX RELIEF 2022 MALAYSIA Haji Land Berhad

https://hajiland.com/wp-content/uploads/2023/03/FB_IMG_1678943279965.jpg

Personal Tax Relief 2022 L Co Accountants

https://landco.my/wp-content/uploads/2022/11/3-3-1024x1024.png

Verkko 22 syysk 2023 nbsp 0183 32 The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before December 16 2017 can Verkko 1 tammik 2021 nbsp 0183 32 How much will I get You can get mortgage interest tax relief on the increased interest you pay on your mortgage in 2023 when compared with the

Verkko paper analyses the effects of removing mortgage interest tax relief on public revenue and expenditure household disposable income and income inequality in 14 EU Verkko 4 tammik 2023 nbsp 0183 32 The Home Mortgage Interest Tax Deduction for Tax Year 2022 Taxes Tax Credits amp Deductions The Home Mortgage Interest Tax Deduction for Tax Year

Download Tax Relief On Mortgage Interest 2022

More picture related to Tax Relief On Mortgage Interest 2022

Government Responds To Mortgage Interest Tax Relief Petition

https://www.carterjonas.co.uk/-/media/images/news-images-t08/residential/2018-resi-mortgage-interest-tax-relief-petition.ashx

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

Verkko Before the TCJA the mortgage interest deduction limit was on loans up to 1 million Now the loan limit is 750 000 That means for the 2022 tax year married couples filing jointly single filers and heads of Verkko 6 lokak 2022 nbsp 0183 32 This European Economy Economic Brief discusses the effects of mortgage interest tax relief and in particular EUROMOD simulations of a removal of

Verkko The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750 000 For taxpayers who Verkko In 2022 you took out a 100 000 home mortgage loan payable over 20 years The terms of the loan are the same as for other 20 year loans offered in your area You paid

Current Mortgage Interest Rates November 2022

https://assets.mymortgageinsider.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-18-at-2.59.08-PM.png

Form 1098 And Your Mortgage Interest Statement

https://media.licdn.com/dms/image/C4E12AQF2dmYELp3mqg/article-cover_image-shrink_600_2000/0/1579879289260?e=2147483647&v=beta&t=YWgT0sQ1MeOYVu6FnvioR6TjRz_b9Vselwk-7LWksWU

https://www.gov.uk/guidance/changes-to-tax-relief-for-residential...

Verkko 20 hein 228 k 2016 nbsp 0183 32 In the tax year 2021 to 2022 Brian s salary is 163 36 000 and his rental income is 163 24 000 His mortgage interest is still 163 15 000 and he has other allowable

https://www.which.co.uk/money/tax/income-ta…

Verkko 19 tammik 2023 nbsp 0183 32 Landlord mortgage interest tax relief in 2022 23 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill

Imminentness Of Mortgage Infrastructure And Customer Adoption

Current Mortgage Interest Rates November 2022

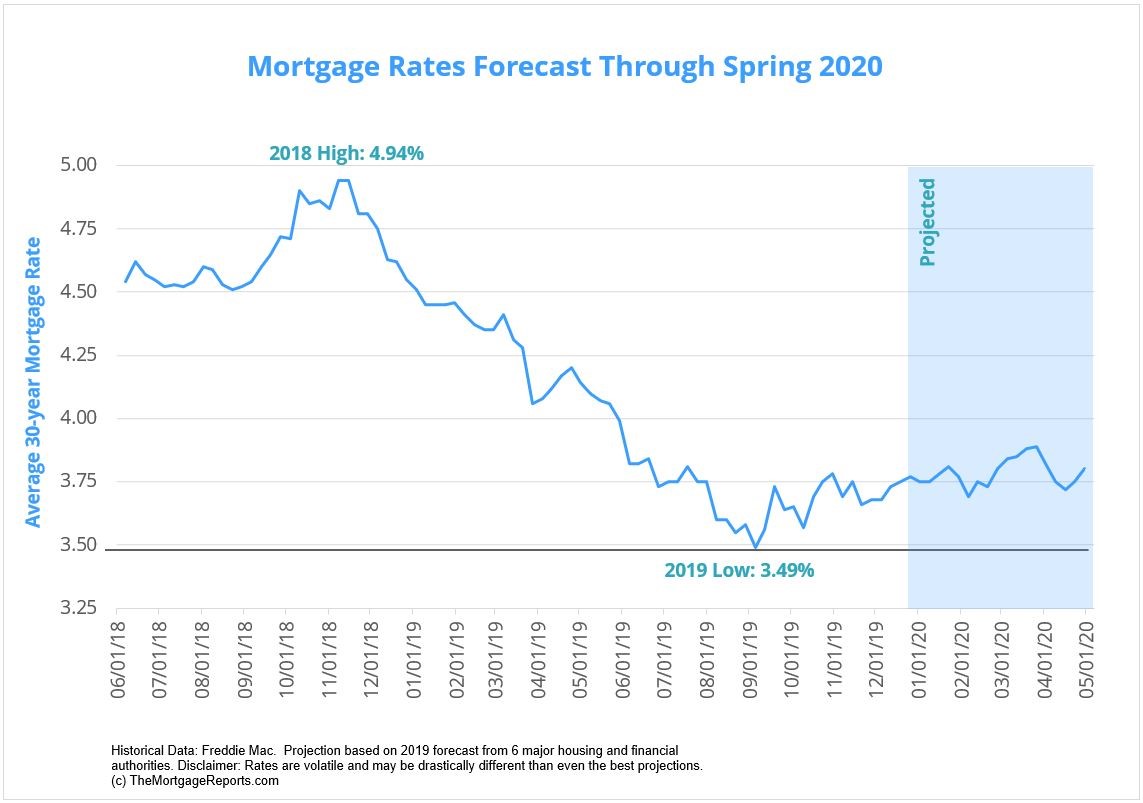

Mortgage Rates Forecast For 2020

Learn How To Generate Tax Debt Relief Leads At Broker Calls

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

Personal Tax Relief 2022 Dec 20 2022 Johor Bahru JB Malaysia

Personal Tax Relief 2022 Dec 20 2022 Johor Bahru JB Malaysia

Is A pensions Tax Raid Coming Weston Murray Moore

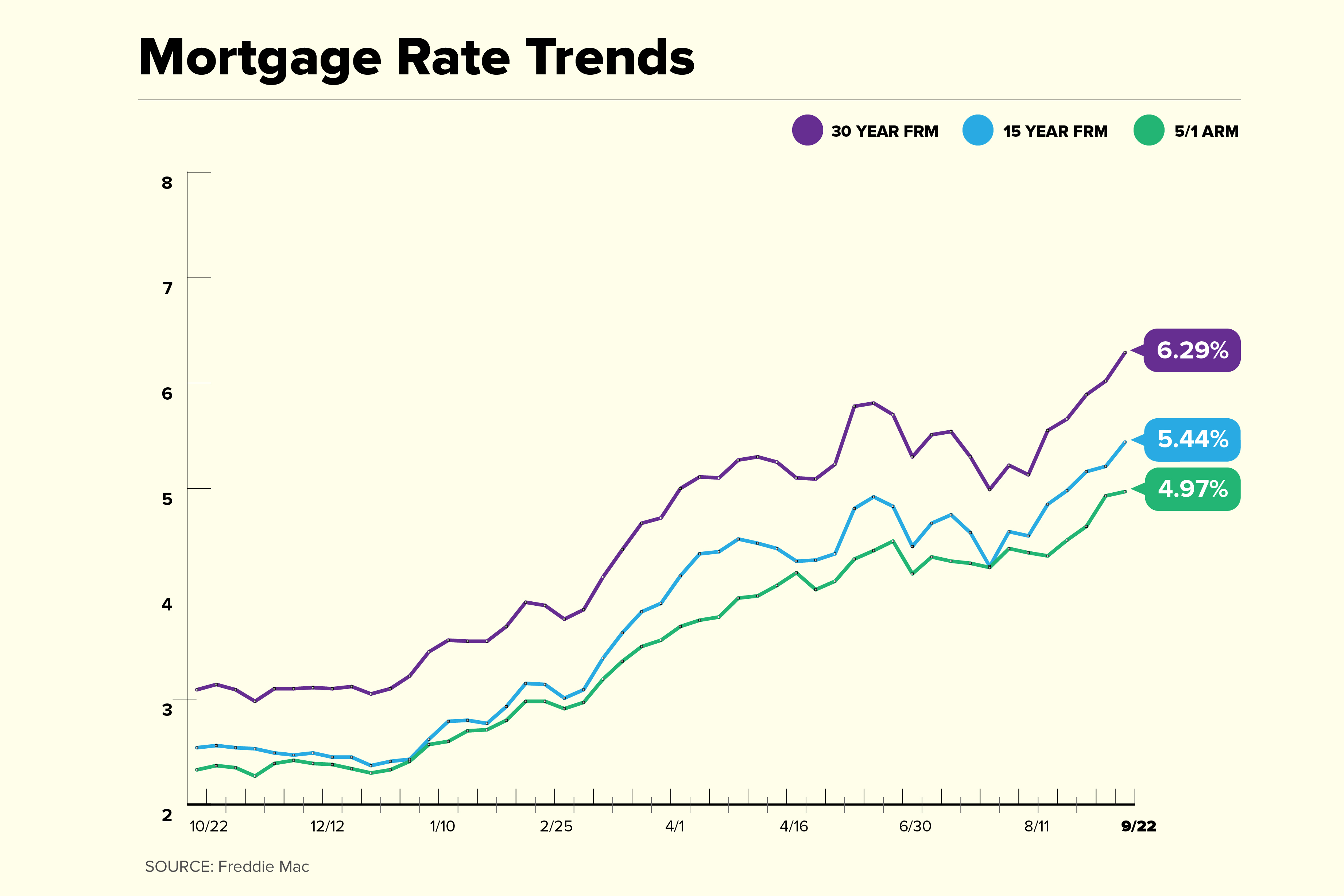

Current Mortgage Rates Stay Well Above 6

Average Mortgage Rates Show Stability Entering 2020 National Mortgage

Tax Relief On Mortgage Interest 2022 - Verkko paper analyses the effects of removing mortgage interest tax relief on public revenue and expenditure household disposable income and income inequality in 14 EU